Vascular Access Device Market Size, Share, Trends, Industry Analysis Report

: By Product (Short PIVCs, Huber Needles, Midline Catheters, PICCs, CVCs, Dialysis Catheters, and Implantable Ports), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 118

- Format: PDF

- Report ID: PM1681

- Base Year: 2024

- Historical Data: 2020-2023

Vascular Access Device Market Overview

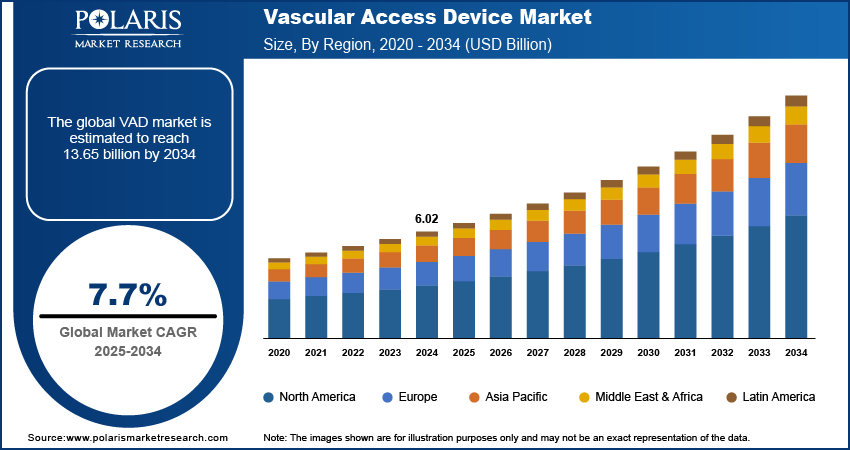

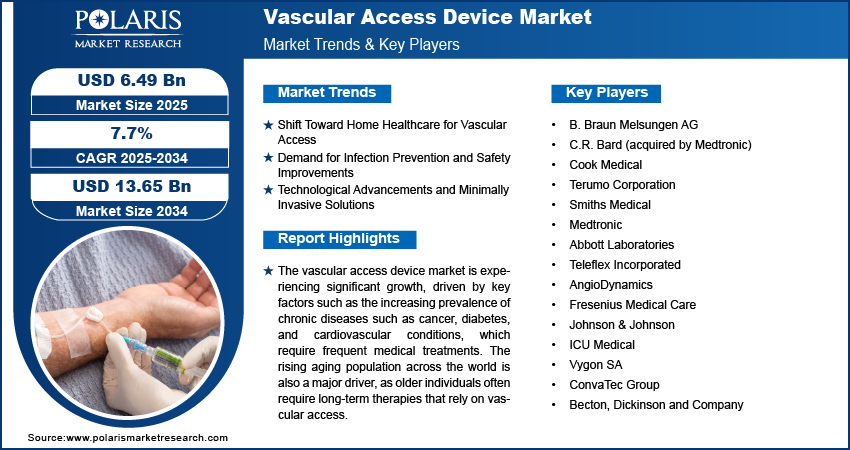

The global vascular access device market size was valued at USD 6.02 billion in 2024. The market is projected to grow from USD 6.49 billion in 2025 to USD 13.65 billion by 2034, exhibiting a CAGR of 7.7% during 2025–2034.

The global vascular access device (VAD) market refers to the industry encompassing medical devices designed to provide access to a patient's vascular system for purposes such as drug administration, fluid delivery, and blood sampling. These devices include catheters, ports, and needles, commonly used in hospitals, clinics, and home care settings. The market is primarily driven by an upsurging aging global population; rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders; and the increasing adoption of minimally invasive procedures. Additionally, advancements in technology, including the development of more reliable, user-friendly, and safer devices, are contributing to market growth. Vascular access device (VAD) market trends such as a shift toward home healthcare, a focus on infection prevention, and increasing demand for long-term VAD solutions further propel the market expansion.

To Understand More About this Research: Request a Free Sample Report

Vascular Access Device Market Drivers and Trends

Shift Toward Home Healthcare for Vascular Access

Patients are opting for treatment in home settings rather than hospitals, owing to the advancements in technology and healthcare practices. This trend is fueled by the desire for increased convenience, reduced healthcare costs, and a preference for a more comfortable environment for long-term treatments. VADs, particularly those used for chemotherapy, parenteral nutrition, and intravenous medications, are increasingly being utilized in home settings. According to a report from the Centers for Disease Control and Prevention (CDC), over 40% of home health patients require intravenous therapies, contributing to the increased demand for VADs in home care. The trend is expected to grow further as healthcare providers increasingly seek ways to manage chronic diseases outside traditional hospital settings.

Demand for Infection Prevention and Safety Improvements

Infection prevention has become a major focus in the VAD market due to the risks associated with catheter-related bloodstream infections (CRBSIs). These infections can lead to severe complications, including sepsis and organ failure, making the safety and sterility of vascular access procedures a critical concern. To address this, manufacturers are focusing on developing VADs with improved materials and designs that minimize the risk of infection. For instance, antimicrobial-coated catheters, improved insertion techniques, and devices designed to reduce contamination are gaining popularity. According to the World Health Organization (WHO), healthcare-associated infections (HAIs) account for about 7% of hospital-acquired conditions worldwide, further emphasizing the importance of safety in vascular access. Additionally, healthcare providers are adopting stricter protocols to reduce infection rates, contributing to the rising demand for safer vascular access devices.

Technological Advancements and Minimally Invasive Solutions

Technological advancements have significantly impacted the development of vascular access devices, particularly through the rise of minimally invasive solutions. The demand for VADs that are less invasive, easier to use, and provide faster recovery times is driving innovations. New materials, such as bioabsorbable and polymer-coated catheters, are improving the comfort and effectiveness of VADs. Innovations such as ultrasound-guided catheter insertions are making the procedures more accurate and reducing the risk of complications. Moreover, the trend toward automation, such as robotic-assisted insertion techniques, is making vascular access procedures safer and more efficient. As a result, healthcare professionals are increasingly adopting these advanced solutions to improve patient outcomes. A study by The Journal of Vascular Access highlights that ultrasound-guided vascular access procedures have reduced complication rates by up to 50%, underscoring the impact of technology on the market.

Vascular Access Device Market Segment Insights

Vascular Access Device Market Outlook – by Product-Based Insights

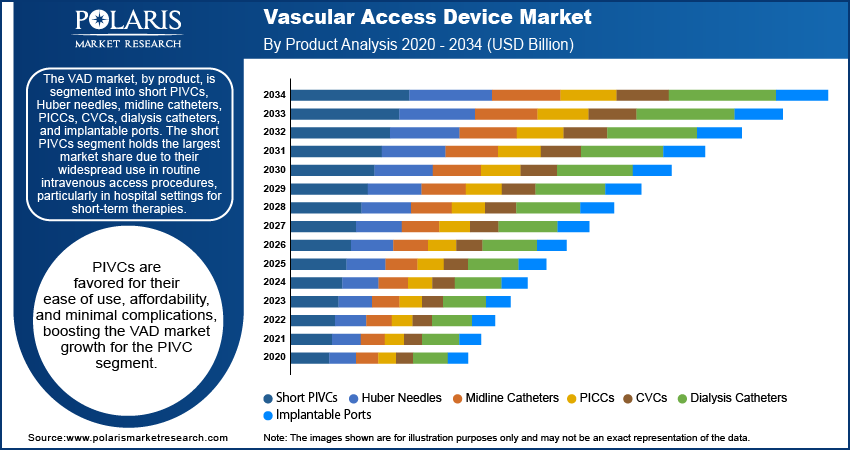

The VAD market, by product, is segmented into short PIVCs, Huber needles, midline catheters, PICCs, CVCs, dialysis catheters, and implantable ports. The short PIVCs segment holds the largest market share due to their widespread use in routine intravenous access procedures, particularly in hospital settings for short-term therapies. These devices are favored for their ease of use, affordability, and minimal complications. In terms of growth, Peripherally Inserted Central Catheters (PICCs) are registering the highest increase in demand, driven by their suitability for long-term intravenous therapy in patients requiring extended treatment, such as those with chronic diseases or cancer. PICCs are being increasingly adopted in both hospital and home healthcare settings due to their reduced complication rates compared to traditional central venous catheters, making them a preferred choice for prolonged use.

Other segments, such as Huber needles and dialysis catheters, also show robust growth due to the rising demand for specialized care in oncology and nephrology. Huber needles, designed for use in implantable ports, are in demand due to their use in long-term therapies, especially for cancer patients requiring frequent medication infusions. The dialysis catheters segment continues to witness steady growth, driven by the increasing prevalence of kidney disease and the rising number of patients undergoing dialysis treatments. The market for the implantable ports segment is also expanding as these devices offer long-term access with minimal discomfort, making them particularly valuable for patients undergoing frequent treatments. While segments such as midline catheters and CVCs have a stable presence, the increasing preference for less invasive and longer-lasting solutions continues to drive demand for products such as PICCs and implantable ports.

Vascular Access Device Market Assessment – by End User-Based Insights

The vascular access device (VAD) market, by end user, is segmented into hospitals, ambulatory surgery centers, and others. The hospitals segment holds the largest market share, driven by their role as the primary healthcare setting for the majority of invasive procedures requiring vascular access, such as surgeries, chemotherapy, and intensive care treatments. Hospitals benefit from a wide range of specialized medical services and equipment, which supports the extensive use of vascular access devices in acute and long-term patient care. Hospitals also have the infrastructure to manage complex vascular access needs, contributing to their dominance in the market.

The ambulatory surgery centers segment is registering the highest growth due to the increasing shift toward outpatient care, driven by the rising preference for cost-effective, less invasive procedures that do not require long hospital stays. ASCs are becoming more popular for procedures that traditionally require hospital admission, such as minor surgeries and diagnostic interventions, which also need vascular access devices. As the demand for outpatient surgeries and procedures rises, ASCs are expected to continue growing rapidly. Additionally, other segments, including home healthcare settings and long-term care facilities, are seeing gradual increases in the use of vascular access devices, particularly with the rise of home care solutions for patients suffering from chronic conditions requiring extended therapies.

Vascular Access Device Market Regional Insights

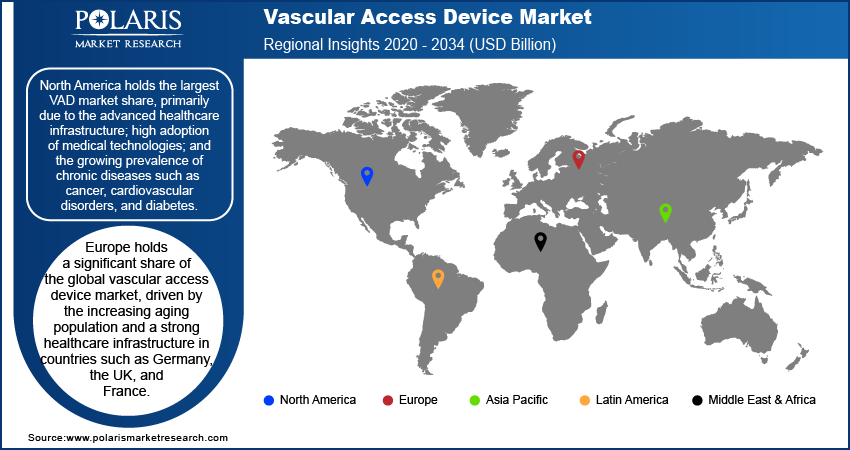

By region, the study provides VAD market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to the advanced healthcare infrastructure; high adoption of medical technologies; and the growing prevalence of chronic diseases such as cancer, cardiovascular disorders, and diabetes. The region benefits from a well-established network of hospitals, ambulatory surgery centers, and home healthcare services, all of which significantly contribute to the demand for vascular access devices. Furthermore, the presence of key market players and continuous innovations in device technologies strengthen the market position in North America. Additionally, high healthcare spending, favorable reimbursement policies, and a growing aging population in the US and Canada are driving substantial growth in the region. Europe also holds a significant share, though it lags behind North America, driven by the rising aging population and increasing healthcare investments in countries such as Germany and the UK. The Asia Pacific VAD market is expected to experience the highest growth, fueled by improving healthcare access, rising disposable incomes, and the increasing prevalence of chronic conditions.

Europe holds a significant share of the global vascular access device market, driven by the rising aging population and a strong healthcare infrastructure in countries such as Germany, the UK, and France. The increasing prevalence of chronic diseases such as cardiovascular conditions, diabetes, and cancer contributes to a growing demand for vascular access devices. The region is also witnessing a rise in outpatient procedures and home healthcare services, further supporting the vascular access device (VAD) market expansion. However, the growth rate in Europe is relatively stable compared to other regions, with a focus on improving the efficiency and safety of vascular access technologies. The European market is also influenced by regulatory frameworks that ensure high standards for medical devices, which impacts the availability and adoption of new vascular access devices.

The Asia Pacific vascular access device market is experiencing the highest growth, driven by rapid economic development, increased healthcare spending, and a growing population of elderly patients. Countries such as China, India, and Japan are witnessing a rise in the prevalence of chronic diseases, spurring demand for VADs. Furthermore, improving healthcare infrastructure, expanding access to medical services, and the adoption of modern medical technologies are contributing to the market's growth. In particular, the demand for peripherally inserted central catheters (PICC) and dialysis catheters is rising due to the increasing number of patients requiring long-term treatments. The region's diverse healthcare landscape presents opportunities for global and local manufacturers to expand their presence. As healthcare access improves and the adoption of advanced technologies increases, the Asia Pacific market is expected to expand rapidly during the forecast period.

Vascular Access Device Market – Key Players and Competitive Insights

A few key players in the vascular access device (VAD) market are B. Braun Melsungen AG, C.R. Bard (acquired by Medtronic), Cook Medical, Terumo Corporation, Smiths Medical, Medtronic, Abbott Laboratories, Teleflex Incorporated, AngioDynamics, Fresenius Medical Care, Johnson & Johnson, ICU Medical, Vygon SA, and ConvaTec Group. These companies provide a range of vascular access solutions such as peripherally inserted central catheters (PICC), central venous catheters (CVC), dialysis catheters, and implantable ports, and they are active in both developed and emerging markets. Several companies are also focused on expanding their product offerings through continuous innovations and the integration of advanced technologies such as antimicrobial coatings and ultrasound-guided insertion techniques to enhance the safety and efficiency of vascular access procedures.

The competitive landscape of the vascular access device market is influenced by several factors such as technological advancements, product development, and strategic collaborations. Companies are increasingly focused on improving the safety and efficacy of their devices to reduce complications such as catheter-related infections and thrombosis. Some players are investing heavily in research and development (R&D) to introduce innovative devices with enhanced materials and coatings that minimize infection risks. Others are expanding their portfolios through acquisitions or partnerships to strengthen their market position. For example, Medtronic's acquisition of C.R. Bard has expanded its vascular access product offerings, enabling the company to leverage Bard’s advanced solutions to better serve a wide range of medical needs.

Market players are focusing on geographical expansion, particularly in emerging markets such as Asia Pacific and Latin America, where there is growing demand for vascular access solutions due to rising healthcare needs. Companies are making efforts to increase their market share by offering affordable and reliable products tailored to the unique healthcare needs of these regions. Additionally, some players are targeting the home healthcare segment, which is gaining momentum as more patients seek to manage their conditions outside hospital settings. This has led to increased demand for devices that are effective and easy to use and maintain in home environments. Competitive strategies in this market are largely driven by the need to meet the evolving needs of healthcare providers and patients while navigating regulatory challenges across different regions.

Medtronic is one of the global VAD market players, offering a range of products including central venous catheters, dialysis catheters, and other vascular access solutions. The company focuses on developing medical technologies to address critical health issues across various medical specialties. Medtronic’s portfolio is boosted by acquisitions, such as the purchase of C.R. Bard in 2017, which expanded its vascular access offerings. The company’s commitment to innovation and patient safety has made it a key player in the market.

B. Braun Melsungen AG is another key player in the vascular access device (VAD) market, with a wide range of products such as peripherally inserted central catheters (PICC), implantable ports, and central venous catheters (CVC). The company is known for its strong presence in the global healthcare market and a focus on providing innovative solutions for medical procedures. B. Braun has been advancing its portfolio by incorporating new technologies to improve patient safety and comfort, as well as developing antimicrobial solutions to reduce infection risks.

List of Key Companies in Vascular Access Device Market

- B. Braun Melsungen AG

- C.R. Bard (acquired by Medtronic)

- Cook Medical

- Terumo Corporation

- Smiths Medical

- Medtronic

- Abbott Laboratories

- Teleflex Incorporated

- AngioDynamics

- Fresenius Medical Care

- Johnson & Johnson

- ICU Medical

- Vygon SA

- ConvaTec Group

- Becton, Dickinson and Company

Vascular Access Device Industry Developments

- In October 2023, B. Braun launched a new product line of antimicrobial-coated catheters designed to reduce the risk of catheter-related bloodstream infections. This launch represents the company’s ongoing efforts to address the growing concern of infections in vascular access procedures.

- In September 2023, Medtronic announced the launch of a new ultrasound-guided vascular access device that aims to improve the accuracy and safety of catheter insertion procedures. This product reflects the company’s focus on enhancing the overall patient experience and reducing complications in vascular access.

Vascular Access Device Market Segmentation

By Product Outlook

- Short PIVCs

- Huber Needles

- Midline Catheters

- PICCs

- CVCs

- Dialysis Catheters

- Implantable Ports

By End User Outlook

- Hospitals

- Ambulatory Surgery Centers

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Vascular Access Device Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.02 billion |

|

Market Size Value in 2025 |

USD 6.49 billion |

|

Revenue Forecast by 2034 |

USD 13.65 billion |

|

CAGR |

7.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The vascular access device market has been segmented on the basis of product and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy

The VAD market growth and marketing strategies are centered around innovation, geographic expansion, and strategic partnerships. Companies are focusing on developing advanced, safer, and more effective products, such as antimicrobial-coated catheters and ultrasound-guided insertion devices, to reduce complications and improve patient outcomes. Many players are expanding into emerging markets such as Asia Pacific and Latin America, where healthcare infrastructure is improving and demand for medical devices is growing. Partnerships, and mergers and acquisitions also play a key role in broadening product portfolios and gaining access to new technologies. Additionally, companies are increasingly targeting the home healthcare segment as more patients seek treatment outside of hospital settings.

FAQ's

The global vascular access device market size was valued at USD 6.02 billion in 2024 and is projected to grow to USD 13.65 billion by 2034.

The global market is projected to register a CAGR of 7.7% during 2025–2034.

North America had the largest share of the global market in 2024.

A few key players in the vascular access device market are B. Braun Melsungen AG, C.R. Bard (acquired by Medtronic), Cook Medical, Terumo Corporation, Smiths Medical, Medtronic, Abbott Laboratories, Teleflex Incorporated, AngioDynamics, Fresenius Medical Care, Johnson & Johnson, ICU Medical, Vygon SA, and ConvaTec Group.

The short peripheral intravenous catheters (PIVCs) segment accounted for the largest share of the global market in 2024.

The hospitals segment dominated the VAD market share in 2024.

A vascular access device (VAD) is a medical device designed to provide access to a patient's blood vessels for medical treatments such as administering medications, fluids, blood sampling, or dialysis. These devices are essential in various healthcare settings, including hospitals, clinics, and home healthcare environments, especially for patients who require long-term or frequent treatments. Common types of vascular access devices are peripheral intravenous catheters (PIVC), peripherally inserted central catheters (PICC), central venous catheters (CVC), dialysis catheters, and implantable ports. These devices allow healthcare providers to deliver care effectively while minimizing discomfort and reducing the risk of complications such as infections

A few key VAD market trends are described below: Rising Shift Toward Home Healthcare: Growing demand for vascular access devices in home care settings, driven by the preference for cost-effective and convenient treatments outside of hospitals. Increasing Focus on Infection Prevention: Increasing emphasis on developing devices with antimicrobial coatings and improved materials to reduce the risk of catheter-related infections. Technological Advancements: Adoption of advanced technologies such as ultrasound-guided catheter insertion and automated robotic assistance to enhance accuracy and reduce complications. Rising Demand for Long-Term VADs: Increasing preference for long-term devices such as PICCs and implantable ports, particularly for patients undergoing extended therapies.

A new company entering the VAD market must focus on developing innovative products that enhance patient safety and comfort, including antimicrobial-coated devices or minimally invasive solutions such as ultrasound-guided insertion tools. Growing focus on the emerging home healthcare segment can also offer a competitive edge by creating user-friendly and reliable devices for at-home treatments. Additionally, prioritizing geographical expansion into emerging markets, where healthcare infrastructure is improving, will help capture untapped demand. Building strong relationships with healthcare providers and ensuring compliance with regulatory standards will be crucial for gaining trust and market share

Companies manufacturing, distributing, or purchasing vascular access devices and related products and other consulting firms must buy the report.