Vanillin Market Size, Share, Trends, Industry Analysis Report

: By Product, Type (Ethyl Vanillin and Methyl Vanillin), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM3229

- Base Year: 2024

- Historical Data: 2020-2023

Vanillin Market Overview

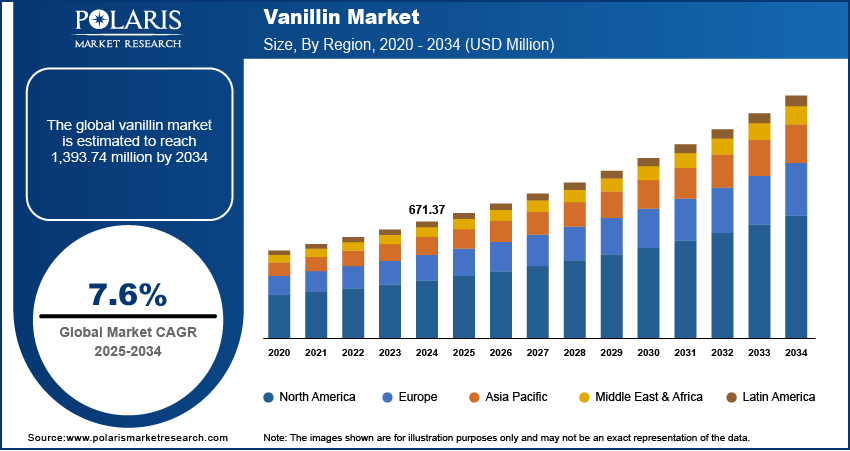

The global vanillin market was valued at USD 671.37 million in 2024. It is expected to grow from USD 721.15 million in 2025 to USD 1,393.74 million by 2034, at a CAGR of 7.6% during 2025–2034.

Vanillin, the primary component responsible for the characteristic aroma and flavor of vanilla, is widely used in food, beverages, pharmaceuticals, and personal care products. The vanillin market demand is driven by rising urbanization and the increasing consumption of convenience foods. Consumer lifestyles are shifting towards ready-to-eat and processed food products, where vanillin serves as a key flavoring agent as the urban populations expand. This trend is particularly evident in urban areas, which, according to a 2023 World Bank Group report, now house 4.61 billion people globally, demonstrating the expanding market potential for processed food products and flavoring ingredients such as vanillin. The demand for bakery, confectionery, and dairy foods, coupled with a growing preference for natural and synthetic flavor enhancers, is further propelling vanillin market development. Additionally, the food industry’s emphasis on enhancing sensory appeal and extending product shelf life continues to reinforce the widespread adoption of vanillin across various applications.

To Understand More About this Research: Request a Free Sample Report

Advancements in vanillin synthesis and production technologies are positively influencing vanillin market growth. Innovations in bio-based synthesis, enzymatic conversion, and sustainable production methods are enabling cost-effective and environmentally friendly alternatives to traditional petrochemical-derived vanillin. The shift toward sustainable ingredients, driven by regulatory policies and consumer preferences for natural and eco-friendly products, has led to increased research in biotechnological and fermentation-based vanillin production. The September 2022 FSSAI report classified vanilla products into three categories: vanilla pods, cut vanilla, and vanilla powder. Each must meet quality standards, including a minimum 2% vanillin content, 20–30% moisture content, and be free from artificial colors and contaminants. Furthermore, improvements in extraction and purification techniques are enhancing yield efficiency and quality, making vanillin more accessible across diverse end-use industries. These technological advancements are playing a crucial role in shaping the vanillin market trends, catering to evolving industry demands and sustainability goals.

Vanillin Market Dynamics

Growth in Food and Beverage Production

The demand for high-quality flavoring agents such as vanillin continues to rise with the expansion of the global food industry, particularly in bakeries, confectionery, dairy, and beverages, driving food and beverage production. Manufacturers are increasingly incorporating vanillin to improve taste, aroma, and overall sensory appeal in their products, catering to evolving consumer preferences. For instance, in September 2022, Solvay expanded its Rhovanil Natural CW range with three new natural vanillin flavors- Delica, Alta, and Sublime to meet the rising demand for healthier, natural food and beverage products. Derived from non-GMO bioconversion of ferulic acid, these flavors offer cost-effective, high-quality solutions for global manufacturers, which further boost the vanillin market expansion. Additionally, as food production scales up to meet the growing population and urbanization trends, the need for consistent and cost-effective flavor solutions further strengthens the market demand.

Increasing Demand for Natural and Organic Products

Rising awareness of health and wellness, coupled with regulatory support for natural additives, has accelerated the shift toward bio-based vanillin derived from sources such as lignin, ferulic acid, and microbial fermentation. A 2024 report from the Ministry of Foreign Affairs stated that the EU organic regulation (EU) 2018/848 took effect in January 2022, introducing new checks for imported organic products. Compliance requires the companies to adjust their processes, such as using permitted pesticides and fertilizers, controlling weeds naturally, and implementing a traceability system while only using allowed solvents such as water, steam, or organic alcohol in extraction. This trend aligns with the broader movement toward sustainable and environmentally friendly production practices, encouraging manufacturers to develop natural alternatives to synthetic vanillin as consumers prioritize clean-label and plant-based ingredients. Therefore, as industries continue to adopt cleaner formulations to meet strict consumer expectations, the preference for natural vanillin is expected to contribute significantly to vanillin market expansion.

Vanillin Market Segment Insights

Vanillin Market Assessment by End Use Outlook

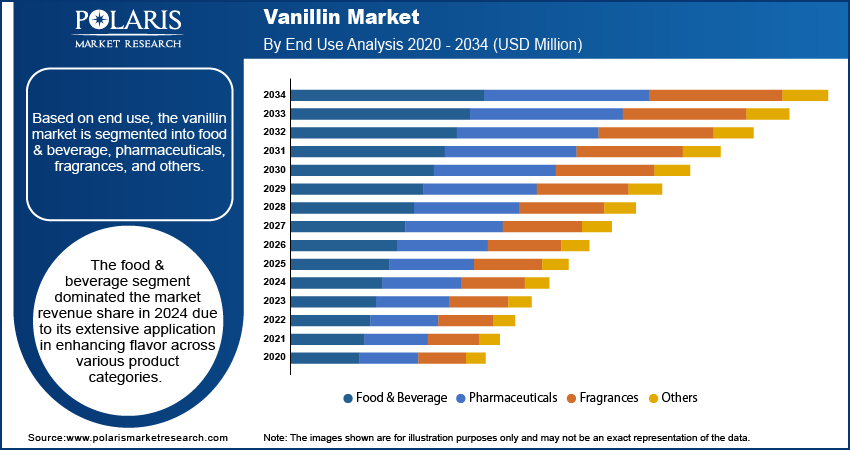

The global vanillin market segmentation, based on end use, includes food & beverage, pharmaceuticals, fragrances, and others. The food & beverage segment dominated the vanillin market share in 2024 due to its extensive application in enhancing flavor across various product categories. Manufacturers increased their reliance on vanillin to improve sensory appeal as consumer preferences shifted toward processed, ready-to-eat, and indulgent food products. The rising consumption of bakery, confectionery, dairy, and beverage products further contributed to the market share. Additionally, the growing demand for innovative and premium food offerings encouraged the use of vanillin as a key ingredient in formulations. The food & beverage sector remained the primary end-use industry, driving market growth with food manufacturers prioritizing consistent flavoring solutions and extended shelf life.

Vanillin Market Evaluation by Product Outlook

The global vanillin market segmentation, based on product, includes natural vanillin and synthetic vanillin. The synthetic vanillin segment is expected to witness a faster growth during the forecast period due to its cost-effectiveness, high purity, and widespread availability. Unlike natural vanillin, which is limited by resource constraints and production costs, synthetic alternatives provide a scalable and consistent supply for industrial applications. The increasing demand for vanillin in mass-market products, such as packaged foods, beverages, and pharmaceuticals, has further fueled the adoption of synthetic variants. Moreover, advancements in synthetic production technologies, such as bioengineering and petrochemical synthesis, have enhanced efficiency and reduced dependency on natural sources. Therefore, as industries seek reliable and economically viable flavoring solutions, the synthetic vanillin segment is expected to experience rapid expansion.

Vanillin Market Regional Analysis

By region, the report provides the vanillin market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global vanillin market revenue in 2024, driven by the region’s strong food processing industry, rising population, and evolving consumer preferences. The growing middle-class population, coupled with increasing disposable income, has led to higher consumption of flavored food and beverage products, directly influencing market demand. Additionally, the presence of key manufacturing hubs and cost-effective production facilities in countries such as China and India has strengthened the regional supply chain. In July 2022, Camlin Fine Sciences announced a new facility in India for the base material for the production of vanillin and ethyl vanillin serving flavor and fragrance manufacturers. It will have a capacity of 6,000 tonnes annually. Additionally, the expansion of the pharmaceutical and personal care sectors, where vanillin serves as a critical ingredient, has also contributed to market leadership. Asia Pacific remained the dominant revenue contributor to the global market development with continued industrialization and urbanization trends.

The Europe vanillin market is projected to witness the fastest growth during the forecast period, supported by increasing consumer demand for natural and sustainable ingredients. The region’s stringent regulations on food additives and growing preference for clean-label products have accelerated the adoption of bio-based vanillin. Additionally, the expansion of the premium and functional food sectors, particularly in bakery, dairy, and confectionery, has fueled market opportunities. Rising investments in research and development for sustainable vanillin production, such as lignin-based and fermentation-derived alternatives, have further strengthened regional market expansion. Therefore, as European consumers prioritize quality, transparency, and eco-friendly sourcing, the demand for vanillin in the region is expected to grow at a significant pace during the forecast period.

Vanillin Market – Key Players & Competitive Analysis Report

The competitive landscape is characterized by a dynamic mix of global multinational corporations and specialized regional players competing to capture vanillin market share through technological innovation, strategic partnerships, and market expansion. Global leaders such as Jiaxing Zhonghua Chemical Co., LTD.; Lesaffre; Solvay; and others are leveraging robust research and development capabilities and extensive global distribution networks to deliver advanced natural and synthetic vanillin solutions. Vanillin market trends indicate a rising demand for bio-based and sustainable vanillin production methods, including technologies derived from lignin, ferulic acid, and microbial fermentation. Reflecting the broader industry shift toward environmentally friendly and clean-label ingredients. According to vanillin market statistics, the market is expected to grow, driven by increasing consumer preferences for natural additives in the food, pharmaceutical, and personal care industries. Additionally, regional companies are capitalizing on localized market needs by offering cost-effective and tailored vanillin products, particularly in emerging markets. The region's strong food processing infrastructure, expanding middle-class population, and increasing disposable income contribute to its market leadership. A few key major players are Apple Flavor & Fragrance Group Co., Ltd.; Borregaard AS; Camlin Fine Sciences Ltd.; Evolva Holding SA; International Flavors & Fragrances Inc.; Jiaxing Zhonghua Chemical Co., LTD.; Lesaffre; Omega Ingredients Limited; Prinova Group LLC; and Solvay.

Jiaxing Zhonghua Chemical Co., Ltd., established in 1976, is a manufacturer of vanillin and ethyl vanillin located in Jiaxing City, Zhejiang Province, China. The company operates on over 500 acres and employs more than 1,300 staff, making it one of the top 500 chemical enterprises in China. Jiaxing Zhonghua has developed a robust industrial chain that includes the production of guaiacol and other related chemicals with an annual production capacity of 10,000 tons of vanillin. Its flagship product, branded as "Eternal Pearl," is recognized as a famous trademark in China and is widely exported to major markets such as Europe and the US. The company emphasizes technological innovation and sustainable practices, aiming to enhance its international competitiveness while maintaining a commitment to quality and environmental responsibility.

Solvay S.A., established in 1863 by Ernest and Alfred Solvay, is a Belgian chemical company headquartered in Brussels. Initially focused on sodium carbonate production via the innovative Solvay process, the company has since diversified into various sectors, such as chemicals and plastics. Solvay operates through five main segments: Consumer Chemicals, Advanced Materials, Performance Chemicals, Functional Polymers, and Corporate & Business Services. The company is committed to sustainability and aims for carbon neutrality by 2050, reflecting its dedication to addressing global challenges such as air and water purification. Among its product offerings is vanillin, a key flavoring agent derived from lignin or guaiacol, used extensively in food and fragrance applications. Solvay continues to drive innovation while maintaining its legacy of excellence in chemical manufacturing with a workforce of over 9,000 employees.

List of Key Companies in Vanillin Market

- Apple Flavor & Fragrance Group Co., Ltd.

- Borregaard AS

- Camlin Fine Sciences Ltd.

- Evolva Holding SA

- International Flavors & Fragrances Inc.

- Jiaxing Zhonghua Chemical Co., LTD.

- Lesaffre

- Omega Ingredients Limited

- Prinova Group LLC.

- Solvay

Vanillin Industry Developments

In May 2023, Evolva signed an agreement with a CMO partner to supply vanillin to a global F&F customer, valued at approximately USD 38 million until 2026.

Vanillin Market Segmentation

By Product Outlook (Volume Tons; Revenue, USD Million, 2020–2034)

- Natural Vanillin

- Synthetic Vanillin

By Type Outlook (Volume Tons; Revenue, USD Million, 2020–2034)

- Ethyl Vanillin

- Methyl Vanillin

By End Use Outlook (Volume Tons; Revenue, USD Million, 2020–2034)

- Food & Beverage

- Pharmaceuticals

- Fragrances

- Others

By Regional Outlook (Volume Tons; Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Vanillin Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 671.37 million |

|

Market Size Value in 2025 |

USD 721.15 million |

|

Revenue Forecast in 2034 |

USD 1,393.74 million |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume Tons; Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 671.37 million in 2024 and is projected to grow to USD 1,393.74 million by 2034.

The global market is projected to register a CAGR of 7.6% during the forecast period.

Asia Pacific contribute notably towards the global vanillin market.

Asia Pacific dominated the market revenue in 2024.

A few of the key players in the market are Apple Flavor & Fragrance Group Co., Ltd.; Borregaard AS; Camlin Fine Sciences Ltd.; Evolva Holding SA; International Flavors & Fragrances Inc.; Jiaxing Zhonghua Chemical Co., LTD.; Lesaffre; Omega Ingredients Limited; Prinova Group LLC; and Solvay.

The food & beverage segment dominated the market in 2024.