Japan Distributed Fiber Optic Sensor Market Size, Share, Trends, & Industry Analysis Report

By Fiber Type, By Operating Principle, By Scattering Process, By Application, By End User, and By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 126

- Format: PDF

- Report ID: PM6262

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

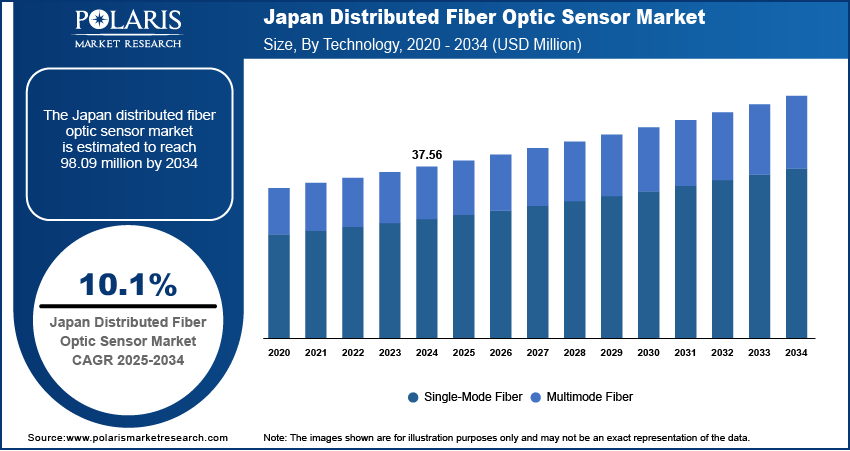

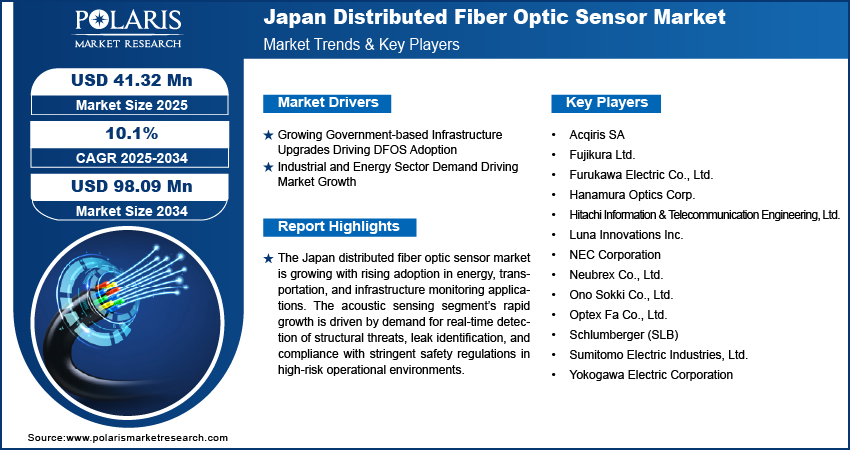

The Japan distributed fiber optic sensor market size was valued at USD 37.56 million in 2024, growing at a CAGR of 10.1% during 2025–2034. Government infrastructure upgrades and smart energy expansion along with rising demand for real-time monitoring in offshore energy, pipelines and industrial plants are driving DFOS market growth in Japan.

Key Insights

- The single-mode fiber segment dominated the Japan distributed fiber optic sensor market in 2024, driven by long-distance transmission, low attenuation, and high accuracy in infrastructure monitoring.

- The acoustic sensing segment is projected to grow at the fastest CAGR, fueled by rising demand for real-time detection and monitoring in energy, defense, and transportation sectors.

Industry Dynamics

- Growing government initiative towards railway safety upgrades, earthquake-resilient infrastructure projects and smart energy network expansion are accelerating DFOS adoption.

- Rising demand from offshore energy facilities, pipelines, and industrial plants for real-time structural and environmental monitoring is driving market growth.

- Increasing deployment in renewable energy projects, including offshore wind farms and solar power facilities, presents growth opportunities in the coming years

- High installation costs, coupled with challenges in integrating DFOS systems into existing infrastructure, are restraining wider adoption across certain sectors.

Market Statistics

- 2024 Market Size: USD 37.56 Million

- 2034 Projected Market Size: USD 98.09 Million

- CAGR (2025–2034): 10.1%

AI Impact on Japan Distributed Fiber Optic Sensor Market

- AI enhances data interpretation in the DFOS market by analyzing complex sensor outputs to deliver accurate real-time insights across infrastructure and industrial applications.

- Integration of AI enables intelligent anomaly detection, identifying early signs of structural stress, temperature changes, or vibrations in pipelines, tunnels, and power grids.

- AI-powered predictive analytics facilitate maintenance forecasting by evaluating historical sensor data, minimizing unplanned downtime and extending asset life in critical sectors.

- AI optimizes system responsiveness by enabling autonomous calibration, adaptive sensing thresholds, and automated alerts, improving monitoring efficiency and decision-making accuracy.

Japan distributed fiber optic sensor (DFOS) technology is growing popularly due to its capability for continuous and accurate monitoring over long distances with minimal maintenance. The technology’s immunity to electromagnetic interference and long operational life supports its use in oil and gas pipelines, power grids, railways and infrastructure projects. Japanese manufacturers are focusing on advanced interrogation units, improved sensing algorithms, and automated calibration to increase resolution and reduce signal loss. Rising focus on sustainability goals are driving the use of recyclable components and energy-efficient manufacturing processes in new product development.

Increasing applications in Japan include pipeline integrity assessment, perimeter surveillance, and structural health monitoring of bridges and tunnels. Thus, there is significant demand for DFOS to detect temperature, strain, and acoustic variations in harsh or high-pressure environments. Moreover, growing customized sensing, solutions are deployed in offshore energy facilities, earthquake-prone infrastructure, and large industrial plants to enhance accuracy and safety. Whereas, the integration of AI-based analytics and cloud monitoring platforms is enabling predictive maintenance, reducing downtime and optimizing operational costs for critical assets across industrial and public sectors.

Rapid infrastructure upgrades and rising investments in Japan’s energy and transportation sectors are boosting demand for distributed fiber optics sensors. According to Yano Research Institute, Japan’s home renovation market was valued at USD 49.96 billion in 2023, up 0.6% from the previous year. Total spending rose most for projects over 10 square meters, which increased by 5.2%. Moreover, rising government programs promoting railway safety enhancements, earthquake-resistant infrastructure and smart energy networks are driving DFOS technology adoption. Project developers are integrating DFOS systems into pipelines, bridges, and offshore facilities to improve safety compliance, minimize operational interruptions and extend asset life. Additionally, the increasing focus on sustainable practices is driving the use of energy-efficient interrogation units, recycled fiber components and low-waste installation methods for long-range and real-time monitoring.

Drivers & Opportunities

Government-Led Infrastructure Upgrades Driving DFOS Adoption: Rising government initiative towards railway safety enhancements, earthquake-resilient infrastructure projects and smart energy network expansion are creating strong demand for distributed fiber optic sensor technology in Japan. As an example, in May 2025, Japan announced to install platform doors at 4,000 train platforms by fiscal 2030, up from 2,647 in 2023, to improve passenger safety. The government will use lighter designs and subsidies to speed up the rollout. DFOS systems enable continuous, long-range monitoring that improves safety compliance and operational efficiency. Their ability to detect temperature, strain and acoustic changes in real time supports early fault detection, reducing downtime and maintenance costs. National policies promoting resilient public infrastructure and smart energy distribution are further pushing DFOS integration into critical assets, strengthening their role in Japan’s long-term infrastructure modernization strategy.

Industrial and Energy Sector Demand Fueling Market Growth

Rising demand from offshore energy facilities, pipelines and large industrial plants is boosting the adoption of distributed fiber optic sensors in Japan. According to METI, Japan aims to develop 10 GW of offshore wind power by 2030 and 30–45 GW by 2040. As of 2024, projects with a total capacity of 5.1 GW are under development. These sectors require precise, real-time structural and environmental monitoring to ensure operational safety and prevent costly failures. DFOS technology offers long-term reliability, minimal maintenance and adaptability to high-pressure or hazardous environments. Its integration with AI-based analytics enables predictive maintenance and optimized asset management. As industrial operations expand and offshore energy projects grow, DFOS deployment is becoming an essential part of operational risk management and efficiency improvement strategies.

Segmental Insights

Fiber Type Analysis

Based on fiber type, the segmentation includes single-mode fiber and multimode fiber. The single-mode fiber segment dominated the Japan distributed fiber optic sensor market in 2024, driven by its capability to transmit data over long distances with minimal signal loss. Its high sensitivity and accuracy make it suitable for large-scale infrastructure monitoring, including railways, power grids, and offshore energy facilities. The segment benefits from lower attenuation rates, enabling precise detection of temperature, strain, and acoustic changes across extended networks. Widespread use in earthquake-prone infrastructure and smart energy networks is supporting its leadership, while ongoing advancements in fiber manufacturing are improving durability and operational performance.

The multimode fiber segment is projected to grow at the fastest CAGR during the forecast period, due to its cost-effectiveness and suitability for short-to-medium range monitoring applications. It is rapidly adopted in industrial plants, transportation hubs, and civil infrastructure where high data transfer rates over shorter distances are required. Multimode fibers are easier to install and maintain, making them ideal for retrofitting existing facilities. Their adaptability for specific sensing tasks, combined with advancements in connectors and transceivers, is accelerating adoption in budget-sensitive projects without compromising on monitoring efficiency.

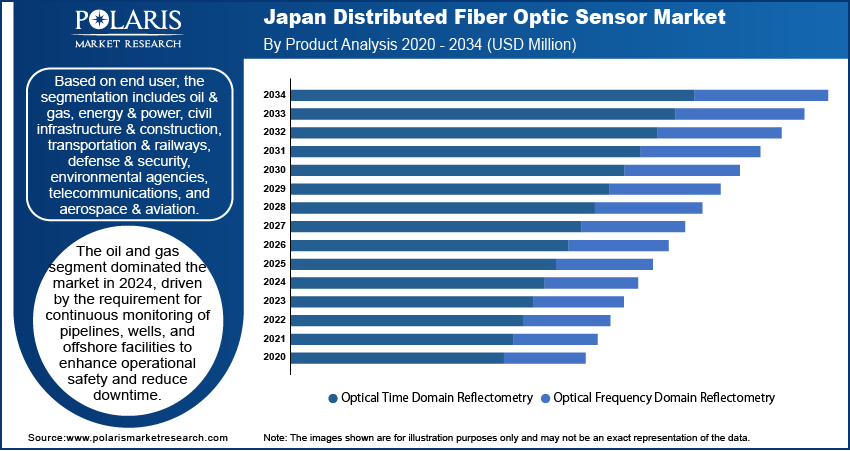

Operating Principle Analysis

By operating principle, the segment includes optical time domain reflectometry and optical frequency domain reflectometry. The optical time domain reflectometry segment dominated the Japan distributed fiber optic sensor market in 2024, due to its versatility in detecting faults, breaks, and performance degradation along fiber networks. OTDR offers precise location mapping, enabling faster repairs and reduced downtime for critical infrastructure such as pipelines, railways, and offshore platforms. Its compatibility with long-distance monitoring supports use in smart grid and earthquake-prone infrastructure projects. The combination of high accuracy, reliability, and established industry trust positions OTDR as the preferred choice for infrastructure requiring continuous, real-time condition monitoring.

The optical frequency domain reflectometry segment is expected to register the fastest CAGR during the forecast period, driven by its high-resolution measurement capabilities. OFDR provides detailed strain and temperature profiles, making it suitable for precision applications in aerospace, advanced manufacturing, and research facilities. The method’s superior spatial resolution supports monitoring of localized structural changes, enhancing safety in high-value assets. Increased use in experimental setups, smart manufacturing plants, and advanced energy infrastructure is fueling adoption, as stakeholders prioritize granular data for predictive maintenance and operational optimization.

Scattering Process Analysis

By scattering process, the segment includes the Rayleigh scattering effect, Raman scattering effect, Brillouin scattering effect, and fiber Bragg grating. The Rayleigh scattering effect segment dominated the Japan distributed fiber optic sensor market in 2024, owing to its effectiveness in detecting micro-strain and temperature variations over long distances. This technique is widely used in structural health monitoring, smart grids, and transportation networks, enabling early detection of potential failures. Rayleigh-based systems offer high sensitivity, making them suitable for earthquake-resilient infrastructure. Their proven track record in continuous, real-time monitoring applications across various industries drives their market leadership, while advancements in sensing algorithms further enhance performance and data accuracy.

The Brillouin scattering effect segment is projected to grow at the fastest CAGR during the forecast period, driven by its ability to measure temperature and strain simultaneously. This dual-sensing capability supports deployment in offshore wind farms, oil and gas pipelines, and large industrial plants where environmental conditions are extreme. Brillouin-based systems are growing popular for their long sensing range and resilience in high-pressure environments. Rising demand for integrated monitoring of structural and environmental parameters is accelerating adoption in projects that require efficient and cost-effective large-scale asset management.

Application Analysis

Based on application, the segmentation includes temperature sensing, acoustic sensing, and other sensing applications. The temperature sensing segment dominated the Japan distributed fiber optic sensor market in 2024, driven by its importance in preventing overheating, detecting leaks, and maintaining optimal operational conditions in pipelines, energy grids, and industrial plants. The technology’s ability to monitor temperature variations in real time supports asset protection and safety compliance. Its extensive use in earthquake-prone structures and offshore energy systems highlights its reliability in challenging environments. Continuous innovation in sensor calibration and thermal mapping is further strengthening its market leadership across diverse industrial and infrastructure applications.

The acoustic sensing segment is anticipated to grow at the fastest CAGR during the forecast period, fueled by its ability to detect vibrations, leaks, and unauthorized intrusions in real time. Acoustic sensing is rapidly applied in perimeter security, railway safety, and structural health monitoring. The method enables detection of abnormal patterns before they escalate into critical failures, enhancing preventive maintenance efforts. Rising demand for non-intrusive, long-range surveillance solutions in defense, transportation, and energy sectors is driving adoption, particularly as AI-powered analytics enhance the accuracy and responsiveness of acoustic monitoring systems.

End User Analysis

By end user, this segment includes oil & gas, energy & power, civil infrastructure & construction, transportation & railways, defense & security, environmental agencies, telecommunications, and aerospace & aviation. The oil and gas segment dominated the Japan distributed fiber optic sensor market in 2024, driven by the need for continuous monitoring of pipelines, wells, and offshore facilities. For example, Japan public financial institutions invested about USD 93 billion in oil and gas projects between 2013-2024. DFOS technology enables early leak detection, structural integrity assessment, and operational efficiency improvements. Its resilience in high-temperature and high-pressure environments ensures reliability in challenging offshore and onshore operations. Increasing safety regulations and the high economic impact of operational disruptions are pushing greater investment in advanced fiber optic sensing solutions for critical oil and gas infrastructure across the country.

The transportation and railways segment is expected to record the fastest CAGR during the forecast period, fueled by government-led railway modernization and safety programs. DFOS systems provide continuous track monitoring, detect infrastructure strain, and identify potential hazards before they cause disruptions. Their deployment enhances safety compliance, reduces maintenance costs, and improves service reliability. The technology’s effectiveness in earthquake-prone regions further strengthens its adoption. Integration with AI-based monitoring platforms is enabling predictive maintenance, helping operators optimize asset management while meeting national safety and operational standards.

Key Players & Competitive Analysis Report

The Japan distributed fiber optic sensor industry is moderately competitive, driven by rising demand from energy and power, transportation, civil infrastructure, and offshore energy sectors. Leading domestic and international players are focusing on advanced interrogation systems, high-precision sensing algorithms and integrated monitoring solutions to meet diverse project requirements. Competitive strategies are shaped by innovations in AI-enabled analytics, earthquake-resilient fiber designs, and dual-parameter sensing capabilities. Manufacturers are enhancing efficiency through automated calibration, modular installation, and remote monitoring integration. Additionally, the rising strategic partnerships with railway operators, utility providers and industrial facilities are expanding market reach, while recyclable fiber materials and energy-efficient manufacturing support compliance with Japan’s sustainability goals.

Key companies in the Japan distributed fiber optic sensor industry include Sumitomo Electric Industries, Ltd., Fujikura Ltd., Furukawa Electric Co., Ltd., Hitachi Information & Telecommunication Engineering, Ltd., Yokogawa Electric Corporation, NEC Corporation, Acqiris SA, Neubrex Co., Ltd., Hanamura Optics Corp., Luna Innovations Inc., Schlumberger (SLB), Ono Sokki Co., Ltd., and Optex Fa Co., Ltd.

Key Players

- Acqiris SA

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Hanamura Optics Corp.

- Hitachi Information & Telecommunication Engineering, Ltd.

- Luna Innovations Inc.

- NEC Corporation

- Neubrex Co., Ltd.

- Ono Sokki Co., Ltd.

- Optex Fa Co., Ltd.

- Schlumberger (SLB)

- Sumitomo Electric Industries, Ltd.

- Yokogawa Electric Corporation

Industry Developments

July 2025: Neubrex announced the launch of its NBX-7035 optical interrogator, offering up to 80 km measurement range, 10 cm Brillouin resolution from a single fiber end, and enhanced stability for long-term monitoring. These upgrades strengthen DFOS applications by enabling broader coverage, simpler deployment, and more reliable real-time infrastructure monitoring.

Japan Distributed Fiber Optic Sensor Market Segmentation

By Fiber Type Outlook (Revenue, USD Million, 2020–2034)

- Single-Mode Fiber

- Multimode Fiber

By Operating Principle Outlook (Revenue, USD Million, 2020–2034)

- Optical Time Domain Reflectometry

- Optical Frequency Domain Reflectometry

By Scattering Process Outlook (Revenue, USD Million, 2020–2034)

- Rayleigh Scattering Effect

- Raman Scattering Effect

- Brillouin Scattering Effect

- Fiber Brag Grating

By Application Outlook (Revenue, USD Million, 2020–2034)

- Temperature Sensing

- Acoustic Sensing

- Other Sensing Applications

By End User Outlook (Revenue, USD Million, 2020–2034)

- Oil & Gas

- Energy & Power

- Civil Infrastructure & Construction

- Transportation & Railways

- Defense & Security

- Environmental Agencies

- Telecommunications

- Aerospace & Aviation

Japan Distributed Fiber Optic Sensor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 37.56 Million |

|

Market Size in 2025 |

USD 41.32 Million |

|

Revenue Forecast by 2034 |

USD 98.09 Million |

|

CAGR |

10.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Japan market size was valued at USD 37.56 million in 2024 and is projected to grow to USD 98.09 million by 2034.

The Japan market is projected to register a CAGR of 10.1% during the forecast period.

A few of the key players in the market are Sumitomo Electric Industries, Ltd., Fujikura Ltd., Furukawa Electric Co., Ltd., Hitachi Information & Telecommunication Engineering, Ltd., Yokogawa Electric Corporation, NEC Corporation, Acqiris SA, Neubrex Co., Ltd., Hanamura Optics Corp., Luna Innovations Inc., Schlumberger (SLB), Ono Sokki Co., Ltd., and Optex Fa Co., Ltd.

The single-mode fiber segment dominated the market in 2024, driven by its capability to transmit signals over long distances with minimal attenuation and high accuracy, making it essential for monitoring critical infrastructure such as railways, power grids, and offshore energy facilities.

The acoustic sensing segment is projected to grow at the fastest CAGR, due to increasing use in railway safety, perimeter surveillance, and leak detection across energy, defense, and industrial sectors.