Utility Communication Market Share, Size, Trends, Industry Analysis Report

By Technology (Wired and Wireless); By Utility; By Application; By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3200

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

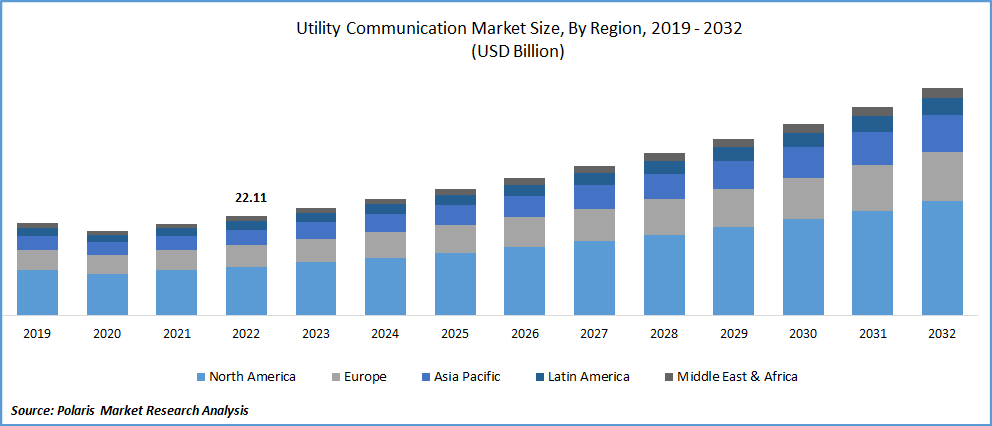

The global utility communication market was valued at USD 23.95 billion in 2023 and is expected to grow at a CAGR of 8.7% during the forecast period. The increasing use of advanced smart grid systems due to their widespread application across several industries including energy and power industry and significant growth in the popularity of these communication systems as they can not only permits safe but also secure and reliable transmission of data, voice, and video across LANs and WANs, that are the key factors propelling the market growth.

Know more about this report: Request for sample pages

Moreover, variety of digital services and social networks are being heavily used in order to boost the engagement between businesses, government, civil society, among others. Thus, major market companies are highly implementing on development and innovations and bringing new solutions into the market, that is creating huge growth opportunities for the utility communication market.

For instance, in August 2022, Siemens, announced that they have entered into a strategic agreement with Rail Vikas Nigam Limited, for the telecommunication and signaling of Kolkata Metro Line 3 & 6. Under this agreement, Siemens will provide highest energy savings, network capacity, and also decreased headways while ensuring the maximum possible safety.

In the last few years, there has been a conjunction taking place among various business realities of the utility industry, the demand for energy in modern society, and sustainability requirements of environment, that is significantly creating the development and implementation of new power system, and is fueling the overall market growth.

The rapid spread of the deadly coronavirus has slowed down the expansion and growth of the oil and gas sector by lowering the demand and supply due to the imposed lockdowns and various stringent regulations on mass movements in many countries. The COVID-19 pandemic also has an adverse impact on field devices manufacturers that is highly used in utility communications.

Industry Dynamics

Growth Drivers

A continuous rise in the number of smart city projects mainly in the developing nations such as India, China, Indonesia, and Malaysia and increasing adoption of utility communication to enhance the efficiency, quality, safety, security, and reliability of electric devices along with the emerging need for energy savings across the globe are prominent factors influencing the global utility communication market growth.

For instance, Indian Government has launched the Smart City Mission in June 2015 with an investment of USD 27.60 billion in which 100 smart cities are to be completed in four rounds. Recently, the government has extended the project deadline up to June 2023 and all smart cities are estimated to complete their projects within the given time.

Furthermore, rapid increase in the focus on improving grid operational efficiency, reliability, and reducing the outage length and rising adoption of automated voltage regulators that help power utilities in efficiently utilizing the existing assets and further reducing the peak demands are also likely to positively impact the demand and growth of the market.

Report Segmentation

The market is primarily segmented based on technology, utility, application, end-users and region.

|

By Technology |

By Utility |

By Application |

By End-User |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Wired segment accounted for highest market share in 2022

The segment growth is mainly accelerated by its numerous beneficial features and characteristics including faster data transfer compared to other networks, difficulty in authorized access to intercept data, and less likely to suffer for various interference. In addition, wired utility communication networks are being widely used in various applications such as businesses and institutes, where devices are unlikely to need to relocate form one place to another.

The wireless segment is expected to register fastest rate of growth over the anticipated period, on account of increased awareness regarding its utilization in various end-use sectors owing to high efficiency, access and availability, better flexibility, cost-effectiveness compared to wired networks, and ability to offer new products and services.

Public utilities segment held the largest market revenue share in 2022

This is due to growing focus on providing variety of public services to consumers at reasonable prices and serve them in a better way. Moreover, increasing government support and several privileges that are being provided to improve the functioning and efficiency of these utilities along with the rapid growth in R&D investment to develop more innovated features and services are likely to have a positive impact on market growth.

Transmission & distribution segment is expected to witness fastest growth

The transmission & distribution segment is projected to grow at a CAGR of throughout the forecast period. The growth of the segment can be mainly attributed to increasing replacement of aging power infrastructure with new and improved ones, that are introduced by key companies recently while integrating several new features and improved capabilities.

Additionally, continuous rise in the demand for electricity all over the world, as a result of increased population and growing penetration for variety of electronic components and products especially in emerging economies of APAC region like China and India, are expected to boost the growth of the segment market in the coming years.

Commercial segment dominated the global market in 2022

Rapid increase in the development of large buildings, high focus on supporting infrastructure that are required to provide electricity, gas, and water among others coupled with the growing focus of businesses to adopt the solutions consuming less energy, without compromising to the operations are among the major factors driving the segment growth at rapid pace.

Moreover, utilities are constantly modernizing their grids by investing in various new intelligent systems and also in two-way communications that are more reliable, resilient, and available to effectively manage the continuously growing complexity among business organizations, and further brings great benefits when applied to water, wastewater, and gas utilities, that is likely to create new growth opportunities for the segment market.

The demand in Asia Pacific is expected to witness significant growth

The Asia Pacific region is expected to emerge at substantial growth rate over the study period, which is highly attributable to extensive growth in the up-gradation of the existing power infrastructure especially in developing countries like China and India along with the growing incorporation of utility communication systems in the grid for real-time monitoring, monitor consumption, effectively integrate renewable power sources, and minimize the outages. In addition, high demand for smart city infrastructure and growing proliferation for smart grid across various countries are likely to fuel the demand and growth of the regional market over the coming years.

However, the North America region dominated the global market in 2022 and accounted for a healthy market share. The regional market growth is mainly driven by early adoption of innovated and advanced communication technologies and variety of initiatives supporting the technological landscape along with the increasing prevalence for smart grids that facilitate quicker restoration of electricity after the power disturbances.

Competitive Insight

Some of the major players operating in the global utility communication market include Hitachi Energy Ltd., Schneider Electric, Siemens Electric, General Electric, Motorola Solutions Inc., FUJITSU, Itron Inc., Telenaktiebolaget LM Ericsson, Digi International Inc., ZTE Corporation, Ribbon Communications Operating Company Inc., Trilliant Holdings Inc., Black & Veatch Holding Company, Valiant Communications, and RAD Open Systems International Inc.

Recent Developments

- In August 2022, Motorola Solutions, announced the acquisition of Barrett Communications, a leading provider of specialized radio communications. With this acquisition, Motorola Solutions will strengthen its commitment to innovation and leadership in the mission critical communications, further help in its portfolio expansion and extend its reach to international markets.

- in July 2022, TDPUD, introduced its latest and new Outage Management System, that improves the accuracy and timeliness of outage communication systems with customers. With this new OMS, customers will be able to receive email and text alerts, when they feel an electric outage, and also an estimated restoration time when available.

Utility Communication Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 25.97 billion |

|

Revenue forecast in 2032 |

USD 50.50 billion |

|

CAGR |

8.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Technology, By Utility, By Application, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Hitachi Energy Ltd., Schneider Electric, Siemens Electric, General Electric, Motorola Solutions Inc., FUJITSU, Itron Inc., Telenaktiebolaget LM Ericsson, Digi International Inc., ZTE Corporation, Ribbon Communications Operating Company Inc., Trilliant Holdings Inc., Black & Veatch Holding Company, Valiant Communications, and RAD Open Systems International Inc. |

FAQ's

The utility communication market report covering key segments are technology, utility, application, end-users and region.

Utility Communication Market Size Worth $50.50 Billion By 2032.

The global utility communication market expected to grow at a CAGR of 8.6% during the forecast period.

Asia Pacific is leading the global market.

Key driving factors in utility communication market rise in the number of smart city projects.