Medical Examination Lights Market Size, Share, Trends, Industry Analysis Report

By Product (LED Examination Lights and Halogen Examination Lights), By Mounting, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6263

- Base Year: 2024

- Historical Data: 2020-2023

Overview

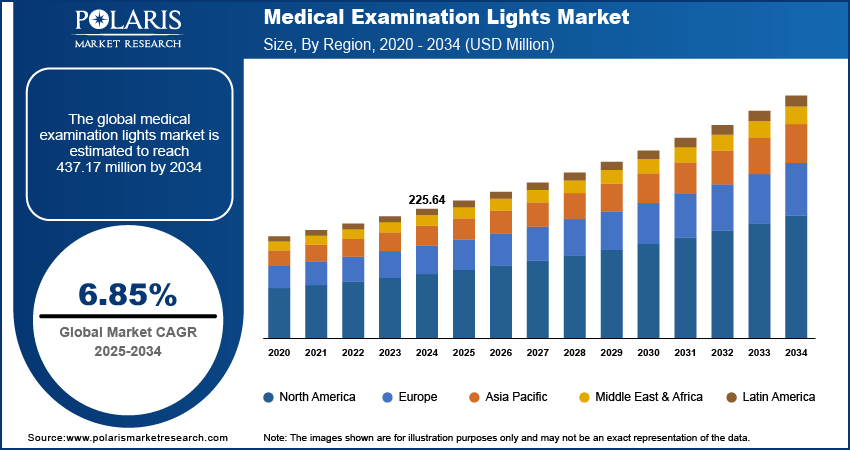

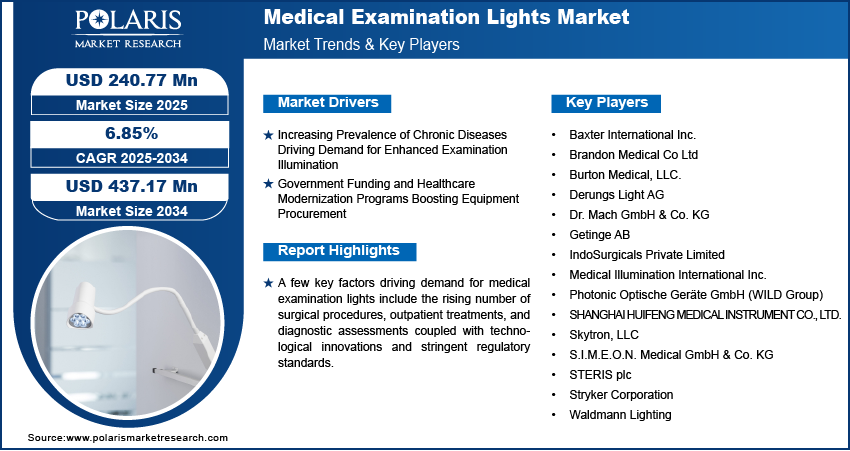

The global medical examination lights market size was valued at USD 225.64 million in 2024, growing at a CAGR of 6.85% from 2025 to 2034. Key factors driving demand for medical examination lights include increasing prevalence of chronic diseases coupled with government funding and healthcare modernization programs boosting equipment procurement.

Key Insights

- The LED examination lights segment held the largest market share in 2024, driven by energy efficiency, long lifespan, low heat emission, and superior illumination quality.

- The ceiling-mounted segment accounted for the highest share in 2024, due to flexible positioning, shadow reduction, and adaptability in high-volume clinical settings.

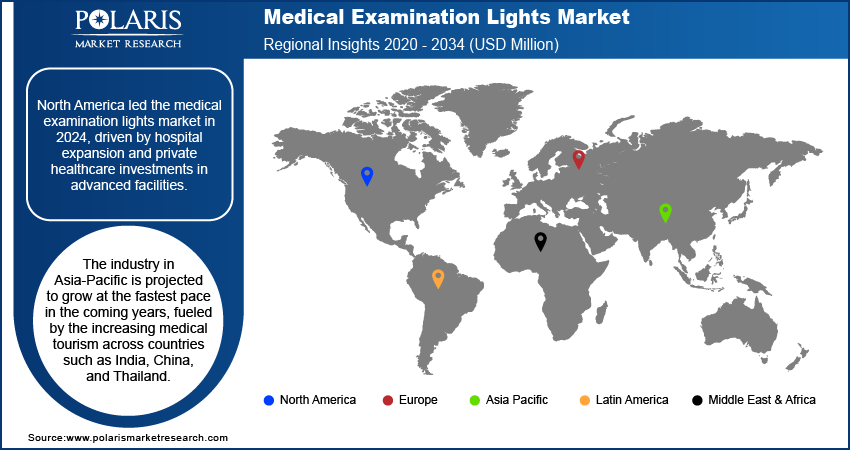

- The North America medical examination lights market dominated the market in 2024. This dominance is driven by the expansion of hospital and outpatient care infrastructure coupled with rising investments by private healthcare providers in state-of-the-art facilities.

- The U.S. held the largest revenue share in the North America medical examination lights landscape in 2024, fueled by the high prevalence of chronic and lifestyle-related diseases that increase patient examination volumes.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, driven by the increasing medical tourism across countries such as India, China, and Thailand.

- India is emerging as a key growth hub, due to rapid expansion of healthcare infrastructure, modernization of hospitals, and increasing outpatient care services.

Industry Dynamics

- Rising prevalence of chronic diseases and increasing patient volumes are driving demand for advanced medical examination lighting systems that improve diagnostic accuracy and clinical workflow efficiency.

- Government funding initiatives and healthcare modernization programs are accelerating procurement of state-of-the-art examination lights across hospitals, clinics, and specialty care centers.

- Integration of LED and laser-based illumination systems presents opportunities to enhance brightness, color rendering, energy efficiency, and procedure-specific lighting customization.

- High acquisition and maintenance costs of advanced examination lights continue to restrain adoption in smaller clinics and resource-limited healthcare facilities.

Market Statistics

- 2024 Market Size: USD 225.64 Million

- 2034 Projected Market Size: USD 437.17 Million

- CAGR (2025–2034): 6.85%

- North America: Largest Market Share

AI Impact on Medical Examination Lights Market

- AI enhances performance optimization in medical examination lights by analyzing usage patterns, lighting needs, and ambient conditions to deliver consistent, high-quality illumination.

- Integration of AI enables adaptive lighting control, automatically adjusting brightness, focus, and color temperature in real time based on procedure type and clinician movements.

- AI-powered diagnostics assist in identifying LED performance issues, overheating risks, or power fluctuations early, enabling predictive maintenance and minimizing equipment failure.

- AI improves clinician interaction by enabling gesture-based controls, automated light positioning, and real-time feedback, enhancing visibility, precision, and workflow efficiency during medical examinations.

The medical examination lights market includes advanced lighting systems designed to provide consistent, shadow-free, and high-intensity illumination for accurate visualization during medical examinations, minor surgical procedures, and diagnostic assessments. Technological advancements in LED lighting, adjustable color temperature, and ergonomic designs enhanced the efficiency, durability, and energy performance of these systems. Delivering precise illumination improves diagnostic accuracy, reduces eye strain for healthcare professionals, and supports better patient care across hospitals, clinics, and specialty care settings.

The adoption of medical examination lights is increasing due to the rising number of surgical procedures, outpatient treatments, and diagnostic assessments that require optimal illumination to ensure accuracy and precision. Globally, approximately 313 million surgical procedures are performed each year, while low- and middle-income countries face an additional need for 143 million procedures annually to meet unmet healthcare demands, save lives, and prevent long-term disabilities. These systems feature advanced LED lighting technologies, adjustable color temperature, shadow reduction mechanisms, and ergonomic designs that enhance visibility, reduce eye strain, and improve procedural efficiency for healthcare professionals.

Technological innovations coupled with stringent regulatory standards aimed at improving patient care and ensuring clinical safety, are driving significant growth in the market. Advanced LED-based medical lighting systems contribute to enhanced examination accuracy, greater energy efficiency, and improved procedural quality, while supporting better patient outcomes and aligning with broader sustainability objectives.

Drivers & Opportunities

Increasing Prevalence of Chronic Diseases Driving Demand for Enhanced Examination Illumination: The rising global burden of chronic diseases such as cardiovascular disorders, diabetes, and cancer is resulting in higher patient examination volumes, creating sustained demand for advanced medical examination lights. According to the World Health Organization, chronic diseases account for approximately 74% of all global deaths annually, necessitating timely diagnosis, monitoring, and treatment across primary, secondary, and tertiary care facilities. Optimal illumination during patient examinations is crucial for accurate visual assessment, early disease detection, and improved procedural efficiency. Healthcare facilities are increasingly investing in high-quality LED examination lights equipped with adjustable color temperature, shadow reduction features, and flexible fueling support precise diagnostics and patient comfort across diverse clinical settings.

Government Funding and Healthcare Modernization Programs Boosting Equipment Procurement: Supportive government initiatives and large-scale healthcare infrastructure upgrades are accelerating the adoption of advanced examination lighting systems. National and regional healthcare programs are prioritizing investments in modern medical devices to improve clinical safety, operational efficiency, and patient outcomes. For instance, the Government of Canada allocated USD 50 million over two years in its 2024 Budget to the Federal Construction and Renovation Program (FCRP), targeting the residential construction and healthcare sectors. Also, the Australian Government pledged USD 1.8 billion in 2025–26 to support public hospitals and healthcare services. These initiatives underscore the commitment of healthcare authorities to equip medical professionals with state-of-the-art tools that enhance diagnostic accuracy, reduce operational costs, and meet with environmental sustainability targets.

Segmental Insights

By Product

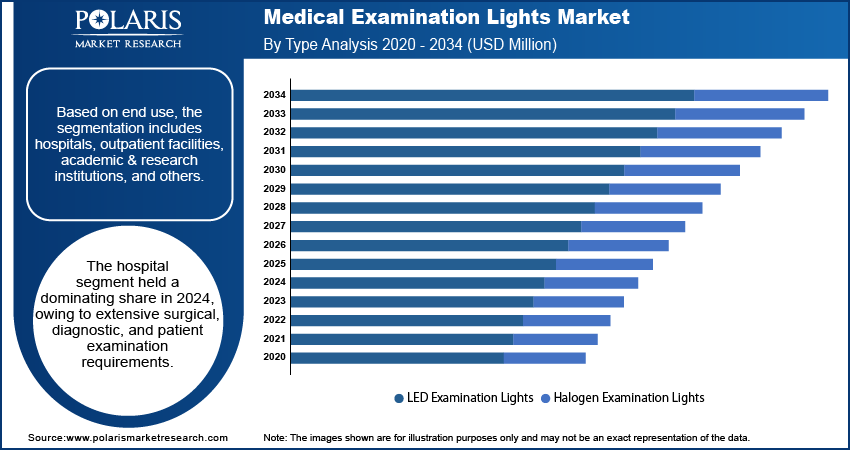

Based on product, the medical examination lights market is segmented into LED examination lights and halogen examination lights. The LED examination lights segment accounted for the largest share in 2024, driven by energy efficiency, long lifespan, low heat emission, and superior illumination quality. Healthcare facilities are increasingly adopting LED systems with adjustable color temperature, shadow reduction, and dimming capabilities to enhance diagnostic accuracy and improve patient comfort during general, dental, and surgical examinations.

Halogen examination lights are expected to register the fastest growth during the forecast period. The high-intensity illumination and precise light focus make it suitable for specialized diagnostic procedures, minor surgeries, and dental or ENT devices. Technological advancements improving energy efficiency, compact design, and portability are supporting wider adoption across hospitals, outpatient centers, and specialty clinics.

By Mounting

Based on mounting, the medical examination lights market is categorized into wall-mounted, ceiling-mounted, mobile/floor-standing, head lights/lamps/clamp-on, and combination systems. Wall-mounted systems accounted for the largest share in 2024, driven by stable and secure installation, efficient use of space, and suitability across operating rooms, outpatient examination rooms, specialty clinics, and diagnostic centers.

Ceiling-mounted lights are projected to witness significant growth during the forecast period, driven by their enhanced positioning flexibility, superior shadow reduction, and adaptability in high-volume surgical, diagnostic, and procedural environments. These attributes support improved visibility, operational efficiency, and precision in diverse clinical applications.

By Application

Based on application, the market is segmented into general examination, gynecological examination, dental examination, ENT examination, dermatology, and others. General examination accounted for the largest share in 2024, fueled by consistently high patient volumes across hospitals, outpatient clinics, and specialty diagnostic facilities requiring optimal illumination for accurate and efficient patient assessments.

Gynecological and dental applications are projected to grow at the highest CAGR during the forecast period, driven by the growing volume of outpatient procedures, emphasis on preventive care, and rising adoption of minimally invasive treatments. Increasing patient awareness of healthcare quality standards further supports demand, enhancing adoption across specialized clinical and diagnostic settings.

By End-Use

Based on end-use, the market is segmented into hospitals, outpatient facilities, academic & research institutions, and others. Hospitals accounted for the largest share in 2024, owing to extensive surgical, diagnostic, and patient examination requirements, coupled with continuous investments in modern, high-performance, energy-efficient lighting systems.

Outpatient facilities are expected to register the fastest growth over the forecast period, attributed to the rising number of outpatient procedures, diagnostic services, primary care visits, and specialized consultations. The growing demand for precise and reliable illumination solutions to support accurate diagnosis, patient comfort, and procedural efficiency is further boosting adoption across diverse outpatient care environments.

Regional Analysis

The North America medical examination lights market held the dominant revenue share in 2024, driven by the expansion of hospital and outpatient care infrastructure coupled with rising investments by private healthcare providers in state-of-the-art facilities. Advanced healthcare infrastructure and strong focus on patient safety are boosting the integration of modern LED, halogen, and hybrid lighting systems across hospitals, specialty clinics, and diagnostic centers.

U.S. Medical Examination Lights Market Insights

The U.S. accounted for the largest share of the North America market in 2024, propelled by the high prevalence of chronic and lifestyle-related diseases that increase patient examination volumes. The U.S. Centers for Disease Control and Prevention reports that six out of ten Americans contains at least one chronic disease, and four out of ten experience two or more chronic conditions. Hospitals and outpatient facilities are increasingly adopting advanced examination lights with adjustable color temperature, shadow reduction, and ergonomic designs to enhance procedural accuracy, improve clinician efficiency, and ensure patient comfort. Rising outpatient visits, preventive care initiatives, and diagnostic procedures are further increasing the demand for innovative lighting solutions that meet stringent clinical standards.

Asia Pacific Medical Examination Lights Market Trends

The Asia Pacific market is projected to hold a fastest growing CAGR by 2034, driven by the increasing medical tourism across countries such as India, China, and Thailand, which is fueling demand for advanced examination equipment. Government initiatives aimed at improving healthcare accessibility, promoting hospital modernization, and supporting the adoption of innovative medical technologies are further accelerating market growth. The rising number of specialty clinics and diagnostic centers in urban areas is contributing to higher adoption of LED and mobile examination lights for precise and reliable illumination.

India Medical Examination Lights Market Overview

India is emerging as a key growth hub in the medical examination lights market due to rapid expansion of healthcare infrastructure, modernization of hospitals, and increasing outpatient care services. Investments in new hospital construction, diagnostic centers, and surgical facilities are driving demand for high-quality, energy-efficient examination lighting systems that improve visibility, clinical workflow, and patient safety. The India Brand Equity Foundation (IBEF) reports that the Union Budget 2025-26 allocated USD 11.50 billion to the healthcare sector for the development, maintenance, and improvement of the nation’s healthcare system. These government programs are supporting the country in healthcare modernization and technology adoption, further propelling the market growth.

Europe Medical Examination Lights Market Assessment

The European market holds the substantial share in the industry, driven by regulatory emphasis on safety, hygiene, and ergonomic design in clinical environments. Investments in specialized hospitals, outpatient care centers, and diagnostic facilities are boosting demand for advanced examination lights that provide uniform illumination, minimize shadows, and enhance procedural precision. Countries such as Germany, France, and the UK are leading the adoption of LED and hybrid examination lighting solutions to meet stringent healthcare standards and improve patient outcomes.

Key Players & Competitive Analysis

The global medical examination lights market is highly competitive, with leading players such as Baxter International Inc., Brandon Medical Co Ltd, Burton Medical, LLC, Derungs Light AG, Dr. Mach GmbH & Co. KG, Getinge AB, IndoSurgicals Private Limited, Medical Illumination International Inc., Photonic Optische Geräte GmbH (WILD Group), SHANGHAI HUIFENG MEDICAL INSTRUMENT CO., LTD., and Skytron, LLC, Lighting shaping the industry through innovative lighting solutions, advanced technology integration, and extensive distribution networks. Baxter International Inc. focuses on providing high-performance examination lights with precise illumination and ergonomic designs to enhance procedural accuracy, while Brandon Medical Co Ltd and Burton Medical, LLC emphasize research-driven product development, offering comprehensive solutions for surgical, diagnostic, and outpatient care settings.

The market is witnessing increased adoption of LED, halogen, and hybrid examination lights across hospitals, outpatient facilities, and academic institutions to enhance procedural accuracy, optimize clinician performance, and improve patient safety. Companies are investing in next-generation mobile and ceiling-mounted systems, head lamps, and combination lighting solutions that deliver uniform illumination, reduce shadows, and support diverse clinical applications. Strategic collaborations with healthcare providers, hospital chains, and diagnostic equipment manufacturers are expanding the reach and capabilities of these products across multiple regions.

Prominent companies in the medical examination lights market include Baxter International Inc., Brandon Medical Co Ltd, Burton Medical, LLC, Derungs Light AG, Dr. Mach GmbH & Co. KG, Getinge AB, IndoSurgicals Private Limited, Medical Illumination International Inc., Photonic Optische Geräte GmbH (WILD Group), SHANGHAI HUIFENG MEDICAL INSTRUMENT CO., LTD., Skytron, LLC, S.I.M.E.O.N. Medical GmbH & Co. KG, STERIS plc, Stryker Corporation, and Waldmann Lighting.

Key Players

- Baxter International Inc.

- Brandon Medical Co Ltd

- Burton Medical, LLC.

- Derungs Light AG

- Dr. Mach GmbH & Co. KG

- Getinge AB

- IndoSurgicals Private Limited

- Medical Illumination International Inc.

- Photonic Optische Geräte GmbH (WILD Group)

- SHANGHAI HUIFENG MEDICAL INSTRUMENT CO., LTD.

- Skytron, LLC

- S.I.M.E.O.N. Medical GmbH & Co. KG

- STERIS plc

- Stryker Corporation

- Waldmann Lighting

Medical Examination Lights Industry Developments

In January 2025: Grand Medical launched GM300D LED examination lamp designed with features such as adjustable brightness, customizable light beam angles, and color-temperature adjustment, catering to the specific needs of various medical procedures. Its energy-efficient design and advanced technical specifications make it a valuable addition to modern healthcare settings, enhancing the quality of medical care and patient outcomes.

Medical Examination Lights Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- LED Examination Lights

- Halogen Examination Lights

By Mounting Outlook (Revenue, USD Billion, 2020–2034)

- Wall-Mounted

- Ceiling-Mounted

- Mobile/Floor-Standing

- Head Lights / Lamps / Clamp-On

- Combination

By Application Outlook (Revenue, USD Billion, 2020–2034)

- General Examination

- Gynecological Examination

- Dental Examination

- ENT Examination

- Dermatology

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Outpatient Facilities

- Academic & Research Institutions

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Examination Lights Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 225.64 Million |

|

Market Size in 2025 |

USD 240.77 Million |

|

Revenue Forecast by 2034 |

USD 437.17 Million |

|

CAGR |

6.85% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 225.64 million in 2024 and is projected to grow to USD 437.17 million by 2034.

The global market is projected to register a CAGR of 6.85% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Baxter International Inc., Brandon Medical Co Ltd, Burton Medical, LLC, Derungs Light AG, Dr. Mach GmbH & Co. KG, Getinge AB, IndoSurgicals Private Limited, Medical Illumination International Inc., Photonic Optische Geräte GmbH (WILD Group), SHANGHAI HUIFENG MEDICAL INSTRUMENT CO., LTD., Skytron, LLC, S.I.M.E.O.N. Medical GmbH & Co. KG, STERIS plc, Stryker Corporation, and Waldmann Lighting.

The LED examination lights segment dominated the market revenue share in 2024.

The ceiling-mounted lights segment is projected to witness the fastest growth during the forecast period.