Audiology Devices Market Size, Share, Trends, Industry Analysis Report

: By Type (Diagnostic Device, Hearing Aid Device, and Hearing Implants), Type of Hearing Loss, Patient Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM1312

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

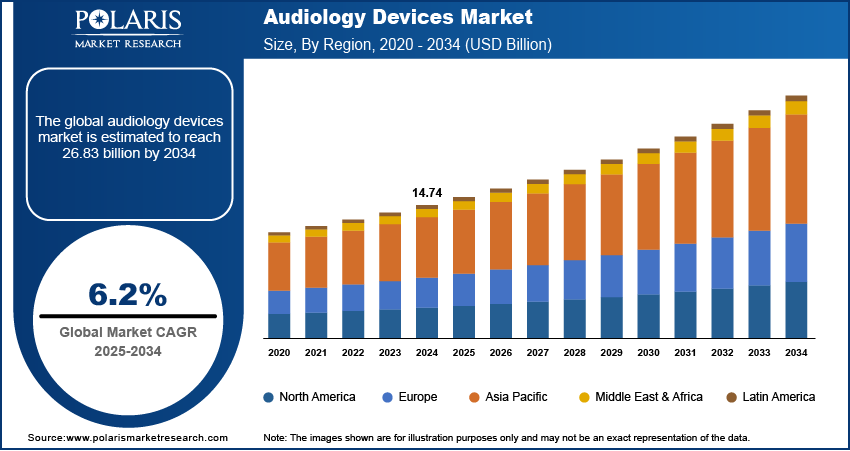

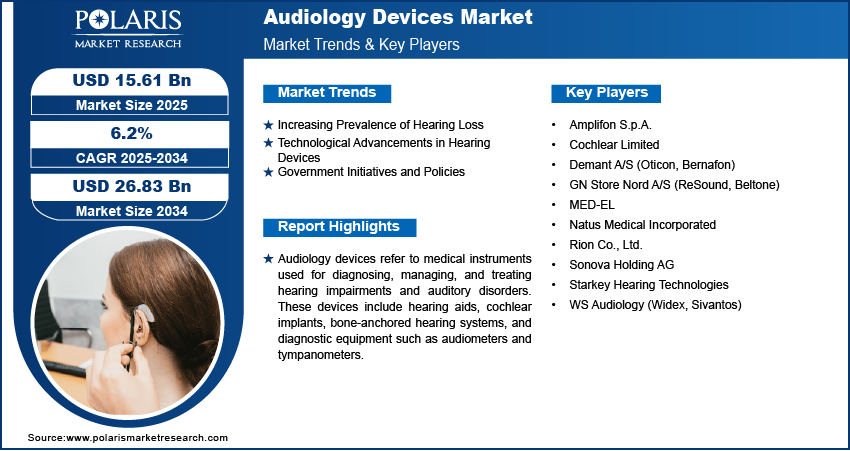

The global audiology devices market size was valued at USD 14.74 billion in 2024. The market is projected to grow from USD 15.61 billion in 2025 to USD 26.83 billion by 2034, exhibiting a CAGR of 6.2% during 2025–2034. The developmental factors of the market are growing existence of hearing illnesses, growing geriatric population, and progressions in hearing aid technology.

Key Insights

- The hearing aid devices segment contributed to the largest revenue share in 2024.

- The sensorineural hearing loss segment constituted of a bigger market share segment due to the growing existence of sensorineural hearing loss which has caused elevated demand for gadgets such as hearing aids and cochlear implants, which are outlined to handle this kind of shortcoming.

- Europe audiology devices market made up for the region with the largest revenue share because of marked attributes covering several regions impacted by elements such as demographic trends, healthcare framework, and technological progressions.

- Asia Pacific is encountering the highest growth rate due to growing geriatric population and growing cases of hearing loss in nations such as India and China.

Industry Dynamics

- The worldwide surge in hearing disablement cases notably pushes the market demand.

- Progressions in hearing technologies have distinctly improved the usefulness and attraction of audiology devices is fueling the market expansion.

- The escalating demand for wireless and digital hearing aids which provide superior sound quality and user ease boosts the market development.

- However, the blemish linked with adorning hearing aids and obtainability of multipurpose wearables such as smart earbuds pulls the market down.

Market Statistics

2024 Market Size: USD 14.74 billion

2034 Projected Market Size: USD 26.83 billion

CAGR (2025-2034): 6.2%

Europe: Largest Market in 2024.

To Understand More About this Research: Request a Free Sample Report

The audiology devices market encompasses a range of medical instruments designed to assist individuals suffering from hearing impairments. These devices include hearing aids, cochlear implants, diagnostic instruments, and other hearing solutions that improve auditory health. The market is expanding due to the rising prevalence of hearing disorders, an aging population, and advancements in hearing aid technology. Additionally, increased awareness about hearing loss and government initiatives to provide affordable hearing solutions are further fueling the audiology devices market growth.

The growing demand for wireless and digital hearing aids, which offer better sound quality and user convenience, boots the audiology devices market development. The adoption of telehealth services for remote hearing assessments is also boosting market expansion. Furthermore, increased healthcare spending and the availability of insurance coverage for hearing aids are making these devices more accessible. As a result, the market is expected to experience steady growth in the coming years, with continuous advancements improving the overall hearing care landscape.

Market Dynamics

Increasing Prevalence of Hearing Loss

The global rise in hearing impairment cases significantly propels the audiology devices market demand. The World Health Organization reported in 2021 that over 5% of the world's population, approximately 430 million people, require rehabilitation to address disabling hearing loss. This number is projected to increase due to factors such as an aging population and increased exposure to environmental noise. As the prevalence of hearing loss escalates, the demand for effective audiology devices grows correspondingly.

Technological Advancements in Hearing Devices

Innovations in hearing technology have markedly enhanced the functionality and appeal of audiology devices. For instance, in 2024, Apple introduced a software upgrade that transformed its AirPods Pro 2 into "clinical-grade" hearing aids for individuals experiencing mild to moderate hearing loss. This development, reported by the Australian in 2024, allows users to perform hearing tests and adjust settings via their iPhone or iPad, promoting earlier treatment and increasing awareness of hearing loss. Such technological advancements in hearing devices improve user experience and attract tech-savvy consumers, thereby contributing to the audiology devices market opportunities.

Government Initiatives and Policies

Government actions are crucial in expanding access to hearing care services and devices. In 2022, the US Food and Drug Administration implemented a rule permitting the sale of over-the-counter hearing aids without medical exams or prescriptions. This policy change, aims to make hearing aids more accessible and affordable, addressing barriers such as cost and stigma associated with traditional hearing aids. By facilitating easier access to hearing devices, such government initiatives significantly propel the audiology devices market expansion.

Segment Insights

Audiology Devices Market Assessment – By Type

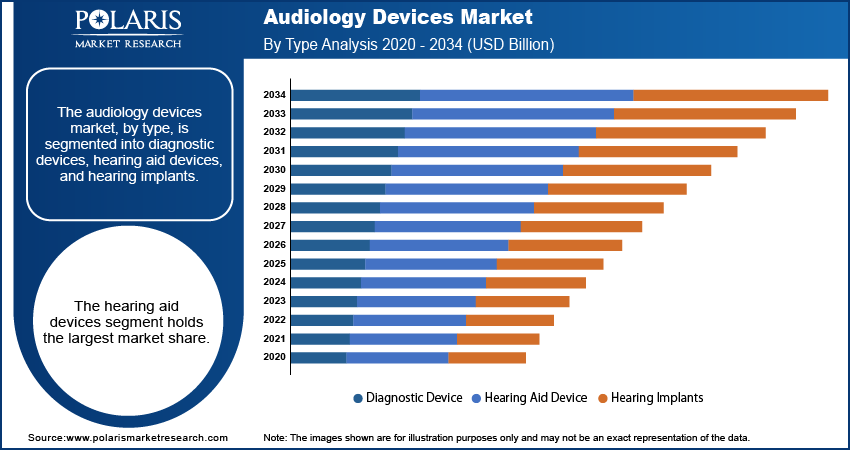

The audiology devices market, by type, is segmented into diagnostic devices, hearing aid devices, and hearing implants. The hearing aid devices segment held the largest market share in 2024. This dominance is attributed to their widespread adoption across various demographics, particularly among individuals experiencing age-related hearing loss. Technological advancements have significantly enhanced the functionality and appeal of hearing aids, incorporating features such as digital signal processing, noise reduction, Bluetooth connectivity, and rechargeable batteries. These innovations have improved user experience and increased acceptance of hearing aids. Furthermore, the availability of diverse styles and models, including behind-the-ear (BTE) and in-the-ear (ITE) options, caters to varying user preferences and degrees of hearing impairment, further solidifying the prominence of hearing aid devices in the market.

The hearing implants segment is experiencing the highest growth rate. This surge is driven by increasing awareness of cochlear implants as effective solutions for severe hearing loss and the introduction of innovative products by key industry players. Additionally, advancements in surgical techniques and supportive reimbursement policies have made hearing implants more accessible to patients, fueling their rapid growth in the market.

Audiology Devices Market Evaluation – By Type of Hearing Loss

The audiology devices market, by type of hearing loss, is segmented into sensorineural hearing loss and conductive hearing loss. The sensorineural hearing loss segment represents a larger audiology devices market share. This condition arises from damage to the inner ear or auditory nerve, often due to aging, prolonged exposure to loud noises, or genetic predispositions. The increasing prevalence of sensorineural hearing loss has led to heightened demand for devices such as hearing aids and cochlear implants, which are designed to manage this type of impairment. Technological advancements have significantly enhanced the effectiveness and user experience of these devices, incorporating features such as digital signal processing, noise reduction, and wireless connectivity. These innovations have improved the quality of life for individuals with sensorineural hearing loss and have contributed to the segment's dominant position in the market.

The conductive hearing loss segment is experiencing the highest growth rate within the market. This type of hearing loss occurs when sound waves are impeded from reaching the inner ear due to issues in the outer or middle ear, such as ear infections, fluid accumulation, or structural abnormalities. Recent advancements in medical treatments, including surgical interventions and bone-anchored hearing aids, have significantly improved the management of conductive hearing loss. These developments have increased patient awareness and acceptance of available solutions, leading to a surge in demand for related audiology devices. As a result, the conductive hearing loss segment is experiencing rapid growth within the market.

Audiology Devices Market Evaluation– By Patient Type

By patient type, the audiology devices market is segmented into adults, pediatrics, and others. In 2024, the adults segment held the largest share of the audiology devices market revenue. This dominance is primarily attributed to the increasing prevalence of age-related hearing loss among the elderly population. As individuals age, the likelihood of experiencing hearing impairment rises, leading to a greater demand for audiology devices such as hearing aids and cochlear implants. Furthermore, heightened awareness about the benefits of early intervention and the availability of advanced hearing solutions have encouraged more adults to seek treatment for hearing loss. Manufacturers have responded by developing devices tailored to adult users, featuring enhanced sound quality, discreet designs, and connectivity options that integrate seamlessly with other personal electronics. These factors collectively contribute to the substantial market share held by the adult segment.

The pediatrics segment is experiencing the highest growth rate. This growth is driven by improved early screening protocols and increasing awareness of the critical role hearing intervention plays in childhood development. Addressing hearing loss during formative years significantly enhances educational outcomes and social integration for children. Manufacturers are focusing on developing child-specific features, including robust construction, tamper-resistant battery compartments, and remote monitoring capabilities for parents. Establishing brand relationships with pediatric patients creates potential customers for a long time, making the pediatrics segment strategically valuable beyond its current size.

Regional Insights

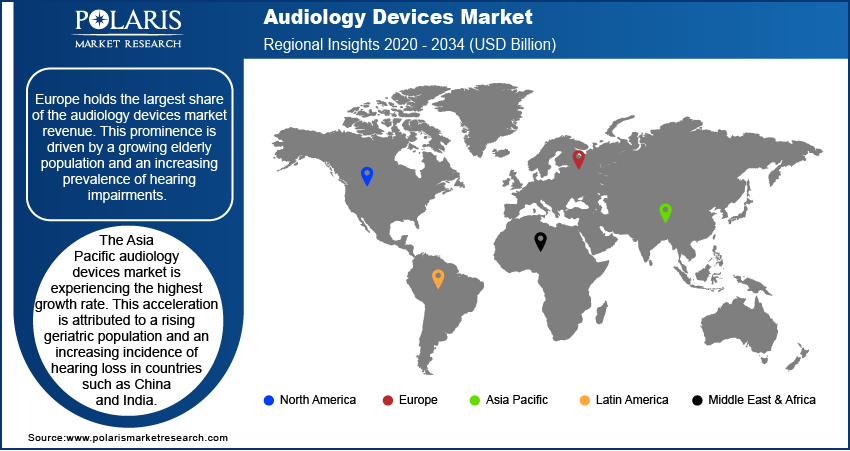

By region, the study provides audiology devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The market exhibits distinct characteristics across various regions, influenced by factors such as demographic trends, healthcare infrastructure, and technological advancements. In 2024, Europe holds the largest share in the market. This prominence is driven by a growing elderly population and an increasing prevalence of hearing impairments. Countries such as Germany and the UK have well-established healthcare systems that facilitate access to advanced audiology devices. Government initiatives, including favorable reimbursement policies and public health campaigns, have heightened awareness and encouraged the adoption of hearing aids and related technologies. The presence of leading audiology device manufacturers further strengthens the market in this region.

The Asia Pacific audiology devices market is experiencing the highest growth rate. This acceleration is attributed to a rising geriatric population and an increasing incidence of hearing loss in countries such as China and India. Enhanced awareness of hearing health, coupled with growing disposable incomes, has led to greater demand for audiology devices. Additionally, improvements in healthcare infrastructure and the availability of cost-effective hearing solutions have made these devices more accessible to a broader segment of the population.

Key Players and Competitive Insights

The audiology devices market features several major companies actively offering products and solutions. A few key players include Sonova Holding AG (parent of Phonak, Unitron, and Advanced Bionics); Cochlear Limited; MED-EL; GN Store Nord A/S (parent of ReSound and Beltone); Starkey Hearing Technologies; WS Audiology (formed from the merger of Widex and Sivantos); Demant A/S (parent of Oticon and Bernafon); Amplifon S.p.A.; Rion Co., Ltd.; and Natus Medical Incorporated.

The competitive landscape of the audiology devices market is characterized by continuous innovation and strategic collaborations. Companies invest significantly in research and development to introduce advanced hearing solutions, such as devices with artificial intelligence capabilities and enhanced connectivity features. Mergers and acquisitions are also prevalent, enabling firms to expand their product portfolios and geographic reach. Additionally, partnerships with healthcare providers and technological firms facilitate the integration of audiology devices with broader health monitoring systems, enhancing user experience and accessibility.

Sonova Holding AG, headquartered in Stäfa, Switzerland, is a leading provider of hearing care solutions. Through its brands Phonak, Unitron, and Advanced Bionics, Sonova offers a comprehensive range of products, including hearing aids, cochlear implants, and wireless communication devices. The company's commitment to innovation is evident in its development of AI-powered hearing aids, aiming to improve user experience and address diverse hearing impairments.

Cochlear Limited, based in Sydney, Australia, specializes in implantable hearing solutions. The company's product lineup includes cochlear implants, bone conduction implants, and acoustic implants designed to treat various types of hearing loss. Cochlear Limited focuses on advancing hearing technology and expanding access to its devices globally, contributing significantly to the audiology devices market.

List of Key Companies

- Amplifon S.p.A.

- Cochlear Limited

- Demant A/S (Oticon, Bernafon)

- GN Store Nord A/S (ReSound, Beltone)

- MED-EL

- Natus Medical Incorporated

- Rion Co., Ltd.

- Sonova Holding AG (Phonak, Unitron, Advanced Bionics)

- Starkey Hearing Technologies

- WS Audiology (Widex, Sivantos)

Audiology Devices Industry Developments

- August 2024: Sonova launched two new hearing aid platforms, including the first real-time AI-powered device aimed at addressing key challenges in hearing loss.

- March 2024: WSAudiology launched Rexton ReCharge, a cost-effective range of rechargeable hearing solutions designed to cater to global hearing needs.

Audiology Devices Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Diagnostic Device

- Hearing Aid Device

- Hearing Implants

By Type of Hearing Loss Outlook (Revenue – USD Billion, 2020–2034)

- Sensorineural Hearing Loss

- Conductive Hearing Loss

By Patient Type Outlook (Revenue – USD Billion, 2020–2034)

- Adults

- Pediatrics

- Others

By Regional Outlook (Revenue –USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Audiology Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.74 billion |

|

Market Size Value in 2025 |

USD 15.61 billion |

|

Revenue Forecast by 2034 |

USD 26.83 billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The audiology devices market size was valued at USD 14.74 billion in 2024 and is projected to grow to USD 26.83 billion by 2034.

The market is projected to register a CAGR of 6.2% during 2025–2034.

Europe held the largest share of the market in 2024.

? A few key players in the audiology devices market are Sonova Holding AG (parent of Phonak, Unitron, and Advanced Bionics); Cochlear Limited; MED-EL; GN Store Nord A/S (parent of ReSound and Beltone); Starkey Hearing Technologies; WS Audiology (formed from the merger of Widex and Sivantos); Demant A/S (parent of Oticon and Bernafon); Amplifon S.p.A.; Rion Co., Ltd.; and Natus Medical Incorporated.

The adults segment accounted for a larger share of the market in 2024.

Audiology devices are specialized medical instruments designed to diagnose, manage, and treat hearing loss and other auditory disorders. These devices include hearing aids, cochlear implants, diagnostic tools such as audiometers, and bone-anchored hearing systems. They help individuals having hearing impairments improve their auditory perception and communication abilities. Advancements in technology, such as artificial intelligence, wireless connectivity, and noise reduction features, have enhanced the functionality and accessibility of these devices. They are widely used in hospitals, audiology clinics, and personal healthcare settings to improve the quality of life for individuals with hearing-related conditions.