Valve Positioner Market Size, Share, Trends, Industry Analysis Report

By Product (Pneumatic Valve Positioner, Electro-Pneumatic Valve Positioner, Digital Valve Positioner), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6179

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

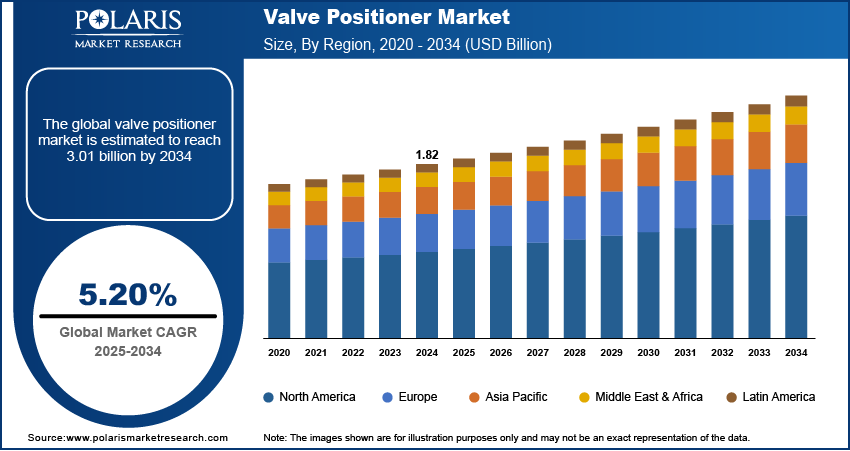

The global valve positioner market size was valued at USD 1.82 billion in 2024, growing at a CAGR of 5.20% from 2025 to 2034. Key factors driving demand for valve positioner include expanding chemical and petrochemical industry worldwide, rising urbanization, and increasing investments in renewable energy.

Key Insights

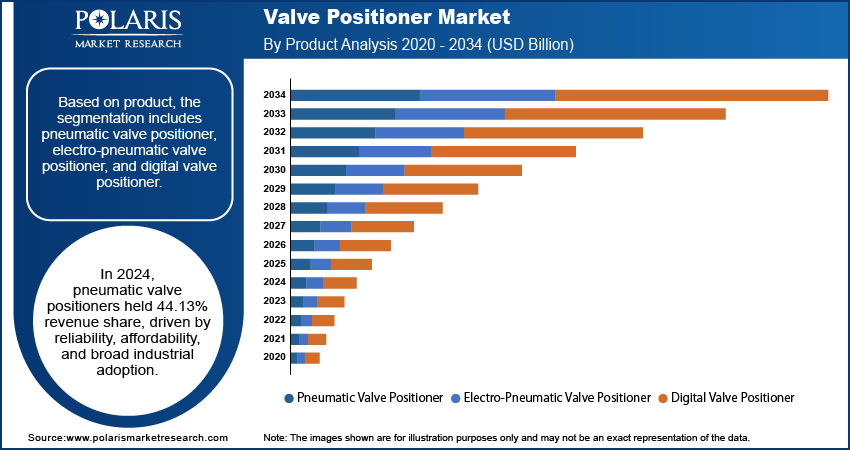

- The pneumatic valve positioner segment held 44.13% of revenue share in 2024 due to its widespread use in industries such as oil & gas and chemical.

- The energy & power segment accounted for 34.03% of revenue share in 2024 due to the need for precise flow control in transmission networks.

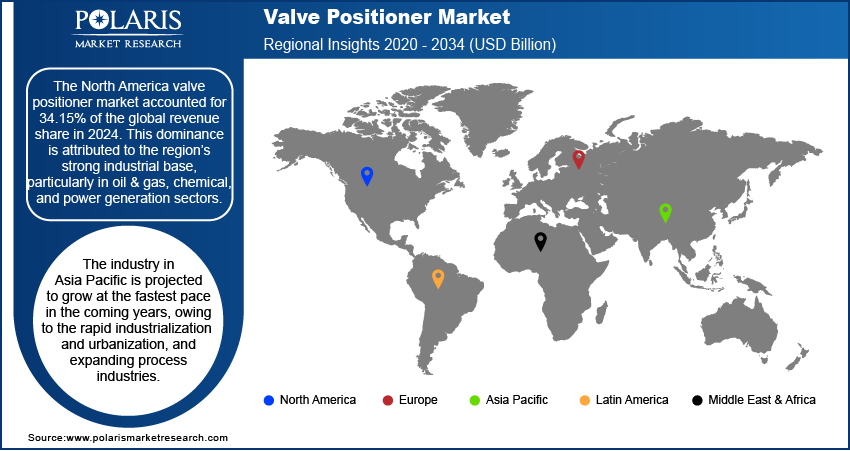

- The North America valve positioner market accounted for 34.15% of global revenue share in 2024. This dominance is attributed to the region’s strong oil & gas and chemical industries.

- The U.S. held the largest revenue share in the North America valve positioner landscape in 2024, due to increasing focus on industrial automation.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to the rapid industrialization across countries.

- Countries such as China, India, and Japan are investing heavily in water treatment, oil & gas, and power plants, fueling the demand for precise valve positioners.

Industry Dynamics

- Expanding chemical and petrochemical industry worldwide is fueling the market growth as these industries rely heavily on valve positioners for safe and efficient operations.

- Increasing investments in renewable energy drive the demand for valve positioners as solar, wind, and bioenergy plants require these positioners for efficient operations.

- Growing industrialization in emerging nations is expected to create a lucrative opportunity during the forecast period.

- The high initial cost of advanced valve positioners is projected to hinder the market growth.

Market Statistics

- 2024 Market Size: USD 1.82 Billion

- 2034 Projected Market Size: USD 3.01 Billion

- CAGR (2025–2034): 5.20%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

A valve positioner is a critical device used in process control systems to precisely regulate the position of a control valve, ensuring accurate flow control of fluids such as gases, liquids, and steam. It acts as an intermediary between the control system and the valve actuator. The positioner compares the valve’s actual position with the commanded signal and makes fine adjustments to eliminate discrepancies. This closed-loop control enhances accuracy, especially in applications requiring tight tolerances, such as chemical processing, oil and gas, and power generation.

The usage of valve positioners spans across industries where precise flow control is essential. In refineries, they ensure optimal fuel or feedstock regulation, while in power plants, they manage steam flow to turbines for efficient energy generation. Valve positioners also contribute to operational efficiency, reduced wear, and longer valve life by enhancing response time, reducing overshoot, and minimizing manual intervention. Advanced positioners, such as smart or digital types, offer additional functionalities such as diagnostics, self-calibration, and communication via protocols such as HART or Foundation Fieldbus, enabling predictive maintenance and improved system integration.

The global valve positioner market demand is driven by the rising urbanization worldwide. According to the United Nations, two-third of the world population is expected to live in urban areas in 2050. This increase in urbanization is creating the need for water treatment plants, power generation units, and oil & gas pipelines, which require precise flow regulation, driving demand for valve positioners to ensure accuracy and automation. Growing urban populations fuel the need for reliable HVAC systems in residential and commercial buildings, where valve positioners are needed to optimize performance. Additionally, stricter environmental regulations in urban areas push industries to adopt advanced process control technologies, further boosting the demand for high-precision valve positioners.

Drivers & Opportunities

Expanding Chemical and Petrochemical Industry Worldwide: The chemical & petrochemical industry relies heavily on precise flow control for safe and efficient operations, which is fueling the demand for valve positioners. Stricter safety and environmental regulations push companies in the industry to adopt advanced valve positioners that enhance process reliability and minimize leaks. Additionally, the rise in specialty chemicals and complex refining processes requires more sophisticated control solutions, further boosting the market for high-performance valve positioners. Therefore, as the chemical and petrochemical industry expands globally, the demand for valve positioners also increases.

Increasing Investments in Renewable Energy: Increasing investments in renewable energy worldwide fuel the demand for valve positioners as solar, wind, and bioenergy plants require precise fluid and gas control for efficient operations. Expanding solar thermal power systems rely on valve positioners to regulate heat transfer fluids, while biogas and hydrogen production plants use them to manage gas flow and pressure. Growing wind energy projects also drive demand, as hydraulic systems in turbines need accurate valve control for optimal performance. Additionally, stricter efficiency standards in renewable energy infrastructure pushing manufacturers to adopt automated valve solutions, further increasing the need for high-precision positioners in this sector.

Segmental Insights

Product Analysis

Based on product, the segmentation includes pneumatic valve positioner, electro-pneumatic valve positioner, and digital valve positioner. The pneumatic valve positioner segment held 44.13% of revenue share in 2024 due to its reliability, cost-effectiveness, and widespread adoption in industries such as oil & gas, chemical, and water treatment. These devices use compressed air to control valve movement, making them highly durable and suitable for harsh environments where electrical components may fail. The simple design of pneumatic valve positioners reduces maintenance requirements, further driving their high adoption. Additionally, many existing industrial infrastructures still rely on pneumatic systems, creating sustained demand for pneumatic valve positioners. The segment’s dominance also aroused from its lower upfront costs compared to advanced alternatives.

The electro-pneumatic valve positioner segment is projected to grow at a robust pace in the coming years, owing to the increasing demand for precision, automation, and energy efficiency in process industries. These devices combine pneumatic actuation with electronic control, offering superior accuracy and faster response times than pneumatic models. Industries such as power generation, pharmaceuticals, and food & beverage are adopting electro-pneumatic positioners to enhance process control and integrate with modern digital systems such as IoT and Industry 4.0 platforms. Stricter environmental regulations and the push for energy savings further accelerate their adoption, as they optimize air consumption and reduce operational costs.

Application Analysis

In terms of application, the segmentation includes energy & power, chemical, oil & gas, water & wastewater management, food & beverage, and other. The energy & power segment accounted for 34.03% of revenue share in 2024 due to the critical need for precise flow control in power plants, renewable energy systems, and transmission networks. Aging infrastructure in traditional thermal power stations and the expansion of solar and wind farms increased demand for reliable valve control solutions to enhance operational efficiency. Strict regulatory standards on emissions and energy optimization further pushed power generation companies to adopt high-performance valve positioners. Additionally, the growing integration of smart grid technologies and the modernization of power distribution systems strengthen the dominance of the segment, as utilities prioritize automation and remote monitoring capabilities.

The oil & gas segment is expected to grow at a rapid pace in the coming years, owing to the rising global energy demand and increased investments in upstream, midstream, and downstream operations. The need for precise pressure and flow regulation in pipelines, refineries, and LNG terminals is projected to drive adoption, particularly in regions expanding their hydrocarbon infrastructure. Digitalization trends such as predictive maintenance and real-time monitoring in offshore and onshore facilities are also boosting demand for advanced valve positioners.

Regional Analysis

The North America valve positioner market accounted for 34.15% of revenue share in 2024. This dominance is attributed to the region’s strong industrial base, particularly in oil & gas, chemical, and power generation sectors. The increasing adoption of automation and Industry 4.0 technologies in the region pushed manufacturers to upgrade their control systems, including smart valve positioners for better precision and efficiency. Additionally, stringent environmental and safety regulations encouraged the replacement of outdated pneumatic systems with advanced digital valve positioners, leading to market growth. The growth of shale gas production in the U.S. and Canada further propelled the demand for reliable valve positioning solutions. The U.S. Energy Information Administration (EIA) in its report stated that, in 2023, about 78% (37.87 trillion cubic feet) of total dry natural gas production in the country was from shale formations.

U.S. Valve Positioner Market Insights

The U.S. held the largest revenue share in the North America valve positioner landscape in 2024 due to rising industrial automation, particularly in the oil & gas, water & wastewater, and energy sectors. The push for smart manufacturing and the integration of Industrial Internet of Things (IIoT) in process industries in the U.S contributed to the market dominance. The EPA’s emissions regulations also compelled industries to adopt high-precision valve positioners to minimize leaks and improve efficiency. Furthermore, the ongoing investments in upgrading aging infrastructure contributed to increased demand for advanced valve positioning solutions in the U.S. in 2024.

Europe Valve Positioner Market Trends

The market in Europe is projected to hold a substantial revenue share in 2034 due to the region’s focus on energy efficiency and sustainability. Strict EU environmental regulations are mandating industries to adopt advanced control systems, boosting the adoption of digital and smart valve positioners. The chemical and pharmaceutical sectors, particularly in Germany and France, are major consumers of valve positioners due to their need for precise flow control. Additionally, Europe’s shift toward renewable energy is creating a need for valve positioners in power generation and storage applications.

Germany Valve Positioner Market Overview

Germany is a key market for valve positioners, driven by its strong manufacturing and engineering sectors. The country’s emphasis on Industry 4.0 and automation in industries such as automotive, chemicals, and machinery is boosting demand for smart and electro-pneumatic positioners. Germany’s energy transition toward renewables and hydrogen infrastructure is also requiring advanced valve control systems. Moreover, strict safety and efficiency standards in process industries are further fueling the replacement of traditional positioners with digital models.

Asia Pacific Valve Positioner Market Assessments

The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to rising industrialization and urbanization and expanding process industries. Countries as China, India, and Japan are investing heavily in oil & gas, water treatment, and power plants, driving the need for precise valve positioners. The rise of smart factories and automation in manufacturing hubs such as China and South Korea is also fueling the market growth. Additionally, government initiatives for infrastructure development and stricter emission norms are pushing industries to adopt advanced valve positioners for better efficiency and compliance. The growing chemical and petrochemical sectors in Southeast Asia are further contributing to market expansion. Department of Chemicals and Petrochemicals of India, in its report, stated that India's chemical and petrochemical (CPC) industry is expected to grow to about USD 300 billion by 2025.

Key Players & Competitive Analysis

The global valve positioner market is highly competitive, with key players such as Emerson Electric Co., ABB, Schneider Electric, and Azbil Corporation dominating due to their advanced technologies, strong R&D capabilities, and extensive distribution networks. Emerson Electric leads with its Fisher and Bettis brands, offering smart positioners with digital communication protocols such as HART and Foundation Fieldbus. ABB competes closely with its TZIDC series, known for high precision and reliability in harsh environments. Schneider Electric leverages its EcoStruxure platform to integrate valve positioners into broader automation systems, appealing to industries seeking IoT-enabled solutions.

The market is witnessing a shift toward wireless and IIoT-enabled positioners, with companies investing in predictive maintenance and remote monitoring features. Mergers, acquisitions, and partnerships are common strategies to expand market share, while price competition remains intense, especially in emerging economies.

A few major companies operating in the valve positioner industry include ABB; Azbil Corporation; Baker Hughes Company; Bray International; Christian Bürkert GmbH & Co. KG; ControlAir Crane Co.; Dwyer Instruments LTD; Emerson Electric Co.; Flowserve Corporation; and Schneider Electric

Key Players

- ABB

- Azbil Corporation

- Baker Hughes Company

- Bray International

- Christian Bürkert GmbH & Co. KG

- ControlAir Crane Co.

- Dwyer Instruments LTD

- Emerson Electric Co.

- Flowserve Corporation

- ifm efector, inc.

- Schneider Electric

Valve Positioner Industry Developments

In October 2024, ifm efector, inc., a provider of sensors, controls, and software for industrial automation, introduced its new MVQ301 process valve positioner, supported by IO-Link.

In November 2023, Emerson announced the launch of its new TopWorx DVR Switchbox, an entry-level addition to the DV Series of valve position indicators. It provides a reliable valve position feedback tool for water and wastewater systems, food and beverage production lines, and industrial utilities.

Valve Positioner Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Pneumatic Valve Positioner

- Electro-Pneumatic Valve Positioner

- Digital Valve Positioner

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Energy & Power

- Chemical

- Oil & Gas

- Water & Wastewater Management

- Food & Beverage

- Other

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Valve Positioner Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.82 Billion |

|

Market Size in 2025 |

USD 1.91 Billion |

|

Revenue Forecast by 2034 |

USD 3.01 Billion |

|

CAGR |

5.20% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |