Vacation Rental Market Share, Size, Trends, & Industry Analysis Report

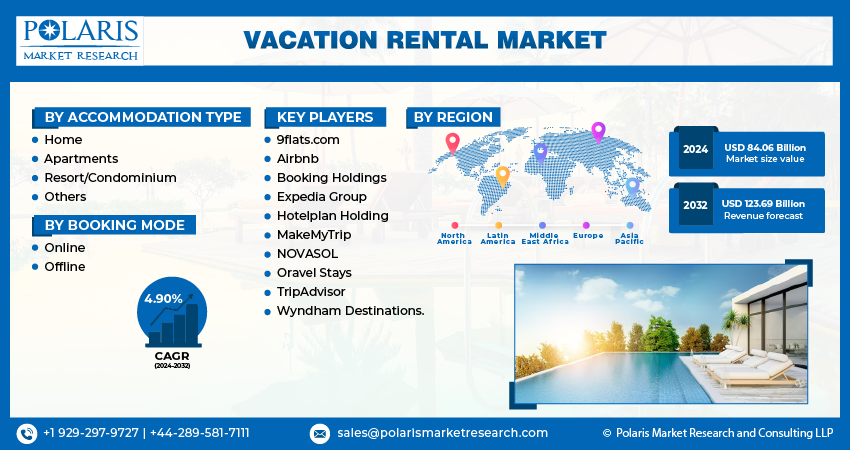

By Booking Mode (Online, Offline), By Accommodation Type (Home, Apartments, Resort/Condominium, Others), By Region, Segment Forecasts, 2025 - 2034

- Published Date:Aug-2025

- Pages: 123

- Format: PDF

- Report ID: PM3810

- Base Year: 2024

- Historical Data: 2020-2023

The global vacation rental market size was valued at USD 95.07 billion in 2024, exhibiting a CAGR of 3.85% during 2025–2034. The market is driven by growing consumer preference for personalized travel experiences, digital booking platform expansion, and increasing global tourism activity.

Key Insights

- The home accommodation segment holds the largest global share, driven by traveler preference for spacious, amenity-rich, and safer lodging options that offer a more personalized experience than traditional hotels.

- The offline segment maintains a significant market share, largely due to Baby Boomers and Gen X travelers who continue to favor traditional booking methods for their perceived reliability and personal service.

- North America leads the global vacation rental market, contributing approximately 36–37% of revenue, supported by strong adoption of short-term rentals in both urban hubs and rural getaways.

- The Asia Pacific region shows the highest growth momentum, with a projected CAGR of around 9%, fueled by a rising middle class, digital adoption, and growing interest in flexible, non-traditional accommodations.

Industry Dynamics

- The rising preference for unique, home-like accommodations and the growing use of digital booking platforms are fueling demand for vacation rentals.

- Increased travel among millennials and expanding global tourism further boost market growth.

- Regulatory challenges and zoning restrictions in major cities limit rental availability.

- The integration of smart home technology enhances guest experiences and offers a competitive differentiation.

Market Statistics

- 2024 Market Size: USD 95.07 billion

- 2034 Projected Market Size: USD 137.88 billion

- CAGR (2025-2034): 3.85%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Integrating vacation rental listings with various distribution channels, such as online travel agencies (OTAs) and meta-search engines, presents a promising opportunity to reach a wider audience. By partnering with platforms like Expedia Partner Solutions, HomeToGo, & TripAdvisor, operators can significantly enhance their visibility and expand their reach. This increased exposure leads to higher booking rates, increased occupancy, and ultimately drives revenue growth for vacation rental operators. These strategic collaborations enable the operators to tap into a larger pool of potential guests, attract more bookings, and maximize the utilization of their properties.

Market growth is being fueled by the increasing expenditure of millennials on travel, vacations, and accommodation. According to the Copyrise, there are approximately 200,000 Mn global millennial tourists who collectively spend around USD 180 Bn on travel annually. For instance, Beijing saw a 96% drop in bookings, Shanghai experienced a 71% decline, Seoul witnessed a 46% decrease, and Rome's bookings fell by 41%.

As of 2021, there were approximately 2.9 million hosts on Airbnb worldwide, with over 14,000 new hosts being added each month. Airbnb's presence extends to around 220 countries, with approximately 100,000 active listings. As the market continues to evolve, service providers in the vacation rental industry are adapting their offerings to meet the changing preferences and needs of travelers. The growing popularity of vacation rentals reflects their ability to cater to the diverse requirements of modern travelers seeking comfortable and customizable accommodations for their trips.

Originally catering to visiting scholars by offering temporary housing, SabbaticalHomes has now broadened its services to encompass short- and medium-term home rentals & exchanges in 57 countries, appealing to both academic and non-academic individuals. In parallel, other companies such as Plum Guide, BoutiqueHomes, & Homestay are also making strides in this domain, implementing changes to their service offerings to deliver unparalleled convenience and distinctive experiences to their clientele. The impact of social media and the internet is significantly contributing to increased consumer awareness about the various services and offerings available within this industry. As a result, more individuals are becoming informed and exploring the diverse options provided by these innovative platforms, leading to a growing demand for unique and personalized accommodation experiences.

Industry Dynamics

Growth Drivers

Increasing preference of vacation rental properties

Vacation rental properties have become increasingly preferred by travelers over traditional hotels due to several compelling reasons. Vacation rentals are more budget-friendly and offer a higher level of comfort and privacy compared to hotels. These properties often cater to families and pet owners, making them an attractive option for a wider range of travelers. The cost-effectiveness of vacation rentals, combined with their comparable amenities to hotels, drives consumer preference towards these accommodations. For instance, a TurnKey Vacation Rentals survey from 2019 revealed that 64% of travelers favor vacation rentals over hotels.

A report from the iProperty Management, in 2021, revealed that 71% of families traveling with children prefer vacation rentals due to the convenience of preparing their meals, a significant factor influencing their decision. Additionally, the increasing supply of vacation rentals has led to heightened demand and availability, driven by their cost-effectiveness compared to hotels. Stratos Jet Charters, Inc. provided statistics indicating the scale of the market.

Report Segmentation

The market is primarily segmented based on accommodation type, booking mode, and region.

|

By Accommodation Type |

By Booking Mode |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Accommodation Type

Home accommodation segment accounted for the largest share in 2024

Home accommodation accounted for major global share. This dominant position is a result of the widespread popularity of home accommodations among travelers, primarily due to their ample space availability, enhanced safety, and access to various amenities. Additionally, the segment's growth is further propelled by the attractive cost advantage of home rentals in rural and travel destinations, making them a preferred choice for budget-conscious travelers seeking comfortable and cost-effective accommodations.

Resort/condominium segment is likely to register highest growth rate. This rapid growth is primarily attributed to the strong influence of millennials, who show a greater inclination towards spending on experiencing various amenities provided by resorts and condominiums. These amenities often include barbeque pits, games, swimming pools, clubhouses, and tennis facilities, making them attractive options for millennials seeking a comprehensive and enjoyable vacation experience.

By Booking mode

Offline segment expected to hold substantial market share in 2024

Offline segment is projected to hold significant market share. This dominance is primarily driven by the significant consumer base of Baby Boomers and Gen X, who prefer using offline modes for booking accommodations. However, with the increasing penetration of the internet and smartphones among consumers, there is an anticipated shift in consumer preferences towards online booking modes. As more individuals become tech-savvy and accustomed to digital platforms, the convenience and accessibility of online booking options are expected to attract a larger share of the market in the coming years.

Online segment witnessed steady growth. This remarkable growth is attributed to consumers' increasing preference for having detailed access to the offerings of accommodations, amenities, and other benefits through digital platforms. The appeal of value for money, convenience, and the desire for authentic travel experiences are significant factors driving the surge in online booking.

Additionally, the rise of startups and third-party travel booking companies offering their services exclusively through applications and websites further contributes to the growth of the online booking segment. As consumers become more comfortable with digital platforms and seek streamlined and efficient booking processes, online booking channels are becoming increasingly favored, leading to the substantial expansion of this segment in the travel and accommodation industry.

According to iProperty Management's 2021 report, 12% of millennials plan to stay in a villa/estate, which is significantly higher compared to only 6% of Boomers and 9% of Gen Xers. This indicates the strong preference of millennials for resort-style accommodations, driving the segment's growth as they increasingly seek luxurious and amenity-rich options for their travel and vacation stays.

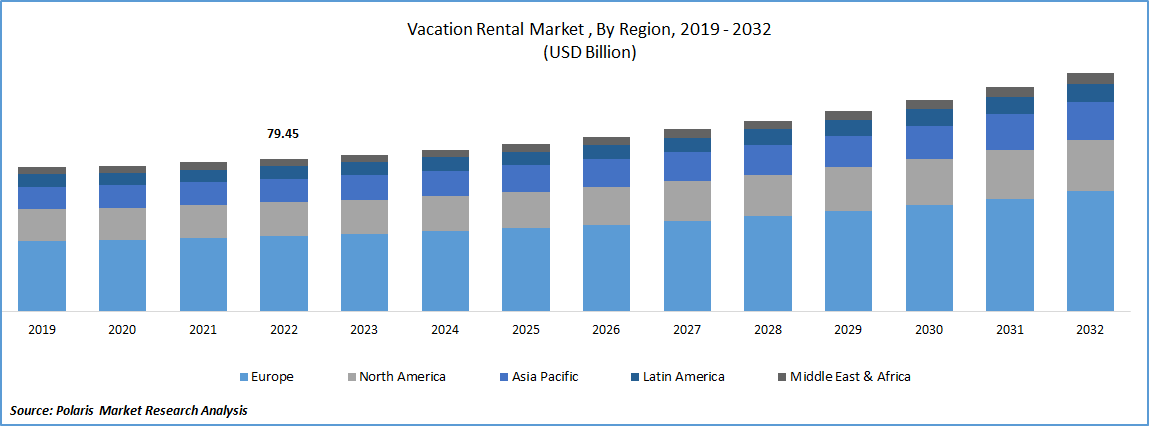

Regional Insights

The North America vacation rental market dominates globally, with the United States being the largest contributor. The region benefits from a mature tourism industry, high domestic travel rates, and strong digital infrastructure that supports online bookings. Urban destinations like New York City and Los Angeles, along with scenic locations such as Florida, Colorado, and the Pacific Northwest, attract millions of travelers seeking alternatives to traditional hotels. Additionally, the post-pandemic shift toward remote work and “workcations” has significantly boosted demand for extended vacation rental stays in rural and suburban areas across North America.

The Europe vacation rental market follows closely, driven by its rich cultural heritage, diverse landscapes, and well-established tourism hotspots such as Italy, France, and Spain. European travelers often favor vacation rentals for longer stays and more authentic local experiences. The region also benefits from strong regulatory frameworks and evolving consumer preferences for sustainable, private accommodations.

The Asia Pacific vacation rental market is growing rapidly, fueled by rising middle-class income, growing tourism in countries like Thailand, Japan, and Australia, and increased international travel interest post-COVID. Online platforms continue to increase market accessibility and visibility across the region.

Key Market Players & Competitive Insights

The vacation rental market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market:

- 9flats.com

- Airbnb

- Booking Holdings

- Expedia Group

- Hotelplan Holding

- MakeMyTrip

- NOVASOL

- Oravel Stays

- TripAdvisor

- Wyndham Destinations.

Recent Developments

- September 2025: MakeMyTrip signed a memorandum of understanding (MoU) with Sun Hospitality & Entertainment Group. With the partnership, MakeMyTrip aims to include the best resorts and hotels in its itineraries.

- May 2025: Vrbo announced the launch of its new promotions suite. The company stated that the new suite will empower hosts to create tailored promotions that can meet the needs of a wide range of traveler segments.

- In May 2025, Oyo’s European vacation home and property management brand Belvilla acquired Australian short-term rental platform MadeComfy in a cash-and-stock deal, strengthening Oyo’s global rental portfolio and bolstering its presence in the Asia-Pacific region

- In April 2025, Garnett Station introduced Stayterra, a brand aimed at expanding high-end vacation rentals across the United States. The company is committed to offering top-tier service by blending local knowledge, strong community ties, and a focus on delivering exceptional, memorable experiences for guests.

(Source: shorttermrentalz.com)

Vacation Rental Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 98.74 billion |

|

Revenue forecast in 2034 |

USD 137.88 billion |

|

CAGR |

3.85% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Accommodation Type, Booking Mode, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The vacation rental market report covering key segments are accommodation type, booking mode, and region.

Vacation Rental Market Size Worth $137.88 Billion by 2034.

The global vacation rental market is expected to grow at a CAGR of 3.85% during the forecast period.

Europe is leading the global market.

key driving factors in vacation rental market are increasing preference of vacation rental properties.