U.S. Ultrapure Water Treatment Systems Market Size, Share, Trend, Industry Analysis Report

By Technology (Electrode Deionization, Ion Exchange, Reverse Osmosis, Ultrafiltration, Others), By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5944

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

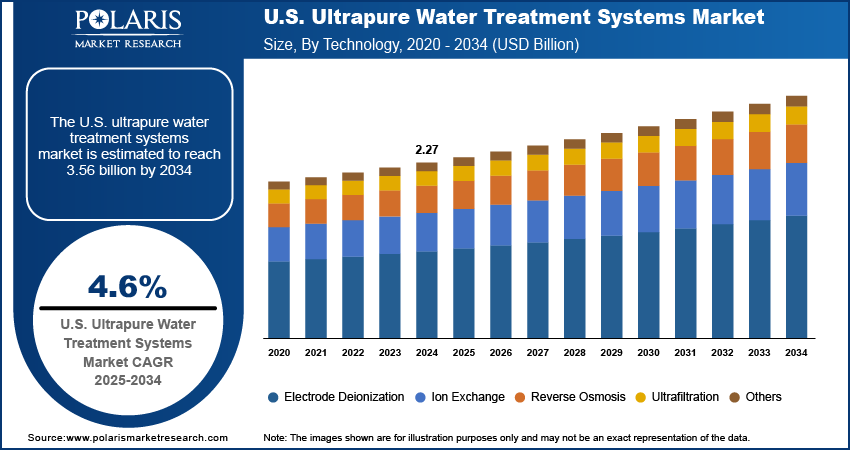

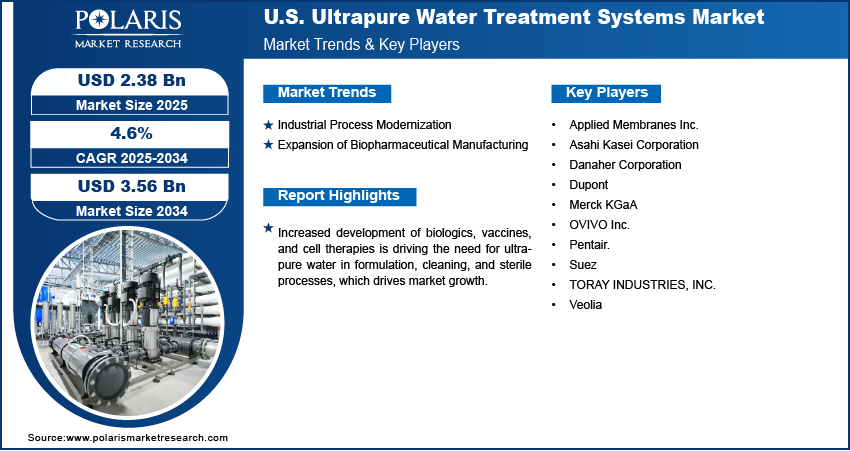

The U.S. ultrapure water treatment systems market size was valued at USD 2.27 billion in 2024 and is projected to register a CAGR of 4.6% from 2025 to 2034. The U.S. ultrapure water treatment systems market is driven by demand from semiconductor and pharmaceutical industries requiring high-quality water, technological advancements, regulatory compliance, and growing focus on sustainable water management and purification technologies.

The U.S. ultrapure water treatment systems market involves advanced purification technologies designed to remove organic and inorganic contaminants, dissolved gases, and particulates from water to meet extremely stringent purity standards. These systems are critical in many industries such as semiconductors, pharmaceuticals, and power generation, where even trace impurities can compromise product integrity or process performance. The imposition of stringent water quality regulations by the EPA and state-level agencies prompt industries to adopt ultrapure water treatment systems to minimize discharge pollutants and improve resource efficiency. This push ensures both environmental compliance and sustainable industrial operations.

Advancements in water filtration technology, such as new membrane materials, electrode deionization methods, and automated control systems, are making ultrapure water production more efficient, scalable, and cost-effective. Technology upgrades are encouraging replacements of legacy systems across industries seeking operational reliability and real-time monitoring. Additionally, the growing semiconductor industry and rapid advancements in semiconductor manufacturing, particularly in chip miniaturization and cleanroom operations, require high-purity water for wafer cleaning and etching. According to the state of the U.S. semiconductor industry, in 2023, the U.S. semiconductor sector captured 50.2% of worldwide sales revenue. The rising semiconductor industry across the country drives the U.S. ultrapure water treatment systems market expansion.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Industrial Process Modernization

Legacy manufacturing facilities in the U.S. are undergoing large-scale upgrades to meet the demands of precision, automation, and contamination control. Industries such as aerospace, optics, and specialty chemicals require an environment where even the smallest impurities impact product performance or yield. This modernization trend is leading to the installation of advanced ultrapure water treatment systems that deliver consistent, high-quality water at extremely low levels of conductivity and total organic carbon. Automation and data integration in these systems help operators monitor quality in real time and meet tighter production tolerances. Growing emphasis on cleanroom compliance, lean manufacturing, and environmental certifications further supports the need for high-efficiency water systems. These technologies are helping companies reduce risk, improve productivity, and extend the life of sensitive equipment. Hence, industrial process modernization boosts the U.S. ultrapure water treatment systems market demand.

Expansion of Biopharmaceutical Manufacturing

Biopharmaceutical production in the U.S. is expanding rapidly due to increased investments in advanced therapies, including biologics, gene therapies, and vaccines. In 2023, the Pharmaceutical Research and Manufacturers Association (PhRMA) reported that biopharmaceutical companies in the U.S. allocated ~USD 96 billion toward research and development (R&D). This expenditure represented more than 20% of the total sales revenue for these firms, highlighting the significant investments in innovation and the development of new therapies within the industry. These processes require highly sterile and contaminant-free environments, where ultrapure water plays a critical role in formulation, media preparation, and equipment cleaning. Water quality standards in the pharmaceutical industry are governed by strict regulations such as the U.S. FDA’s current Good Manufacturing Practices (cGMP), necessitating systems that ensure constant compliance. Ultrapure water systems are increasingly favored for their ability to deliver microbial-free, low-conductivity water that meets USP and ISO standards. Manufacturers are adopting technologies such as reverse osmosis, UV oxidation, and continuous deionization to maintain water purity at every step of production. The emphasis on reducing batch contamination, improving product stability, and ensuring patient safety is driving sustained demand. In addition, the integration of real-time monitoring and automation supports operational efficiency and audit readiness, reinforcing the role of ultrapure systems in biopharma growth.

Segment Insights

Technology Analysis

Based on technology, the U.S. ultrapure water treatment systems market segmentation includes electrode deionization, ion exchange, reverse osmosis, ultrafiltration, and others. In 2024, the reverse osmosis segment accounted for ~45% of the revenue share due to its robust efficiency in eliminating dissolved solids, organics, bacteria, and pyrogens. This technology is widely adopted in industries that demand stringent water purity levels, particularly in semiconductor manufacturing, pharmaceutical production, and high-purity chemical processing. Its ability to provide a reliable pretreatment foundation for multi-stage purification systems makes it a core component in ultrapure water infrastructure. Increasing demand for membrane-based treatment systems that support scalability and low operational costs has further strengthened the market presence of reverse osmosis (RO).

Rising investments in precision manufacturing and cleanroom environments are encouraging industrial players to replace legacy systems with high-recovery RO technologies that minimize waste while maintaining stable flow rates. For instance, in May 2025, Florida's governor officially opened an advanced, reverse osmosis water treatment facility on Stock Island, marking a significant investment of USD 47 million in the region's water infrastructure. Continued improvements in membrane durability and fouling resistance are supporting long-term performance, making reverse osmosis a preferred choice for industries aiming for water reuse and zero-liquid discharge goals.

The electrode deionization segment is expected to register the highest CAGR from 2025 to 2034, driven by the demand for continuous, chemical-free deionization processes across high-purity applications. Industries such as microelectronics, pharmaceuticals, and energy are transitioning to EDI systems due to their ability to maintain ultra-low conductivity levels without the need for resin regeneration chemicals. The operational benefits, such as low energy consumption, minimal maintenance, and real-time conductivity control, make EDI systems attractive for automated environments that prioritize sustainability and compliance. Growth in modular system adoption and the shift toward decentralized water treatment solutions are also favoring EDI deployment in both greenfield and retrofit installations. Regulatory emphasis on minimizing chemical discharge and ensuring process water integrity is prompting facilities to replace conventional ion exchange with EDI for final polishing stages. Advancements in stack design, membrane materials, and integration with RO systems are improving cost-efficiency and broadening its industrial footprint.

Application Analysis

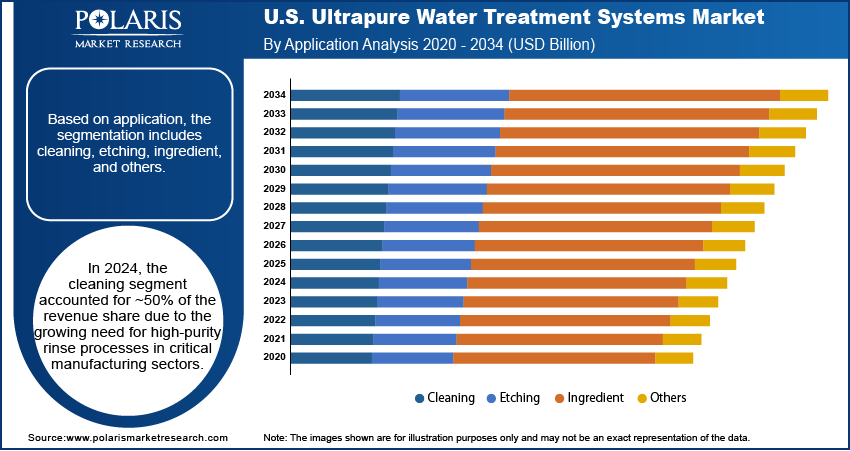

Based on application, the U.S. ultrapure water treatment systems market segmentation includes cleaning, etching, ingredient, and others. In 2024, the cleaning segment accounted for ~50% of the revenue share due to the growing need for high-purity rinse processes in critical manufacturing sectors. In semiconductor fabrication, medical device assembly, and optics production, even trace contaminants on surfaces can result in performance degradation or complete component failure. Ultrapure water is an essential input for cleaning sensitive wafers, surgical tools, and photolithography masks, ensuring surface cleanliness at sub-micron levels. Automated wet-cleaning systems used in advanced production lines require water with precise control over total organic carbon (TOC), resistivity, and particulate content. Increasing automation and miniaturization in manufacturing are driving demand for consistently clean rinse cycles, reducing error rates and rework costs. Water purity also affects the efficiency of detergents and chemicals used in surface preparation and residue removal. The expanding presence of cleanroom facilities and adherence to ISO cleanliness standards are supporting continued investments in dedicated ultrapure water cleaning systems.

The ingredient segment is projected to register the highest CAGR of 5.9% from 2025 to 2034 due to the increasing use of ultrapure water as a direct input in formulation processes. Industries such as pharmaceuticals, personal care, and specialty chemicals rely on high-grade water to serve as a base for injectable drugs, creams, oral solutions, and high-performance coatings. These products demand low microbial counts, minimal ionic contamination, and stable water composition to maintain product quality, shelf life, and regulatory compliance. Market momentum is further enhanced by expanding GMP guidelines and FDA scrutiny around water-for-injection (WFI) systems. Product developers are prioritizing water system upgrades to meet stricter validation standards and reduce contamination risks during scale-up. Ultrapure water plays a critical role in ingredient consistency, ensuring precise chemical interactions and stability across batches. Rising innovation in biologics and biosimilars is also contributing to the growing need for controlled water quality in formulation settings.

End Use Analysis

Based on end use, the U.S. ultrapure water treatment systems market segmentation includes food & beverage, healthcare, pharmaceuticals, power generation, semiconductor, and others. In 2024, semiconductor segment accounted for ~42% of the revenue share, owing to the sector’s critical dependence on extreme water purity standards. Chip fabrication processes, such as photolithography, etching, and chemical vapor deposition, require high volumes of ultrapure water to maintain nanoscale cleanliness. Any deviation in water quality leads to defects in microelectronic circuits and impacts yield rates, pushing fabs to invest in sophisticated multi-stage water purification systems. The growing adoption of advanced node technologies (below 10 nm) increases the sensitivity of components, reinforcing demand for higher resistivity and lower TOC levels in rinse water. Semiconductor manufacturers are integrating real-time monitoring and predictive analytics to maintain water quality across facility operations. Strategic investments in fab expansions, coupled with public-private partnerships to strengthen domestic semiconductor supply chains, are boosting demand for large-scale, closed-loop ultrapure water treatment infrastructure tailored for continuous, uninterrupted operation.

The pharmaceuticals segment is projected to register the highest CAGR from 2025 to 2034 driven by increased production of high-purity drugs, sterile injectables, and biopharmaceuticals. These applications require process water that complies with stringent USP and FDA standards, including limits on endotoxins, bacteria, and residual organics. Ultrapure water is essential in drug formulation and in cleaning validation, equipment sterilization, and cleanroom environmental control. The rise in cell and gene therapies, which are highly sensitive to contamination, is encouraging biopharma manufacturers to adopt advanced purification technologies such as ultrafiltration, EDI, and continuous monitoring. Facilities are investing in centralized water systems that support real-time data logging and alarm management to reduce downtime and ensure regulatory traceability. High demand for pandemic response capacity, coupled with the expansion of contract manufacturing operations, is accelerating the deployment of modular, GMP-compliant ultrapure water treatment systems in pharmaceutical production hubs.

Key Players and Competitive Analysis

The competitive landscape of the U.S. ultrapure water treatment systems market is shaped by increasing demand for high-efficiency purification technologies across advanced manufacturing sectors. Industry analysis reveals that players are prioritizing technology advancements such as real-time monitoring, automated filtration controls, and membrane innovations to meet stricter regulatory requirements in semiconductor, pharmaceutical, and power generation applications. Market expansion strategies include strategic alliances with OEMs and facility operators to integrate turnkey ultrapure water systems into new and retrofit installations. Joint ventures are facilitating the development of modular and scalable systems, catering to evolving industrial needs and compliance mandates.

Mergers and acquisitions are being pursued to consolidate expertise in filtration media, sensor integration, and deionization technologies, strengthening vertical control and market positioning. Post-merger integration efforts are focusing on harmonizing engineering workflows and enhancing service capabilities across regional footprints. Digital twin models and predictive maintenance tools are gaining traction in service portfolios, enabling operational efficiency and extended system lifecycle. Strong emphasis on ESG commitments and circular water management strategies is also guiding product development and partnerships.

Competitive differentiation now relies on delivering energy-efficient systems with minimal downtime, robust data analytics, and compliance-aligned performance. The market remains fragmented, but innovation-led consolidation is steadily reshaping the strategic dynamics.

Key Players

- Applied Membranes Inc.

- Asahi Kasei Corporation

- Danaher Corporation

- Dupont

- Merck KGaA

- OVIVO Inc.

- Pentair.

- Suez

- TORAY INDUSTRIES, INC.

- Veolia

Industry Developments

In June 2025, Aquatech acquired Century Water, which engaged in ultrapure water and wastewater recycling solutions.

In November 2024, Toray Industries, Inc. started advance sales of the TBW-XHR series of reverse osmosis membrane elements to domestic water treatment engineering companies. These high-removal, low-pressure elements significantly enhance urea removal efficiency when using recycled wastewater for producing ultrapure water, suitable for semiconductor manufacturing.

U.S. Ultrapure Water Treatment Systems Market Segmentation

By Technology Outlook (Revenue USD Billion, 2020–2034)

- Electrode Deionization

- Ion Exchange

- Reverse Osmosis

- Ultrafiltration

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Cleaning

- Etching

- Ingredient

- Others

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Food & Beverage

- Healthcare

- Pharmaceuticals

- Power Generation

- Semiconductor

- Others

U.S. Ultrapure Water Treatment Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.27 billion |

|

Market Size in 2025 |

USD 2.38 billion |

|

Revenue Forecast by 2034 |

USD 3.56 billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 2.27 billion in 2024 and is projected to grow to USD 3.56 billion by 2034.

The market is projected to register a CAGR of 4.6% during the forecast period.

A few of the key players are Applied Membranes Inc.; Asahi Kasei Corporation; Danaher Corporation; Dupont; Merck KGaA; OVIVO Inc.; Pentair.; Suez; TORAY INDUSTRIES, INC.; and Veolia.

In 2024, the reverse osmosis segment accounted for ~41% of the revenue share due to its high efficiency in removing dissolved solids, particulates, organic matter, and microbial contaminants.

In 2024, the cleaning segment accounted for ~50% of the revenue share. Cleaning processes in semiconductor, pharmaceutical, and biotechnology industries require ultrapure water to eliminate the slightest traces of particles, ions, and organic residues from surfaces, tools, and equipment.