Veterinary Artificial Insemination Market Size, Share, Trends, Industry Analysis Report

By Solution (Equipment & Consumables, Semen, Services), By Type, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 130

- Format: PDF

- Report ID: PM3661

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

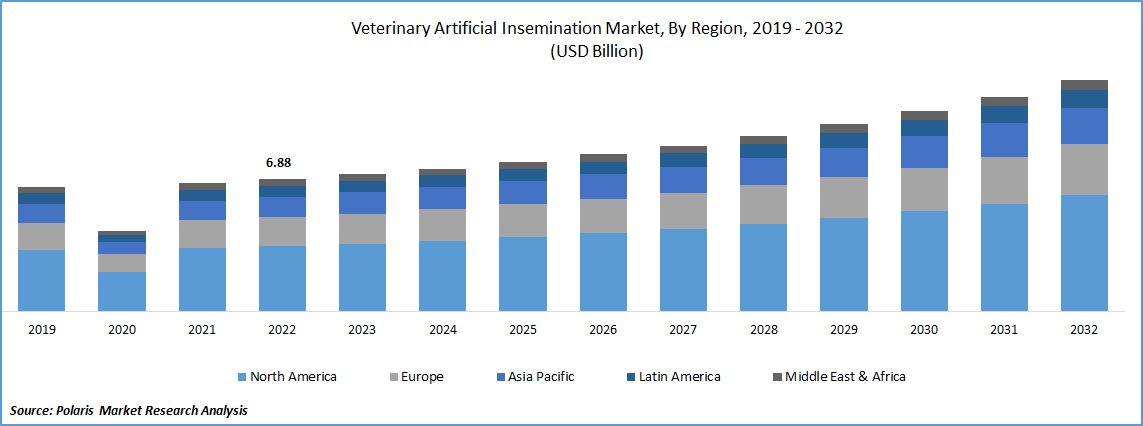

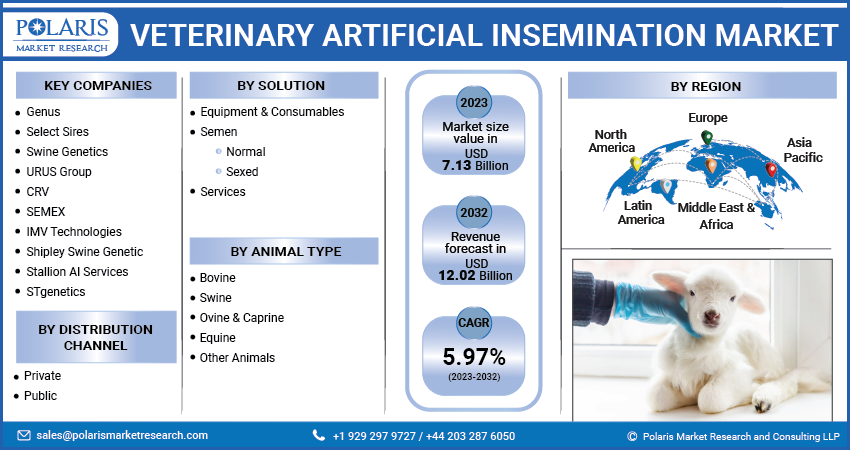

The veterinary artificial insemination market size was valued at USD 7.80 billion in 2024, exhibiting a CAGR of 6.7% from 2025 to 2034. Rising demand for improved animal genetics and increasing livestock productivity drive the market growth. In addition, growing awareness of reproductive technologies among farmers and breeders for economic and efficiency gains would boost the market expansion during the forecast period.

Key Insights

- The services segment dominated the market share in 2024. The growth is driven by the complexity of artificial insemination procedures and the growing demand for professional expertise in animal reproduction.

- The bovine segment held the largest share in 2024. The widespread adoption of artificial insemination in the cattle industry drives the segment growth.

- The private distribution channel segment held the largest market share in 2024. The segment is fueled by the extensive network of private veterinary clinics, animal husbandry service providers, veterinary clinical trial sponsors, and specialized breeding centers globally.

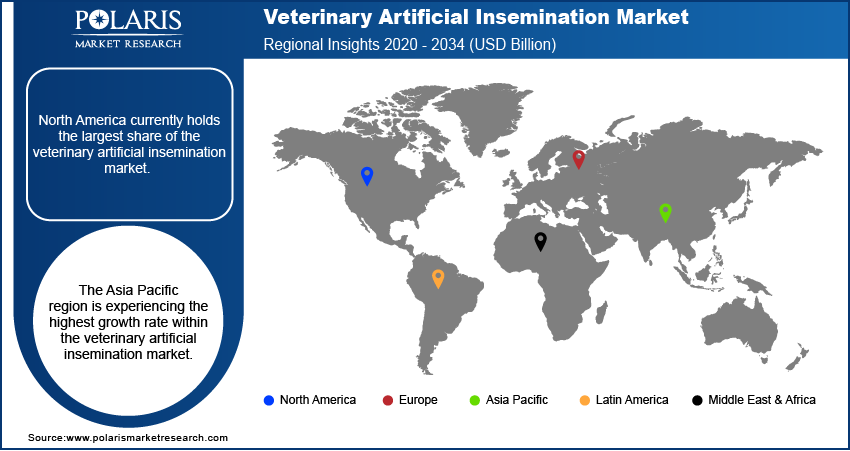

- North America held the largest share of the global veterinary artificial insemination market in 2024. This dominance is attributed to the region's sophisticated animal agriculture sector. The high adoption rates of advanced breeding technologies also drives the industry expansion.

- The Asia Pacific market is expected to register the highest growth rate during the forecast period. This rapid expansion is fueled by the region's large and growing livestock population. The increasing awareness of the benefits of artificial insemination in improving animal genetics and productivity propels the market growth.

Industry Dynamics

- There is a growing emphasis on utilizing artificial insemination to enhance genetic traits in livestock, such as disease resistance, milk production, and meat quality.

- Governments of various countries are taking Initiatives to enhance livestock genetics and productivity, which propels the growth of the industry.

- Rising focus on reducing risks associated with animal breeding would create opportunities during the forecast period.

- Advancements in semen sexing technologies are gaining traction. It enables breeders to predetermine the sex of offspring with greater accuracy.

- Lack of skilled professionals hinders the market growth.

Market Statistics

- 2024 Market Size: USD 7.80 billion

- 2034 Projected Market Size: USD 14.88 billion

- CAGR (2025–2034): 6.7%

- North America: Largest market in 2024

AI Impact on Veterinary Artificial Insemination Market

- AI tools analyze genetic data to select optimal mating pairs. It improves offspring traits such as milk yield, growth rate, and disease resistance.

- Robotics and AI-integrated devices are used to automate the insemination process, mostly in large-scale operations.

- AI-powered sensors and wearables help monitor the behavior and physiology of animals to pinpoint the ideal insemination window, which boosts success rates.

- AI collects data from health metrics, breeding records, and environmental factors. It helps make reproductive decisions and reduce insemination failures.

The veterinary artificial insemination market focuses on technologies and services that enhance reproductive efficiency in animals, particularly livestock. The process includes the controlled sperm insertion into the female reproductive tract without natural mating. It improves genetic quality, manages breeding cycles, and boosts productivity in animal husbandry. The increasing demand for animal protein and the rising need for sustainable farming practices drive the adoption of these technologies. Veterinary artificial insemination also offers essential support in conserving endangered species and enhancing gene pool diversity. The market growth is propelled by the rising need for improved genetics and breeding outcomes in livestock that require sterilization containers, the increasing animal and fishery industry, and the growing awareness of preventing sexually transmitted diseases in animals.

The increasing demand for superior genetic traits in animals, including enhanced milk production, meat quality, and disease resistance, boosts market expansion. Artificial insemination is more hygienic than natural mating. It minimizes the risks associated with animal breeding, including disease transmission. Governments are taking various initiatives aimed at enhancing livestock genetics and productivity, which boosts the market expansion. The increasing adoption of artificial insemination services by veterinary clinics and hospitals propels growth. Also, professional expertise and advanced facilities are available for these procedures, as well as veterinary surgeries.

Drivers and Trends

Increased Demand for Superior Genetic Traits in Animals: Farmers are increasingly seeking to enhance the productivity and health of their livestock through improved genetics. Artificial insemination facilitates the widespread use of semen from animals with desirable traits, leading to healthier and more productive offspring. According to a report by the United States Department of Agriculture (USDA) in 2022, cattle stocks in the U.S. totaled 91.8 million in 2021 and 93.6 million in 2020. The data indicate a growing livestock industry that benefits from genetic improvements. Hence, the increasing demand for enhanced genetic traits is significantly driving the industry growth.

Minimizing Risks Associated with Animal Breeding: Artificial insemination minimizes several risks associated with natural animal breeding. Natural mating can lead to the transmission of diseases and injuries among animals. Such an incidence requires the use of different veterinary antibiotics. As per a study on animal health improvement and AMR reduction in the Indian poultry sector, the use of antimicrobials in the livestock sector is expected to double between 2010 and 2030. Artificial insemination helps reduce the reliance on such practices by providing a controlled and hygienic method of breeding. Therefore, rising focus on reducing risks associated with animal breeding boosts the adoption of veterinary artificial insemination.

Government Initiatives Enhancing Livestock Genetics and Productivity: Governments of many countries introduce various programs to improve bovine and other animal genetics. The Department of Animal Husbandry and Dairying in India implemented the Rashtriya Gokul Mission. The initiative focuses on developing and conserving indigenous breeds and genetically upgrading the bovine population. According to the department's annual report for 2022–23, India's milk production significantly increased with a 5.29% annual growth due to such initiatives. These government efforts to boost livestock productivity through genetic improvement fuel the industry growth.

Segmental Insights

Solution Analysis

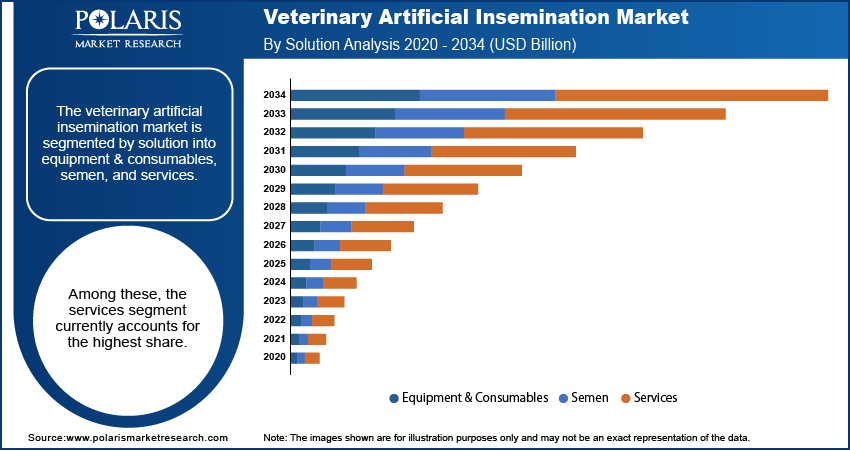

The segmentation includes equipment & consumables, semen, and services. The services segment accounted for the largest share in 2024. The increasing complexity of artificial insemination procedures and the growing demand for professional expertise in animal reproduction drive the segment dominance. The segment encompasses a range of offerings, including consultation, semen processing and storage, insemination procedures, and training for farm personnel. The rising awareness regarding the benefits of professional artificial insemination services and the need for specialized skills and equipment fuel the segment expansion.

The semen segment is expected to register the highest growth rate during 2025–2034. This is attributed to the foundational role of semen in the artificial insemination process. The consistent demand for high-quality semen from genetically superior animals across various livestock species, including cattle, swine, and equine, boosts the segment’s growth rate. The ongoing need for genetic improvement and the widespread adoption of artificial insemination practices in animal breeding programs boost the semen segment growth.

Type Analysis

The segmentation includes bovine, swine, ovine & caprine, equine, and others. The bovine segment dominates the revenue share due to the widespread adoption of artificial insemination in the cattle industry globally. The demand for enhanced milk and meat production, coupled with well-established artificial insemination practices for cattle breeding, contributes to the dominance of this segment. The large population of cattle and the continuous focus on improving their genetic makeup through artificial insemination solidify the bovine segment's leading position.

The equine segment is experiencing the highest growth rate during the forecast period. This increasing adoption is driven by the unique advantages artificial insemination offers in horse breeding. It allows for the breeding of valuable horses across geographical distances. Artificial insemination reduces the risks associated with live cover and facilitates precise breeding management. The growing interest in competitive equestrian sports and the desire for offspring from champion bloodlines boost the use of artificial insemination in horses.

Distribution Channel Analysis

The segmentation includes private and public. The private distribution channel holds the largest share. The dominance is attributed to the extensive network of private veterinary clinics, animal husbandry service providers, veterinary clinical trial sponsors, and specialized breeding centers globally. These private entities often offer various artificial insemination services, including semen supply, storage, and the insemination procedure itself, making them a readily accessible option for animal owners. The established infrastructure and widespread presence of the private distribution channel contribute significantly to its leading share.

The public segment is expected to record the highest growth rate during the forecast period. This increasing growth is propelled by government initiatives and programs aimed at enhancing livestock productivity and supporting animal health. Public sector entities include government veterinary hospitals and agricultural departments. These entities increasingly promote and provide artificial insemination services, often at subsidized rates or as part of broader livestock improvement schemes. The rising emphasis on bolstering the agricultural sector and improving animal genetics through public support fuels the expansion of the public distribution channel.

Regional Analysis

The North America veterinary artificial insemination market holds the largest share. This dominance can be attributed to the region's sophisticated animal agriculture sector, high adoption rates of advanced breeding technologies, and the presence of leading companies in the animal health and reproduction industry. The well-established infrastructure for veterinary services and the strong emphasis on maximizing livestock productivity contribute significantly to North America's leading position.

The Asia Pacific veterinary artificial insemination market is expected to witness the highest growth rate in the coming years. This rapid expansion is fueled by the region's large and growing livestock population and increasing awareness of the benefits of artificial insemination in improving animal genetics and productivity. Rising disposable incomes enable greater investment in animal health and breeding services, which drives the regional market development. Government initiatives promoting modern animal husbandry practices and the increasing demand for animal protein propel the Asia Pacific market expansion.

Key Players and Competitive Insights

The competitive landscape is characterized by a mix of global and regional players. The companies are striving to offer advanced genetic solutions and reproductive services. Competition revolves around factors such as the quality and variety of semen offered, technological advancements in semen sexing and cryopreservation, the provision of comprehensive services such as genetic consultation and on-farm support, and the establishment of strong distribution networks. Strategic collaborations, and mergers and acquisitions are also notable trends. Companies aim to expand their penetration and enhance their product portfolios to meet the evolving demands of animal breeders.

A few major players active in the veterinary artificial insemination market include IMV Technologies; Neogen Corporation; Zoetis Inc.; Select Sires Inc.; Genus plc (ABS Global); Swine Genetics International, Ltd.; URUS Group LP; STgenetics; CRV; and Viking Genetics.

Key Companies

- CRV

- Genus plc (ABS Global)

- IMV Technologies

- Neogen Corporation

- Select Sires Inc.

- STgenetics

- Swine Genetics International, Ltd.

- URUS Group LP

- Viking Genetics

- Zoetis Inc.

Veterinary Artificial Insemination Industry Developments

- March 2025: Rajasthan began using 100,000 locally-made sex-sorted semen doses, in partnership with NDDB. The doses can boost female calf births and strengthen high-yield cow populations.

- January 2025: IMV Technologies revealed its plan to acquire Canada’s Conception Ro-Main Inc.. The company aims to expand its farm animal division with AI-driven and IoT-enabled swine farming innovations.

- February 2024: HKScan Sweden partnered with PIC to enhance its Hampshire pig line, using PIC’s expertise and technologies to improve breeding and productivity outcomes.

Veterinary Artificial Insemination Market Segmentation

By Solution Outlook (Revenue – USD Billion, 2020–2034)

- Equipment & Consumables

- Semen

- Services

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Bovine

- Swine

- Ovine & Caprine

- Equine

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Private

- Public

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Veterinary Artificial Insemination Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.80 billion |

|

Market Size in 2025 |

USD 8.30 billion |

|

Revenue Forecast by 2034 |

USD 14.88 billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.80 billion in 2024 and is projected to grow to USD 14.88 billion by 2034.

The market is projected to register a CAGR of 6.7% during the forecast period, 2024-2034.

North America had the largest share of the market.

Some major players include IMV Technologies, Neogen Corporation, Zoetis Inc., Select Sires Inc., Genus plc (ABS Global), Swine Genetics International, Ltd., URUS Group LP, STgenetics, CRV, and Viking Genetics.

The semen segment accounted for the larger share of the market in 2024.

Following are some of the trends: ? Increasing Focus on Genetic Improvement: There's a growing emphasis on utilizing artificial insemination to enhance genetic traits in livestock, such as disease resistance, milk production, and meat quality, driven by the need for greater efficiency and sustainability in animal agriculture. ? Advancements in Semen Sexing Technologies: Innovations in semen sexing are gaining traction, allowing breeders to predetermine the sex of offspring with greater accuracy.

Veterinary Artificial Insemination (AI) is a reproductive technology where sperm is collected from a male animal and manually deposited into the female's reproductive tract to achieve pregnancy without natural mating. This technique is widely used across various animal species, including livestock, companion animals, and even wildlife. The primary goal is to improve breeding efficiency, genetic quality, and overall herd or population health. AI offers numerous advantages over natural mating, such as facilitating the use of superior genetics over a wider population, reducing the risk of disease transmission, and overcoming physical limitations in breeding.