Polyurea Coatings Market Size, Share, Trends, Industry Analysis Report

: By Raw Material (Aliphatic and Aromatic), By Polyurea Type, By Technology, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 125

- Format: PDF

- Report ID: PM2536

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

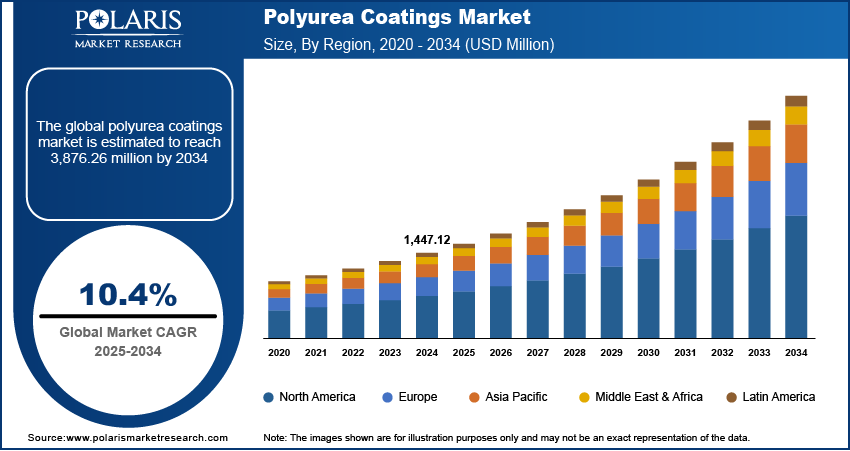

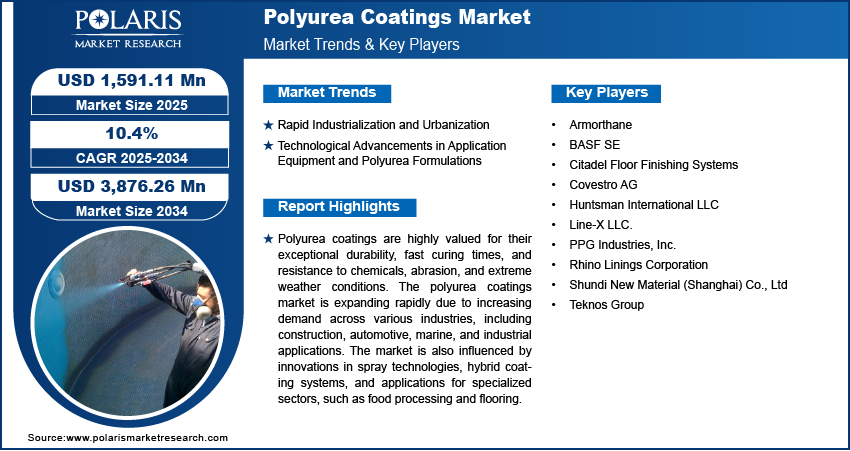

The polyurea coatings market size was valued at USD 1,447.12 million in 2024. It is projected to grow from USD 1,591.11 million in 2025 to USD 3,876.26 million by 2034, exhibiting a CAGR of 10.4% during 2024–2034.

Polyurea coatings are strong and flexible layers created when two chemicals—an isocyanate and an amine—react together to form a rubber‑like material. These coatings cure instantly and offer exceptional resistance to chemicals, water, abrasion, and UV radiation. The global polyurea industry encompasses everything from making and selling raw materials to using them in transportation, construction, and manufacturing industries around the world.

Increasing demand for durable and corrosion-resistant coatings across the construction, automotive, and oil & gas industries is a major factor contributing to the global polyurea coatings market expansion. Additionally, advancements in spray and injection application technologies and rapid infrastructure development and urbanization in emerging economies such as China, India, and Brazil are propelling the demand for polyurea coatings.

Market Dynamics

Rapid Industrialization and Urbanization

Rapid urbanization is significantly boosting the adoption of polyurea coatings. In India, as of 2024, the urban population reached 37%. Rapid urbanization leads to the construction of new highways and expressways. To meet the growing infrastructure requirements, polyurea coatings are increasingly being used in overpasses and tunnels due to their effectiveness in preventing corrosion and water access. A main advantage of polyurea is its ultra-fast curing time, which allows construction crews to reduce work windows on busy roads and keep traffic disruptions to a minimum. Additionally, the demand for polyurea coatings has surged globally as governments and private investors are investing billions in infrastructure projects such as roads, bridges, and high-speed rail networks, all of which require durable, chemical-resistant liners. As per the Braumiller Law Group, in 2024, China invested ∼USD 92.4 billion in various projects across the 149 countries involved in the Belt and Road Initiative (BRI). China’s BRI incorporates numerous large-scale infrastructure projects across the globe. One such major project is the China-Pakistan Economic Corridor (CPEC), which includes highways, railways, and energy developments, with China investing US$ 62 billion to connect Gwadar Port in Pakistan to Xinjiang. As large-scale infrastructure projects continue to expand, polyurea coatings are becoming essential for ensuring long-lasting, efficient construction. Hence, rising industrialization and urbanization boost the polyurea coatings market growth.

Technological Advancements in Application Equipment and Polyurea Formulations

Technological advancements in pouring, spray, and bio‑based formulations have transformed the global polyurea coatings market trends, enabled faster application and broader material use possibilities. They also reduced project costs. New spray systems such as Graco Reactor 3, launched in March 2022, allow contractors to maximize material yield, productivity, and profitability. This system’s smart drum‑to‑gun connectivity, touchscreen controls, and ratio assurance improve the precision and consistency of polyurea coatings by diminishing waste and ensuring ideal mix proportions on every job. Similarly, in February 2025, Sprayroq launched Polyurea AR‑3400, manufactured for excellent corrosion resistance and flexibility in difficult environments. Its fast‑curing spray formulation makes a seamless and joint‑free layer on pipelines, tanks, and bridge components, by cutting application time and labor costs. By combining precision spray technology with a robust polyurea chemistry, this product highlights next‑generation equipment and formulations driving efficiency, performance, and broader adoption across industrial and infrastructure projects in the global market.

Segment Insights

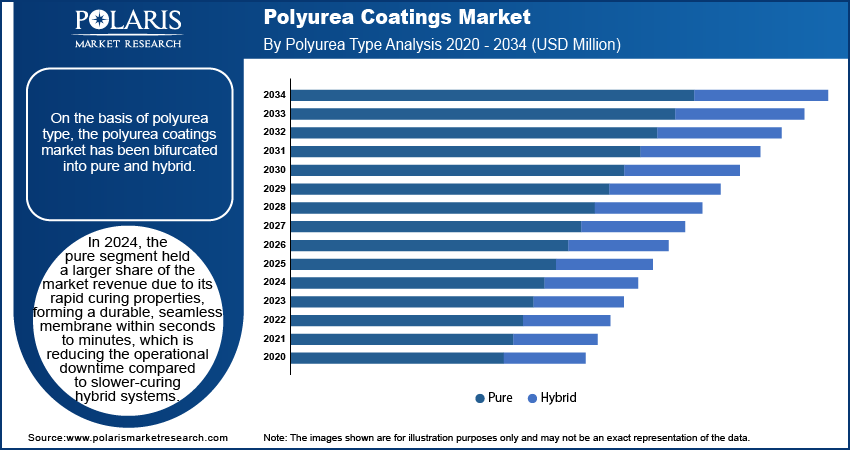

Market Assessment by Polyurea Type

On the basis of polyurea type, the market has been bifurcated into pure and hybrid. In 2024, the pure segment held a larger market revenue share due to its rapid curing properties, forming a durable, seamless membrane within seconds to minutes, which is reducing the operational downtime compared to slower-curing hybrid systems. Unlike hybrid systems containing polyurethane links, pure polyurea is minimally sensitive to moisture during application, ensuring consistent adhesion and finish even in humid environments. Adoption in automotive bedliners, underbody coatings, and roofing and waterproofing in construction and water treatment further expanded the segment’s share in 2024. For instance, in Dubai’s District One lagoon project, Delta Coatings applied over 20,000 m² of aliphatic pure polyurea lining, achieving a seamless, UV‑stable finish in under six months using Desmodur and Desmophen technology. Continued innovation in low‑VOC and high-elongation pure polyurea continues to expand their application potential.

Market Outlook by Raw Material

On the basis of raw material, the market has been bifurcated into aliphatic and aromatic. In 2024, the aromatic segment led the polyurea coatings market share due to its cost-effectiveness, ease of processing, and strong mechanical properties. Aromatic polyurea coatings are primarily used by construction and manufacturing sectors, particularly in environments with limited UV exposure. Their affordability and versatility have led to widespread adoption, especially in regions prioritizing infrastructure development.

The aliphatic segment is poised for substantial growth due to increasing demand for durable, weather-resistant coatings across transportation and infrastructure projects. Aliphatic polyurea coatings are mainly used for outdoor use where superior UV resistance and color stability are required.

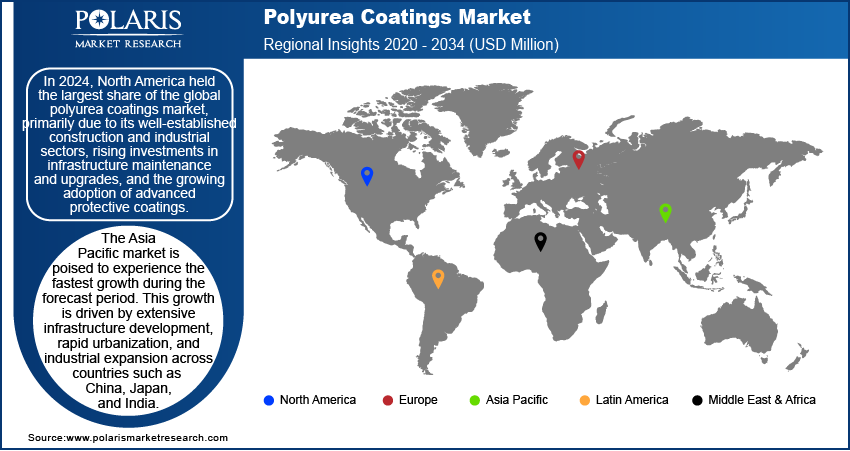

Regional Insights

By region, the study provides polyurea coatings market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. In 2024, North America held the largest market share, primarily due to the region’s well-established construction and industrial sectors, rising investments in infrastructure maintenance and upgrades, and the growing adoption of advanced protective coatings. For instance, in May 2024, PPG Industries announced the investments of US$ 300 million to expand its advanced manufacturing capabilities in North America to support increasing demand for paints and coatings in the automotive industry. This initiative includes constructing a new 250,000-square-foot facility in Loudon County, Tennessee, aimed at producing over 11 million gallons of paint and coatings annually by 2026. Similarly, in May 2023 York Region culvert therapy project in Canada, polyurea coatings were applied using trenchless techniques to restore aging pipes beneath a four-lane road, highlighting the material’s speed, strength, and effectiveness. These capabilities make polyurea coatings an ideal solution for modern infrastructure, offering seamless protection against abrasion, chemicals, and UV damage. Such advancements reflect the region’s strategic use of polyurea coatings to enhance the longevity and performance of critical infrastructure, solidifying North America’s leadership in this evolving industry.

The Asia Pacific polyurea coatings market experiences the fastest growth during the forecast period. This growth is driven by widespread infrastructure development, urbanization, and industrial expansion across countries such as China, Japan, and India. In India, the government is investing heavily in developing infrastructure for smart cities and industrial corridors, which has increased the demand for high-performance coatings. For infrastructure projects, the 2023-24 budget allocated was about USD 122 billion, which is 3.3% of the nation's GDP. Similarly, China continues to lead in infrastructure initiatives, with major projects such as the Dalian-Yantai Undersea Railway Tunnel and the Gwadar-Kashgar Railway Line underway. These developments demand protective coatings that can survive severe environmental conditions, thus propelling the adoption of polyurea solutions.

Key Players and Competitive Insights

The market is highly competitive, fueled by growing demand across construction, automotive, marine, and industrial sectors due to its exceptional durability, rapid curing, and resistance to chemicals and abrasion. Key players focus on developing advanced formulations that meet evolving regulatory standards and sustainability goals, including low-VOC and environmentally friendly coatings. Companies are investing in R&D to enhance performance characteristics such as flexibility, UV stability, and adhesion to diverse substrates. Innovation in spray technologies and hybrid systems also contributes to expanding application areas. Strategic partnerships, geographic expansion, and acquisitions are common as companies aim to strengthen their market presence and meet the increasing global demand. A few major players in the market include BASF SE; Teknos Group; Huntsman International LLC; Citadel Floor Finishing Systems; PPG Industries, Inc.; Covestro AG; Rhino Linings Corporation; Armorthane; Shundi New Material (Shanghai) Co., Ltd; and Line-X LLC.

BASF SE, founded in 1865, is one of the world’s largest and most diversified chemical companies, headquartered in Germany. BASF operates across a vast global footprint with production sites in over 90 countries and serves customers in nearly every industry. The company’s business model spans the entire chemical value chain and is organized into six key segments—Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care, and Agricultural Solutions. Within the coatings market, BASF plays a major role through its comprehensive range of protective coatings, including polyurea and polyurethane-based products designed for industrial, automotive, and construction applications. The company has made significant strides in developing low-VOC and high-performance coating technologies that align with global regulatory standards and customer expectations for durable, safe, and sustainable materials.

Huntsman International LLC is a global manufacturer and marketer of differentiated chemicals with a strong presence across a range of end markets including construction, automotive, aerospace, textiles, and consumer products. Headquartered in The Woodlands, Texas, USA, the company was originally founded in 1970 by Jon M. Huntsman and has since grown into a major player in the specialty chemicals industry. Huntsman operates through several business segments: Polyurethanes, Performance Products, Advanced Materials, and Textile Effects. Its Polyurethanes segment, one of the largest globally, offers MDI-based polyurethane solutions, including polyurea systems, used extensively in coatings, adhesives, and insulation. With more than 70 manufacturing and R&D facilities in over 30 countries, Huntsman serves thousands of customers globally and employs over 9,000 people. The company is known for its focus on innovation, sustainability, and customer-driven solutions, investing significantly in R&D to develop high-performance, environmentally friendly products.

List of Key Companies in Polyurea Coatings Market

- Armorthane

- BASF SE

- Citadel Floor Finishing Systems

- Covestro AG

- Huntsman International LLC

- Line-X LLC.

- PPG Industries, Inc.

- Rhino Linings Corporation

- Shundi New Material (Shanghai) Co., Ltd

- Teknos Group

Polyurea Coatings Industry Developments

January 2024: BASF introduced a new line of polyurea coatings tailored for high-impact industrial environments. These coatings are engineered to enhance durability and extend the lifespan of surfaces in demanding conditions.

October 2023: Everest Systems launched EverMax Polyurea, a resilient and adaptable coating designed specifically for commercial roofing. This product offers low shrinkage, exceptional flexibility, and remarkable resistance to mechanical damage, suitable for regions facing severe weather conditions.

June 2023: Sherwin-Williams launched its fast-curing polyurea floor coating that provides extended curing time and ultra-chemical resistance. This innovation aims to boost the company's share in the industrial flooring sector.

Polyurea Coatings Market Segmentation

By Raw Material Outlook (Revenue, USD Million, 2020–2034)

- Aliphatic

- Aromatic

By Polyurea Type Outlook (Revenue, USD Million, 2020–2034)

- Pure

- Hybrid

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Spraying

- Pouring

- Hand Mixing

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Building & Construction

- Transportation

- Industrial

- Landscape

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Polyurea Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,447.12 Million |

|

Market Size Value in 2025 |

USD 1,591.11 Million |

|

Revenue Forecast by 2034 |

USD 3,876.26 Million |

|

CAGR |

10.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,447.12 million in 2024 and is projected to grow to USD 3,876.26 million by 2034.

The global market is expected to register a CAGR of 10.4% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are BASF SE; Teknos Group; Huntsman International LLC; Citadel Floor Finishing Systems; PPG Industries, Inc.; Covestro AG; Rhino Linings Corporation; Armorthane; Shundi New Material (Shanghai) Co., Ltd; and Line-X LLC.

The pure segment dominated the market in 2024.