U.S. Orthopedic Devices Market Share, Size, Trends, Industry Analysis Report

By Product (Accessories and Surgical Devices); By Application; Segment Forecast, 2024- 2032

- Published Date:May-2024

- Pages: 115

- Format: PDF

- Report ID: PM4894

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

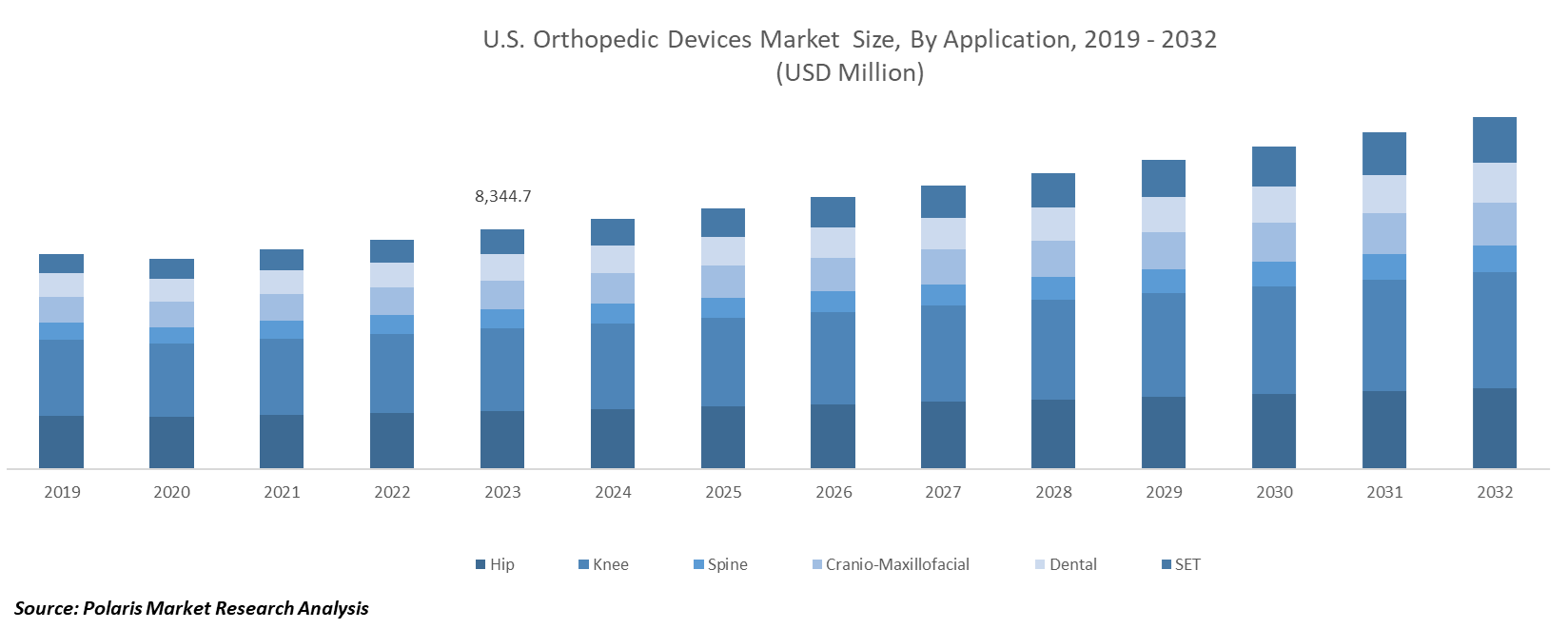

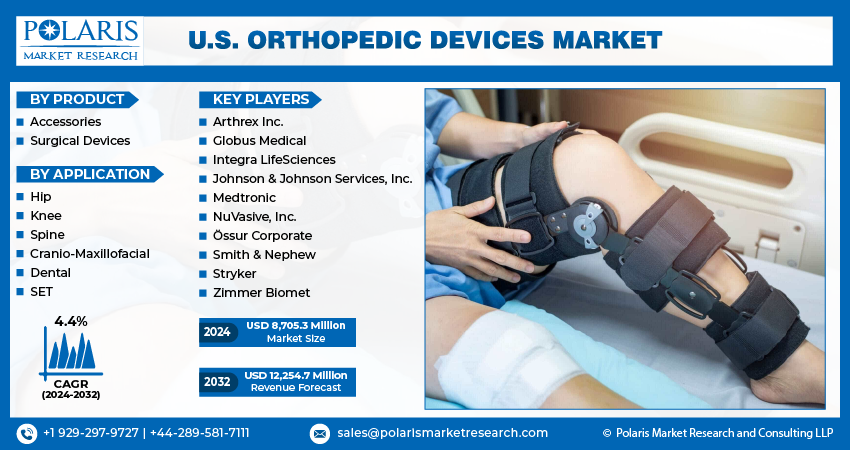

The U.S. orthopedic devices market size was valued at USD 8,344.7 million in 2023. The market is anticipated to grow from USD 8,705.3 million in 2024 to USD 12,254.7 million by 2032, exhibiting a CAGR of 4.4% during the forecast period.

Industry Trend

Orthopedic devices serve as vital tools in the management and prevention of various musculoskeletal conditions. As the prevalence of orthopedic disorders continues to rise, particularly with conditions like rheumatoid arthritis (RA), osteoarthritis, fibromyalgia, and juvenile arthritis becoming more prevalent, the demand for orthopedic devices in the U.S. market sees a notable surge. These devices offer innovative solutions and treatments that alleviate pain, enhance mobility, and improve overall quality of life for individuals affected by musculoskeletal issues. As a result, the orthopedic devices market in the U.S. experiences substantial growth driven by the increasing need for effective interventions and advancements in medical technology.

To Understand More About this Research:Request a Free Sample Report

Minimally invasive surgical techniques have emerged as a cornerstone in the orthopedic domain, offering a multitude of benefits including accelerated recovery periods, minimized bleeding and scarring, improved clinical results, and reduced postoperative complications and hospital stays. This surge in popularity is largely attributed to the growing prevalence of orthopedic ailments, particularly among the elderly demographic.

A combination of factors, including a sedentary lifestyle, an aging population, obesity, and a higher frequency of work-related injuries, contributes to the rising incidence and prevalence of musculoskeletal disorders. Obesity, in particular, is closely associated with the secretion of pro-inflammatory cytokines and a decrease in bone mass, which heightens the risk of developing musculoskeletal ailments. Conditions such as osteoporosis, osteoarthritis, fractures, and various soft tissue disorders are intricately linked to the pathophysiology of obesity. These interconnected factors collectively contribute to the increasing burden of musculoskeletal disorders on individuals and healthcare systems alike.

Moreover, leading companies in the orthopedic market are strategically enhancing their offerings by augmenting their portfolio of robotic-assisted surgery systems. This strategy involves launching innovative products, engaging in mergers and acquisitions, and expanding market presence to fortify their competitive position and cater to the evolving needs of healthcare providers and patients alike.

For instance, in April 2023, Stryker partnered with Project C.U.R.E. to provide medical equipment to underserved regions. Project C.U.R.E., acknowledged as the major distributor globally of donated medical devices and supplies to communities with limited resources, positively influenced the lives of patients, families, and children across more than 135 countries.

Key Takeaway

- By product category, the accessories segment accounted for the largest market share in 2023.

- By application category, the SET segment is projected to grow at a highest CAGR during the projected period.

What are the market drivers driving the demand for the U.S. orthopedic devices market?

Rising Aging Population have been Projected to Spur Product Demand

As people age, they are more susceptible to orthopedic conditions like osteoarthritis and osteoporosis. Osteoarthritis, for example, is a degenerative joint disease that commonly affects older individuals, leading to pain, stiffness, and reduced mobility. Similarly, osteoporosis, characterized by a decrease in bone density, makes bones more prone to fractures, particularly in the elderly. With the aging population, there is a growing need for orthopedic interventions to manage these conditions and improve quality of life. Orthopedic implants and devices, such as joint replacement implants, bone grafts, and spinal fusion devices, play a crucial role in addressing these orthopedic disorders. Joint replacement surgeries, including hip and knee replacements, are among the most common orthopedic procedures performed on older adults to alleviate pain and restore function.

Furthermore, as the elderly population continues to grow, there is an increasing demand for orthopedic devices that cater to their specific needs, such as implants designed for longevity and durability. Manufacturers are innovating to develop implants and devices that are better suited to the aging population, incorporating materials and designs that enhance longevity and functionality.

Which factor is restraining the demand for U.S. orthopedic devices?

Surgical Risks and Complications

Surgical risks and complications pose significant concerns for both patients and healthcare providers considering orthopedic procedures. These concerns can have a notable impact on the demand for orthopedic devices in the U.S. market. The fear of complications such as infection, implant failure, and prolonged recovery times can discourage patients from opting for orthopedic surgery. Infections at the surgical site can lead to serious complications, requiring additional medical interventions and prolonging the recovery process. Similarly, implant failure, whether due to mechanical issues or biological factors like poor bone integration, can result in the need for revision surgeries and further discomfort for the patient. Additionally, the prospect of enduring a lengthy and challenging recovery period can deter patients from pursuing surgical interventions, especially if they have concerns about their ability to resume normal activities and responsibilities.

Moreover, the potential for surgical risks and complications may prompt patients to explore conservative treatment options as alternatives to surgery. Non-surgical approaches, such as physical therapy, medication management, injections, and lifestyle modifications, may offer relief from orthopedic conditions without the inherent risks associated with surgery. Patients may prefer these less invasive options to avoid the potential complications and uncertainties associated with surgical procedures.

Report Segmentation.

The market is primarily segmented based on product and application

|

By Product |

By Application |

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Product Insights

Based on a product analysis, the market is segmented into accessories and surgical devices. The accessories segment held the largest market in 2023. This segment encompasses a wide range of ancillary products and components that complement orthopedic devices, enhancing their functionality, usability, and effectiveness. Accessories may include items such as surgical instruments, fixation devices, braces, splints, screws, plates, and other supporting tools used in orthopedic procedures and treatments. Accessories play a crucial role in supporting and enhancing the performance of orthopedic devices. Surgeons and healthcare providers rely on various accessories to ensure precise implantation, fixation, and alignment of orthopedic implants, as well as to facilitate effective post-operative care and rehabilitation.

The accessories segment encompasses a diverse array of products tailored to meet the specific needs of different orthopedic procedures and patient populations. This wide variety of accessories allows healthcare providers to select the most appropriate tools and components for each patient's unique condition and treatment plan.

By Application Insights

Based on application analysis, the market has been segmented on the basis of hip, knee, spine, cranio-maxillofacial, dental, and SET. The SET (sports medicine, extremities, and trauma) segment is anticipated to experience the highest Compound Annual Growth Rate (CAGR) during the forecast period for the US orthopedic devices market. The increasing participation in sports and physical activities has led to a surge in sports-related injuries, including ligament tears, fractures, and joint dislocations. The SET segment comprises devices specifically designed to address these injuries, such as arthroscopic instruments, implants for ligament reconstruction, and fracture fixation devices. Continuous advancements in SET devices, including minimally invasive surgical techniques, innovative implant materials, and enhanced instrumentation, are driving market growth. These technological innovations improve surgical outcomes, reduce recovery times, and enhance patient satisfaction, driving demand for SET devices.

Competitive Landscape

The U.S. orthopedic devices market is fiercely competitive, characterized by a mix of established giants, specialized manufacturers, and innovative startups. Additionally, a wave of startups is introducing disruptive technologies, driving innovation in areas like 3D printing and robotics. Strategic collaborations and regulatory compliance pose challenges, but they also offer opportunities for market expansion and technological advancement. Overall, the U.S. orthopedic devices market remains dynamic, with companies continually striving to differentiate themselves and meet the evolving needs of patients and healthcare providers.

Some of the major players operating in the global market include:

- Arthrex Inc.

- Globus Medical

- Integra LifeSciences

- Johnson & Johnson Services, Inc.

- Medtronic

- NuVasive, Inc.

- Össur Corporate

- Smith & Nephew

- Stryker

- Zimmer Biomet

Recent Developments

- January 2024, Enovis Corporation has completed the acquisition of LimaCorporate S.p.A. to augment its standing in the worldwide orthopedic reconstruction market. The acquisition will bolster Enovis' position by adding a range of proven surgical solutions and technologies to its portfolio, ensuring that it remains at the forefront of the industry.

- July 2023, Stryker has launched the Ortho Q Guidance system, a cutting-edge solution for developed surgery planning and recommendation in knee and hip procedures. This system provides surgeons with easy control from the sterile field.

- April 2023, Enovis Corporation acquired Novastep, which is a subsidiary of Amplitude Surgical SA. Novastep is a developer of clinically proven foot and ankle solutions, and its portfolio of CE-marked forefoot and midfoot implants, along with its robust OUS channel, is expected to bolster Enovis' global position in the market.

- March 2022, DePuy Synthes, part of Johnson & Johnson MedTech, acquired CUPTIMIZE Hip-Spine Analysis, enhancing surgical planning for total hip arthroplasty with VELYS™ Hip Navigation.

- March 2022, DePuy Synthes, a Johnson & Johnson MedTech company, introduced ATTUNE Cementless Fixed Bearing Knee and ATTUNE Medial Stabilized Knee to its portfolio.

Report Coverage

The U.S. orthopedic devices market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product and application, and their futuristic growth opportunities.

U.S. Orthopedic Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8,705.3 million |

|

Revenue forecast in 2032 |

USD 12,254.7 million |

|

CAGR |

4.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product and By Application |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in U.S. Orthopedic Devices Market Globus Medical, Integra LifeSciences, Johnson & Johnson Services, Inc., Medtronic, NuVasive, Inc

The U.S. orthopedic devices market exhibiting a CAGR of 4.4% during the forecast period.

U.S. Orthopedic Devices Market report covering key segments are product and application

The key driving factors in U.S. Orthopedic Devices Market Rising aging population have been projected to spur product demand.

The U.S. orthopedic devices market size is expected to reach USD 12,254.7 Million by 2032.