US Nicotine Pouches Market Size, Share, Trends, & Industry Analysis Report

By Product (Tobacco-derived and Synthetic Nicotine), By Flavor Type, By Strength – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5821

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

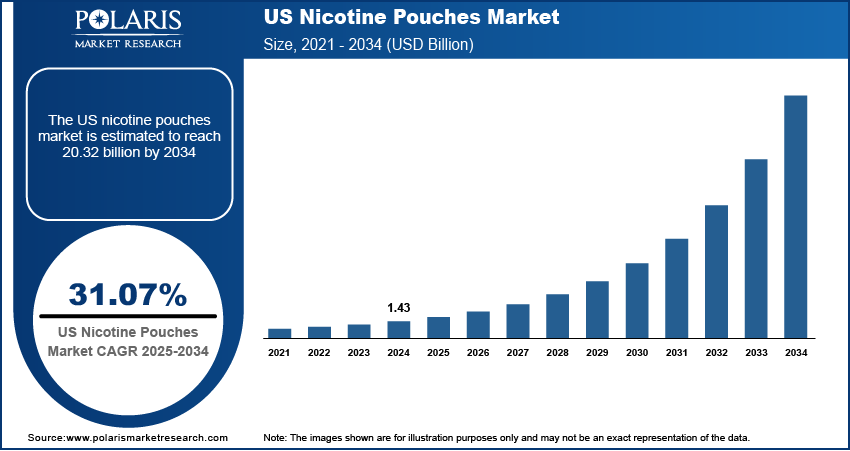

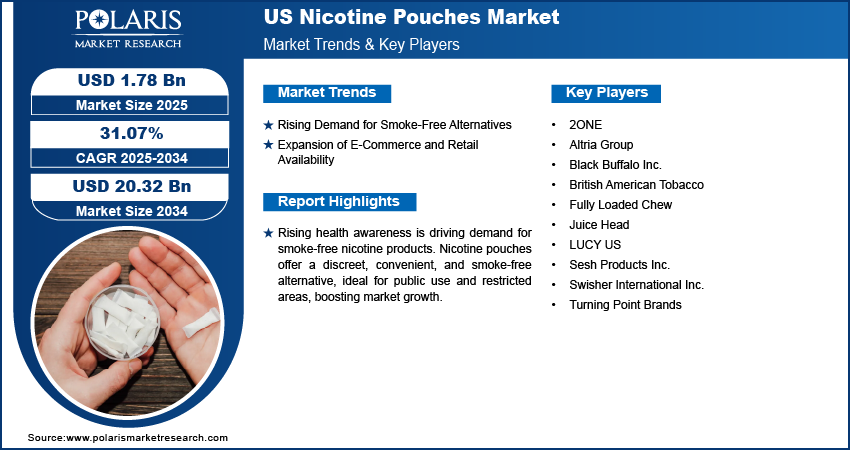

The US nicotine pouches market was valued at USD 1.43 billion in 2024 and is expected to register a CAGR of 31.07% during the forecast period. The market growth is driven by the rising demand for smoke-free alternatives and the expansion of e-commerce and retail availability.

The US nicotine pouches market has experienced significant growth in recent years, driven by increasing demand for smokeless tobacco products, discreet, and convenient nicotine alternatives to traditional tobacco products. Nicotine pouches offer a smoke-free, odorless, and portable option for consumers who are looking to reduce their exposure to harmful chemicals found in cigarettes. The market is characterized by a wide variety of flavors, nicotine strengths, and brands, providing consumers with the flexibility to choose products based on their preferences and needs. As more individuals seek alternatives to smoking, the nicotine pouches market is well-positioned to capitalize on the growing trend toward harm reduction in the tobacco industry. With its discrete nature, ease of use, and lack of the need for specialized devices such as e-cigarettes or vapes, nicotine pouches have become a popular choice for both current smokers and those trying to quit.

The market has benefited from a variety of drivers, including the increasing health-consciousness among consumers, the rising availability of smokeless and tobacco-free alternatives, and a growing focus on regulatory shifts that encourage harm-reduction initiatives. Moreover, as the millennial and Generation Z consumer segments show an increasing preference for products that support a healthier lifestyle, nicotine pouches are well-positioned to meet this demand. Online retailing and the ability for manufacturers to market products directly to consumers have also contributed to the market’s expansion, helping brands reach a broader audience across various demographics. The development of unique flavor profiles, including mint, fruit, coffee, and cinnamon, has further helped differentiate products in the competitive landscape.

To Understand More About this Research: Request a Free Sample Report

Technological advancements have played a key role in the development and evolution of nicotine pouches, particularly with regard to nicotine delivery systems and product innovation. Continuous innovation in the manufacturing process allows for more efficient nicotine absorption and enhanced user experiences. Nicotine pouch producers are increasingly focusing on improving product quality through more consistent nicotine release mechanisms, which appeals to discerning users who want a reliable and satisfying experience. Furthermore, advancements in packaging technology improve product durability and convenience, making nicotine pouches even more appealing to consumers on the go. On the e-commerce front, digital marketing and online sales platforms have revolutionized how nicotine pouches are sold and marketed, allowing for direct access to target audiences and fostering an online community of users. The continuous adoption of new technologies and the ability to innovate are expected to fuel the industry's growth.

Industry Dynamics

Rising Demand for Smoke-Free Alternatives

Consumers are shifting toward alternatives that provide nicotine satisfaction without combustion, tar, or harmful chemicals as awareness of smoking-related health risks grows. Nicotine pouches offer a discreet and convenient way to consume nicotine without producing smoke or requiring spitting, making them ideal for use in public spaces and workplaces where smoking is restricted. Thus, rising demand for smoke-free nicotine products is driving the US nicotine pouches market growth.

Expansion of E-Commerce and Retail Availability

The growth of online retail platforms and widespread availability in convenience stores and supermarkets have significantly boosted market penetration. According to the United States Census Bureau, in the first quarter of 2025, e-commerce sales were recorded worth USD 300.2 billion. E-commerce platforms allow consumers to explore various brands, compare nicotine strengths, and purchase products discreetly, driving sales. Additionally, major retail chains are increasingly stocking nicotine pouches, making them easily accessible to a broader audience. This expanding distribution network continues to support the overall growth of the market.

US Nicotine Pouches Market Share by States (2024)

|

States |

Share (%) |

|

New York |

4.31% |

|

Alabama |

1.01% |

|

Alaska |

0.54% |

|

Arizona |

2.09% |

|

Arkansas |

1.38% |

Segmental Insights

By Product Analysis

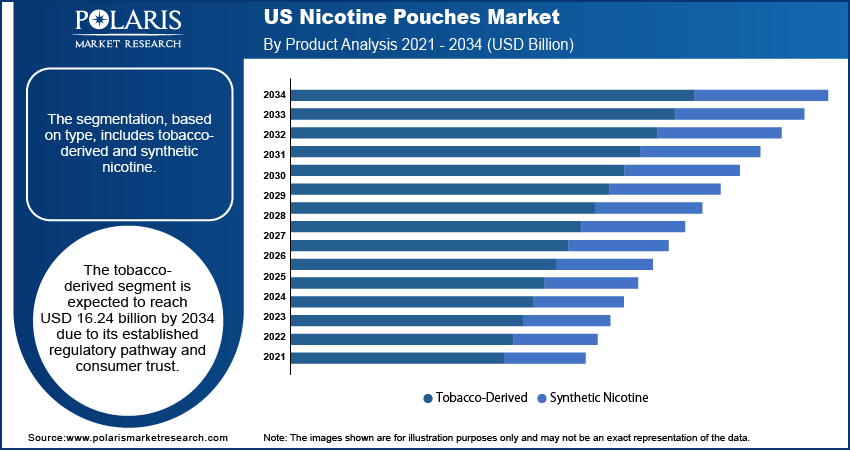

The segmentation, based on type, includes tobacco-derived and synthetic nicotine. The tobacco-derived segment is expected to reach USD 16.24 billion by 2034, due to its established regulatory pathway and consumer trust. These pouches use nicotine extracted from the tobacco plant but do not contain tobacco leaf or dust, making them appealing to users seeking cleaner, smoke-free alternatives. Major brands such as on! and Velo use tobacco-derived nicotine, offering consistency in strength and quality. This category benefits from better brand recognition and broader retail availability. However, it is also closely monitored by the FDA, which influences labeling and marketing practices in the country.

The synthetic nicotine segment accounted for 18.42% share in 2024, as these pouches are gaining popularity, especially among newer and younger adult users. Made in labs without using the tobacco plant, synthetic nicotine appeals to consumers looking for tobacco-free experiences. These products often fall into a less regulated space, allowing for quicker innovation and marketing flexibility. Brands such as LUCY and Juice Head use synthetic nicotine to position themselves as modern, clean alternatives, thereby driving the segment growth.

By Flavor Type Analysis

The segmentation, based on flavor type, includes original/unflavored and flavored. The original/unflavored segment accounted for a 14.93% share in 2024 due to the demand from traditional tobacco users seeking a straightforward, tobacco-like nicotine experience without added flavors. These users often prioritize discretion and simplicity, especially in environments where flavored products are banned or discouraged. Health-conscious consumers and older demographics also contribute to demand, preferring products without artificial flavoring. Additionally, unflavored options appeal to users aiming for a less stimulating experience while still satisfying nicotine cravings, thereby driving the segment growth.

By Strength Analysis

The segmentation, based on strength, includes light, normal, strong, and extra strong. The strong segment accounted for a 21.31% share in 2024 as strong nicotine pouches are designed for experienced users seeking a more intense nicotine experience. Typically ranging from 6mg to 12mg or higher per pouch, this segment appeals to former heavy smokers or dippers who require a higher dose to satisfy cravings. Brands often market strong options with bold packaging and names that signal potency, thereby driving the segment growth.

Key Players & Competitive Analysis Report

The US nicotine pouches market is highly competitive, led by major players such as British American Tobacco (Velo) and Altria (on!), which dominate through strong distribution and regulatory experience. Emerging brands such as LUCY US, Juice Head, and 2ONE compete through direct-to-consumer strategies, innovative flavors, and tech-driven marketing. Niche players such as Black Buffalo and Fully Loaded Chew focus on tobacco-free or nicotine-free alternatives, targeting traditional dip users or those quitting nicotine. Companies such as Turning Point Brands and Sesh Products emphasize value pricing and wide retail presence. The market is growing, though facing increased regulatory oversight and evolving consumer preferences.

Key Players

- 2ONE

- Altria Group

- Black Buffalo Inc.

- British American Tobacco

- Fully Loaded Chew

- Juice Head

- LUCY US

- Sesh Products Inc.

- Swisher International Inc.

- Turning Point Brands

Industry Developments

October 2024: Motorsports Business Management (MBM Motorsports) has struck a multi-race sponsorship agreement with 2ONE® Nicotine Pouches ("Twenty-One") to wrap up the 2024 NASCAR Cup Series season.

June 2023: Altria Group, Inc. announced the completion of its acquisition of NJOY Holdings, Inc.

May 2023: British American Tobacco Bangladesh Company Limited announced its plans to invest USD 5.19 million in its factory to boost production capacity. The company produces tobacco products and operates cigarette factories in Dhaka and Savar, a green leaf threshing factory in Kushtia, a green leaf redrying plant in Manikganj, and a network of leaf and sales offices across the country.

US Nicotine Pouches Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Tobacco-derived

- Synthetic Nicotine

By Flavor Type Outlook (Revenue, USD Billion, 2020–2034)

- Original/Unflavored

- Flavored

- Mint

- Fruit

- Coffee

- Cinnamon

- Others

By Strength Outlook (Revenue, USD Billion, 2020–2034)

- Light

- Normal

- Strong

- Extra strong

US Nicotine Pouches Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.43 Billion |

|

Market Size in 2025 |

USD 1.78 Billion |

|

Revenue Forecast by 2034 |

USD 20.32 Billion |

|

CAGR |

31.07% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.43 billion in 2024 and is projected to grow to USD 20.32 billion by 2034.

The market is projected to register a CAGR of 31.07% during the forecast period.

A few of the key players in the market are 2ONE, Altria Group, Black Buffalo Inc., British American Tobacco, Fully Loaded Chew, Juice Head, LUCY US, Sesh Products Inc., Swisher International Inc., and Turning Point Brands.

The tobacco derived segment dominated the market share in 2024.

The strong segment is expected to witness the fastest growth during the forecast period.