Used Cooking Oil Market Share, Size, Trends & Industry Analysis Report

By Source (Restaurants and Other Food Outlets, Household, Food Manufacturers, Caterers, Others); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM1626

- Base Year: 2024

- Historical Data: 2020-2023

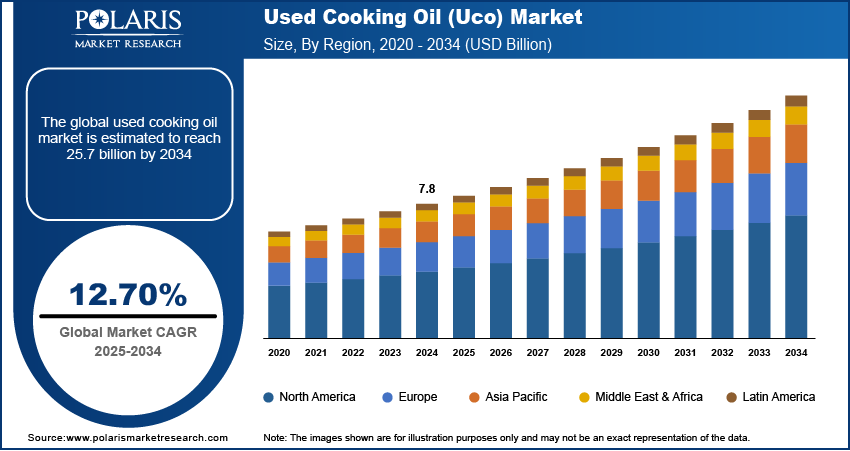

The global used cooking oil (UCO) market was valued at USD 7.8 billion in 2024 and is anticipated to grow at a CAGR of 12.70% from 2025 to 2034. The market is growing due to rising use in biodiesel production and waste-to-energy applications.

Key Insights

- The food manufacturers segment is projected to register the highest CAGR during the forecast period, fueled by rising consumer interest in diverse cuisines and increased demand for used cooking oil in food production.

- In 2024, the biodiesel segment held the largest market share, driven by the urgent need for renewable and sustainable energy alternatives.

- Europe led the used cooking oil market in 2024, supported by strong environmental regulations and heightened focus on eco-friendly waste management.

- The Asia Pacific region is expected to witness the fastest growth, driven by rapid industrialization, growing biodiesel adoption, and increasing environmental awareness.

Industry Dynamics

- Rising demand for used cooking oil is driven by increasing biofuel production, environmental concerns, and growing focus on sustainable waste management practices.

- Market expansion is supported by rising adoption in biodiesel manufacturing, industrial applications, and regulatory incentives promoting recycling and circular economy.

- Challenges such as inconsistent oil quality, collection logistics, and contamination risks impact efficient processing and market growth.

- Innovations in advanced filtration, conversion technologies, and supply chain optimization are improving oil recovery, product quality, and sustainable utilization.

Market Statistics

- 2024 Market Size: USD 7.80 billion

- 2034 Projected Market Size: USD 25.70 billion

- CAGR (2025-2034): 12.70%

- Europe: Largest market in 2024

AI Impact on Used Cooking Oil Market

- AI analyzes consumption patterns and waste generation to optimize used cooking oil collection, processing, and recycling strategies.

- Integration of AI enables real-time monitoring of oil quality and contamination levels, ensuring safe and efficient reuse or conversion.

- AI-powered tools support development of advanced biofuel production processes from used cooking oil, improving yield and sustainability.

- AI enhances supply chain management by predicting collection demand, optimizing logistics, and minimizing processing delays in the used cooking oil market.

To Understand More About this Research: Request a Free Sample Report

Used cooking oils (UCO) are commonly employed in homes, hotels, restaurants, cafes, and the food processing industry for frying and cooking. These oils can be recycled through an essential procedure and find widespread use in various industries to produce oleochemicals, biodiesel, and soaps.

UCO, obtained from cooking and frying activities in households and restaurants, is collected, purified, and transformed into renewable and environmentally friendly fuel. This converted oil, known as biodiesel, is used in diesel engines to power vehicles and machinery, reducing pollution. Additionally, UCO is increasingly used as a high-energy additive in livestock feed products.

The growing utilization of UCO as a raw material for biodiesel production drives the demand in the used cooking oil market. Moreover, the comprehensive application of UCO in manufacturing grease, bio-lubricants, oleochemicals, and animal feed has further increased its demand across multiple industries, fueling industry growth.

The increasing number of restaurants and the expansion of the food processing industry have accelerated the usage of used cooking oil. The health benefits associated with using used cooking oils and their utilization as additives in animal feed have also contributed to the industry's growth.

Used cooking oil (UCO) offers numerous creative applications, including lamp oil, hair moisturizer, leather preservation, paint remover, household lubricant, and more. The increasing focus of consumers on waste reduction and recycling efforts has driven the development of sustainable approaches.

The emphasis on sustainability, coupled with the growing interest in DIY activities, is expected to drive the use of UCO in the forecast period. With its unique properties, UCO can serve as a protective medium against outward factors like dust and sand. Its diverse lubricant, moisturizer, preservative, and more applications are likely to contribute to its market growth.

Additionally, the growing concerns about food safety are expected to boost the demand for food-grade lubricants. Also, government initiatives in various countries, especially those promoting converting used cooking oil into biodiesel, represent significant opportunities to expand the used cooking oil market.

Drivers & Opportunities

- Increasing health awareness and rising clean energy alternatives

A rising focus on improving animal health implies a growing demand for products or services related to animal healthcare. This focus can create opportunities for companies operating in the animal health industry to develop and provide innovative solutions, due to market growth.

As awareness about the environmental impact of traditional energy sources grows, there is a rising interest in clean energy alternatives. This trend opens up opportunities for companies involved in producing and distributing clean energy technologies or services. It can drive market growth as more consumers and industries adopt sustainable energy solutions.

Emerging economies are experiencing rapid economic growth, resulting in an expansion of their consumer markets. This increased demand from emerging economies creates opportunities for businesses to enter or expand their presence in these markets, driving market growth. The factors like improving animal health, clean energy awareness, and emerging market demand are expected to drive market growth. Challenges such as the cost of UCO production and health concerns associated with its excessive intake may hinder the market's expansion during the forecast period.

Report Segmentation

- The market is primarily segmented based on source, application, and region.

|

By Source |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source Analysis

- The Food Manufacturers segment expected to the witness fastest CAGR during the forecast period.

The Food Manufacturers segment expected to witness the fastest CAGR during the forecast period, due to the growing trend of trying unique and diverse cuisines, which has increased the demand for UCO in food manufacturing processes. Food manufacturers use UCO as an ingredient or cooking medium in various food products.

Furthermore, the statement anticipates that the restaurant and other food outlets segment will experience the highest growth rate during the forecast period. This projection is based on the global expansion of restaurants and cafes.

As more restaurants and food outlets open worldwide, there is an increased potential for UCO utilization in these establishments. The popularity of diverse cuisines drives this. Meanwhile, the expected growth of restaurants and food outlets worldwide will contribute to a higher rate during the forecast period.

By Application Analysis

- Bio-diesel segment accounted for the largest market share in 2024

In 2024, the bio-diesel segment accounted for the largest market share due to a growing need for renewable and sustainable energy sources. Biodiesel, produced from UCO, is considered a renewable and environmentally friendly alternative to traditional fossil fuels. The conversion of UCO into biodiesel helps address the increasing energy demands while reducing reliance on non-renewable resources.

Environmental concerns, such as climate change and pollution, have driven the adoption of cleaner and greener energy solutions. Biodiesel derived from UCO offers advantages in reducing greenhouse gas emissions compared to fossil fuels. By utilizing UCO for biodiesel production, the market can contribute to mitigating environmental impacts and promoting sustainable energy practices.

Regional Analysis

- Europe region dominated the largest market share in 2024

In 2024, Europe region dominated the largest used cooking oil (UCO) market, driven by increasing environmental concerns and supportive regulations. The region's emphasis on sustainability, the growing demand for biodiesel, and the rising awareness regarding animal health have contributed to the market's growth.

Governments in various European countries are implementing policies encouraging the collection and processing of used cooking fats from restaurants, cafes, catering businesses, and hotels. These initiatives are expected to positively impact market growth by promoting responsible waste management and the utilization of UCO for beneficial purposes.

The Asia Pacific region is projected to experience fastest growth during the forecast period. It can be attributed to the increasing number of companies entering the UCO processing industry and the growing awareness among people regarding sustainable energy resources and environmental well-being. The region's dynamic market landscape and focus on adopting greener practices drive the demand for UCO in the area.

Key Market Players & Competitive Insight

The market is a burgeoning industry driven by the increasing demand for sustainable and eco-friendly solutions in various sectors, including biodiesel production and food industries. The market players in the used cooking oil industry are actively engaged in collection, processing, and refining activities, striving to meet the rising demand while adhering to environmental regulations.

Some of the major players operating in the global market include:

- Argent Energy

- Baker Commodities Inc.

- Biomotive Fuel Ltd.

- Brocklesby Ltd

- Darling Ingredients

- Devon Biofuels

- Greenergy International Ltd.

- Lywood Consulting

- Proper Oils

- Uptown Biodiesel Limited

Recent Developments

- August 2024: M11 Industries announced the commencement of operations of its new biodiesel plant in Karnataka, India. The plant has a production capacity of 450 tonnes per day and will transform used cooking oil into biodiesel.

- In May 2025, Münzer Bharat partnered with Goa’s FDA to educate locals and hospitality businesses on sustainable used-cooking-oil management. The initiative highlighted proper collection methods and environmental benefits while addressing health risks of improper disposal.

- In November 2022, Neste, a renowned company specializing in renewable fuels and sustainable solutions, revealed its acquisition of Crimson Renewable Energy Holdings, LLC., the used cooking oil (UCO) aggregation and collection business, and its associated assets. This strategic move further strengthens Nestle's position in the US West Coast market and expands its capabilities in UCO recycling and processing.

Used Cooking Oil Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 8.79 billion |

|

Revenue forecast in 2034 |

USD 25.7 billion |

|

CAGR |

12.70% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Source, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Used cooking oil Market report covering key segments are source, application, and region

Used Cooking Oil Market Size Worth $ 25.7 Billion By 2034

The global used cooking oil market is expected to grow at a CAGR of 12.70% during the forecast period.

Europe is leading the global market.

The key driving factors in Used cooking oil Market is global expansion of food industry and the rising demand for biofuels