U.S. Postal Automation Systems Market Share, Size, Trends, Industry Analysis Report

By Type (Hardware, Software, Services); By Technology; By Application; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4460

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

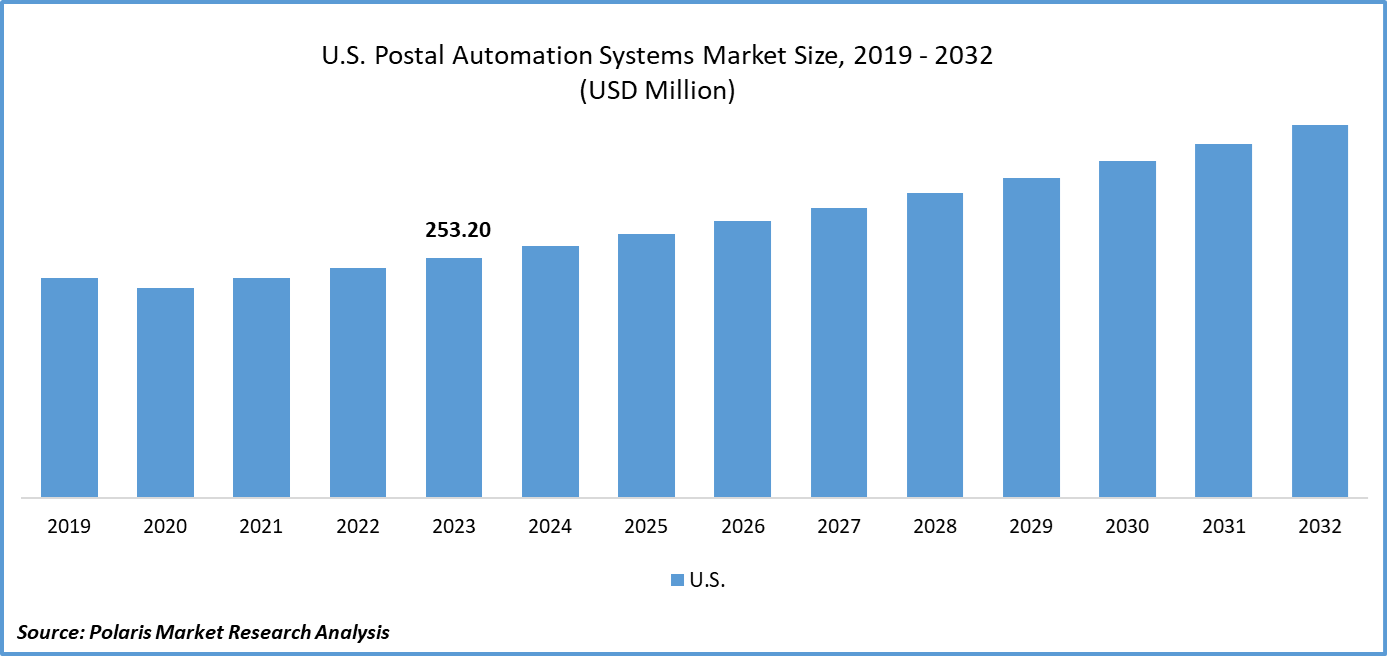

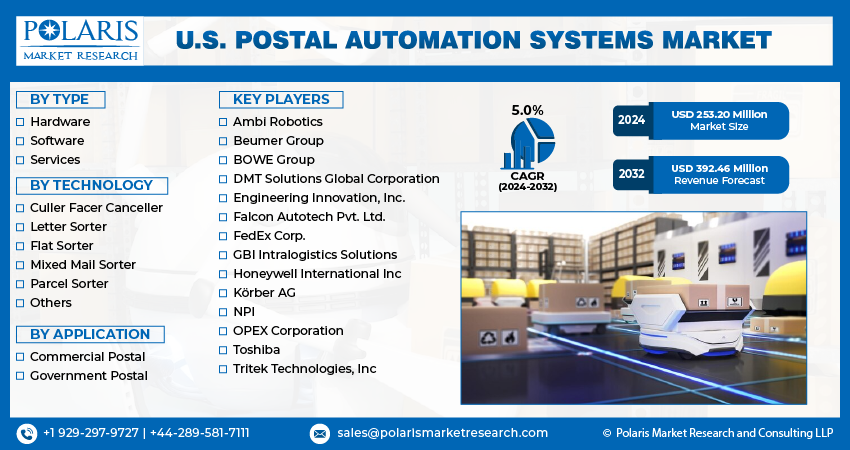

U.S. Postal Automation Systems Market size was valued at USD 253.20 million in 2023. The market is anticipated to grow from USD 265.23 million in 2024 to USD 392.46 million by 2032, exhibiting a CAGR of 5.0% during the forecast period

Industry Trends

Postal automation systems refer to the use of technology and machinery to streamline and optimize the processing, sorting, and delivery of mail and packages within a postal service or courier company. These systems aim to increase efficiency, accuracy, and speed while reducing labor costs and improving customer satisfaction. Postal automation typically involves the use of advanced hardware and software solutions such as barcode scanners, optical character recognition (OCR) devices, and machine learning algorithms. These technologies enable the automatic reading, sorting, and routing of mail items, allowing for faster and more accurate delivery.

The U.S. postal automation systems market outlook for postal automation systems is expected to experience significant growth in the coming years, driven by the increasing demand for efficient and fast delivery services. There is a growing need for reliable and timely delivery of packages and mail, which can be achieved through the use of advanced postal automation systems. Additionally, the need to reduce manual labor costs and improve accuracy in sorting and delivering mail is also propelling the adoption of these systems. Another key driver of the postal automation systems market is advancements in technology. Advancements in areas such as machine learning, artificial intelligence, and robotics have made it possible to develop more sophisticated and efficient automation solutions that can handle complex tasks with greater speed and accuracy than ever before.

However, the market needs to be improved by the high initial investment and maintenance cost required to implement these systems. Also, concerns about data privacy and security, as well as the potential loss of jobs due to automation, slow down the adoption rate. On one hand, the surge in e-commerce during the pandemic has increased the demand for efficient delivery services, leading to an accelerated adoption of automation technologies in the postal industry. On the other hand, supply chain disruptions during the pandemic had negative impacts on U.S. postal automation systems market players, which subsequently affected market growth.

To Understand More About this Research: Request a Free Sample Report

Key Takeaways

- By type category, the hardware segment accounted for the largest U.S. postal automation systems market share in 2023

- By technology category, the culler facer canceller segment held the dominating U.S. postal automation systems market share in 2023

- By application category, the commercial postal segment is expected to grow with a significant CAGR over the U.S. postal automation systems market forecast period

What are the market drivers driving the demand for the U.S. postal automation systems market?

Technological advancements drive the U.S. postal automation systems market's latest trends.

Advancements in technology are playing a significant role in driving the postal automation systems market by enhancing the affordability, efficiency, and responsiveness of the processes. The incorporation of Artificial Intelligence (AI), Machine Learning (ML), the Internet of Things, and Cloud Computing. are some of the major technological developments that are revolutionizing the postal sector. The postal sector has increasingly adopted these technologies to enhance operational efficiency and improve the parcel and mail handling process.

AI and ML technologies offer superior accuracy in processing and sorting, thereby reducing errors and facilitating rapid delivery of mail and packages. The United States Postal Service has deployed AI-based solutions for governing a smart system that identifies postal parcels and tracks their transport from sender to recipient. Thus, the technological advancements in the United States are considered the driving factor for the growth of the market.

Which factor is restraining the demand for U.S. postal automation systems?

The high initial investment and maintenance cost required to implement these systems are retraining the market growth.

The high initial investment and maintenance costs associated with implementing advanced automation systems are hindering the growth of the market. The cost of purchasing and installing sophisticated machinery, such as flat sorter and culler facer canceller, is relatively expensive for many organizations, particularly for small and medium enterprises. Also, the ongoing maintenance and repair costs of these systems are significant, which deters potential buyers. These factors make it difficult for some companies to justify their investment in automation technology, especially when they may not see immediate returns. As a result, the market growth for postal automation systems is limited by the high upfront and ongoing costs associated with their implementation.

Report Segmentation

The market is primarily segmented based on type, technology, and application.

|

By Type |

By Technology |

By Application |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Type Insights

Based on type analysis, the market is segmented on the basis of hardware, software, and services. The hardware segment holds the largest U.S. postal automation systems market share in 2023. This dominance is attributed to the rising demand for faster and more efficient mail processing, along with a focus on reducing costs and improving accuracy.

Further, the technology driving the growth in the hardware segment is the use of automated sorting machines. These machines can handle large volumes of mail with high speed and precision, thereby reducing the need for manual sorting and enhancing overall efficiency. Moreover, these machines come equipped with advanced imaging and scanning technologies, enabling them to read and sort mail based on its content and destination. Also, the adoption of robotics-based hardware has contributed to the dominance of this segment. This technology enables the automation of various functions in the postal industry, such as sorting, scanning, and even delivery.

By Technology Insights

Based on technology analysis, the market has been segmented on the basis of culler facer canceller, letter sorter, flat sorter, mixed mail sorter, parcel sorter, and others. The culler facer canceler segment accounted for the dominant U.S. postal automation systems market size in 2023 due to its ability to efficiently process large volumes of mail and packages while also reducing labor costs associated with manual sorting and processing. These machines are capable of reading barcodes, OCR, and IMb codes, allowing them to accurately sort and direct mail pieces to their intended destinations. In addition, they can cancel stamps, permitting the USPS to reclaim funds from undeliverable mail, which is a significant cost savings for the organization. Further, advancements in technology have enabled these machines to operate at high speeds, with some models able to process up to 60,000 pieces per hour, making them an attractive investment for postal services looking to streamline operations and increase efficiency.

By Application Insights

Based on application analysis, the market has been segmented on the basis of commercial postal and government postal. The commercial postal applications segment is expected to experience significant growth over the forecast period due to the increasing adoption of postal automation systems by businesses. As businesses continue to rely on mail as a primary means of communication, they are turning to automation solutions to improve their mailing processes. This has led to an increased demand for postal automation systems, which in turn is driving the growth of the commercial postal applications segment. In addition, advancements in technology, such as machine learning and artificial intelligence, are enabling more sophisticated automation capabilities, further fueling the growth of this segment.

Competitive Landscape

The U.S. postal automation systems industry analysis involves several key market players, including technology providers, system integrators, and postage operators. Technology providers, such as Körber AG, Toshiba, and Honeywell, develop and manufacture automated sorting machines, scanners, and other equipment used in postal facilities. The U.S. market is witnessing a significant level of merger and acquisition activity by the top market players. These companies are keen on improving operational efficiency and embracing technological advancements through strategic alliances and acquisitions. Such transactions often result in the consolidation of resources, promoting innovation and enabling market players to stay competitive in a rapidly evolving environment.

Some of the major players operating in the U.S. market include:

- Ambi Robotics

- Beumer Group

- BOWE Group

- DMT Solutions Global Corporation

- Engineering Innovation, Inc.

- Falcon Autotech Pvt. Ltd.

- FedEx Corp.

- GBI Intralogistics Solutions

- Honeywell International Inc

- Körber AG

- NPI

- OPEX Corporation

- Toshiba

- Tritek Technologies, Inc

Recent Developments

- In September 2020, Geekplus Technology Co., Ltd. launched the S100C, a large-size parcel sorting robot. The S100C can support unit sortation, parcel sortation, and bin transportation, making it applicable to many industries.

- In July 2023, Ambi Robotics, a provider of AI-powered robotic parcel sorting systems, introduced AmbiSort B-Series, a modular parcel induction and sorting solution that redefines speed, flexibility, and scalability in the shipping logistics market.

- In December 2021, Beumer Group announced the launch of a new sortation system for handling small and medium-sized parcels. The system enables more efficient sorting of the growing number of small and medium-sized e-commerce parcels.

- In January 2022, FedEx Express, a subsidiary of FedEx Corp., announced the launch of DoraSorter, which is an AI-powered intelligent sorting robot.

Report Coverage

The Postal Automation Systems market research report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, technology, application, and futuristic growth opportunities.

U.S. Postal Automation Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 253.20 million |

|

Revenue Forecast in 2032 |

USD 392.46 million |

|

CAGR |

5.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Technology, By Application |

|

Country Scope |

The U.S. |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. Postal Automation Systems Market report covering key segments are type, technology, and application.

U.S. Postal Automation Systems Market Size Worth USD 392.46 Million By 2032

U.S. Postal Automation Systems Market exhibiting a CAGR of 5.0% during the forecast period

key driving factors in U.S. Postal Automation Systems Market are technological advancements drive the U.S. postal automation systems market's latest trends