U.S. Polyurea Market Size, Share, Trends, & Industry Analysis By Raw Material (Aromatic, and Aliphatic), By Product, By Application, and By Country – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5949

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

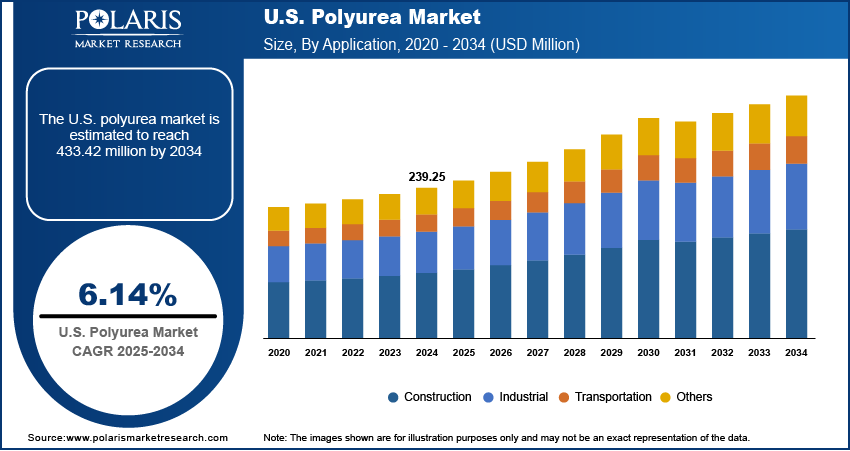

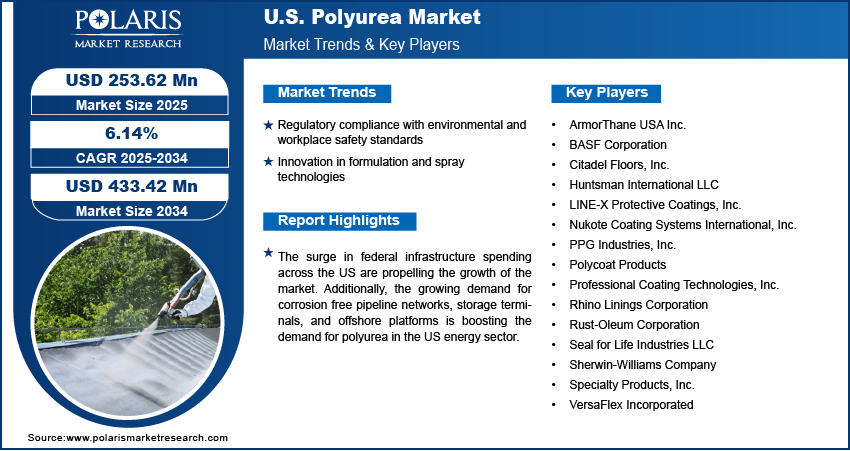

The US polyurea market size was valued at USD 239.25 million in 2024, growing at a CAGR of 6.14% from 2025–2034. Regulatory compliance with environmental and workplace safety standards coupled with innovation in formulation and spray technologies is driving the market growth.

Polyurea is growing across the US construction and repair ecosystem due to its superior resistance to abrasion, chemicals, and water intrusion. It is used extensively in waterproofing membranes, containment linings, and secondary barriers. Polyurea’s fast-curing and VOC-compliant properties are important in urban projects, with tight timelines and strict environmental regulations. Additionally, its compatibility with spray application equipment and ability to adhere to concrete, steel, and composite substrates make it a practical choice for large-scale and time-sensitive projects across the US.

Additionally, the availability of domestic manufacturing capabilities, research initiatives in performance materials, and a mature construction sector is further propelling the demand for polyurea products. Public and private stakeholders increasingly adopting polyurea-based solutions in large-scale maintenance and restoration projects due to its low maintenance needs and high material integrity. These advantages continue to make polyurea a preferred material in protective coating plans in US construction professionals and infrastructure decision-makers.

The surge in federal infrastructure spending across the US are propelling the adoption of protective materials for civil and municipal projects. According to the US Federal Aviation Administration, under the Infrastructure Investment and Jobs Act (IIJA) USD 25 million allocated for airport modernization projects, including terminal expansions and structural improvements. These projects require materials that offer quick installation, minimal disruption, and long-term durability under mechanical stress and exposure to moisture. Polyurea systems meet these specifications through rapid curing, seamless coverage, and resistance to cracking, which allows construction teams to complete work on tight schedules without compromising performance.

Additionally, the growing demand for corrosion free pipeline networks, storage terminals, and offshore platforms is boosting the demand for polyurea in the US energy sector. The US hosts one of the world’s largest systems of energy infrastructure, much of which is aging and subject to harsh environmental exposure. Asset owners are actively upgrading protective systems to reduce the risk of leaks, environmental damage, and costly downtime. Polyurea coatings are well-suited for these applications, offering fast-set properties, strong chemical resistance, and excellent flexibility over a wide temperature range. Energy companies aiming to enhance asset integrity and meet project timelines are increasingly adopting polyurea as a reliable surface protection solution across the oil and gas sector.

Industry Dynamics

Regulatory Compliance with Environmental and Workplace Safety Standards

Stringent regulatory enforcement in the US continues to accelerates the reduction of hazardous emissions and improvement of workplace safety, thus driving the market growth. Agencies such as the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) are updating guidelines to restrict the use of materials with high volatile organic compounds (VOCs) and limit exposure to harmful chemicals in industrial settings. For instance, in July 2024, the US Environmental Protection Agency (EPA) proposed amendments to the National Volatile Organic Compound (VOC) Emission Standards. The proposed changes include the addition of new compounds and updated reactivity factors, a revision of the default reactivity factor, updates to emission limits across coating categories, and adjustments to the VOC threshold covered by the rule. These regulatory changes are shaping procurement decisions across commercial, infrastructure, and utility-based applications.

The adoption of polyurea coatings are significantly growing in the US due to inherently low-VOC or VOC-free compositions and ability to apply without emitting strong odors or toxic vapors. These coatings are suitable for use in enclosed spaces, sensitive environments, and occupied buildings where air quality regulations are strictly enforced. Fast-curing and non-flammable formulations improve on-site worker safety by minimizing health risks and avoiding prolonged downtime for curing or ventilation. Growing environmental accountability among contractors and facility owners is driving a shift toward materials that meet evolving safety standards and long-term sustainability goals.

Innovation in Formulation and Spray Technologies

The rising advancement in formulation technologies and spray equipment by local manufacturers is further boosting the market growth of the polyurea market in the country. Material manufacturers are enhancing polyurea’s chemical structure to improve adhesion, elongation, and UV resistance, making it suitable for a wider range of industrial surfaces. For instance, in May 2024, ArmorThane introduced a specialized polyurea roof coating for RVs, combining seamless waterproofing, UV reflectivity, and high durability to extend roof lifespan indefinitely. These product innovation supports streamlined field operations and consistent coating quality in technically demanding environments.

Improved spray delivery systems and refined coating formulations are enabling contractors to apply polyurea with higher speed, accuracy, and reduced waste. The adoption of digitally monitored spray rigs, real-time viscosity control, and pre-heating systems made polyurea more accessible for medium- and large-scale projects across the commercial, utility, and energy sectors. These technical upgrades shorten project timelines reducing labor costs and enhance field safety. Therefore, advancements in formulation and application technology are making polyurea coatings more efficient, reliable, and cost-effective driving wider adoption across key industrial and infrastructure sectors in the country.

Segmental Insights

Raw Material Analysis

The segmentation, based on raw material includes, aromatic and aliphatic. The aromatic segment is projected to reach substantial revenue share by 2034. This is attributed to the growing use in protective coatings and waterproofing systems across infrastructure and industrial applications. Aromatic Polyurea is preferred for applications where UV exposure is limited, such as in buried structures, secondary containment, wastewater systems, and internal linings. Its cost-effectiveness, rapid curing time, and compatibility with various substrates make it suitable for large-scale usage in infrastructure rehabilitation and maintenance. Contractors use aromatic formulations for excellent adhesion and resistance to moisture, which are essential in high-volume civil projects where performance and speed are equally critical.

The aliphatic segment is projected to grow at the fastest rate during the forecast period, driven by its superior UV resistance and color stability. This type of Polyurea is increasingly used in applications where aesthetic durability and weather exposure are key concerns, such as architectural coatings, decorative surfaces, and transportation assets. Also, the ability of aliphatic Polyurea to maintain gloss, prevent discoloration, and resist environmental degradation is further accelerating the market growth.

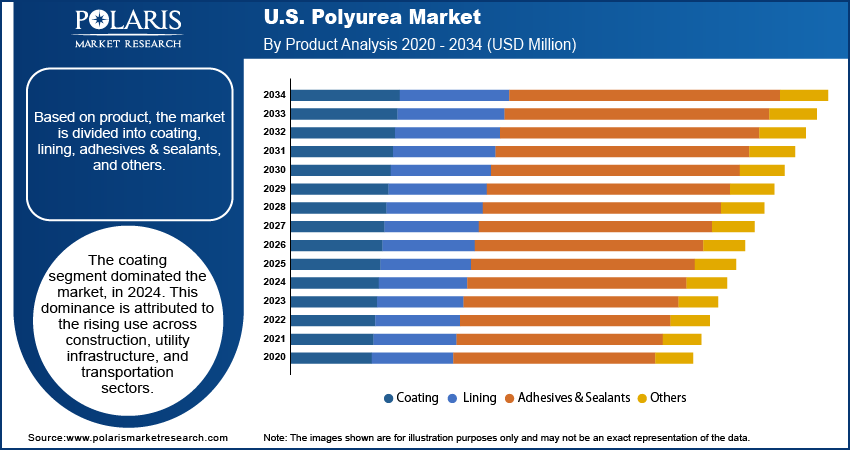

Product Analysis

The segmentation, based on product includes, coating, lining, adhesives & sealants, and others. The coating segment dominated the market, in 2024. This dominance is attributed to the rising use across construction, utility infrastructure, and transportation sectors. Polyurea coatings are extensively applied on concrete and metal surfaces to provide a seamless, waterproof, and abrasion-resistant protective barrier. Infrastructure projects such as parking structures, tunnels, pipelines, and bridges use polyurea coatings for fast application, long-term durability, and strong bonding strength. These coatings offer chemical resistance, making it suitable for environments exposed to industrial effluents or aggressive cleaning agents. The growing need for asset protection and reduced downtime is pushing developers to choose Polyurea coatings over conventional alternatives.

The adhesives & sealants segment is expected to witness the fastest growth during the forecast period. The rapid curing ability and high tensile strength of Polyurea are leading to increased adoption in bonding and sealing applications across manufacturing, automotive, and civil construction industries. Polyurea adhesives are used for assembling composite panels, metal fixtures, and flexible joints, while sealants are applied in expansion joints, pipeline penetrations, and facade insulation. These materials offer resistance to water ingress, vibration, and thermal cycling, which makes them reliable for long-term performance in dynamic environments.

Application Analysis

The segmentation, based on application includes, construction, industrial, transportation, and others The construction segment dominated the market, in 2024. This dominance is attributed to the widespread usage in flooring, roofing, foundation waterproofing, and concrete protection. Polyurea’s fast-curing property reduces project downtime, making it well-suited for large-scale construction schedules. It offers long-term resistance to moisture, chemical exposure, and surface erosion, which are critical in commercial and civil infrastructure projects. Contractors are increasingly applying Polyurea in bridges, commercial buildings, parking decks, and stadiums to ensure longevity and reduced lifecycle maintenance. The expansion of urban infrastructure and increasing focus on asset protection continue to strengthen its use in the construction sector.

The transportation segment is projected to grow at the fastest pace over the forecast period. Rising investments in roadways, railways, and transit infrastructure are driving demand for protective materials that withstand mechanical wear, environmental exposure, and dynamic loading. Polyurea is used in railway car linings, truck bed coatings, underbody protection, and marine vessels to safeguard surfaces from corrosion, saltwater, and abrasion. Its lightweight properties and ability to conform to complex geometries make it ideal for vehicles and equipment where weight and durability are critical. Growing investment from public and private sectors in transportation infrastructure is boosting the adoption of Polyurea for asset protection and maintenance.

Key Players & Competitive Analysis Report

The US polyurea market is moderately consolidated, with competition driven by advancements in formulation technologies, application methods, and industry-specific customization. Leading companies are focusing on developing fast-set, high-performance systems suitable for varied end-use environments such as infrastructure rehabilitation, containment linings, commercial roofing, and corrosion control. Several participants are expanding product portfolios by offering polyurea systems that meet environmental compliance standards, minimize downtime, and improve long-term durability under extreme operational conditions. This rising focus on performance innovation and applicator convenience is boosting market expansion across commercial, municipal, and industrial sectors. Strategic initiatives such as domestic manufacturing expansion, product certifications, contractor training programs, and targeted marketing are common among US-based players aiming to strengthen regional presence and brand visibility.

Prominent players in the US polyurea market include ArmorThane USA Inc., BASF Corporation, Citadel Floors, Inc., Huntsman International LLC, LINE-X Protective Coatings, Inc., Nukote Coating Systems International, Inc., PPG Industries, Inc., Polycoat Products, Professional Coating Technologies, Inc., Rhino Linings Corporation, Rust-Oleum Corporation, Seal for Life Industries LLC, Sherwin-Williams Company, Specialty Products, Inc., and VersaFlex Incorporated.

Key Players

- ArmorThane USA Inc.

- BASF Corporation

- Citadel Floors, Inc.

- Huntsman International LLC

- LINE-X Protective Coatings, Inc.

- Nukote Coating Systems International, Inc.

- PPG Industries, Inc.

- Polycoat Products

- Professional Coating Technologies, Inc.

- Rhino Linings Corporation

- Rust-Oleum Corporation

- Seal for Life Industries LLC

- Sherwin-Williams Company

- Specialty Products, Inc.

- VersaFlex Incorporated

Industry Developments

June 2024:Sprayroq launched Polyurea AR‑3400, a high-performance coating designed for demanding industrial environments. The product offers fast curing, enhanced abrasion resistance, strong adhesion, and excellent chemical resistance, making it well-suited for protective linings in harsh operating conditions.

US Polyurea Market Segmentation

By Raw Material Outlook (Revenue, USD Million, 2020–2034)

- Aromatic

- Aliphatic

By Product Outlook (Revenue, USD Million, 2020–2034)

- Coating

- Lining

- Adhesives & Sealants

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Construction

- Industrial

- Transportation

- Others

US Polyurea Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 239.25 Million |

|

Market Size in 2025 |

USD 253.62 Million |

|

Revenue Forecast by 2034 |

USD 433.42 Million |

|

CAGR |

6.14% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |

FAQ's

The US market size was valued at USD 239.25 million in 2024 and is projected to grow to USD 433.42 million by 2034.

The US market is projected to register a CAGR of 6.14% during the forecast period.

A few of the key players in the market are ArmorThane USA Inc., BASF Corporation, Citadel Floors, Inc., Huntsman International LLC, LINE-X Protective Coatings, Inc., Nukote Coating Systems International, Inc., PPG Industries, Inc., Polycoat Products, Professional Coating Technologies, Inc., Rhino Linings Corporation.

The coating segment dominated the market, in 2024.

The transportation segment is projected to grow at the fastest pace over the forecast period.