Vessel Sealing Devices Market Share, Size, Trends, Industry Analysis Report

By Application (General Surgery, Laparoscopic); By Region; Segment Forecast, 2022-2030

- Published Date:Dec-2022

- Pages: 114

- Format: PDF

- Report ID: PM2943

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

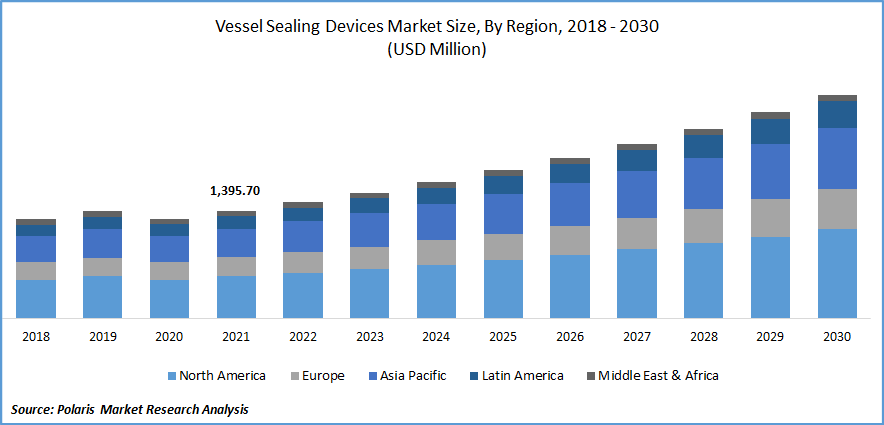

The global vessel sealing devices market was valued at USD 1,395.70 million in 2021 and is expected to grow at a CAGR of 8.5% during the forecast period.

The market's growth potential is attributed to the main factors including expanding surgical techniques, product developments, and inclination for minimally invasive surgeries. For instance, Medtronic, a leader in the market for vascular sealing devices, reported sales of USD 5.4 million for its portfolio of surgical innovations, which includes stapling, cutting-edge energy, and imaging tools. This was caused by a robust portfolio with ongoing product improvements.

Know more about this report: Request for sample pages

In a minimally invasive surgical operation, a vascular sealing device is utilized to cut, coagulate, separate, and close the blood vessels. Various energy types are frequently employed to seal the vessels. Bipolar, ultrasonic, and hybrid energy kinds are included in this. Active electrodes in the vessel sealing devices circuit an AC current aimed at the desired tissue. When selecting the proper vessel sealing mechanisms, a number of aspects, including dependability and efficiency, are taken into account.

The vessel sealing devices market for vessel sealing devices is expanding as a result of rising product improvement. This is because there is a rising need for vessel sealing technologies that provide higher levels of uniformity, utility, dependability, efficiency, and safety.

Due to low demand and sales, the COVID-19 pandemic negatively affected the vessel sealing device market. This was brought on by issues with the supply chain, postponed or canceled elective surgeries, diminished sales and marketing efforts, and movement limitations as a result of lockdowns.

A model reference list of fundamental and important medical equipment used in healthcare institutions for the clinical management of coronavirus and other end uses is required in response to the worldwide COVID-19 pandemic. While the pandemic is still going on, businesses in the vessel sealing devices industry are keeping strong supply chains for their products to lower the morbidity and mortality rates in hospitals.

The integration of these gadgets into robotic surgical systems involves other market participants. For instance, the da Vinci surgical system is compatible with Intuitive Surgical's SynchroSeal, which enables users to quickly seal and cut vessels up to 5 mm in diameter.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Devices that provide a rapid and less intrusive method of sealing tears and holes in blood vessels are being developed by med-tech businesses in the vascular sealing devices sector. An electrically actuated glue patch that is administered with a minimally invasive balloon catheter has gained recognition thanks to a research team led by Nanyang Technological University (NTU), Singapore. These tools offer a viable alternative to open or keyhole surgery for repairing or stitching together internal blood artery abnormalities.

Additionally, the expanding market for vascular sealing devices is benefited from the increased demand for effective and safe surgical instruments to reduce infection rates and blood loss. Additional factors that are expected to contribute to the market's growth include the creation of state-of-the-art, high-quality vessel sealing devices, a rise in cardiovascular, urological, gynecological, and orthopedic procedures, and a significant expansion of the medical industry.

Report Segmentation

The market is primarily segmented based on application and region.

|

By Application |

By Region |

|

|

Know more about this report: Request for sample pages

In 2021, the laparoscopic surgery segment dominated the market

The market for vascular sealing devices was dominated by the laparoscopic surgery segment, due to an increase in the demand for and use of minimally invasive procedures, as well as public awareness of the advantages of laparoscopic procedures over open procedures. Furthermore, the market is anticipated to grow as a result of favorable reimbursement policies for laparoscopic procedures in the United States. Due to its benefits, awareness of these surgeries is also growing, which supports the market's expansion. According to a 2020 retrospective study conducted by the Department of Surgery, Cleveland Medical Center, in the United States, minimally invasive surgery is becoming more and more popular, and general surgery residents are performing fewer open operations. The need for vessel sealing devices is anticipated to increase as a result of this development.

General procedures have a small market share due to their expensive price and extended post-operative hospital stay. Olympus Corporation also provides instrument lines for endoscopic and open surgery under the Thunder beat and Sonicbeat names. The tools employ sophisticated bipolar energy for vessel sealing and reliable hemostasis, and ultrasonic energy for swift and accurate dissection. For the best results during open surgical procedures, the seal and cut mode streamlines the process of spot coagulation and pre-sealing of vessels.

The demand in Asia-Pacific is expected to witness significant growth.

Over the next several years, the vessel sealing device market in Asia Pacific is anticipated to grow at the fastest rate of CAGR. This is due to investments made by businesses to increase their regional presence and build out the infrastructure for healthcare.

In 2022, North America held the greatest revenue share in the market for vessel sealing devices. The presence of significant firms and hospitals with cutting-edge technology in the United States and Canada accounts for the region's considerable market share. Due to an aging population, the prevalence of chronic illnesses, and the rising number of operations, Europe represented the second-largest revenue share of the market in 2022. For instance, According to the Federal Statistical Office, Germany saw 17.2 million surgical procedures in 2019. Among them, surgeries on the intestine, the spine, endoscopes, and hip implants were some of the most frequent. According to estimates, this will raise the region's share.

Competitive Insight

Some of the major players operating in the global market include, Medtronic, Olympus Corporation, B. Braun Melsungen AG, Medical Devices Business Services, Inc. (Johnson & Johnson), Erbe Elektromedizin GmbH, Bowa Medical, OmniGuide Holdings, Inc., Intuitive Surgical, Bolder Surgical, LLC, KLS Martin Group

Recent Developments

- In November 2019, Intuitive Surgical got FDA authorization for their SynchroSeal vascular sealer and E-100 Generator for da Vinci X/Xi surgical systems.

Vessel Sealing Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1,511.40 million |

|

Revenue forecast in 2030 |

USD 2,906.01 million |

|

CAGR |

8.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Medtronic, Olympus Corporation, B. Braun Melsungen AG, Medical Devices Business Services, Inc. (Johnson & Johnson), Erbe Elektromedizin GmbH, Bowa Medical, OmniGuide Holdings, Inc., Intuitive Surgical, Bolder Surgical, LLC, KLS Martin Group |