U.S. Private 5G Network Market Size, Share, Trends, Industry Analysis Report

By Component (Hardware, Software & Services), By Operational Frequency, By Spectrum, By Vertical – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6411

- Base Year: 2024

- Historical Data: 2020-2023

Overview

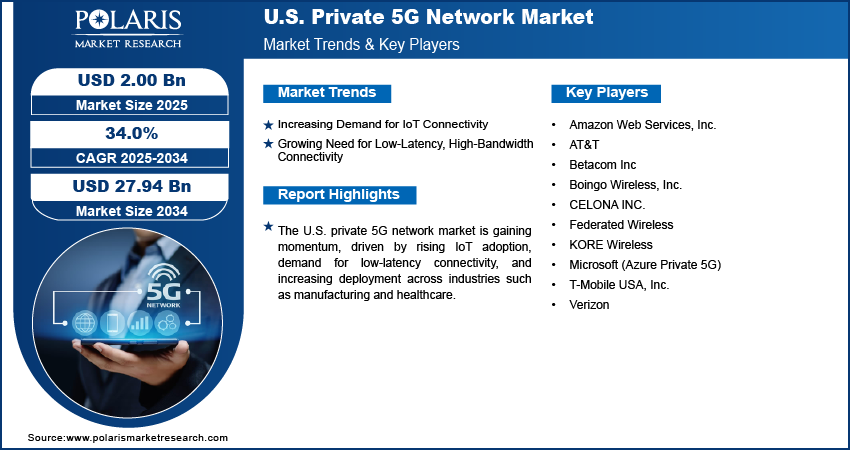

The U.S. private 5G network market size was valued at USD 1.36 billion in 2024, growing at a CAGR of 34.0% from 2025 to 2034. Key factors driving demand include the expansion of automation and edge computing in sectors such as healthcare and logistics, adoption of simplified deployment models and AI-driven network management, increasing demand for IoT connectivity, and the growing need for low-latency, high-bandwidth connectivity.

Key Insights

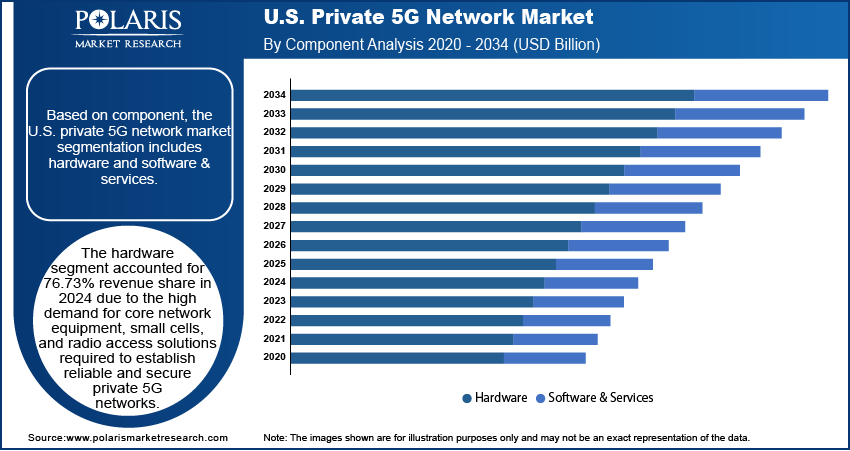

- The hardware segment dominated the revenue in 2024, capturing a 76.73% share. High demand for core network equipment, small cells, and RAN solutions needed to build secure networks drove this segment dominance.

- The mmWave segment is expected to grow at a 47.7% CAGR during the forecast period. This growth is fueled by its capacity to provide ultra-high bandwidth and extremely low-latency connections.

- The unlicensed/shared spectrum segment held a 73.63% share in 2024. Its popularity stems from offering deployment flexibility while avoiding the cost and complexity of licensed spectrum.

- The healthcare segment is expected to be the fastest-growing segment, with a 49.2% CAGR. This is driven by the rising use of telemedicine, connected devices, and digital health tech.

Market Dynamics

- The expansion of IoT devices and sensors across industries is driving private 5G adoption, as it provides the necessary secure and scalable connectivity to manage immense data flows.

- Mission-critical applications such as autonomous robotics and remote surgery require ultra-reliable, low-latency networks, a need that is accelerating the implementation of private 5G.

- High upfront costs and technical complexity can be a major barrier for many companies, especially smaller ones, to deploy these networks.

- These networks enable new automation and real-time data use cases, such as smart factories, that can significantly boost productivity and create new revenue streams.

Market Statistics

- 2024 Market Size: USD 1.36 billion

- 2034 Projected Market Size: USD 27.94 billion

- CAGR (2025–2034): 34.0%

AI Impact on U.S. Private 5G Network Market

- AI automates network optimization and traffic routing in real-time, boosting operational efficiency and reducing the need for manual intervention.

- AI analyzes network data to predict equipment failures before they happen, preventing costly downtime and ensuring consistent, reliable service for critical operations.

- AI continuously monitors network traffic to instantly detect and neutralize potential security threats, providing a much stronger defense for sensitive industrial data.

- AI enables advanced use cases such as autonomous guided vehicles and smart quality control by processing the vast data from 5G-connected sensors in real-time.

A private 5G network is a dedicated cellular infrastructure designed exclusively for a specific organization or enterprise, offering enhanced control, security, and performance compared to public networks. In the U.S., the growth of private 5G is driven by the expansion of automation and edge computing across critical sectors such as healthcare, manufacturing, and logistics. Private 5G enables low-latency, high-bandwidth communication that supports seamless data transfer and decision-making at the edge, with enterprises increasingly integrating IoT-enabled devices, robotics, and real-time monitoring systems. This integration enhances operational efficiency and also provides enterprises with greater reliability and flexibility in managing mission-critical applications within secure, closed environments.

.webp)

The U.S. private 5G network market is driven by the adoption of simplified deployment models and AI-driven network management. Enterprises are increasingly turning to modular and software-based deployment strategies, which reduce the complexity and cost traditionally associated with private networks. In June 2025, Vodafone and Cyient launched an AI-powered network management solution. It unifies configuration data and inventory to enhance efficiency, provide cross-market visibility, and enable data-driven decisions through analytics and anomaly detection. Additionally, AI-driven network management solutions enable predictive maintenance, automated resource allocation, and dynamic traffic optimization, allowing organizations to maximize performance with minimal manual intervention. These advancements lower barriers to entry and empower U.S. enterprises by simplifying network orchestration and scaling capabilities across diverse industries to rapidly deploy and manage private 5G networks, further accelerating market adoption.

Drivers & Opportunities

Increasing Demand for IoT Connectivity: The increasing demand for IoT connectivity is contributing to the deployment of private 5G networks, as enterprises across industries are deploying a growing number of connected devices and IoT sensors to enable smarter operations. Private 5G offers the scalability, security, and reliability required to manage the vast volumes of data generated by IoT ecosystems in sectors such as healthcare, logistics, and manufacturing. Private 5G ensures seamless device interoperability and real-time data exchange with its ability to support massive machine-type communications. This capability allows organizations to enhance predictive maintenance, optimize resource utilization, and improve decision-making, making private 5G an essential enabler of advanced IoT-driven business models in the U.S.

Growing Need for Low-Latency, High-Bandwidth Connectivity: The growing need for low-latency, high-bandwidth connectivity is fueling the adoption of private 5G networks in the U.S. Enterprises increasingly rely on mission-critical applications such as autonomous robotics, remote surgeries, AR/VR training, and intelligent supply chain systems that demand immediate communication and ultra-fast data transfer. In June 2024, Hewlett Packard Enterprise introduced a private 5G networking solution. It is designed to simplify deployment and management, provide reliable coverage across large campuses, and enable new industrial use cases. This move reflects the industry's response to complex connectivity demands. Unlike traditional networks, private 5G provides the consistent performance and dedicated capacity required to run these applications without disruptions. This combination of ultra-reliable low-latency communication (URLLC) and enhanced bandwidth empowers U.S. enterprises to unlock new levels of productivity, safety, and innovation, reinforcing private 5G as a strategic foundation for digital transformation.

Segmental Insights

Component Analysis

Based on component, the segmentation includes hardware and software & services. The hardware segment accounted for 76.73% revenue share in 2024 due to the high demand for core network equipment, small cells, and radio access solutions required to establish reliable and secure private 5G networks. In the U.S., enterprises across industries prioritize investments in robust physical infrastructure to ensure seamless coverage, low latency, and strong data security within their operational environments. Hardware comprises the backbone of private 5G deployments, supporting critical functions such as network slicing and large-scale IoT technology integration. The need for scalable and high-performance infrastructure, particularly in sectors such as manufacturing and logistics, continues to drive the dominance of the hardware segment.

The software & services segment is expected to register a CAGR of 49.2% during the forecast period driven by the rising importance of network management, AI-driven orchestration, and cloud-based solutions. The demand for software platforms that enable automation, predictive analytics, and traffic optimization is rapidly increasing as U.S. enterprises aim for greater flexibility and efficiency. Additionally, professional services, such as consulting, deployment, and managed services, are becoming essential to support enterprises lacking in-house expertise. The growing reliance on intelligent software and service-based models is enabling organizations to streamline operations, reduce complexities, and accelerate the adoption of private 5G services.

Operational Frequency Analysis

In terms of operational frequency, the segmentation includes sub-6 GHz and mmWave. The sub-6 GHz segment dominated the market with 81.88% share in 2024 due to its ability to provide widespread coverage, reliability, and cost-effectiveness for private 5G deployments in the U.S. Enterprises prefer sub-6 GHz frequencies because they balance speed and penetration, making them suitable for diverse environments such as large manufacturing facilities, healthcare campuses, and logistics hubs. This frequency band supports stable connectivity across indoor and outdoor settings, ensuring uninterrupted communication for mission-critical applications. Its broad utility and scalability make sub-6 GHz the preferred choice for initial private 5G implementations across industries.

The mmWave segment is projected to grow at a 47.7% CAGR during the forecast period owing to its ability to deliver ultra-high bandwidth and extremely low latency. In the U.S., industries such as aerospace, defense, and advanced healthcare are increasingly adopting mmWave to power data-intensive applications such as AR/VR, remote surgeries, and real-time analytics. mmWave’s performance in high-density environments makes it ideal for specialized use cases, while its limited penetration poses challenges in large or obstructed areas. Moreover, the increasing demand for high-capacity, high-speed communication in controlled environments is expected to fuel the adoption of mmWave technology in private 5G networks.

Spectrum Analysis

In terms of spectrum, the segmentation includes licensed and unlicensed/shared. The unlicensed/shared segment accounted for 73.63% share in 2024, owing to the flexibility it offers enterprises in deploying private 5G networks without the cost and regulatory hurdles associated with licensed spectrum. In the U.S., businesses are increasingly leveraging unlicensed and shared bands such as CBRS to gain greater control over their connectivity while maintaining cost efficiency. This model enables enterprises to deploy networks tailored to their specific operational needs, making it particularly attractive for small to mid-sized organizations.

The licensed segment is expected to witness substantial growth at a CAGR of 47.5% during the forecast period, attributed to the superior performance, reliability, and security it offers. Large U.S. enterprises and critical infrastructure sectors such as defense, utilities, and healthcare are increasingly turning to licensed spectrum to ensure interference-free communication and maximum data protection. Licensed spectrum provides greater control over the quality of service, enabling organizations to run mission-critical applications with guaranteed connectivity. Thus, as the reliance on advanced digital technologies increases, the preference for licensed spectrum is expected to accelerate, particularly among enterprises with strict regulatory and security requirements.

Vertical Analysis

The segmentation, based on vertical, includes manufacturing, food & beverages, energy & utilities, transportation & logistics, aerospace & defense, government & public safety, corporates/enterprises, mining, healthcare, oil & gas, and others. The manufacturing segment held a 25.40% share in 2024 due to the rising integration of automation, robotics, and IoT in U.S. production facilities. Private 5G networks enable seamless machine-to-machine communication, predictive maintenance, and real-time quality control, all of which are critical to maintaining efficiency and competitiveness in manufacturing operations. The technology supports flexible production lines, smart factories, and digital twins, allowing U.S. manufacturers to optimize processes and reduce downtime. The ability of private 5G to provide reliable, low-latency connectivity makes it an important part of industrial digital transformation.

The healthcare segment is expected to witness the fastest growth at a 49.2% CAGR during the forecast period, driven by the increasing adoption of digital health technologies, telemedicine, and connected medical devices in the U.S. Private 5G networks offer the security, reliability, and low latency required for sensitive healthcare applications such as remote surgeries, patient monitoring, and AI-assisted diagnostics. Hospitals and research institutions are leveraging private 5G to enhance operational efficiency, ensure uninterrupted data flow, and improve patient outcomes. Thus, this push toward smarter, technology-driven healthcare systems is accelerating the demand for private 5G solutions in this sector.

Key Players & Competitive Analysis

The U.S. private 5G landscape is characterized by intense competition among telecom giants, specialized vendors, and cloud providers. Vendor strategies focus on technological advancement in core networks and spectrum agility to capture revenue opportunity. Competitive intelligence reveals a strategic push towards vertical-specific solutions, particularly for small and medium-sized businesses, which represent a significant latent demand and opportunity. Expert's insight suggests that future development strategies will be shaped by economic and geopolitical shifts and the need to build sustainable value chains. Success hinges on competitive positioning through tailored product offerings and forming a robust partner & customer ecosystem to navigate this complex environment.

A few major companies operating in the U.S. private 5G network market include Amazon Web Services, Inc.; AT&T; Betacom Inc; Boingo Wireless, Inc.; CELONA INC.; Federated Wireless; KORE Wireless; Microsoft (Azure Private 5G); T‑Mobile USA, Inc.; and Verizon.

Key Players

- Amazon Web Services, Inc.

- AT&T

- Betacom Inc

- Boingo Wireless, Inc.

- CELONA INC.

- Federated Wireless

- KORE Wireless

- Microsoft (Azure Private 5G)

- T‑Mobile USA, Inc.

- Verizon

U.S. Private 5G Network Industry Developments

- August 2025: Chesapeake, Virginia, announced that it is deploying a city-owned private wireless network with Boldyn Networks to support municipal operations, public safety, and its broader smart city connectivity initiative.

- July 2025: Memphis Light, Gas and Water chose Nokia to deploy a private 5G network supporting its grid modernization across Memphis and Shelby County, aiming to improve power distribution, reduce outages, and enhance service restoration for over 420,000 customers.

U.S. Private 5G Network Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Radio Access Network

- Core Network

- Backhaul & Transport Interconnecting

- Software & Services

- Installation & Integration

- Data Services

- Support & Maintenance

By Operational Frequency Outlook (Revenue, USD Billion, 2020–2034)

- Sub-6 GHz

- mmWave

By Spectrum Outlook (Revenue, USD Billion, 2020–2034)

- Licensed

- Unlicensed/Shared

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Manufacturing

- Food & Beverages

- Automotive

- Pharmaceuticals

- Electrical & Electronics

- Heavy Machinery

- Clothing & Accessories

- Other Manufacturing Verticals

- Energy & Utilities

- Transportation & Logistics

- Aerospace & Defense

- Government & Public Safety

- Corporates/Enterprises

- Mining

- Healthcare

- Oil & Gas

- Others

U.S. Private 5G Network Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.36 Billion |

|

Market Size in 2025 |

USD 2.00 Billion |

|

Revenue Forecast by 2034 |

USD 27.94 Billion |

|

CAGR |

34.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

|

|

Customization |

|

FAQ's

The market size was valued at USD 1.36 billion in 2024 and is projected to grow to USD 27.94 billion by 2034.

The market is projected to register a CAGR of 34.0% during the forecast period.

A few of the key players in the market are Amazon Web Services, Inc.; AT&T; Betacom Inc; Boingo Wireless, Inc.; CELONA INC.; Federated Wireless; KORE Wireless; Microsoft (Azure Private 5G); T?Mobile USA, Inc.; and Verizon.

The hardware segment accounted for 76.73% revenue share in 2024.

The mm wave segment is projected to grow at a 47.7% CAGR during the forecast period.