U.S. Riflescopes & Red Dot Sight Market Size, Share, Industry Analysis Report

By Magnification (1-8x, 8-15x, >15x), By Sight Type, By Technology, By Range, By Application – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6334

- Base Year: 2024

- Historical Data: 2020-2023

Overview

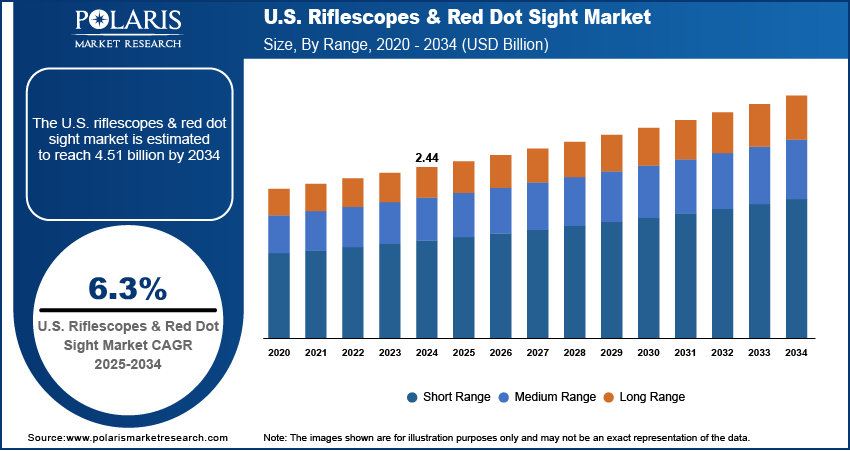

The U.S. riflescopes & red dot sight market size was valued at USD 2.44 billion in 2024, growing at a CAGR of 6.3% from 2025 to 2034. Key factors driving demand include military & law enforcement modernization, increasing firearms ownership & shooting sports participation, advances in scopes, and rising popularity of competitive shooting.

Key Insights

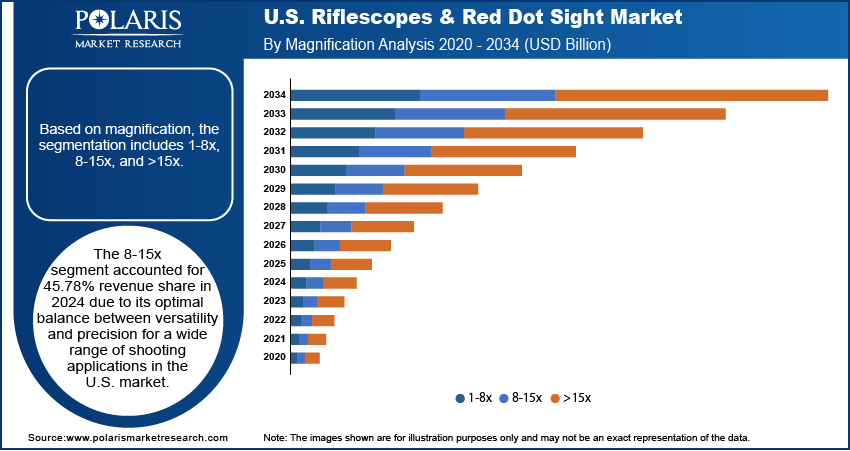

- The 8-15x segment dominated with 45.8% revenue share in 2024, favored for its versatile precision in hunting, tactical, and competitive shooting applications across the U.S. market.

- The reflex sights segment is projected to register a CAGR of 5.7% during the forecast period, driven by rising demand for fast target acquisition in close-to-medium-range civilian and tactical scenarios.

- The electro-optic/IR segment held 52.4% market share in 2024, as its low-light and all-weather capabilities cater to defense, law enforcement, and night hunting needs.

- The medium-range optics segment is expected to register a CAGR of 6.6%, appealing to U.S. shooters for its balance of precision and adaptability across varied disciplines.

Industry Dynamics

- Innovations such as clearer optics, better magnification, and smart reticles improve accuracy, appealing to hunters, tactical users, and sport shooters, driving market growth.

- Rising interest in precision shooting sports fuels demand for high-end scopes, as competitors seek innovative optics to enhance performance.

- Rising costs of advanced optics and competition from cheaper imports pressure U.S. manufacturers on pricing and profitability, which restrains the market expansion.

- Growing civilian demand for tactical optics, driven by sport shooting and home defense trends, expands market potential.

Market Statistics

- 2024 Market Size: USD 2.44 billion

- 2034 Projected Market Size: USD 4.51 billion

- CAGR (2025-–2034): 6.3%

AI Impact on U.S. Riflescopes & Red Dot Sight Market

- AI-powered optics improve accuracy with auto-adjusting reticles, real-time ballistic calculations, and target tracking, appealing to tactical and long-range shooters.

- AI integrates with digital scopes, offering features such as recoil analysis, shot correction, and environmental adjustments, boosting user performance.

- AI-driven automation lowers production costs over time, making advanced optics more affordable for casual shooters and hunters.

- Companies leveraging AI gain a market advantage with next-gen optics, while lagging brands risk losing share to tech rivals.

Riflescopes and red dot sights are optical devices designed to enhance a shooter's accuracy by providing clear aiming points on targets. Riflescopes offer variable magnification for precision at longer distances, while red dot sights enable quick target acquisition with an illuminated reticle for close to mid-range shooting. The U.S. market is witnessing substantial growth driven by ongoing military and law enforcement modernization initiatives. These modernization programs prioritize the integration of advanced optics to improve operational efficiency, situational awareness, and engagement capabilities in diverse environments. Riflescopes with variable magnification and red dot sights with rapid target acquisition capabilities are increasingly deployed to meet the demands of modern combat and tactical operations. Furthermore, advancements in lens coatings, illumination systems, and durability standards ensure these devices perform reliably under harsh conditions, reinforcing their role as essential components of next-generation defense and law enforcement equipment.

The market is driven by increasing firearms ownership and rising participation in shooting sports across the U.S. Civilian adoption has further expanded beyond hunting to include competitive shooting, recreational target practice, and home defense applications. The growing popularity of shooting sports has boosted interest in high-quality, user-friendly optics that enhance both performance and enjoyment. An April 2025 U.S. House Committee report stated that recreational hunting and target shooting contributed USD 106.2 billion in retail sales and USD 133 billion in total economic output, highlighting their economic impact. Additionally, product innovations offering lightweight designs, customizable reticles, and improved battery efficiency have made these optics more appealing to a broader user base. This trend, combined with an expanding consumer preference for precision and versatility, continues to strengthen the market’s position in the U.S. recreational and personal defense sectors.

Drivers & Opportunities

Increasing Advancement of Scopes: Advances in scopes are driving expansion opportunities, as innovations in optical clarity, magnification range, and reticle technology enhance shooting performance across various applications. Modern scopes now incorporate advanced lens coatings for improved light transmission, ruggedized housings for extreme durability, and digital features such as ballistic calculators and integrated laser rangefinders. These enhancements serve the evolving needs of hunters, tactical professionals, and recreational shooters seeking greater accuracy and adaptability in different environmental conditions. Moreover, the integration of lightweight materials and compact designs further broadens usability, making advanced scopes accessible to a wider range of users. This technological progression continues to elevate user experience, reinforcing demand in both professional and civilian markets.

Rising Popularity of Competitive Shooting: The rising popularity of competitive shooting is boosting growth opportunities, as participants seek high-performance optics to gain a competitive edge. According to the 2022 U.S. National Survey of Fishing, Hunting, and Wildlife-Associated Recreation, approximately 19 million Americans participated in target shooting competitions, ranging from precision rifle matches to dynamic 3-gun events. These competitions require optics that deliver rapid target acquisition, exceptional accuracy, and reliability under time constraints. Red dot sights and advanced scopes meet these demands by offering features such as adjustable magnification, illuminated reticles, and quick target transition capabilities. Additionally, the sport’s focus on precision and speed has driven competitors to invest in optics that enhance their skill levels while adapting to various match formats and target distances. This growing engagement in shooting sports continues to promote steady demand for technologically advanced and competition-ready optical solutions.

Segmental Insights

Magnification Analysis

Based on magnification, the segmentation includes 1-8x, 8-15x, and >15x. The 8-15x segment accounted for 45.78% revenue share in 2024 due to its optimal balance between versatility and precision for a wide range of shooting applications in the U.S. market. Both professional sharpshooters and recreational shooters widely prefer this magnification range for its capability to engage mid- to long-range targets with high accuracy while maintaining a broad field of view. The segment benefits from increasing adoption in hunting, competitive shooting, and tactical applications, where target acquisition speed and clarity are equally important. Additionally, advancements in lens coating technology and improved light transmission have further enhanced image quality in this magnification range, reinforcing its appeal among American users aiming for performance without excessive weight or bulk.

Sight Type Analysis

In terms of sight type, the segmentation includes telescopic and reflex. The reflex segment is expected to register a CAGR of 5.7% during the forecast period, owing to its increasing popularity for close-to-medium-range shooting scenarios in the U.S. Reflex sights provide rapid target acquisition with minimal parallax, making them a preferred choice for law enforcement, home defense, and competitive shooting sports. Their lightweight design and compatibility with a variety of firearms, including handguns, rifles, and shotguns, contribute to their widespread adoption. Additionally, advancements in durability, battery efficiency, and reticle customization have expanded their usability in diverse environmental conditions. The rising demand for compact optics that enhance shooting speed without compromising accuracy is expected to accelerate growth in this segment.

Technology Analysis

The segmentation, based on technology, includes electro-optic/IR, thermal imaging, and laser. The electro-optic/IR segment held 52.40% share of the market in 2024, driven by its broad application in both civilian and defense markets in the U.S. Electro-optic and infrared technologies enhance visibility in low-light and challenging weather conditions, offering a critical advantage for tactical operations, night hunting, and surveillance. The U.S. market benefits from continuous innovation in sensor sensitivity, power efficiency, and integration with ballistic calculation systems, improving shooting accuracy across varied scenarios. The growing focus on versatile optics such as night vision device are capable of transitioning seamlessly between day and night use has further fueled adoption. Moreover, increasing demand from security agencies and professional shooters highlights the segment’s strong positioning.

Range Analysis

In terms of range, the segmentation includes, short range, medium range, and long range. The medium range segment is expected to witness the highest CAGR of 6.6% during the forecast period due to its alignment with the diverse needs of U.S. shooters. Medium-range optics strike a balance between target engagement distance and image clarity, making them ideal for hunting, tactical training, and certain competitive disciplines. These optics offer the flexibility to operate effectively in both wooded environments and open terrain, supporting a wide variety of use cases. Advances in reticle design, optical clarity, and shock resistance have made medium-range solutions more accessible to civilian and professional users alike. Additionally, the increasing interest in precision shooting sports and multi-purpose rifles has further boosted demand for laser optics optimized for this range category.

Key Players & Competitive Analysis

The U.S. riflescope & red dot sight market is shaped by emerging technologies, strategic investments, and geopolitical shifts driving demand for precision optics. Major companies such as Vortex Optics, Leupold, and Aimpoint dominate through revenue growth strategies, leveraging technological advancements such as thermal imaging and smart reticles. Industry trends reveal rising adoption in competitive shooting and tactical applications, with latent demand in civilian and defense segments. Disruptions and trends, including AI-enhanced targeting, are reshaping product offerings, while supply chain challenges impact pricing. Competitive intelligence highlights consolidation via mergers and acquisitions, as mid-sized firms innovate to capture niche markets. Future development strategies focus on lightweight, durable designs, with expansion opportunities in law enforcement and outdoor recreation. Revenue forecasts remain strong, supported by sustainable value chains and expert insights predicting steady growth amid economic fluctuations.

A few major companies operating in the U.S. riflescopes & red dot sight market include Aimpoint; BSA Optics; Burris Company; Bushnell Corporation; FLIR Systems; Hawke Optics; Hensoldt; Leupold & Stevens, Inc.; Nightforce Optics, Inc.; and Vortex Optics.

Key Players

- Aimpoint

- BSA Optics

- Burris Company

- Bushnell Corporation

- FLIR Systems

- Hawke Optics

- Hensoldt

- Leupold & Stevens, Inc.

- Nightforce Optics, Inc.

- Vortex Optics

Industry Developments

- June 2025: Excelitas launched the SharpDot Reticle LED, featuring high-efficiency RCLED technology for improved battery life and visibility. It offers selectable reticles (dot, ring, or both) and comes in red or green, reducing glare for clearer targeting in red dot sight applications for firearms and optics systems.

- January 2025: Aimpoint and GLOCK launched the GLOCK x Aimpoint COA combo, featuring select 9mm pistols (G43X, G48, G19 Gen5, G45, G47) with the factory-installed COA red dot optic. The compact sight uses Aimpoint’s A-CUT interface for optimized concealed carry performance.

U.S. Riflescopes & Red Dot Sight Market Segmentation

By Magnification Outlook (Revenue, USD Billion, 2020–2034)

- 1-8x

- 8-15x

- >15x

By Sight Type Outlook (Revenue, USD Billion, 2020–2034)

- Telescopic

- Reflex

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Electro-Optic/IR

- Thermal Imaging

- Laser

By Range Outlook (Revenue, USD Billion, 2020–2034)

- Short Range

- Medium Range

- Long Range

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Hunting

- Armed Forces

- Others

U.S. Riflescopes & Red Dot Sight Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.44 Billion |

|

Market Size in 2025 |

USD 2.59 Billion |

|

Revenue Forecast by 2034 |

USD 4.51 Billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.44 billion in 2024 and is projected to grow to USD 4.51 billion by 2034.

The market is projected to register a CAGR of 6.3% during the forecast period.

A few of the key players in the market are Aimpoint; BSA Optics; Burris Company; Bushnell Corporation; FLIR Systems; Hawke Optics; Hensoldt; Leupold & Stevens, Inc.; Nightforce Optics, Inc.; and Vortex Optics.

The 8-15x segment accounted for 45.78% revenue share in 2024.

The medium range segment is expected to witness the highest CAGR of 6.6% during the forecast period.