ENT Devices Market Size, Share, Trends, Industry Analysis Report

: By Product, By Diagnostic Devices Type (Endoscopes and Hearing Screening Devices), By Surgical Devices Type, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM4701

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

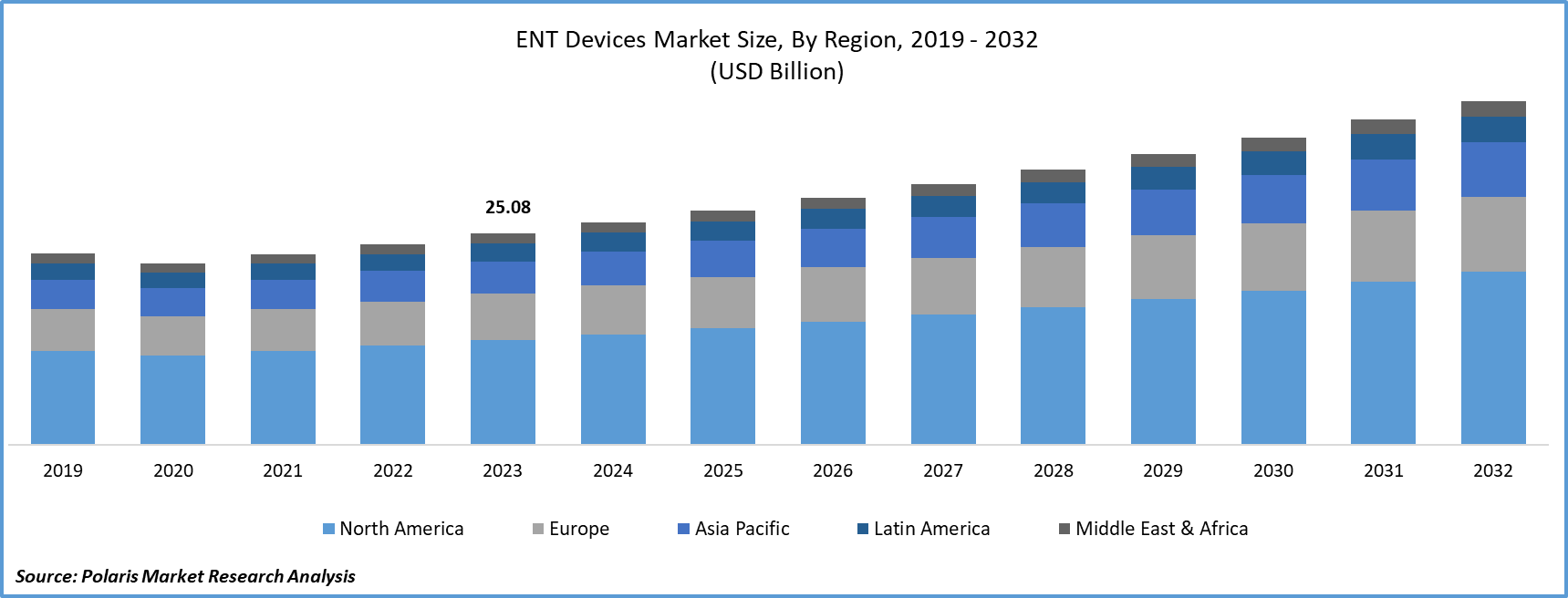

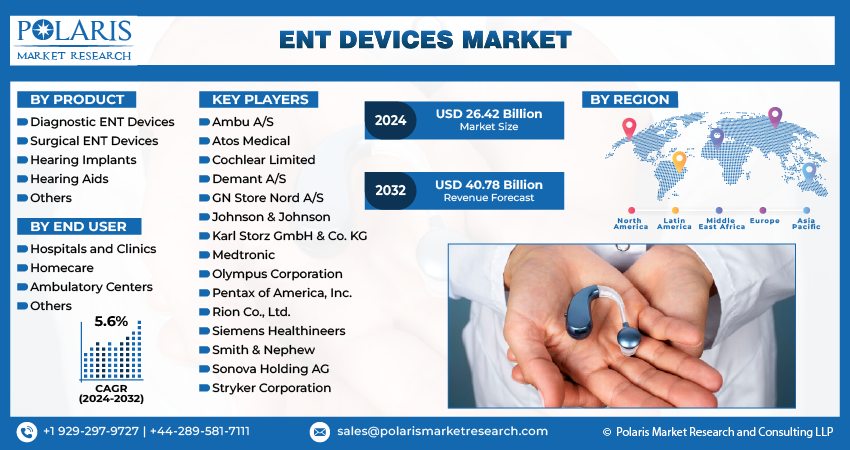

The global ear, nose, and throat (ENT) devices market size was valued at USD 27.24 billion in 2024, growing at a CAGR of 5.56% from 2025 to 2034. The growing number of ENT cases, an aging population, new technologies, and increased healthcare investments are driving market growth.

Key Insights

- In 2024, the hearing aids segment dominated the ENT devices market due to the rising prevalence of hearing loss and the increasing adoption of hearing aid technologies across all age groups.

- The endoscopes segment is expected to expand at the highest rate due to their capability to enhance the precision and effectiveness of ENT examinations and procedures.

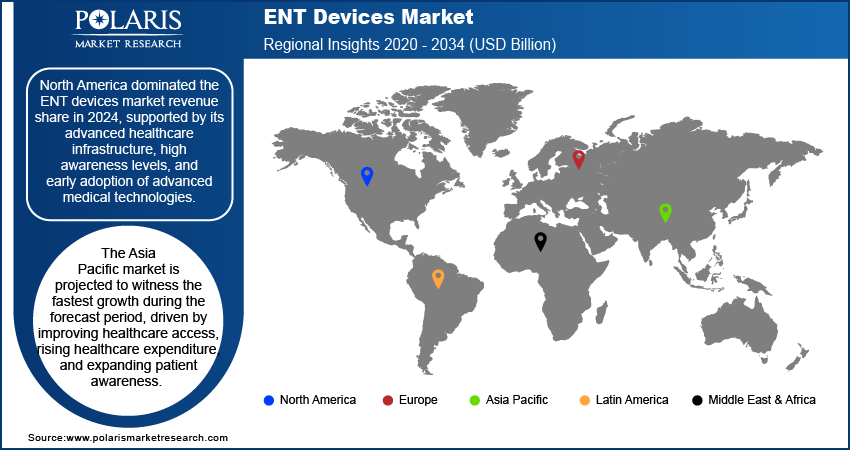

- North America had the largest market revenue in 2024 owing to a well-developed healthcare infrastructure, strong awareness, and early adoption of new medical technologies.

- Asia Pacific is projected to maintain the highest growth rate during the forecast period, driven by enhanced healthcare availability, rising spending, and increased patient awareness.

Industry Dynamics

- Continuous investments in updating healthcare centers and outfitting ENT departments with innovative equipment are fueling favorable demand and market expansion.

- The increasing number of ENT disorders is driving demand for diagnosis and treatment services, thereby fueling market growth.

- The increasing elderly population is driving growth in the ENT devices market due to the high correlation between aging and ENT disorders.

- Limited consciousness in some geographies and exorbitant costs of advanced ENT devices pose obstacles to the mass adoption of the market and its expansion.

Market Statistics

2024 Market Size: USD 27.24 billion

2034 Projected Market Size: USD 46.74 billion

CAGR (2025-2034): 5.56%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

ENT (Ear, Nose, and Throat) devices are specialized medical instruments designed for the diagnosis, treatment, and management of disorders related to the head and neck region. The ENT devices market is witnessing steady growth, largely driven by advancements in minimally invasive and digital ENT technologies. In February 2025, GN launched ReSound Vivia, the world’s smallest AI-powered hearing aid, featuring Intelligent Focus and a DNN chip trained on 13.5M speech samples. The portfolio also includes ReSound Savi, offering Bluetooth LE Audio and Auracast in an essentials-range model. These innovations have significantly improved procedural efficiency, reduced recovery time, and enhanced patient outcomes. Technologies such as image-guided surgery systems, video endoscopes, and robotic-assisted procedures are transforming the standard of care, offering precision and reduced trauma during interventions. The growing preference for outpatient and day-care surgical procedures is further fueling the demand for such advanced ENT devices.

The ENT devices market growth is attributed to rising healthcare expenditure and infrastructure development, especially across emerging economies. An April 2025 report by the IBEF, India's Union Budget 2025-26 allocated USD 11.50 billion, reflecting a 9.78% increase from the previous allocation. Improved healthcare funding has enabled the procurement of advanced diagnostic and surgical ENT equipment in both public and private healthcare settings. Additionally, infrastructure upgrades have expanded access to specialized ENT care, particularly in underpenetrated regions. Governments and healthcare institutions are increasingly prioritizing the modernization of hospitals and clinics, which includes equipping ENT departments with state-of-the-art tools. This ongoing investment in healthcare systems is creating robust demand for innovative ENT solutions, strengthening the overall market trajectory.

Market Dynamics

Increasing Prevalence of ENT Disorders

The increasing prevalence of ENT disorders directly amplifies the demand for diagnostic services and therapeutic interventions, which is driving the ENT device market development. Conditions such as chronic sinusitis, otitis media, hearing loss, and voice-related disorders are becoming more common due to factors such as rising pollution levels, lifestyle changes, and higher rates of allergies and infections. A January 2025 CDC report states that 2-3 per 1,000 US children are born with detectable hearing loss. Over 98% of newborns undergo hearing screenings, with more than 6,000 infants identified with hearing loss in 2022. This surge in ENT-related health issues necessitates timely and effective treatment, thereby accelerating the adoption of advanced ENT devices across healthcare settings. Both patients and clinicians are turning to technologically advanced tools for better clinical outcomes as awareness about early diagnosis and specialist consultations grows, which is further propelling growth opportunities.

Growing Geriatric Population

The growing geriatric population is driving the ENT devices market expansion, given the strong correlation between aging and ENT-related health complications. Elderly individuals are more susceptible to disorders such as presbycusis (age-related hearing loss), balance disorders, and voice impairments, all of which require continuous monitoring and intervention. A WHO report, published in October 2024, projected that the global population aged 60+ will rise from 1 billion in 2020 to 1.4 billion by 2030 and double to 2.1 billion by 2050. The population aged 80+ will triple to 426 million in the same period. There is an increased dependency on ENT devices for both diagnosis and rehabilitation with age-related degeneration of sensory functions. Moreover, the aging demographic is more likely to seek medical care and undergo procedures that enhance the quality of life, thus contributing to the sustained demand for ENT solutions designed specifically to meet their unique clinical needs.

Segment Insights

Market Assessment by Product

The global market segmentation, based on product, includes diagnostic devices, surgical devices, hearing aids, hearing implants, CO2 lasers, and image-guided surgery systems. The hearing aids segment dominated the ENT devices market share in 2024 due to the rising prevalence of hearing loss and the growing adoption of hearing assistance technologies across all age groups. Hearing aids are widely used as a first-line solution for managing mild to moderate hearing impairments, which are increasingly being diagnosed due to enhanced awareness and accessibility to audiology devices. Technological advancements in hearing aid design, such as the integration of Bluetooth connectivity, noise cancellation, and improved battery life, have made them more user-friendly and discreet, encouraging greater patient compliance. Furthermore, the aging population and growing focus on improving the quality of life among older people have especially contributed to the widespread adoption of these devices.

Market Evaluation by Diagnostic Devices Type

The global ENT devices market segmentation, based on diagnostic devices type, includes endoscopes, and hearing screening devices. The endoscopes segment is expected to witness the fastest growth during the forecast period, primarily due to their role in enhancing the accuracy and efficiency of ENT examinations and procedures. Endoscopic visualization allows clinicians to inspect internal anatomical structures with high precision, supporting early detection and minimally invasive surgery for conditions affecting the ear, nose, and throat. Continuous advancements in imaging clarity, ergonomics, and flexibility have made endoscopes a critical tool in both outpatient and surgical settings. The rising demand for precise and less invasive diagnostic procedures is accelerating ENT industry uptake across both developed and emerging healthcare markets.

Regional Analysis

By region, the report provides the ENT devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024, supported by its advanced healthcare infrastructure, high awareness levels, and early adoption of advanced medical technologies. The region benefits from a well-established network of ENT specialists, robust reimbursement frameworks, and substantial investments in research and innovation. For instance, in March 2025, Cochlear and GN expanded their R&D partnership under the Smart Hearing Alliance, focusing on integrated hearing solutions. The collaboration aims to enhance bimodal offerings, leveraging AI and DNN for seamless device connectivity and improved user experiences in clinical hearing care. Additionally, a high prevalence of ENT disorders, especially age-related hearing loss, has reinforced the demand for both diagnostic and therapeutic ENT devices. These factors, combined with favorable regulatory policies and the presence of key market players, have positioned North America as a leading contributor to global ENT industry.

The Asia Pacific market is projected to witness the fastest growth during the forecast period, driven by improving healthcare access, rising healthcare expenditure, and expanding patient awareness. A July 2024 report from the Ministry of Finance revealed that health expenditure in India rose to USD 70.5 billion, with its share increasing from 1.4% to 1.9% during the reported period FY 2017–18 to FY 2023–24. Countries across the region are actively investing in upgrading medical infrastructure, particularly in urban and semi-urban areas, which is enhancing the availability of advanced ENT care. The growing burden of ENT disorders, combined with a rapidly aging population and increasing adoption of modern diagnostic and therapeutic tools, is creating a strong demand for the ENT industry. Furthermore, the presence of a large, untapped population and supportive government initiatives in healthcare modernization are further propelling expansion opportunities in this region.

Key Players and Competitive Analysis

The ENT devices sector demonstrates robust structural dynamics characterized by strategic mergers among major players, such as Medtronic, Karl Storz, and Olympus Corporation. Industry analysis indicates noteworthy technological advancements in minimally invasive diagnostic and surgical platforms, driving competitive differentiation across business segments encompassing rhinology, otology, and laryngology. Leading manufacturers are actively pursuing strategic alliances with healthcare providers to establish comprehensive product offerings/mapping that address the full spectrum of clinical requirements. The competitive landscape is increasingly defined by digitalization initiatives, with AI-enhanced imaging and navigation systems emerging as key differentiators in high-value segments. Regional footprint expansion in Asia Pacific markets represents a critical priority for established players seeking to capitalize on latent demand and opportunities resulting from improving healthcare infrastructure. Future development strategies increasingly emphasize integration capabilities with hospital information systems and value-based care models. Innovation trajectories suggest a heightened focus on single-use devices and remote monitoring capabilities, particularly in post-surgical care applications. Smaller entrants are securing competitive positioning through specialized technological advancements in niche therapeutic areas. At the same time, major deals and strategic alliances analysis reveal intensifying consolidation pressures that will likely reshape industry ecosystems over the medium term. A few key major players are Ambu A/S; Atos Medical AB; Cochlear Limited; Demant A/S; GN Store Nord A/S; Johnson & Johnson Services, Inc.; KARL STORZ GmbH & Co. KG; Medtronic plc; Olympus Corporation; Pentax of America, Inc.; Rion Co., Ltd.; Siemens Healthineers AG; Smith & Nephew plc; Sonova Holding AG; and Stryker Corporation.

Medtronic plc specializes in the development and manufacturing of advanced ear, nose, and throat (ENT) devices, offering a comprehensive portfolio of over 5,000 products designed for sinus surgery, otology, neurotology, skull base surgery, and related procedures. Their ENT product range includes diagnostic devices such as endoscopes and hearing screening tools, as well as surgical instruments such as powered surgical tools, radiofrequency handpieces, balloon sinus dilation devices, and voice prosthesis systems. Medtronic’s solutions emphasize minimally invasive techniques, which are pivotal in improving patient outcomes, reducing recovery times, and enhancing surgical precision. The company also provides image-guided surgery systems and biomaterials for nasal and ear packing, supporting complex ENT interventions. Medtronic’s leadership in the ENT industry is driven by continuous innovation, integration of advanced technologies, and a focus on addressing a broad spectrum of ENT disorders, such as sinusitis, hearing loss, and sleep apnea.

Atos Medical AB specializes in the development and sale of ENT (ear, nose, and throat) medical devices, with a particular focus on improving the quality of life for individuals suffering from a neck stoma following laryngectomy or tracheostomy. Founded in 1986 in Sweden, Atos Medical has established itself in neck stoma care, offering innovative solutions for voice and pulmonary rehabilitation to help people breathe, speak, and live well. The company’s flagship Provox system includes a range of advanced voice prostheses, heat and moisture exchangers (HMEs), and adhesives designed for speech restoration and respiratory health after total laryngectomy. Atos Medical has expanded its portfolio to include products such as the Provox ActiValve, Provox Vega, and Provox FreeHands FlexiVoice, each addressing specific patient needs such as hands-free speaking and improved humidification. The Freevent brand extends its expertise to tracheostomy care, providing high-quality devices for both adult and pediatric patients. Atos Medical emphasizes clinical research, education, and continuous product development in collaboration with ENT specialists and patients, ensuring evidence-based, reliable, and user-friendly solutions. Now part of Coloplast A/S, Atos Medical operates in over 90 countries, maintaining a strong innovation and patient-centered care in the ENT industry.

List of Key Companies:

- Ambu A/S

- Atos Medical AB

- Cochlear Limited

- Demant A/S

- GN Store Nord A/S

- Johnson & Johnson Services, Inc.

- KARL STORZ GmbH & Co. KG

- Medtronic plc

- Olympus Corporation

- Pentax of America, Inc.

- Rion Co., Ltd.

- Siemens Healthineers AG

- Smith & Nephew plc

- Sonova Holding AG

- Stryker Corporation

ENT Devices Industry Developments

March 2025: Ear Solutions partnered with Audientes to launch the world’s first self-fitting digital hearing aid, Ven. Leveraging Ear Solutions’ distribution network in India, the collaboration aims to expand access to hearing care for millions.

February 2023: Innovia Medical introduced its Summit Medical ENT series in the UK market. This product lineup showcases a range of high-quality essentials, including Rhino Rocket, Grommets and Ventilation Tubes, AbsorbENT Nasal and Sinus Packs, and Denver Splint.

October 2022: Sony Electronics revealed the launch of its over-the-counter (OTC) hearing aids for the US market. Created in collaboration with WS Audiology, the two inaugural products from this partnership are the CRE-C10 and the CRE-E10 self-adjusting OTC hearing aids.

September 2021: Acclarent, Inc. unveiled its inaugural AI-driven ENT technology in the US, aimed at streamlining surgical preparation and offering immediate guidance during ENT navigation procedures. This novel software suite, comprising TruSeg and TruPath, is compatible with the TruDi Navigation System. It harnesses a machine learning algorithm to offer dependable and precise image-guided preoperative planning and navigation for ENT procedures.

ENT Devices Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Diagnostic Devices

- Surgical Devices

- Hearing Aids

- Hearing Implants

- CO2 Lasers

- Image-Guided Surgery Systems

By Diagnostic Devices Type Outlook (Revenue, USD Billion, 2020–2034)

- Endoscopes

- Hearing Screening Devices

By Surgical Devices Type Outlook (Revenue, USD Billion, 2020–2034)

- Powered Surgical Instruments

- Radiofrequency (RF) Hand pieces

- Handheld Instruments

- Balloon Sinus Dilation Devices

- ENT Supplies

- Ear Tubes

- Voice Prosthesis Devices

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals and Clinics

- Homecare

- Ambulatory Centers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

ENT Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 27.24 billion |

|

Market Size Value in 2025 |

USD 28.72 billion |

|

Revenue Forecast by 2034 |

USD 46.74 billion |

|

CAGR |

5.56% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 27.24 billion in 2024 and is projected to grow to USD 46.74 billion by 2034.

The global market is projected to register a CAGR of 5.56% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Ambu A/S; Atos Medical AB; Cochlear Limited; Demant A/S; GN Store Nord A/S; Johnson & Johnson Services, Inc.; KARL STORZ GmbH & Co. KG; Medtronic plc; Olympus Corporation; Pentax of America, Inc.; Rion Co., Ltd.; Siemens Healthineers AG; Smith & Nephew plc; Sonova Holding AG; and Stryker Corporation.

The hearing aids segment dominated the market share in 2024.

The endoscopes segment is expected to witness the fastest growth during the forecast period.