Ventilators Market Share, Size, Trends, Industry Analysis Report

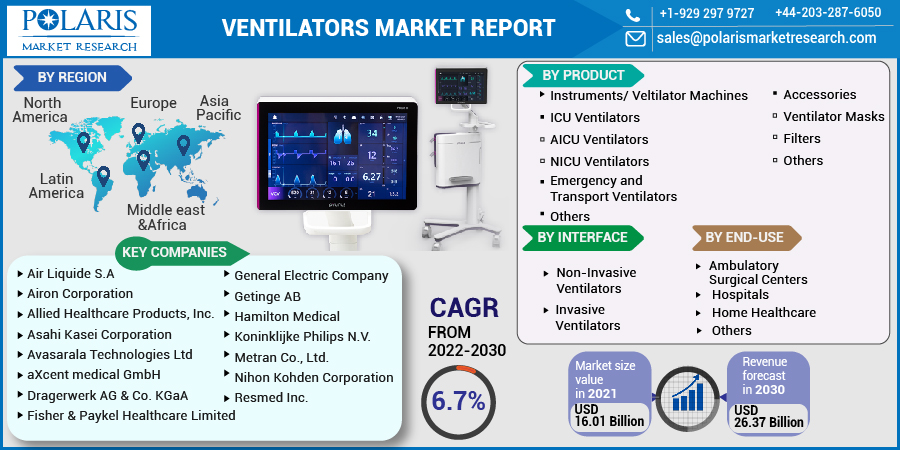

By Product (Instruments/ Ventilator Machines, Accessories); By End-Use; By Interface (Invasive, Non-Invasive); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 119

- Format: PDF

- Report ID: PM1990

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

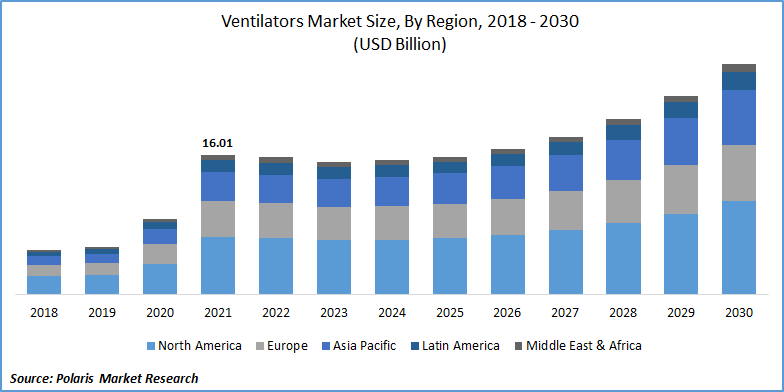

The global Ventilators market was valued at USD 16.01 Billion in 2021 and is expected to grow at a CAGR of 6.7% during the forecast period. Increasing chronic and infectious disease incidences, a growing number in the aging populations, a spike in the number of preterm births, an increasing number of ICU beds, evolving technologies of neonatal care, and the advent of the COVID-19 pandemic are some of the critical factors that will possibly supplement the growth of the global ventilators market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Ventilators are in high demand in the market around the globe. This is due to increasing COVID-19 cases that cause an acute respiratory infection with pneumonia, and these devices are the most common supportive care for critically ill patients. They help or substitute breathing by injecting oxygen into the bloodstream for vital organs. As a result, the industry is projected to expand significantly in the coming years. Hybrid respiratory solutions, helmet-based, wireless networking, 3D printing, and high-performance turbine-based ventilators are some technological advancements that can help the market expand.

The emergence of COVID-19 will be the most important factor that will drive the market during the forecast period. The increasing cases of COVID-19, respiratory diseases, and emerging technologies have resulted in the introduction new ventilator products in the market. For instance, In April 2020, Philips increased the Philips Respironics E30 ventilator production with plans to produce nearly 15,000 units every week to meet the increasing global need due to the pandemic.

A research team from IISc, India, has successfully developed a prototype of an ICU-grade ventilator within 50 days. The ventilator uses proprietary techniques and algorithms that will correct the ratio of air and oxygen supports in both non-invasive and invasive ventilation in the market.

Governments across the globe are significantly investing to increase the number of ventilators in healthcare facilities in this market. In April 2020, General Motors entered into a deal with the government to produce 30,000 ventilators for $489.4 million to meet the need of hospitals during the coronavirus pandemic. General Electric and Ford Motor also entered into a $336 million federal contract to produce 50,000 ventilators for the U.S. government.

Industry Dynamics

Growth Drivers

The increasing incidence of chronic and respiratory diseases, growing geriatric population, development of new ventilator technologies, along the emergence of the COVID-19 pandemic is expected to drive the global market during the forecast period. Globally, more than 720 billion people are over 65 years of age, and most chronic diseases affect this population in the market. Ventilator is used in the treatment of many chronic diseases which need emergency treatment.

The geriatric population is expected to double by 2050. Chronic respiratory diseases such as COPD are increasing worldwide, and according to research conducted by UK researchers, nearly 550 billion people are suffering from COPD globally. It is the third most common cause of death in the year 2019.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on product interface, end-use, and region.

|

By Product |

By Interface |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Product

The instruments/ventilator machines segment generated the highest market revenue in 2021, owing to a spike in the number of respiratory disease patients, a surge in the percentage of preterm births, and the outbreak of the COVID-19 pandemic. ICU ventilators generated the highest market revenue in 2021, owing to the high demand for non-invasive ventilators and the rise in the patient population.

Insight by End-Use

The hospital end-user segment generated the highest revenue in 2021. One of the significant factors contributing to the surge in demand is an increase in hospital ICU admissions. The rising prevalence of respiratory disease and COVID-19 is also the added factor expected to propel the growth of this market segment. The COVID-19 pandemic has put a strain on healthcare services and enhanced the number of hospital admissions. Furthermore, the growing number of hospitals in developing economies is expected to augment the demand for ICU equipment in this market.

Geographic Overview

North American region is expected to be the most significant contributor to market revenue share in the global ventilators market due to the modern healthcare infrastructure, increased geriatric population, and chronic respiratory diseases. The U.S. is also home to more than 54 billion geriatric population in 2021, which is expected to reach 100 billion by 2060. There are also more than 16 billion people living with COPD.

Asia Pacific region is expected to be the fastest-growing region in the global ventilators market due to the increase in healthcare infrastructure, rising cases of COVID-19, chronic respiratory diseases, and various collaborations and strategic agreements. For instance, in June 2020, the government allocated INR 2,000 crore for producing 50,000 ventilators indigenously to meet the need of healthcare facilities during a pandemic.

Competitive Insights

There is an increased focus on developing innovative, cost-effective ventilators across the globe to meet the urgent need for healthcare owing to the pandemic situation. Many companies, including some of the U.S.-based automotive giants, have switched to the production of mechanical ventilators, which is expected to increase the competition in the global ventilators market significantly.

Some of the major players operating in the market include Air Liquide S.A, Airon Corporation, Allied Healthcare Products, Inc., Asahi Kasei Corporation, Avasarala Technologies Ltd, aXcent medical GmbH, Dragerwerk AG & Co. KGaA, Fisher & Paykel Healthcare Limited, General Electric Company (GE Healthcare), Getinge AB, Hamilton Medical, Koninklijke Philips N.V., Metran Co., Ltd., Nihon Kohden Corporation, Resmed Inc., Shenzhen Mindray Bio-Medical Electronic Co., Ltd., Smiths Group plc, Ventec Life Systems, and Vyaire Medical, Inc.

Ventilators Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 16.01 Billion |

|

Revenue forecast in 2030 |

USD 26.37 Billion |

|

CAGR |

6.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Interface, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Air Liquide S.A, Airon Corporation, Allied Healthcare Products, Inc., Asahi Kasei Corporation, Avasarala Technologies Ltd, aXcent medical GmbH, Dragerwerk AG & Co. KGaA, Fisher & Paykel Healthcare Limited, General Electric Company (GE Healthcare), Getinge AB, Hamilton Medical, Koninklijke Philips N.V., Metran Co., Ltd., Nihon Kohden Corporation, Resmed Inc., Shenzhen Mindray Bio-Medical Electronic Co., Ltd., Smiths Group plc, Ventec Life Systems, and Vyaire Medical, Inc. |