U.S. Property Management Services Market Size, Share, Trend, Industry Analysis Report

By Property Type (Residential, Commercial, Industrial, Others), By Service, By End User – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6320

- Base Year: 2024

- Historical Data: 2020-2023

Overview

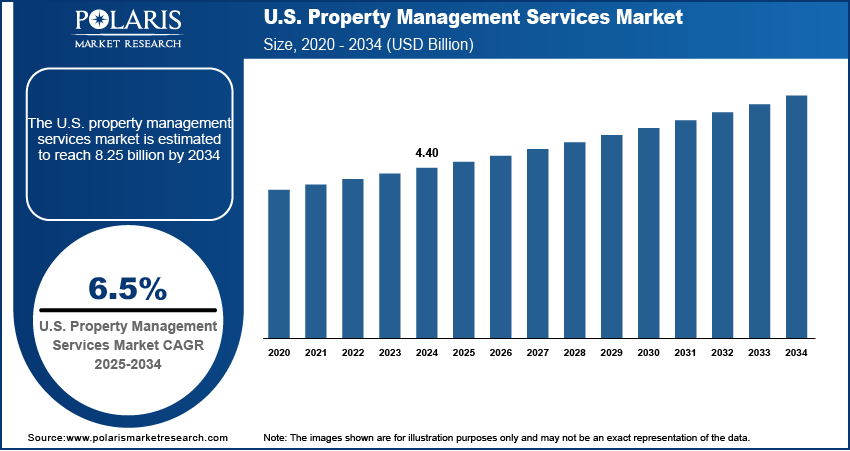

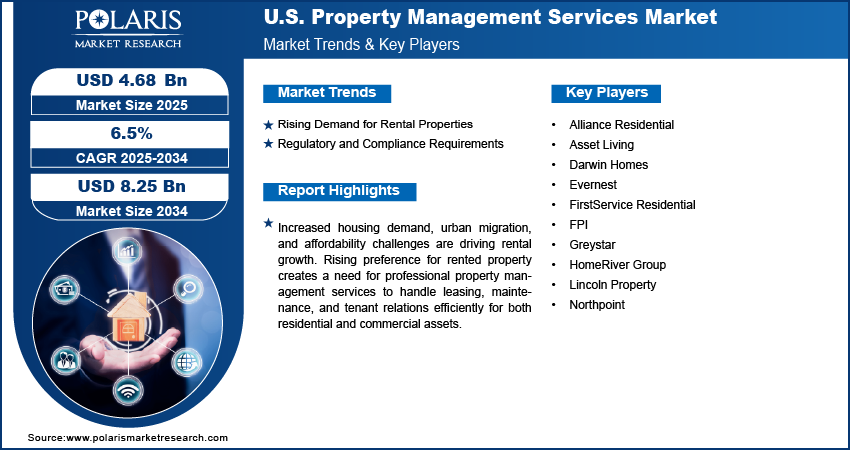

The U.S. property management services market size was valued at USD 4.40 billion in 2024, growing at a CAGR of 6.5% from 2025 to 2034. Integration of digital platforms, AI-powered analytics, and cloud-based property management systems is enhancing operational efficiency, enabling real-time monitoring, automated rent collection, and predictive maintenance, making services more appealing to property owners.

Key Insights

- The repair & maintenance segment held ~34% of the market share in 2024, driven by ongoing property upkeep to retain value and meet tenant standards.

- The residential segment captured ~60% of the revenue share in 2024, fueled by rising rental demand in urban and suburban markets.

- The property managers/agents segment led with ~46% share in 2024, due to their key role in overseeing day-to-day property operations and tenant management.

Industry Dynamics

- Increasing rental housing demand due to rising home prices and mortgage rates is driving the need for professional property management services.

- Growing adoption of smart home technology and IoT in rental units is boosting demand for tech-integrated property management solutions.

- Expansion into single-family rental (SFR) portfolios enables property managers to tap into a rapidly growing segment with high investor interest.

- Labor shortages and high turnover among on-site staff challenge service delivery and operational scalability in the property management sector.

Market Statistics

- 2024 Market Size: USD 4.40 billion

- 2034 Projected Market Size: USD 8.25 billion

- CAGR (2025–2034): 6.5%

AI Impact on U.S. Property Management Services Market

- AI streamlines property management tasks such as automating rent collection, maintenance requests, and tenant screening.

- AI-powered sensors and data analytics forecast equipment failures before they occur, allowing proactive maintenance. This reduces repair costs, extends asset life, and improves tenant satisfaction.

- AI chatbots handle tenant queries 24/7, personalize communications, and support seamless lease renewals.

- AI analyzes real-time market data, enabling dynamic pricing strategies and investment decisions.

The U.S. property management services market encompasses professional services for managing residential, commercial, and industrial real estate assets. The services include operations such as tenant management, rent collection, maintenance, lease administration, and financial reporting. They help in optimizing property value and ensuring operational efficiency. Increased housing demand, urban migration, and affordability challenges are driving rental growth, creating a need for professional property management services to handle leasing, maintenance, and tenant relations efficiently for both residential and commercial assets.

Property owners are increasingly outsourcing management tasks to professionals to reduce operational burdens, improve tenant retention, and optimize asset performance, especially in multi-family and large commercial complexes. Moreover, the popularity of short-term rentals and vacation properties is fueling demand for specialized property management services that handle guest turnover, cleaning, marketing, and compliance with local regulations.

Drivers & Opportunities/Trends

Rising Demand for Rental Properties: Rising demand for rental properties in the U.S. is being fueled by a combination of growing housing needs, rapid urban migration, and ongoing affordability challenges. According to the U.S. Census Bureau, in 2024, the rental demand surged with 37% of households renting, driven by high home prices and mortgage rates. Many individuals and families are turning to rental options instead of homeownership due to high property prices and limited housing inventory. This shift is increasing the need for professional property management services that can oversee every aspect of rental operations, from marketing and leasing to regular maintenance and tenant relations. Property owners are relying on these services to ensure smooth day-to-day management, preserve asset value, and provide tenants with a positive and hassle-free living experience.

Regulatory and Compliance Requirements: Regulatory and compliance requirements in the property sector are becoming increasingly complex, making it essential for owners to work with skilled management professionals. Property managers play a key role in navigating zoning laws, building safety codes, and tenant rights regulations, ensuring all legal obligations are met. They help reduce the risk of costly penalties or disputes by maintaining compliance and adhering to industry best practices. Their expertise also extends to implementing standardized operational procedures that protect the owner’s investment while providing transparency and fairness to tenants. This growing regulatory landscape is driving more property owners to outsource management to experienced firms capable of keeping up with evolving laws and maintaining high operational standards.

Segmental Insights

Service Analysis

Based on service, the U.S. property management services market segmentation includes rent collection, mortgage & utility payment, leasing, accounting & legal services, repair & maintenance, and other. The repair & maintenance segment accounted for the largest revenue share of ~34% in 2024. The dominance is attributed to the continuous need to preserve property value and meet tenant expectations. Timely upkeep of HVAC systems, plumbing, electrical infrastructure, and structural elements directly impacts tenant retention and long-term asset appreciation. Property managers are increasingly integrating preventive maintenance programs that minimize emergency repairs and reduce operational costs for owners. The expansion of smart building technologies is also driving demand for specialized maintenance services, enabling predictive monitoring and efficiency improvements. This segment’s prominence reflects its essential role in safeguarding investments and ensuring compliance with safety standards.

The rent collection segment is expected to register the highest CAGR of 7.0% from 2025 to 2034, driven by the adoption of digital payment systems and automated billing solutions. Rising demand for contactless transactions, flexible payment options, and transparent accounting processes is reshaping this service area. Property managers are leveraging technology platforms to streamline payment tracking, issue reminders, and provide real-time reporting for owners. This shift improves cash flow and also reduces administrative burdens and late payment risks. In an increasingly competitive rental market, efficient rent collection has become critical for sustaining consistent revenue streams and improving the overall tenant experience, further propelling segment growth.

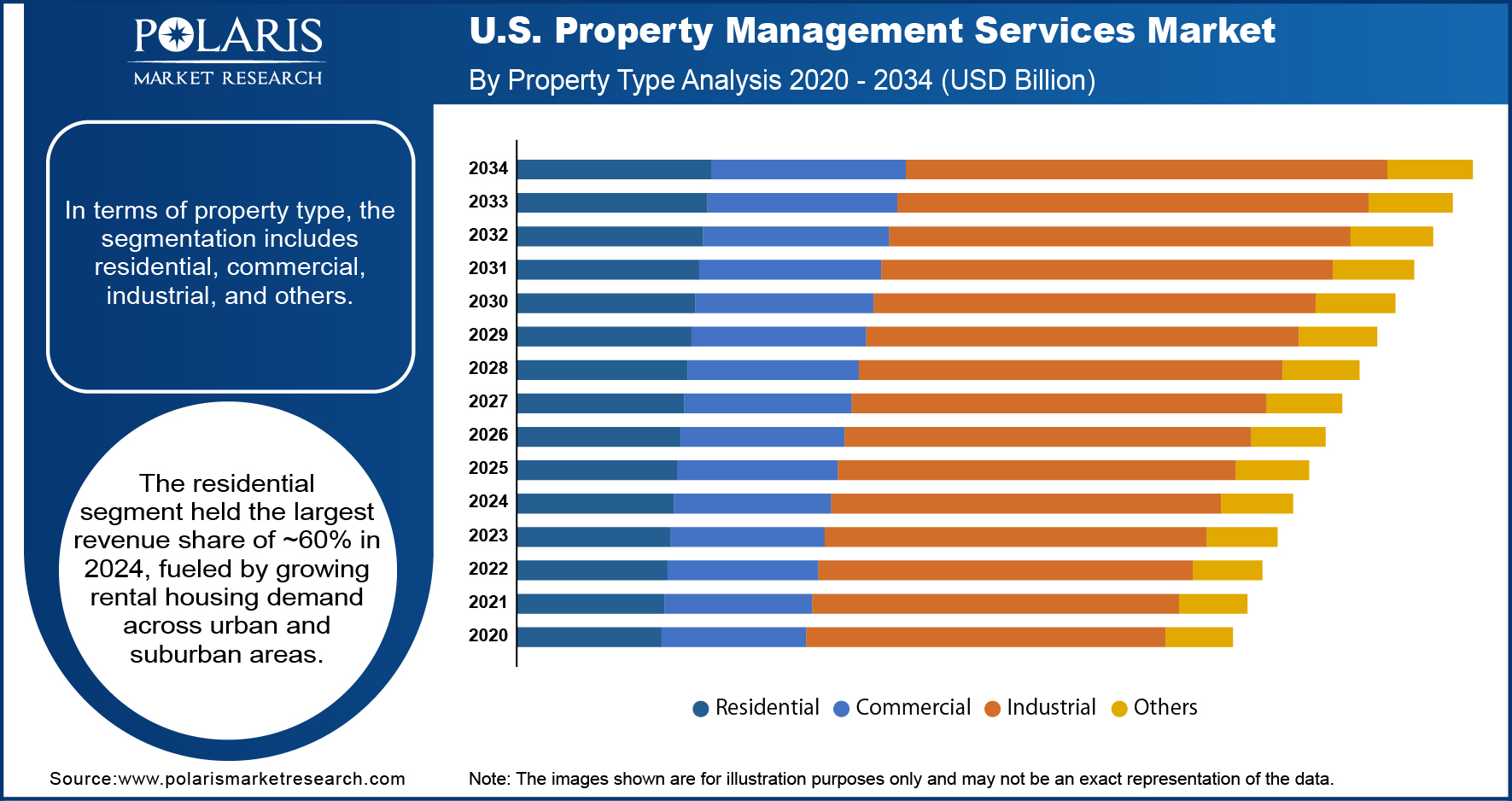

Property Type Analysis

In terms of property type, the U.S. property management services market segmentation includes residential, commercial, industrial, and others. The residential segment held the largest revenue share of ~60% in 2024, fueled by growing rental housing demand across urban and suburban areas. Rising population mobility, delayed homeownership trends, and lifestyle shifts toward flexible living arrangements have amplified the need for professional residential management services. Property managers are tasked with handling tenant screening, lease administration, maintenance coordination, and community engagement for single-family homes, multifamily complexes, and condominiums. Increased emphasis on amenities, sustainability, and tenant satisfaction is prompting managers to adopt more service-oriented approaches. The residential sector’s scale and recurring service requirements continue to solidify its leading position in the market.

The commercial segment is expected to register the highest CAGR of 7.0% from 2025 to 2034 due to evolving needs in office spaces, retail centers, and mixed-use developments. Changing workplace dynamics, including hybrid work models, are prompting owners to reconfigure spaces and enhance tenant services. Managers are focusing on optimizing operational efficiency, ensuring regulatory compliance, and implementing energy-efficient upgrades to attract and retain high-value tenants. Demand for facilities management, security, and technology-driven monitoring solutions is further expanding service opportunities. The growth trajectory reflects how commercial property management is adapting to market shifts and tenant expectations in a post-pandemic business environment.

End User Analysis

In terms of end user, the U.S. property management services market segmentation includes property managers or agents, housing association, and others. The property managers or agents segment held the largest revenue share of ~46% in 2024, driven by their central role in coordinating all aspects of property operations. These professionals act as intermediaries between owners and tenants, managing leases, overseeing maintenance, and ensuring financial performance. The increasing complexity of legal, financial, and operational requirements is strengthening reliance on professional managers who bring specialized expertise and technology-driven solutions. Their ability to provide strategic oversight, enhance asset value, and maintain strong tenant relationships underscores their dominant position in the service ecosystem, making them indispensable to property owners seeking operational stability and profitability.

The housing association segment is expected to register the highest CAGR of 7.1% from 2025 to 2034, fueled by their expanding role in managing affordable housing and community living arrangements. Rising demand for well-maintained, cost-effective housing options is prompting associations to adopt professional management frameworks. They oversee maintenance, ensure compliance with housing regulations, and manage shared amenities to enhance resident satisfaction. Growing emphasis on sustainability and community engagement is also encouraging housing associations to invest in long-term operational strategies. The segment’s rapid expansion reflects both the increasing need for organized housing management and the push toward improving quality and accessibility in the residential sector.

Key Players & Competitive Analysis

The competitive landscape of the U.S. property management services market is shaped by intense rivalry, with players leveraging diverse market expansion strategies to strengthen their presence. Industry analysis highlights a focus on mergers and acquisitions, joint ventures, and strategic alliances to enhance service portfolios and geographic reach. Post-merger integration remains critical for optimizing operational efficiency and client retention. Technology advancements, including AI-driven property monitoring, predictive maintenance, and digital tenant management platforms, are redefining service delivery and driving competitive differentiation. Firms are also adopting innovative models for leasing, maintenance, and tenant engagement to improve value propositions. Competitive dynamics are further influenced by evolving customer expectations, sustainability demands, and compliance requirements, prompting service providers to adapt quickly. The market continues to see investments in automation and data analytics to streamline workflows, enhance decision-making, and deliver measurable ROI, ensuring long-term competitiveness in a rapidly evolving real estate services environment.

Key Players

- Alliance Residential

- Asset Living

- Darwin Homes

- Evernest

- FirstService Residential

- FPI

- Greystar

- HomeRiver Group

- Lincoln Property

- Northpoint

U.S. Property Management Services Industry Developments

May 2025: Lincoln Property Company invested in Unire Real Estate Group to expand its property management footmark in Southern California, strengthening regional operations and service offerings.

February 2024: Asset Living launched a centralized business intelligence platform to enhance decision-making, improve property performance, and drive operational efficiency across its real estate portfolio.

U.S. Property Management Services Market Segmentation

By Service Outlook (Revenue, USD Billion, 2020–2034)

- Rent Collection

- Mortgage & Utility Payment

- Leasing

- Legal & Accounting Services

- Repair & Maintenance

- Other

By Property Type Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Property Managers or Agents

- Housing Association

- Others

U.S. Property Management Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.40 billion |

|

Market Size in 2025 |

USD 4.68 billion |

|

Revenue Forecast by 2034 |

USD 8.25 billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 4.40 billion in 2024 and is projected to grow to USD 8.25 billion by 2034.

The U.S. market is projected to register a CAGR of 6.5% during the forecast period.

A few of the key players in the market are Alliance Residential, Asset Living, Darwin Homes, Evernest, FirstService Residential, FPI, Greystar, HomeRiver Group, Lincoln Property, and Northpoint.

The repair & maintenance segment accounted for the largest revenue share of ~34% in 2024 due to the continuous need to preserve property value and meet tenant expectations.

The residential segment held the largest revenue share of ~60% in 2024, fueled by growing rental housing demand across urban and suburban areas.