U.S. Ocean Economy Market Size, Share, Trends, Industry Analysis Report

By Industry Type (Marine Transport and Shipping, Marine Tourism and Recreation, Fisheries and Aquaculture) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6165

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

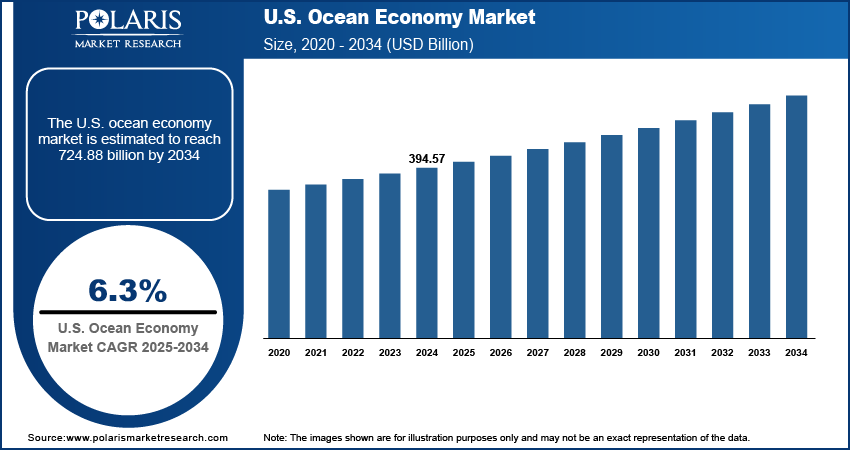

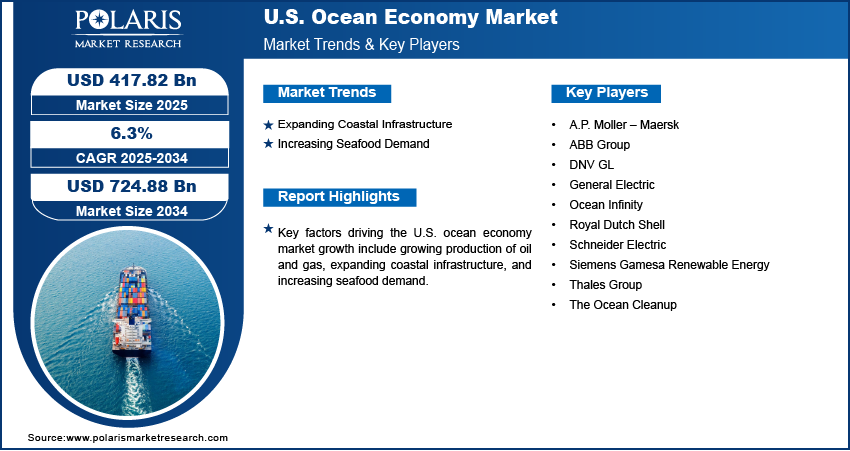

The U.S. ocean economy market size was valued at USD 394.57 billion in 2024, growing at a CAGR of 6.3% from 2025 to 2034. Key factors propelling the market growth in the U.S. include the growing production of oil and gas, expanding coastal infrastructure, and increasing seafood demand.

Key Insights

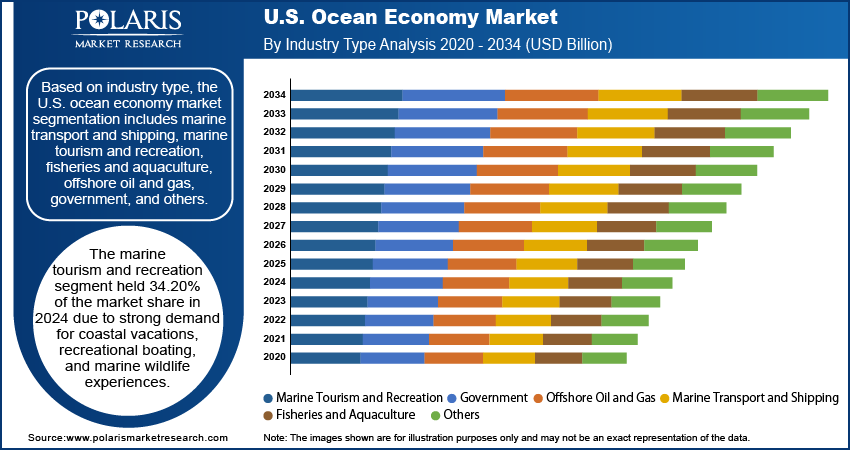

- The marine tourism and recreation segment held 34.20% of the U.S. ocean economy market share in 2024, driven by strong demand for recreational boating and coastal vacations.

- The fisheries and aquaculture segment is projected to register a CAGR of 4.1 from 2025 to 2034, owing to the increasing investments in aquaculture facilities.

Industry Dynamics

- The expanding coastal infrastructure is fueling the ocean economy by increasing shipping volumes and boosting demand for logistics and freight services.

- The increasing demand for seafood is fueling fishing activities, prompting the aquaculture industry to expand its operations, which is driving market revenue.

- The threat of overexploitation and unsustainable practices hinder the market growth.

- The expanding offshore renewable energy projects in the U.S. are expected to create a lucrative market opportunity during the forecast period.

Market Statistics

- 2024 Market Size: USD 394.57 Billion

- 2034 Projected Market Size: USD 724.88 Billion

- CAGR (2025–2034): 6.3%

To Understand More About this Research: Request a Free Sample Report

The ocean economy refers to the broad range of economic activities that take place in the ocean, seas, and coastal areas. It includes both established sectors such as marine transport and shipping, fisheries and aquaculture, offshore oil and gas, shipbuilding, and tourism, as well as emerging sectors such as offshore renewable energy, marine biotechnology, and deep-sea mining. These industries contribute significantly to global GDP, employment, food security, trade, and energy supply. The ocean economy also supports ecosystem services such as carbon sequestration, biodiversity, and coastal protection.

The U.S. encompasses a wide array of industries that operate in or depend on the ocean and Great Lakes. It includes sectors such as marine transportation and shipping, offshore oil and gas, living marine resources, shipbuilding, tourism and recreation, and emerging areas, including marine renewable energy. According to the National Oceanic and Atmospheric Administration (NOAA), the U.S. ocean or marine economy contributed $476 billion to the national GDP and supported around 2.4 million jobs in 2022. Additionally, advancements in offshore wind energy and maritime logistics would create new economic opportunities during the forecast period. The U.S. government is increasingly investing in sustainable ocean economy initiatives, research, and coastal resilience strategies to support long-term growth.

The U.S. ocean economy market demand is driven by the growing production of oil and gas. According to the International Energy Statistics published in March 2024, the U.S. has produced more crude oil than any nation for the past six years in a row, which directly expanded the ocean economy as energy companies required more support services, such as underwater robotics, marine construction, and supply vessels, boosting demand for specialized maritime businesses. Rising production also increased the demand for oil tankers and LNG carriers, thereby strengthening the shipping and logistics sectors. Therefore, the surge in energy production created jobs, accelerated technological advancements in offshore engineering, and reinforced the ocean economy’s role in global energy supply chains.

Drivers & Opportunities

Expanding Coastal Infrastructure: The expansion of coastal infrastructure, including ports, harbors, and offshore terminals, is fueling the ocean economy by increasing shipping volumes and boosting demand for logistics and freight services. Enhanced coastal infrastructure is also supporting offshore wind farms and oil rigs, driving growth in the marine construction and maintenance industries. Better transportation links are further attracting fisheries, aquaculture, and tourism businesses, creating jobs and stimulating local economies. Additionally, modernized infrastructure is encouraging investments in shipbuilding, marine technology, and coastal real estate, thereby further strengthening the expansion of the ocean economy.

Increasing Seafood Demand: The rising demand for seafood in the U.S. is fueling fishing activities, prompting the aquaculture industries to expand their operations and invest in more advanced vessels and equipment. This growth is propelling the need for processing plants, cold storage facilities, and efficient supply chains, strengthening marine logistics and port services. According to the U.S. Department of Agriculture, the value of U.S. seafood imports expanded by 133% from 1995 to 2021. Higher seafood consumption is also driving innovation in sustainable fishing techniques and offshore aquaculture farms, boosting demand for marine biotechnology and environmental monitoring services. Therefore, the growing demand for seafood is fueling the ocean economy market growth in the U.S.

Segmental Insights

Industry Type Analysis

Based on industry type, the segmentation includes marine transport and shipping, marine tourism and recreation, fisheries and aquaculture, offshore oil and gas, government, and others. The marine tourism and recreation segment held 34.20% of the U.S. ocean economy market share in 2024 due to strong demand for coastal vacations, recreational boating, and marine wildlife experiences. The post-pandemic surge in travel, coupled with increasing disposable incomes and a growing preference for outdoor activities, fueled the dominance of the segment. Coastal states such as Florida, California, and Hawaii saw record numbers of visitors, boosting revenues from cruise lines, waterfront resorts, and recreational fishing charters. Additionally, technological advancements, such as online booking platforms and eco-tourism initiatives, made marine experiences more accessible and appealing to a broader audience, contributing to the segment’s dominance.

The fisheries and aquaculture segment is projected to register a CAGR of 4.1 from 2025 to 2034, owing to the rising demand for sustainable and locally sourced seafood and increasing investments in aquaculture facilities, especially in coastal and Great Lakes states. Federal programs, such as the National Aquaculture Plan and NOAA’s support for marine resource management, have encouraged innovation and scalability in fish farming operations. Additionally, concerns about climate change and overfishing are shifting policy and market focus toward sustainable aquaculture, thereby strengthening its future market position.

Key Players & Competitive Analysis

The U.S. ocean economy is a dynamic and highly competitive market, driven by industries such as offshore energy, maritime shipping, marine technology, and environmental sustainability. Major players such as Royal Dutch Shell and General Electric dominate the offshore oil, gas, and wind energy sectors, while A.P. Moller – Maersk leads in global shipping and logistics. Technology firms such as ABB Group, Siemens Gamesa Renewable Energy, and Thales Group provide advanced automation, offshore wind solutions, and underwater systems, enhancing efficiency and sustainability. Competition is further intensifying as companies invest in decarbonization, digitalization, and renewable energy. Government policies, such as the Inflation Reduction Act (IRA), further shape the landscape by incentivizing offshore wind and green maritime technologies.

A few major companies operating in the U.S. ocean economy market include A.P. Moller – Maersk, ABB Group, DNV GL, General Electric, Ocean Infinity, Royal Dutch Shell, Schneider Electric, Siemens Gamesa Renewable Energy, Thales Group, and The Ocean Cleanup.

Key Companies

- A.P. Moller – Maersk

- ABB Group

- DNV GL

- General Electric

- Ocean Infinity

- Royal Dutch Shell

- Schneider Electric

- Siemens Gamesa Renewable Energy

- Thales Group

- The Ocean Cleanup

U.S. Ocean Economy Industry Developments

June 2025: ABB announced the launch of the AMXE Marine Motor, a next-generation electric propulsion solution to enhance vessel efficiency.

June 2025: The Ocean Cleanup launched a 30-city program to reduce ocean plastic pollution from rivers by one-third by 2030.

U.S. Ocean Economy Market Segmentation

By Industry Type Outlook (Revenue, USD Billion, 2021–2034)

- Marine Transport and Shipping

- Marine Tourism and Recreation

- Fisheries and Aquaculture

- Offshore Oil and Gas

- Government, and Others

U.S. Ocean Economy Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 394.57 Billion |

|

Market Size in 2025 |

USD 417.82 Billion |

|

Revenue Forecast by 2034 |

USD 724.88 Billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 394.57 billion in 2024 and is projected to grow to USD 724.88 billion by 2034.

The market is projected to register a CAGR of 6.3% during the forecast period.

A few of the key players in the market are A.P. Moller – Maersk, ABB Group, DNV GL, General Electric, Ocean Infinity, Royal Dutch Shell, Schneider Electric, Siemens Gamesa Renewable Energy, Thales Group, and The Ocean Cleanup.

The marine tourism and recreation segment dominated the market share in 2024.

The fisheries and aquaculture segment is expected to witness the fastest growth during the forecast period.