US Metallocene LDPE Market Size, Share, Trends, & Industry Analysis Report

By Polymer Type, By Application (Packaging and Non- Packaging), By End User, and By Country – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM6083

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

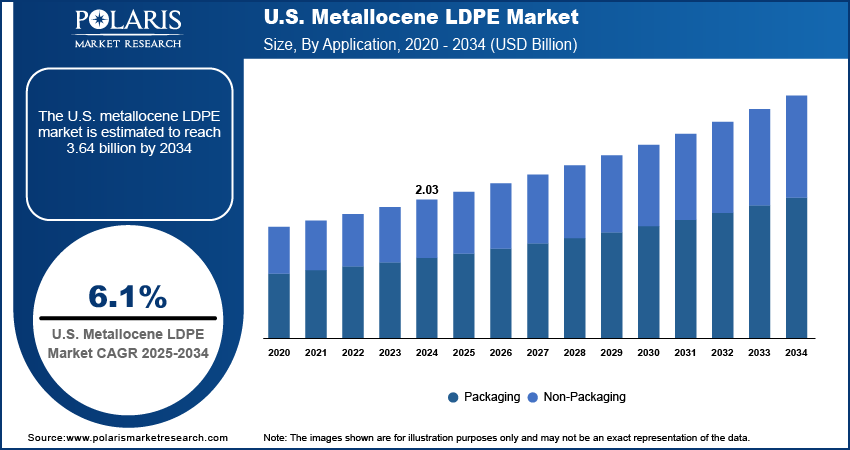

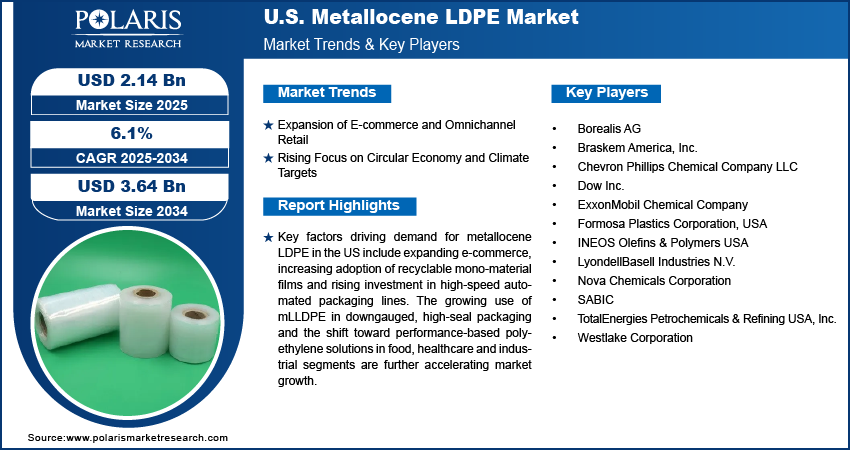

The US metallocene LDPE market size was valued at USD 2.03 billion in 2024, growing at a CAGR of 6.1% during 2025–2034. Expansion of e-commerce and omnichannel retail combined with growing focus on circular economy goals and climate targets is driving the demand for recyclable and high-performance packaging solutions based on metallocene LDPE.

Key Insights

- The mLLDPE segment accounted for 62.65% market share in 2024.

- The healthcare segment is projected to grow at the fastest rate over the forecast period, driven by rising demand for sterile packaging and medical-grade films.

- The US market is expanding steadily, fueled by growth in e-commerce logistics, increasing focus on recyclable packaging, and regulatory support for sustainable material adoption.

Industry Dynamics

- Expanding e-commerce and retail logistics across the US is driving the demand for metallocene LDPE in flexible packaging used for shipping, secondary wrapping and protective mailers.

- Rising focus on circular economy and sustainable packaging standards is accelerating the use of recyclable metallocene LDPE films in food, personal care and healthcare applications.

- Rising technological advancements in recyclable mono-material packaging creates opportunity for the market in the coming years. This is due to the growing popularity among brand owners and retailers for sustainable alternatives to multi-layer films.

- Volatile raw material cost and compliance with evolving plastic regulations are creating cost pressures for smaller manufacturers, limiting their competitiveness in certain high-demand sectors.

Market Statistics

- 2024 Market Size: USD 2.03 billion

- 2034 Projected Market Size: USD 2.14 billion

- CAGR (2025-2034): 6.1%

To Understand More About this Research: Request a Free Sample Report

Metallocene LDPE (mLLDPE) consumption is increasing in the US due to its use in high-performance film applications across packaging, agriculture and industrial sectors. mLLDPE consistent polymer structure allows downgauging without compromising strength, which supports material savings in large-volume production. The material is preferred for mono-material packaging formats and high-speed automated lines due to its seal integrity, optical clarity and processability. Growing demand for flexible packaging in food, personal care and healthcare sectors is driving steady adoption across domestic supply chains.

The metallocene LDPE market is significantly growing driven by sustainability goals and innovation in recyclable film structures. Rising investments in circular packaging coupled with regulatory support for source reduction are driving adoption of metallocene-based solutions. In November 2024, ExxonMobil announced to invest USD 200 million to expand its advanced recycling capacity at the Baytown facility in Texas, aiming to process more plastic waste into circular polymers. This development is expected to boost availability of recycled feedstock for metallocene LDPE production, fueling demand for high-performance, recyclable packaging materials.

The downgauging capability, high seal strength and optical clarity are driving the adoption of metallocene LDPE across the US flexible packaging sector. There is a growing need for lightweight, recyclable and energy-efficient films to support sustainable packaging targets and material recovery goals. Manufacturers are investing in process optimization, feedstock innovation, and advanced extrusion technologies to improve product consistency and recyclability. Additionally, federal initiatives to lower plastic waste along with industry commitments to circular economy standards are boosting market expansion across food, medical and industrial packaging segments. For example, in November 2024, the US EPA introduced updated guidelines to promote the use of mono-material recyclable films in consumer packaging.

Drivers & Opportunities/Trends

Expansion of E-commerce and Omnichannel Retail: The rapid expansion of e-commerce and omnichannel retail is increasing the demand for durable and lightweight packaging materials that withstand extended handling, shipping and distribution cycles. According to the US Census Bureau, e-commerce sales reached USD 300.2 billion in Q1 2025, with little change from the previous quarter. This marked a 6.1% increase from Q1 2024 and accounted for 16.2% of total retail sales. Metallocene LDPE offers high seal strength, puncture resistance and downgauging capability, making it suitable for protective mailers, secondary wraps and flexible pouches used in online retail logistics. The US-based retailers and packaging suppliers are adopting high-performance mLDPE films to improve delivery efficiency and reduce material waste. This shift is contributing to consistent market growth across the country’s consumer packaging ecosystem.

Rising Focus on Circular Economy and Climate Targets: The US market is witnessing a transition toward circular economy practices driven by federal climate goals and industry-led sustainability commitments. Regulatory focus on recyclable packaging formats is prompting manufacturers to use metallocene LDPE in mono-material film structures. The polymer’s downgauging potential and compatibility with existing recycling streams support national efforts to reduce plastic waste and greenhouse gas emissions. Producers are investing in cleaner feedstock sources and low-emission production technologies. These developments are enhancing the role of mLDPE in sustainable packaging solutions across food, healthcare and retail applications.

Segmental Insights

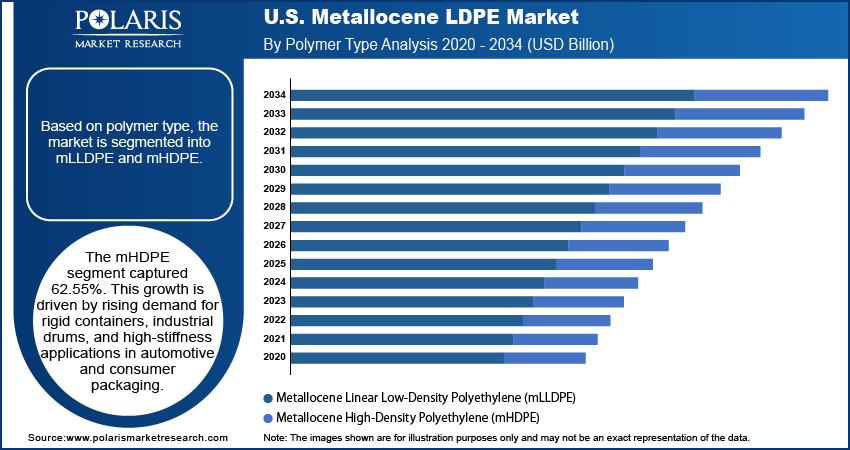

Polymer Type Analysis

Based on polymer type, the segmentation includes metallocene linear low-density polyethylene (mLLDPE) and metallocene high-density polyethylene (mHDPE). The mLLDPE segment dominated the market in 2024, due to its widespread use in high-performance film applications across food, personal care and healthcare packaging. Its ability to offer downgauging, high tensile strength and sealing consistency makes it suitable for mono-material films and biodegradable packaging formats. The material performs well under high-speed processing conditions, making it ideal for automated lines used in large-scale production. Regulatory pressure to improve recyclability and reduce packaging waste is further driving the adoption of mLLDPE. Rising continuous production expansions by key manufacturers are ensuring steady supply across retail and industrial supply chains.

The mHDPE segment is expected to grow at the fastest rate during the forecast period. This is driven by increasing demand for rigid packaging and performance-based containers. The material provides excellent stiffness, impact resistance and moisture barrier, which makes it suitable for heavy-duty liners, closures, bottles and industrial drums. Its growing use in consumer goods, automotive parts and chemical packaging is driving volume growth. In addition, the market is benefiting from innovation in blow molding and extrusion processes that support precision manufacturing. Rising preference for recyclable and lightweight rigid packaging is further driving mHDPE consumption across multiple end-use sectors.

Application Analysis

By application, the segmentation includes packaging and non-packaging. The packaging segment dominated the market in 2024, due to growing demand from food, personal care and e-commerce industries. mLDPE is widely used in film structures that offer high clarity, seal strength and downgauging potential. The material supports sustainability goals by enabling mono-material design and compatibility with recycling systems. Growth in online retail and increasing reliance on flexible pouches, wraps and liners is driving segment leadership. Increasing investments in automated packaging lines and demand for high-performance films in regulated sectors such as food and healthcare continue to support market dominance.

The non-packaging segment is projected to grow at the fastest pace through 2034. This is owing to rising applications in industrial films, medical sheets, agriculture liners and geomembranes. mLDPE’s mechanical strength, flexibility and resistance to environmental stress make it suitable for construction, medical and agricultural use. Government incentives to support sustainable agriculture and modern infrastructure are boosting demand for advanced films and coatings. In addition, growing demand for disposable protective covers and medical wraps is increasing across hospitals and clinics. As product innovations extend beyond packaging, non-packaging applications are expected to contribute significantly to overall market growth.

End User Analysis

Based on end user channel, the segmentation includes food and beverage, agriculture, consumer goods, healthcare, electrical and electronics, automotive, and industrial manufacturing. The food and beverage segment accounted for the highest market share in 2024, fueled by high consumption of flexible packaging materials across processed food, frozen products and ready-to-eat meals. mLDPE is widely used for its sealing reliability, downgauging capability and regulatory compliance with food safety standards. Growing demand for resealable pouches, vacuum films and barrier wraps is driving segment growth. The trend toward extended shelf life and consumer convenience packaging is further driving the use of mLDPE films. Manufacturers are prioritizing recyclable solutions to meet industry sustainability targets, strengthening its position in food-grade packaging.

The healthcare segment is projected to grow at the fastest pace during the forecast period. This is attributed to increasing use of high-performance films in medical packaging, disposable equipment and pharmaceutical products. As per the Center for Medicare and Medicaid Services, the US health spending rose by 7.5% in 2023 to USD 4.867 trillion, representing 17.6% of GDP and USD 14,570 per person. This aims to boost demand for metallocene LDPE in pharmaceutical films and sterile packaging due to its strength and clarity. Rising demand for mLDPE is due to its puncture resistance, sterilization compatibility and high sealing performance in critical packaging applications. Rising demand for flexible blister packs, surgical wraps and protective covers is driving volume growth. In addition, rising regulatory compliance, sterility assurance and the need for high-barrier films are boosting mLDPE usage in medical-grade applications. The expanding healthcare infrastructure and rising expenditure on medical supplies across the US are further accelerating segment growth.

Key Players & Competitive Analysis Report

The US metallocene LDPE industry is moderately consolidated, with competition driven by product performance, recyclability, and regulatory compliance. Leading manufacturers are focusing on polymer innovation, downgauging efficiency, and scalable production to meet the rising demand for high-strength and recyclable films. Key strategies include expanding production capacity, developing mono-material packaging formats, and meet product offerings with circular economy targets. Companies are enhancing supply chain integration to ensure reliable distribution across food, healthcare and e-commerce sectors, while meeting performance standards and sustainability regulations across the packaging value chain.

Key companies in the US metallocene LDPE industry include ExxonMobil Chemical Company, Dow Inc., LyondellBasell Industries N.V., Chevron Phillips Chemical Company LLC, SABIC, Borealis AG, INEOS Olefins & Polymers USA, Westlake Corporation, Braskem America, Inc., Formosa Plastics Corporation, USA, TotalEnergies Petrochemicals & Refining USA, Inc., and Nova Chemicals Corporation.

Key Players

- Borealis AG

- Braskem America, Inc.

- Chevron Phillips Chemical Company LLC

- Dow Inc.

- ExxonMobil Chemical Company

- Formosa Plastics Corporation, USA

- INEOS Olefins & Polymers USA

- LyondellBasell IndUStries N.V.

- Nova Chemicals Corporation

- SABIC

- TotalEnergies Petrochemicals & Refining USA, Inc.

- Westlake Corporation

Industry Developments

May 2025: Univation Technologies announced a world-scale design capable of producing up to one million tonnes per year of polyethylene USing its advanced UNIPOL PE Process. This capacity expansion supports large-scale production of metallocene LLDPE, meeting rising global demand for high-strength, recyclable film applications.

In October 2024: SABIC partnered with Polivouga and Nueva Pescanova to develop flexible food packaging USing certified bio-renewable HDPE and SUPEER mLLDPE derived from USed cooking oil. The initiative promotes the USe of sUStainable mLLDPE grades in food packaging to advance circular economy objectives.

US Metallocene LDPE Market Segmentation

By Polymer Type Outlook (Revenue, USD Billion, 2020–2034)

- Metallocene Linear Low-Density Polyethylene (mLLDPE)

- Metallocene High-Density Polyethylene (mHDPE)

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Packaging

- Food Packaging

- Industrial Packaging

- Agricultural Films

- Stretch & Shrink Films

- Non-Packaging

- Wires & Cables

- Automotive Parts

- Housewares

- Medical Applications

By End User Channel Outlook (Revenue, USD Billion, 2020–2034)

- Food & Beverage

- Agriculture

- Consumer Goods

- Healthcare

- Electrical & Electronics

- Automotive

- Industrial Manufacturing

US Metallocene LDPE Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.03 Billion |

|

Market Size in 2025 |

USD 2.14 Billion |

|

Revenue Forecast by 2034 |

USD 3.64 Billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The US market size was valued at USD 2.03 billion in 2024 and is projected to grow to USD 3.64 billion by 2034.

The US market is projected to register a CAGR of 6.1% during the forecast period.

A few of the key players in the market are ExxonMobil Chemical Company, Dow Inc., LyondellBasell Industries N.V., Chevron Phillips Chemical Company LLC, SABIC, Borealis AG, INEOS Olefins & Polymers USA, Westlake Corporation, Braskem America, Inc., Formosa Plastics Corporation, USA, TotalEnergies Petrochemicals & Refining USA, Inc., and Nova Chemicals Corporation.

The mLLDPE segment dominated the market share in 2024, driven by its widespread use in high-performance films across food packaging, consumer goods, and industrial applications.

The healthcare segment is expected to witness the fastest growth during the forecast period, driven by rising demand for medical films, sterilizable packaging, and pharmaceutical-grade barrier materials.