U.S. Recycled PET Flakes Market Size, Share, Trends, Industry Analysis Report

By Product (Clear, Colored), By End Use (Fiber, Sheet & Film, Strapping) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6154

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

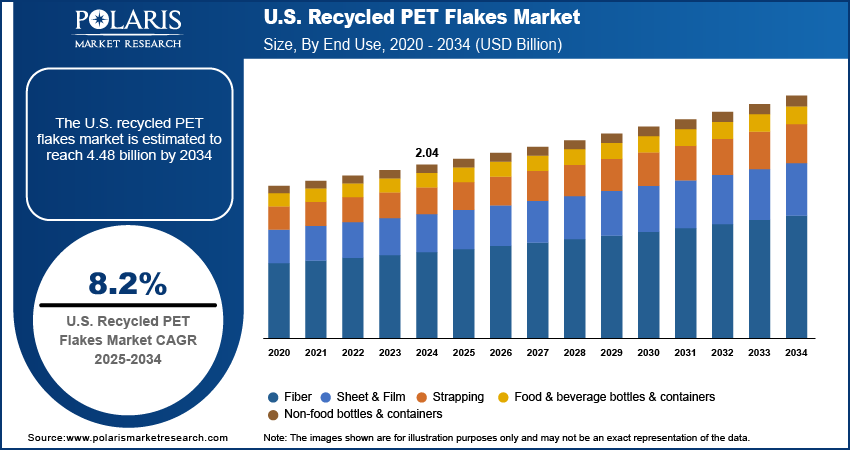

The U.S. recycled PET flakes market was valued at USD 2.04 billion in 2024 and is expected to register a CAGR of 8.2% from 2025 to 2034. The market growth is driven by the introduction of state-level recycling laws and regulations and corporate sustainability commitments in the U.S.

Key Insights

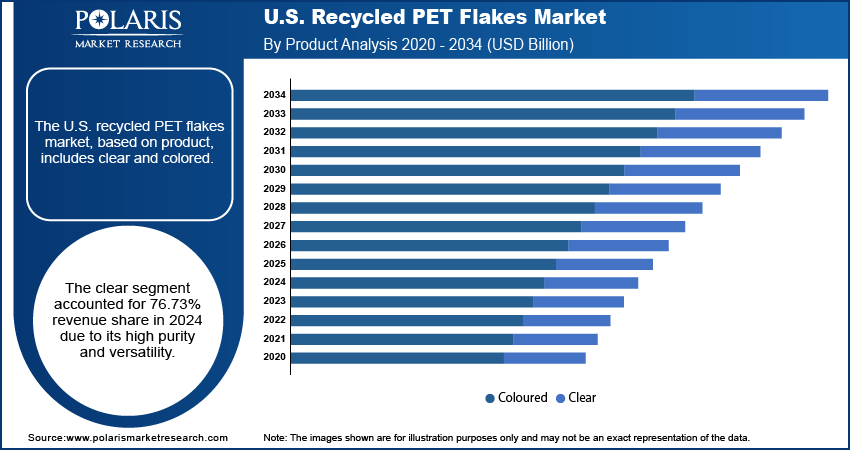

- The clear segment accounted for 76.73% revenue share in 2024 due to the exceptional purity levels and multifaceted applications of clear recycled PET flakes.

- The colored segment is expected to register a CAGR of 8.06% during the forecast period as increasing demand from the textile and automotive industries is contributing to a consistent utilization of colored flakes, particularly for applications in carpets, insulation materials, and industrial fabric.

- The fiber segment is expected to register a CAGR of 7.75% during the forecast period as fashion and outdoor gear brands in the country such as Patagonia, The North Face, and Levi's are enhancing their sustainability initiatives by integrating a higher proportion of recycled materials into their product lines.

- The food & beverage bottles & containers segment accounted for a 23.93% share in 2024 as clear rPET flakes are in high demand for making new water bottles, soft drink containers, and food packaging.

Industry Dynamics

- The imposition of state-level recycling laws and regulations is fueling the industry growth.

- Corporate sustainability commitments in the U.S. boost the adoption of recycled PET flakes.

- Rising Focus on environmental sustainability is boosting the demand for recycled PET flakes.

- Inconsistent quality and contamination of collected PET waste hampers efficient recycling and limits end-use applications.

Market Statistics

- 2024 Market Size: USD 2.04 billion

- 2034 Projected Market Size: USD 4.48 billion

- CAGR (2025–2034): 8.2%

To Understand More About this Research:Request a Free Sample Report

The U.S. recycled PET flakes market represents a significant segment of the evolving landscape within the global plastics sector. Polyethylene terephthalate (PET) is a highly versatile thermoplastic polymer widely utilized in the manufacture of a variety of products, including bottles, packaging materials, textiles, carpets, automotive components, and consumer goods. There has been a marked increase in the demand for recycled PET flakes as a viable substitute for virgin PET resin with the escalating emphasis on environmental sustainability and effective plastic waste management. This shift addresses environmental concerns and aligns with circular economy principles, promoting the reuse of materials and reducing reliance on fossil fuel-derived feedstocks.

Fashion and textile companies in the U.S. are increasingly turning to recycled polyester made from PET flakes. Brands such as Patagonia and Nike have committed to using more recycled materials in their clothing lines. The growing "Made in USA" movement, combined with consumer demand for eco-conscious products, has strengthened domestic recycling loops. PET flakes are a key material in producing sustainable fabrics used in sportswear, casualwear, and home textiles. The demand for PET flakes as a raw material continues to rise as more U.S. fashion companies adopt environmental responsibility, thereby driving the U.S. recycled PET flakes market growth.

Companies are adopting eco-friendly packaging in the U.S. due to rising environmental awareness among consumers. PET flakes, made from recycled plastic bottles, offer a sustainable alternative to virgin plastic. Many American manufacturers, especially in the food and beverage sector, are shifting toward packaging that includes recycled content. Additionally, U.S. consumers are willing to support brands that prioritize sustainability. This demand is creating a strong need for PET flakes as companies try to meet expectations for lower environmental impact while still delivering cost-effective and reliable packaging options, thereby propelling the industry growth.

Drivers & Opportunities

State-Level Recycling Laws and Regulations: Several U.S. states such as California, Oregon, and New York have passed strict recycling and plastic reduction laws that directly impact packaging choices. For instance, as per the requirements introduced in California, beverage bottles must contain at least 15% recycled plastic content, which will increase to 50% by 2030. These state-level mandates push companies to use more recycled PET flakes in their products to stay compliant. Additionally, bottle deposit programs and recycling incentives in many U.S. states have increased plastic bottle return rates, helping improve the supply of raw materials for PET flake production within the country, thereby fueling the growth.

Corporate Sustainability Commitments in the U.S.: Major U.S.-based corporations such as Coca-Cola, PepsiCo, Walmart, and Unilever USA have made public commitments to increase the recycled content in their packaging. For instance, Coca-Cola has pledged to make all bottles in the U.S. with 50% recycled material by 2030. These sustainability goals create consistent demand for PET flakes, especially food-grade quality. Shareholder and consumer pressure are further motivating companies to report on their environmental impact, leading them to use recycled materials more aggressively. Consequently, corporate policies and ESG reporting practices are propelling the growth of the U.S. recycled PET flakes market.

Segmental Insights

Product Analysis

The clear segment accounted for 76.73% share of the U.S. recycled PET flakes market revenue in 2024 due to their high purity and versatility. These flakes are preferred for food-grade applications, especially for manufacturing beverage bottles and food containers, as they are easily processed and colored as needed. The demand for clear rPET grow with strong demand from major brands such as Coca-Cola and PepsiCo, who are committed to using recycled material in their clear PET bottle. Additionally, the U.S. Food and Drug Administration (FDA) has approved certain processes for using clear rPET in direct food contact, further boosting the segment growth.

The colored segment is expected to register a CAGR of 8.06% during the forecast period. Rising demand from the textile and automotive sectors supports steady usage of colored flakes, especially for carpets, insulation, and industrial fabrics. Additionally, these flakes offer a cost-effective alternative to virgin materials in non-food applications where color matching is less critical. The growing push for sustainable manufacturing across industries such as construction and packaging has further increased interest in all forms of recycled plastics, including colored rPET. Moreover, improvements in sorting and cleaning technology have made colored flakes more accessible and usable for diverse industrial purposes, thereby fueling the segment growth.

By End Use Analysis

The fiber segment is expected to register a CAGR of 7.75% during the forecast period, as recycled PET flakes are melted and spun into polyester fibers used in clothing, carpets, upholstery, and insulation. U.S. fashion and outdoor gear brands such as Patagonia, North Face, and Levi’s are increasing their use of recycled materials to meet eco-conscious consumer demand. Additionally, recycled fibers are being used in the automotive and home furnishing industries. Moreover, the U.S. textile sector’s shift toward circular production models and domestic sourcing supports the expansion of rPET flakes for fiber manufacturing nationwide.

The food & beverage bottles & containers segment accounted 23.93% share in 2024 as clear rPET flakes are in high demand for making new water bottles, soft drink containers, and food packaging. Driven by both consumer expectations and regulations such as California’s recycled content laws brands are increasing recycled content in their packaging. Major beverage companies in the U.S. are committed to using 25%–50% rPET in their bottles by 2030. Moreover, the FDA’s approvals for food-grade rPET use have further accelerated adoption, thereby driving the segment growth.

Key Players & Competitive Analysis

The U.S. recycled PET flakes market is moderately consolidated, with a mix of established players and specialized recyclers competing based on quality, processing technology, and supply chain reach. Clear Path Recycling and Clear Path Recycling LLC, based in North Carolina, are major contributors, producing high volumes of food-grade rPET for packaging and textile applications. PolyQuest, Inc., headquartered in Wilmington, offers customized rPET solutions and maintains strong partnerships with packaging and automotive sectors. GSM Plastics and Verdeco Recycling are focused on closed-loop recycling systems and sustainable manufacturing. Alen USA and Polyvim contribute by supplying high-quality flakes to manufacturers needing FDA-compliant materials. Companies such as Indorama Ventures and Veolia operate U.S. recycling plants, improving domestic processing capacity and vertical integration.

Key Players

- Alen USA

- Clear Path Recycling

- Clear Path Recycling LLC

- GSM Plastic

- Indorama Ventures

- PolyQuest, Inc.

- Polyvim

- Veolia

- Verdeco Recycling

U.S. Recycled PET Flakes Industry Developments

March 2025: PT ALBA Tridi Plastics Recycling Indonesia secured FDA approval for its food-grade recycled PET, marking a major milestone and enabling U.S. market entry with high-quality, food-safe rPET produced in Central Java.

U.S. Recycled PET Flakes Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Clear

- Colored

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Fiber

- Sheet & Film

- Strapping

- Food & beverage bottles & containers

- Non-food bottles & containers

- Other

U.S. Recycled PET Flakes Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.04 Billion |

|

Market Size in 2025 |

USD 2.20 Billion |

|

Revenue Forecast by 2034 |

USD 4.48 Billion |

|

CAGR |

8.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.04 billion in 2024 and is projected to grow to USD 4.48 billion by 2034.

The U.S. market is projected to register a CAGR of 8.2% during the forecast period.

A few of the key players in the market are Alen USA; Clear Path Recycling; Clear Path Recycling LLC; GSM Plastic; Indorama Ventures; PolyQuest, Inc.; Polyvim; Veolia; and Verdeco Recycling.

The clear segment dominated the market share in 2024.

The fiber segment is expected to witness the fastest growth during the forecast period.