Uterine Fibroid Treatment Market Share, Size, Trends, Industry Analysis Report

By Drug Class; By Drug Type (Submucosal Fibroids, Intramural Fibroids, Submucosal Fibroids, Pedunculated Fibroids); By End Use; By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3549

- Base Year: 2023

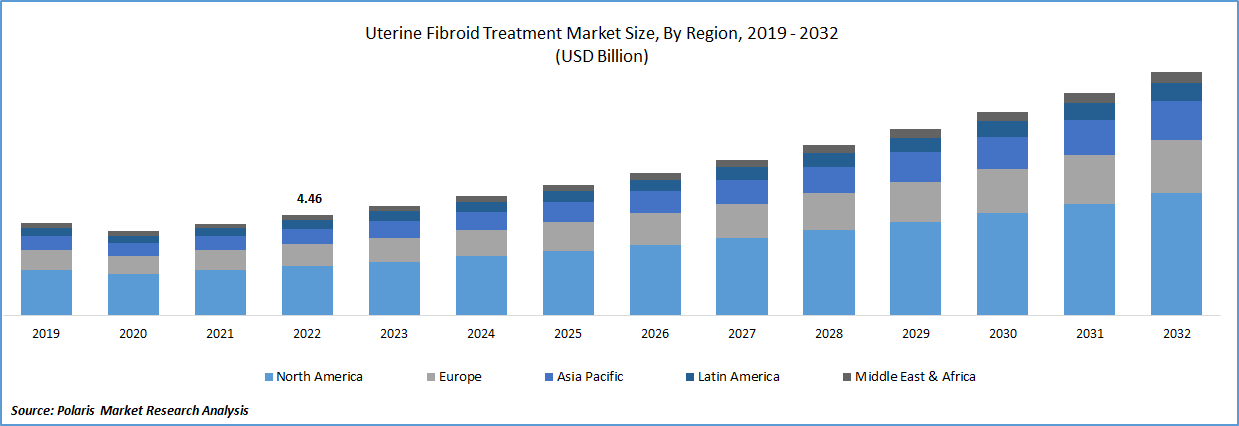

- Historical Data: 2019-2022

Report Outlook

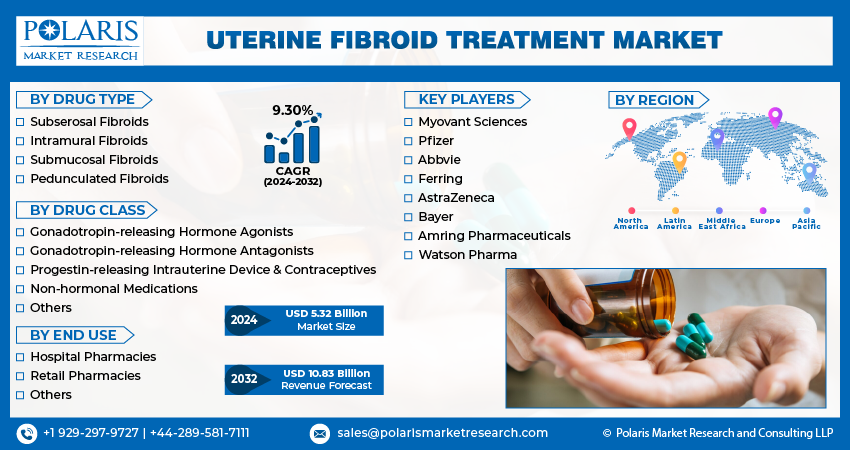

The global uterine fibroid treatment market was valued at USD 4.87 billion in 2023 and is expected to grow at a CAGR of 9.30% during the forecast period. New product launches and the rising prevalence of uterine fibroids are major factors driving market growth. The development of uterine fibroids, which are non-cancerous growths in the uterus, has been linked to several risk factors, including reduced fertility, frequent alcohol consumption, caffeine consumption, hypertension, diabetes mellitus, & history of pelvic inflammatory disease. The rising prevalence of uterine fibroids is a significant contributor to market growth, as more people are seeking effective treatments for this condition.

To Understand More About this Research: Request a Free Sample Report

The development of new treatments, including novel drugs and minimally invasive surgical options, is helping to meet this demand, and is driving market growth. In addition, the increasing focus on women's health and the importance of early detection and treatment of uterine fibroids is also contributing to market growth.

As more awareness is raised about this condition and its potential impact on women's health and quality of life, more individuals are seeking treatment options, further driving the growth of the market. Recent advances in drug development have led to the development of new drugs that target the hormones involved in the growth and maintenance of uterine fibroids. These drugs have been shown to effectively reduce heavy menstrual bleeding and improve other symptoms associated with uterine fibroids, such as pelvic pain and pressure.

Governments and private organizations are taking steps to raise awareness of the condition and its impact on women's health. This includes efforts to educate the public about risk factors for uterine fibroids, as well as the importance of early detection and treatment. These initiatives are expected to increase demand for uterine fibroid treatments and drive market growth.

As the prevalence of uterine fibroids continues to rise, there is a growing need for effective treatment options. This is a significant driver of market growth, as pharmaceutical and medical device companies work to develop new and innovative treatments for the condition. These efforts are expected to lead to the development of new drugs, surgical techniques, and other treatment options that can meet the needs of individuals with uterine fibroids.

The research report offers a quantitative and qualitative analysis of the uterine fibroid treatment devices market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

For instance, in February 2022, Contemporary OB/GYN published an article titled "A Look at the current state of Uterine fibroid care," which highlights the prevalence of uterine fibroids among women. The high prevalence of the condition underscores the significant impact it can have on women's health and quality of life. Uterine fibroids can cause a range of symptoms, including heavy menstrual bleeding, pelvic pain, and pressure, and can even lead to infertility in some cases.

Industry Dynamics

Growth Drivers

Recently, there have been significant developments in the treatment of uterine fibroids, with the approval of two oral GnRH antagonists - Yselty & Myfembree. Yselty was approved by the EMA in June 2022, to treat moderate-severe symptoms of the uterine leiomyomas, while Myfembree was approved by the U.S. Food and Drug Administration (FDA) for the treatment of heavy bleeding associated with uterine fibroids. These drugs, in combination with add-back therapy, have been shown to be very effective in reducing heavy menstrual bleeding and other symptoms associated with uterine fibroids. This has led to increased demand for these treatments and is expected to drive uterine fibroid treatment market growth in this area.

In addition to the development of new treatments, there is also a growing emphasis on raising awareness of uterine fibroids and educating individuals about the condition. This includes efforts by companies like Minerva Surgical, which launched a uterine health education website in November 2021. Overall, the combination of new treatments and increased awareness of uterine fibroids is expected to drive significant market growth in this area. As more individuals seek out effective treatment options for this condition, the market for uterine fibroids is expected to expand in the coming years.

Report Segmentation

The market is primarily segmented based on drug type, drug class, end use, and region.

|

By Drug Type |

By Drug Class |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Contraceptives segment accounted for the largest market share in 2022

This is due to the potential benefits these treatments offer women with uterine leiomyomas, including fibroid shrinkage, reduction in menstrual bleeding, & improvement in the quality of life. In addition to progestin-releasing IUDs and contraceptives, GnRH agonist drugs are considered effective treatment option for the uterine fibroids. These drugs work by suppressing ovulation, which reduces the production of estrogen & progesterone, there-by relieving the symptoms of uterine fibroids.

GnRH antagonists’ segment is anticipated to gain significant growth rate over the next coming years. Increasing availability and use of GnRH antagonists for the treatment of uterine fibroids, coupled with their demonstrated efficacy and safety drives the segment growth. Myfembree, which was approved by the U.S. FDA in May 2021 for the treatment of heavy bleeding associated with uterine fibroids, is a combination of Relugolix, Estradiol, & nor-ethindrone acetate. The drug has demonstrated significant reductions in menstrual bleeding and improvements in quality of life in clinical trials.

Sub-mucosal fibroids segment held the significant revenue share in 2022

Sub-mucosal fibroids segment held the maximum market share. Submucosal fibroids are a type of non-cancerous growth in the uterus that typically develop during a woman's reproductive years. Submucosal fibroids are known to cause significant symptoms, including heavy menstrual bleeding, prolonged menstrual periods, pelvic pain, and pressure. In some cases, they can also cause infertility and pregnancy complications. Therefore, it is essential to diagnose and treat submucosal fibroids promptly to prevent the development of more severe symptoms and complications.

Intramural fibroids segment recorded robust growth. Intramural fibroids can cause a range of fertility issues, including reduced implantation rates, miscarriage, preterm labor, and premature rupture of membranes. The presence of intramural fibroids may also affect the success rates of in vitro fertilization (IVF) and other assisted reproductive technologies (ART) as they can interfere with the implantation of the fertilized egg into the uterine lining. Therefore, prompt diagnosis and treatment of intramural fibroids may be necessary to optimize fertility outcomes.

North America region dominated the global market in 2022

The North America region dominated the global market with considerable market share. Presence of well-established healthcare infrastructure, high awareness levels among the population, and favorable reimbursement policies are also driving the growth in the region. The region also has many key players operating in the market, which is further fueling the growth. As per the estimates of the NIH, around 20-25 percent of the females have fibroids, and by around 50 years of age, nearly, 80 percent black women, and 70 per cent of white women have fibroids. Moreover, as per the Society for Maternal-Fetal Medicine, around, 36 per cent of the UF cases were diagnosed during early pregnancy.

Asia Pacific region is expected to be the fastest growing region with a healthy CAGR over the study period. The growing awareness about the availability of novel treatment options and the increasing adoption of minimally invasive surgeries are also expected to drive market growth in the region. Additionally, several global companies are collaborating with local players to develop and commercialize therapies in the APAC region, which is expected to further boost market growth.

Competitive Insight

Many key players in the uterine fibroid market are undertaking strategic initiatives to increase their market share. For example, in November 2021, Minerva Surgical, Inc. launched a new website to educate women about uterine health. Some of the major players operating in the global market include Myovant Sciences, Pfizer, Abbvie, Ferring, AstraZeneca, Bayer, Amring Pharmaceuticals, and Watson Pharma.

Recent Developments

- In June 2022, Pfizer collaborated with the Myovant Sciences to commercialize “Myfembree” drug to the Asian markets.

- In September, 2021, Kissei Pharma entered into an agreement with the Bio Genuine to develop & commercialize “linzagolix” in the China.

Uterine Fibroid Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD5.32 billion |

|

Revenue forecast in 2032 |

USD 10.83 billion |

|

CAGR |

9.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Drug Type, Drug Class, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Myovant Sciences, Pfizer, Abbvie, Ferring, AstraZeneca, Bayer, Amring Pharmaceuticals, and Watson Pharma |

The uterine fibroid treatment devices market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

FAQ's

The global uterine fibroid treatment market size is expected to reach USD 10.83 billion by 2032.

Key players in the uterine fibroid treatment market are Myovant Sciences, Pfizer, Abbvie, Ferring, AstraZeneca, Bayer, Amring Pharmaceuticals.

North America contribute notably towards the global Uterine Fibroid Treatment Market.

The global uterine fibroid treatment market is expected to grow at a CAGR of 9.3% during the forecast period.

The Uterine Fibroid Treatment Market report covering key segments are drug type, drug class, end use, and region.