Recycled Fibers Market Size, Share, Trends, & Industry Analysis Report

: By Material (Synthetic Recycled Fibers and Natural Recycled Fibers), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5734

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

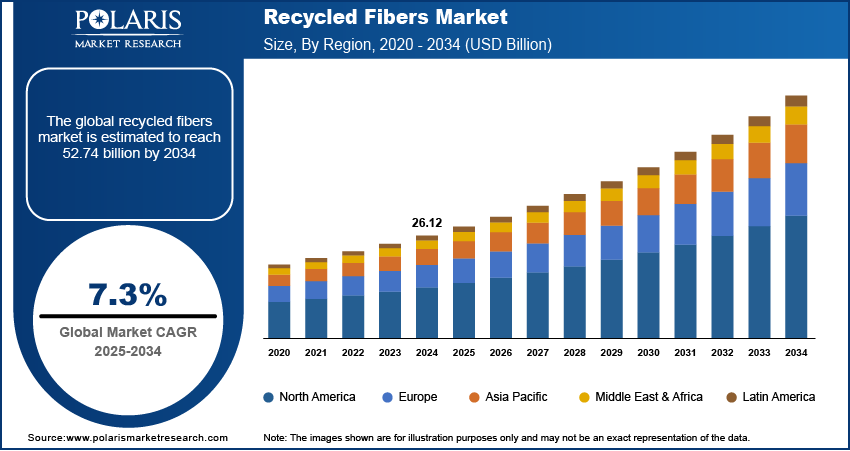

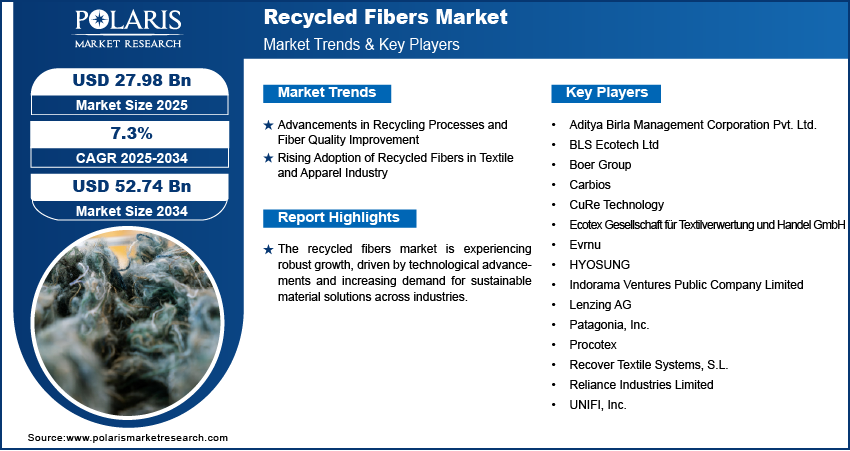

The global recycled fibers market size was valued at USD 26.12 billion in 2024, growing at a CAGR of 7.3% during 2025–2034. The growth is driven by the increasing environmental awareness and demand for sustainable materials.

Recycled fibers, derived from pre- and post-consumer waste materials, are increasingly being used in various industries, such as textiles, packaging, and construction, due to their sustainability and cost-effectiveness. The rise in investments in recycling infrastructure and supply chain enhancements supports the growth opportunities. Governments and private players are strategically investing in advanced material recovery facilities, automated sorting technologies, and localized collection systems to streamline the recycling process. For instance, in January 2025, Ingka Investments, IKEA's largest retailer, announced its plans to allocate ~USD 1.08 billion toward recycling infrastructure ventures. The initiative addresses global resource overconsumption and low recycling rates under 20%, aiming to boost circular economy practices by transforming waste into reusable materials. These improvements increase the yield and quality of recycled fibers, as well as lower production costs and improve operational efficiency. As a result, manufacturers are increasingly incorporating recycled content into their product lines, further accelerating market expansion.

To Understand More About this Research: Request a Free Sample Report

The growing consumer preference for eco-friendly and durable products is reshaping brand strategies across industries. Consumers are actively seeking products made from sustainable materials, such as recycled fibers, which offer reduced environmental impact without compromising performance with increasing environmental awareness. Brands and retailers are responding by highlighting waste recycled services in their product offerings and marketing initiatives, which encourages more producers to shift toward circular practices. In March 2022, Lenzing Group completed its Thailand lyocell expansion, adding 100,000 tons/year capacity. The plant supports the rising demand for TENCEL fibers and advances Lenzing’s specialty fiber leadership and carbon-neutral goals. This shift in consumer behavior has a major role in driving demand, especially in segments such as fashion, automotive, and home furnishings, where sustainability has become an important differentiator.

Industry Dynamics

Advancements in Recycling Processes and Fiber Quality Improvement

Advancements such as chemical recycling, advanced mechanical processing, and fiber regeneration technologies have greatly improved the quality, strength, and versatility of recycled fibers. In April 2025, researchers led by Yiqi Yang launched a chemical recycling technology allowing fiber-to-fiber reprocessing. The method effectively removes dyes, separates blended fabrics (natural/synthetic), and regenerates high-quality fibers, addressing major challenges in textile recycling. These improvements allow recycled materials to meet or exceed the performance standards of virgin fibers, making them suitable for a wider range of high-value applications. Improved processing capabilities also reduce contamination, improve color consistency, and expand the types of input waste that can be efficiently recycled. As a result, industries are increasingly incorporating recycled fibers into mainstream production, driven by both environmental objectives and material performance equality. Hence, advancements in recycling processes and fiber quality improvement are accelerating the adoption of recycled fibers.

Rising Adoption of Recycled Fibers in Textile and Apparel Industry

The rapid growth of the textile and apparel industry, combined with the rising adoption of recycled fibers, further fuels market expansion. In February 2025, the India textile and apparel market was projected to register a CAGR of 10%, reaching USD 350 billion by 2030. Exports are anticipated to reach USD 100 billion, reflecting the textile sector expansion in India. Brands are integrating recycled materials into their collections to align with eco-conscious values as consumer demand boosts for sustainable and ethically produced clothing. This trend is particularly strong among fashion retailers seeking to reduce their environmental footprint while maintaining design and quality standards. Additionally, the fast-paced nature of the textile industry encourages the use of scalable and cost-effective raw materials, making recycled fibers an attractive option. The widespread application of recycled fibers in garments, apparel and footwear, and accessories reinforces their position as an important material in the evolving landscape of sustainable fashion.

Segmental Insights

By Material Analysis

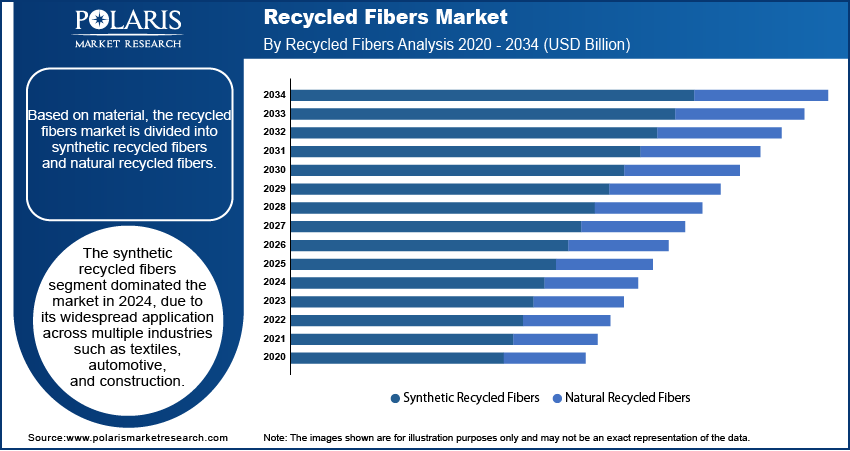

The segmentation, based on material, includes synthetic recycled fibers and natural recycled fibers. The synthetic recycled fibers segment dominated the market in 2024 due to its widespread application across multiple industries such as textiles, automotive, and construction. Synthetic fibers such as polyester and nylon are widely available as post-consumer and industrial waste. These materials are relatively easier and more cost-effective to recycle. Additionally, their durability, lightweight properties, and versatility make them highly suitable for manufacturing a broad range of end-use products. The established recycling infrastructure for synthetic materials further supports their dominance while increasing demand for sustainable and high-performance alternatives continues to drive their use across sectors.

By End Use Analysis

The segmentation, based on end use, includes textile & apparel, automotive, construction, and others. The automotive segment is expected to witness the fastest growth during the forecast period due to the rising focus on lightweight, sustainable, and cost-effective materials in vehicle manufacturing. Automakers are increasingly adopting recycled fibers for interior components such as seat fabrics, door panels, and insulation to reduce environmental impact and meet evolving regulatory requirements. The shift toward electric vehicles has further boosted the demand for lightweight materials, where recycled fibers offer both performance and environmental benefits. Additionally, the rising focus on circular economy in automotive supply chains is encouraging the use of recycled inputs to reduce lifecycle emissions and improve brand sustainability.

Regional Analysis

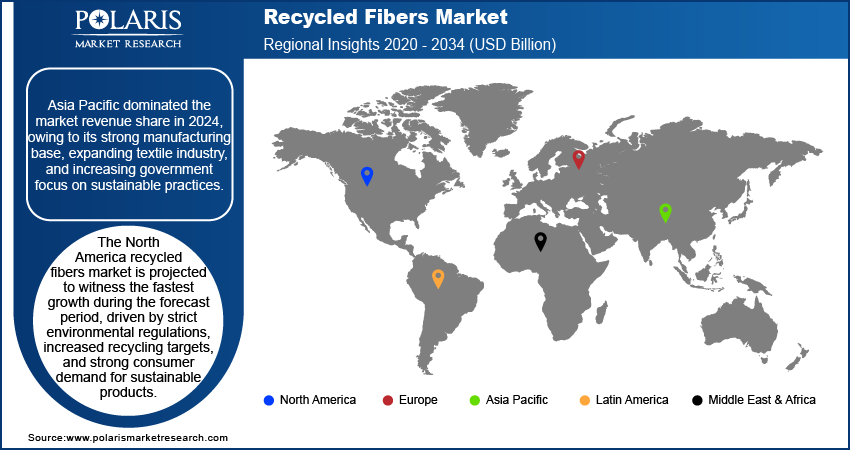

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific recycled fibers market dominated with the largest revenue share in 2024, owing to its strong manufacturing base, expanding textile industry, and increasing government focus on sustainable practices. Countries such as China, India, Bangladesh, and Vietnam are major producers of textiles and garments and are integrating recycled fibers to meet both international sustainability standards and local environmental targets. Additionally, growing urbanization and industrial development have intensified waste generation, prompting investments in recycling infrastructure. According to a February 2024 report by India’s Ministry of Environment, Forest and Climate Change, showcasing Central Pollution Control Board data (2021–22), the country generates 170,338 tonnes per day (TPD) of solid waste on average, with 91,512 TPD undergoing treatment. The region’s cost-competitive labor and rising environmental awareness are also contributing to its leadership in the global recycled fibers industry.

The North America recycled fibers market is projected to witness the fastest growth during the forecast period, driven by strict environmental regulations, increased recycling targets, and strong consumer demand for sustainable products. The presence of established recycling systems and innovation in fiber recovery technologies support the region’s ability to increase the production of high-quality recycled materials. Moreover, major retailers and fashion brands in the US and Canada are actively integrating recycled fibers into their supply chains to meet ESG goals and reduce environmental impact. In May 2025, Intradeco Holdings partnered with Recover to establish a textile recycling facility in El Salvador, expanding sustainable cotton fiber production. The Central American plant marks Recover's fifth global location, improving circular solutions for the textile industry. Countries such as the US, Canada, and Mexico are witnessing strong momentum in the adoption of recycled content across industries, supporting robust market expansion.

The Europe recycled fibers market is projected to witness substantial growth during the forecast period, supported by advanced environmental policies, circular economy initiatives, and increased investments in sustainable materials. The European Union's directives on waste management and textile recycling are pushing both public and private sectors to adopt greener practices. Additionally, consumer preference for sustainable and ethically produced goods is further driving market growth. Countries such as Germany, France, Italy, and the Netherlands are at the forefront of this shift, leveraging advanced recycling technologies and strong environmental governance to lead regional development in recycled fibers.

Key Players & Competitive Analysis Report

The recycled fibers industry is witnessing rapid growth, driven by sustainable value chains, economic and geopolitical shifts, and increasing demand across textile & apparel, automotive, and construction sectors. Competitive intelligence and strategy reveal that major players are leveraging emerging technologies and strategic investments to strengthen their positions.

Developed markets dominate adoption while emerging markets present untapped revenue opportunities due to rising environmental awareness. Disruptions and trends, such as advancements in synthetic recycled fibers and natural recycled fibers, are reshaping the industry. Small and medium-sized businesses are gaining traction through innovation, while larger firms focus on market expansion strategies and mergers and acquisitions. Expert insights highlight latent demand and opportunities in high-growth regions supported by macroeconomic trends. To stay ahead, companies must align with industry trends, optimize supply chain management, and capitalize on expansion opportunities in untapped markets.

Future development strategies will rely on technological advancements, sustainability transformation, and competitive positioning in a rapidly evolving landscape. A few key players are Aditya Birla Management Corporation Pvt. Ltd.; BLS Ecotech Ltd; Boer Group; Carbios; CuRe Technology; Ecotex Gesellschaft für Textilverwertung und Handel GmbH; Evrnu; HYOSUNG; Indorama Ventures Public Company Limited; Lenzing AG; Patagonia, Inc.; Procotex; Recover Textile Systems, S.L.; Reliance Industries Limited; and UNIFI, Inc.

Key Players

- Aditya Birla Management Corporation Pvt. Ltd.

- BLS Ecotech Ltd

- Boer Group

- Carbios

- CuRe Technology

- Ecotex Gesellschaft für Textilverwertung und Handel GmbH

- Evrnu

- HYOSUNG

- Indorama Ventures Public Company Limited

- Lenzing AG

- Patagonia, Inc.

- Procotex

- Recover Textile Systems, S.L.

- Reliance Industries Limited

- UNIFI, Inc.

Industry Developments

March 2025: BASF launched the commercial loopamid plant in Shanghai, China, with a 500-ton annual capacity. The GRS-certified facility converts textile waste into polyamide 6, supporting circular textile solutions. The innovation addresses recyclability demands in the industry.

October 2024: CARBIOS and its consortium partners (On, Patagonia, PUMA, Salomon, PVH Corp.) unveiled the 100% textile-waste-derived polyester garment using enzymatic biorecycling. This innovation advances textile circularity by converting polyester waste into high-quality fibers, matching virgin polyester performance.

July 2024: CARBIOS and Nouvelles Fibres Textiles collaborated to supply 5,000 tons/year of polyester textiles from French end-of-life textiles to CARBIOS’ biorecycling plant in Longlaville (operational 2026). This collaboration advances enzymatic textile recycling for industry-scale circularity.

Recycled Fibers Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Synthetic Recycled Fibers

- Natural Recycled Fibers

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Textile & Apparel

- Automotive

- Construction

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Recycled Fibers Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 26.12 billion |

|

Market Size Value in 2025 |

USD 27.98 billion |

|

Revenue Forecast by 2034 |

USD 52.74 billion |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 26.12 billion in 2024 and is projected to grow to USD 52.74 billion by 2034.

The global market is projected to register a CAGR of 7.3% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are American Polyfilm, Inc.; BASF; Covestro AG; Novotex Italiana S.p.A.; RTP Company; San Fang Chemical Industry Co., Ltd.; SWM International; The Lubrizol Corporation; Toray Industries, Inc.; and Wiman Corporation.

The synthetic recycled fibers segment dominated the market in 2024.

The automotive segment is expected to witness the fastest growth during the forecast period.