U.S. Small Molecule CDMO Market Size, Share, Trend, Industry Analysis Report

By Drug Type (Innovators, Generics), By Product, By Application – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6333

- Base Year: 2024

- Historical Data: 2020-2023

Overview

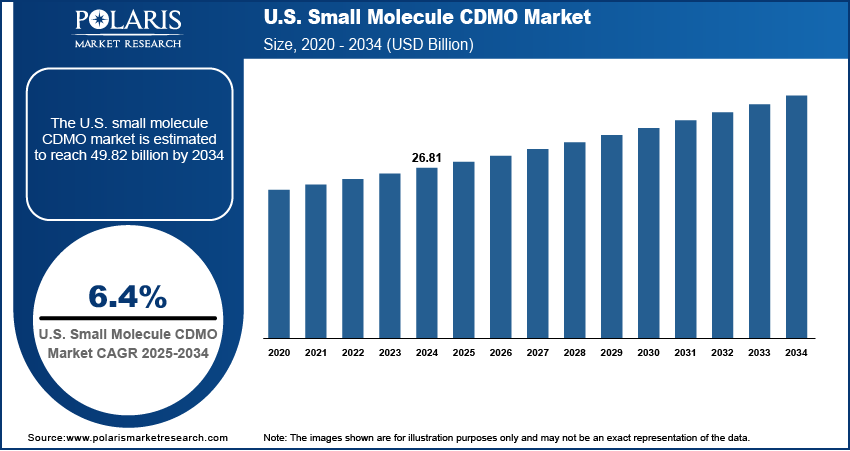

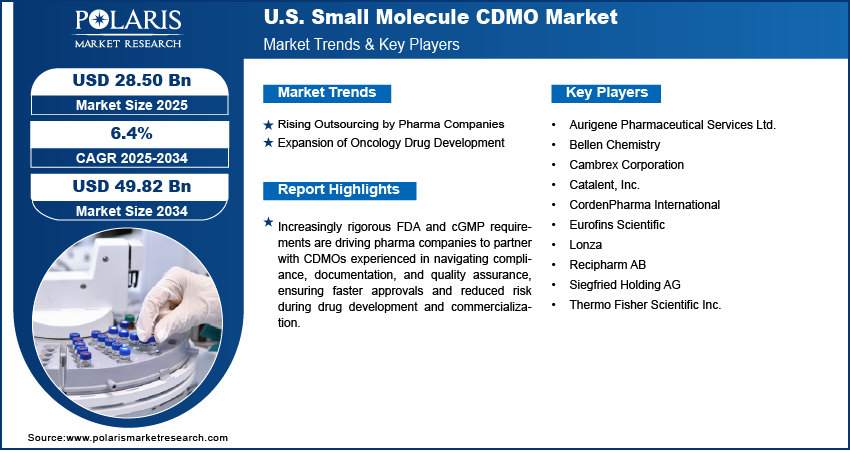

The U.S. small molecule CDMO market size was valued at USD 26.81 billion in 2024, growing at a CAGR of 6.4% from 2025 to 2034. Increasingly rigorous FDA and cGMP requirements are driving pharma companies to partner with CDMOs experienced in navigating compliance, documentation, and quality assurance, ensuring faster approvals and reduced risk during drug development and commercialization.

Key Insights

- The active pharmaceutical ingredients segment led in 2024, driven by increasing formulation complexity and demand for specialized manufacturing expertise.

- The innovators segment captured the largest share in 2024, fueled by growth in novel small molecule pipelines for oncology, neurology, and metabolic diseases.

- The oncology segment dominated in 2024, due to rising demand for targeted small molecule therapies and high-potency APIs.

Industry Dynamics

- Strong presence of biotech startups and pharmaceutical firms drives demand for outsourced small molecule development and manufacturing.

- Increased investments in oncology and CNS drug pipelines accelerate reliance on U.S.-based CDMOs with regulatory expertise and fast turnaround.

- Growth of continuous manufacturing and AI-driven process optimization enables U.S. CDMOs to enhance efficiency and reduce production timelines.

- High operational costs and talent shortages in specialized chemistry roles limit scalability for mid-sized CDMOs in the U.S. market.

Market Statistics

- 2024 Market Size: USD 26.81 billion

- 2034 Projected Market Size: USD 49.82 billion

- CAGR (2025–2034): 6.4%

The small molecule contract development and manufacturing organization (CDMO) market refers to service providers that support pharmaceutical companies in the development, manufacturing, and commercialization of small molecule drugs. These organizations offer end-to-end solutions, including process development, active pharmaceutical ingredient production, formulation, and packaging, enabling pharmaceutical companies to optimize costs, scale production, ensure regulatory compliance, and accelerate time-to-market for new therapeutics. An expanding biotechnology ecosystem with limited in-house manufacturing capacity is fueling demand for CDMOs that provide end-to-end services, from early-stage API synthesis to clinical trial material production for small molecule drugs.

Innovations in synthetic chemistry, continuous manufacturing, and process optimization are enabling CDMOs to deliver higher yields, lower costs, and improved product quality, strengthening their role in small molecule drug development and production. Moreover, Patent expirations of branded drugs are boosting demand for cost-effective generics, prompting companies to rely on CDMOs for efficient formulation, production scalability, and regulatory compliance in the competitive small molecule generics market.

Drivers & Opportunities

Rising Outsourcing by Pharma Companies: Pharmaceutical companies are increasingly relying on CDMOs for small molecule development and manufacturing to improve efficiency and reduce operational costs. For instance, in August 2025, Lonza, Akadeum Life Sciences, and Excellos collaborate to enhance cell therapy manufacturing via improved quality of starting materials. Outsourcing allows these companies to avoid significant capital investments in infrastructure while gaining access to specialized expertise and advanced technologies. This approach also helps them focus resources on core activities such as drug discovery and commercialization, while the CDMOs handle process development, scale-up, and compliance with regulatory requirements. The ability of CDMOs to provide flexible capacity, handle complex projects, and shorten production timelines makes them valuable partners. This trend continues to strengthen demand for contract development and manufacturing partnerships.

Expansion of Oncology Drug Development: The growing focus on targeted cancer therapies and small molecule-based oncology drugs is increasing the need for CDMOs with advanced capabilities. Many oncology treatments require complex synthesis processes, specialized analytical testing, and the handling of high-potency active pharmaceutical ingredients (HPAPIs), which demand strict safety and quality controls. CDMOs with expertise in these areas can meet the unique requirements of oncology drug manufacturing, from early-stage development to commercial production. The surge in oncology research pipelines, driven by the need for more effective treatments, has created a steady demand for these specialized services.

Segmental Insights

Product Analysis

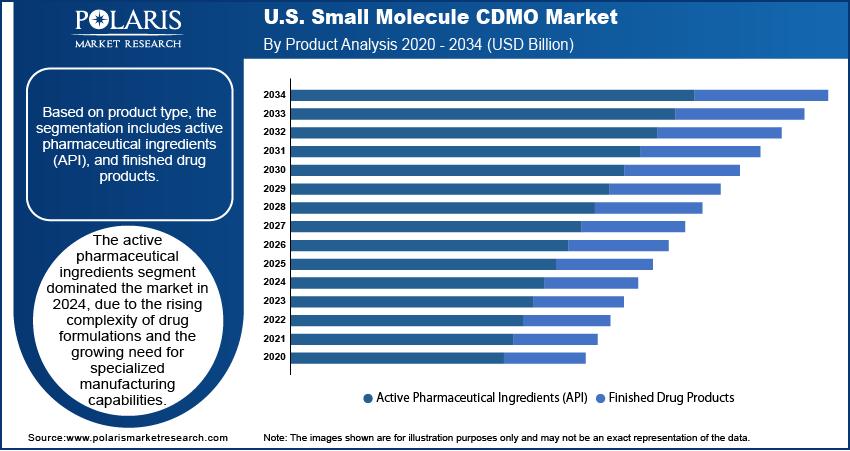

Based on product type, the U.S. small molecule CDMO market segmentation includes active pharmaceutical ingredients (API), and finished drug products. Active pharmaceutical ingredients segment dominated the market in 2024 due to the rising complexity of drug formulations and the growing need for specialized manufacturing capabilities. Demand surged for APIs that require high containment and precision synthesis, especially for oncology and rare disease treatments. CDMOs with advanced process chemistry, scalable production infrastructure, and strong regulatory compliance attracted significant contracts from pharmaceutical companies. The ability to handle high-potency APIs, coupled with expertise in cost-effective scale-up from clinical to commercial volumes, positioned the segment as a critical driver of outsourced drug development service in the U.S., maintaining its dominance in the product type category.

The finished drug products segment is expected to register a significant CAGR from 2025 to 2034 supported by the increasing trend toward end-to-end outsourcing solutions. Pharmaceutical firms are seeking CDMOs that integrate formulation development, packaging, and commercial supply under one roof to reduce operational complexity. The demand is particularly strong for oral solid dosage forms, specialized delivery systems, and niche batch manufacturing to support both innovator launches and lifecycle management of existing drugs. Growth in personalized medicine and smaller production runs for targeted therapies is also driving investment in flexible manufacturing lines, boosting the segment’s long-term expansion trajectory.

Drug Type Analysis

In terms of drug type, the U.S. small molecule CDMO market segmentation includes innovators and generics. The innovators segment held the largest revenue share in 2024, due to a surge in novel small molecule development pipelines, particularly in oncology, neurology, and metabolic disorders. Pharmaceutical companies relied heavily on CDMOs to provide early-stage process optimization, complex synthesis, and compliance-ready manufacturing for new chemical entities. Many of these projects required rapid scale-up from clinical trials to commercial production, favoring CDMOs with advanced analytical capabilities and regulatory track records. The increasing focus on first-to-market advantages and the need for accelerated timelines further strengthened the segment’s dominance, making innovator partnerships a core revenue driver for the market.

The generics segment is expected to register the highest CAGR from 2025 to 2034, fueled by the finish of key drug patents and the push for affordable medication. The U.S. healthcare system’s emphasis on cost containment is encouraging manufacturers to expand generic offerings, creating opportunities for CDMOs to produce at scale while maintaining quality and compliance. Demand is particularly high for complex generics, including those with challenging formulations or modified-release profiles, which require specialized technical expertise. CDMOs capable of delivering efficient technology transfers, rapid validation, and large-scale commercial runs are expected to benefit significantly from this generics-driven growth.

Application Analysis

In terms of application, the U.S. small molecule CDMO market segmentation includes oncology, cardiovascular disease, central nervous system conditions, autoimmune/inflammation, and others. The oncology segment held the largest revenue share in 2024, due to the rapid growth of targeted small molecule therapies and high-potency active pharmaceutical ingredients. Many cancer drugs require specialized containment, advanced synthetic routes, and precise quality control, making CDMOs with these capabilities highly sought after. The surge in personalized treatment strategies and combination regimens has further increased the need for flexible, small-batch manufacturing. Pharmaceutical companies are also partnering with CDMOs to accelerate timelines for oncology drug launches, as market competition and patient demand for innovative treatments intensify. This combination of technical complexity and high demand solidified oncology’s leading market position.

The autoimmune/inflammation segment is expected to grow significantly from 2025 to 2034, supported by the rising prevalence of chronic inflammatory conditions and a growing pipeline of small molecule treatments targeting these pathways. Pharmaceutical firms are advancing therapies for conditions such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease, many of which require specialized formulation and stability solutions. CDMOs with experience in complex synthesis, solubility enhancement, and long-term stability testing are well-positioned to capture this demand. The increasing use of targeted therapies with improved safety profiles is also driving contract manufacturing needs in this segment, contributing to sustained expansion.

Key Players and Competitive Analysis

The competitive landscape of the U.S. small molecule CDMO market reflects a dynamic environment shaped by strategic positioning and continuous innovation. Industry analysis reveals a strong emphasis on market expansion strategies, with players focusing on scaling manufacturing capacity and enhancing specialized service offerings. Joint ventures and strategic alliances are increasingly pursued to broaden technological capabilities and geographic reach, while mergers and acquisitions remain pivotal in consolidating expertise and accelerating growth. Post-merger integration efforts are aimed at streamlining operations and optimizing resource utilization. Technology advancements, particularly in high-potency API production, continuous manufacturing, and advanced analytical platforms, are driving differentiation. Competitors are also prioritizing flexible manufacturing models and tailored solutions to cater to the diverse needs of innovators and generic drug developers.

Key Players

- Aurigene Pharmaceutical Services Ltd.

- Bellen Chemistry

- Cambrex Corporation

- Catalent, Inc.

- CordenPharma International

- Eurofins Scientific

- Lonza

- Recipharm AB

- Siegfried Holding AG

- Thermo Fisher Scientific Inc.

U.S. Small Molecule CDMO Industry Developments

May 2025: Lonza launched the Design2Optimize platform to improve the development and production of small molecule APIs, utilizing an optimized design of experiments (DoE) for process optimization.

June 2024: Siegfried announced plans to acquire an early-phase CDMO facility in Wisconsin, U.S., focused on highly potent APIs, to enhance its early-stage development and manufacturing capabilities in North America.

U.S. Small Molecule CDMO Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Active Pharmaceutical Ingredients (API)

- Finished Drug Products

By Drug Type Outlook (Revenue, USD Billion, 2020–2034)

- Innovators

- Generics

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Oncology

- Cardiovascular Disease

- Central Nervous System (CNS) Conditions

- Autoimmune/Inflammation

- Others

U.S. Small Molecule CDMO Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 26.81 billion |

|

Market Size in 2025 |

USD 28.50 billion |

|

Revenue Forecast by 2034 |

USD 49.82 billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 26.81 billion in 2024 and is projected to grow to USD 49.82 billion by 2034.

The U.S. market is projected to register a CAGR of 6.4% during the forecast period.

A few of the key players in the market are Aurigene Pharmaceutical Services Ltd.; Bellen Chemistry; Cambrex Corporation; Catalent, Inc.; CordenPharma International; Eurofins Scientific; Lonza; Recipharm AB; Siegfried Holding AG; and Thermo Fisher Scientific Inc.

The active pharmaceutical ingredients segment dominated the market in 2024 due to the rising complexity of drug formulations and the growing need for specialized manufacturing capabilities.

The innovators segment held the largest revenue share in 2024 due to a surge in novel small molecule development pipelines, particularly in oncology, neurology, and metabolic disorders.