Veterinary Neurodegenerative Disease Diagnostics Market Size, Share, Trends, & Industry Analysis Report

By Product (Consumables, Reagents, & Kits and Equipment & Instruments), By Test, By Animal Type, By Indication, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5768

- Base Year: 2024

- Historical Data: 2020-2023

Overview

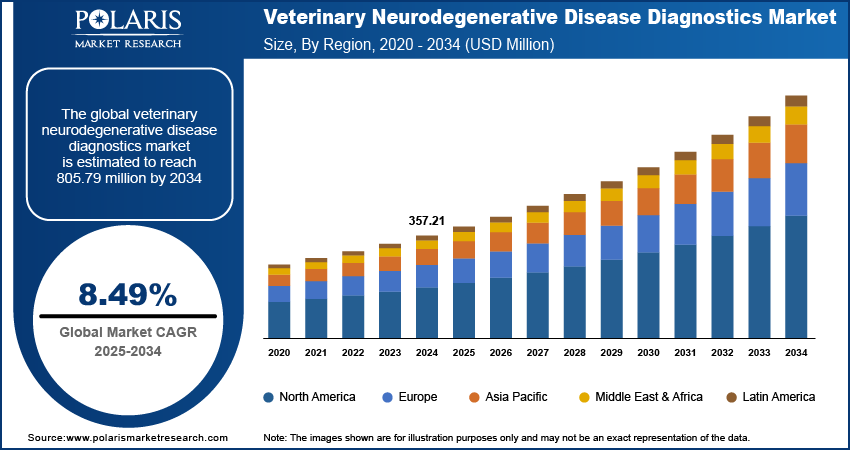

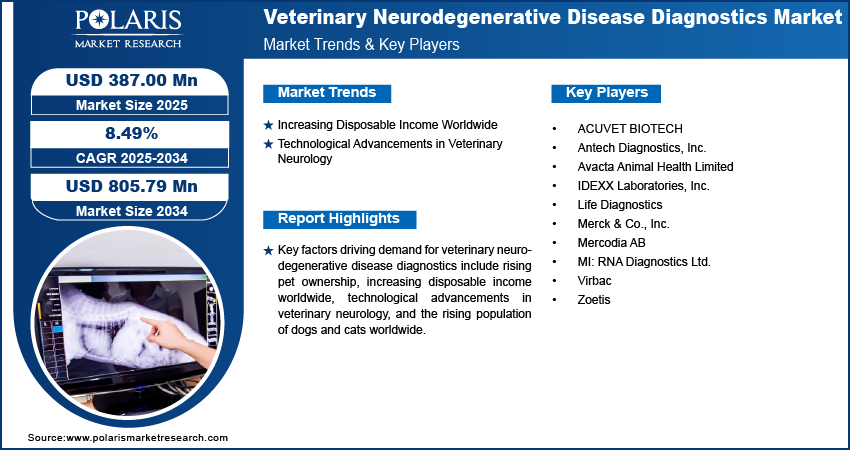

The global veterinary neurodegenerative disease diagnostics market size was valued at USD 357.21 million in 2024, growing at a CAGR of 8.49% during 2025–2034. Key factors driving demand for veterinary neurodegenerative disease diagnostics include rising pet ownership, increasing disposable income worldwide, technological advancements in veterinary neurology, and the rising population of dogs and cats worldwide.

Veterinary neurodegenerative disease diagnostics are specialized tests and technologies used by veterinarians to detect, monitor, and manage neurodegenerative diseases in animals, such as canine cognitive dysfunction syndrome, degenerative myelopathy in dogs, cerebellar abiotrophy in horses, and others. These diagnostics include advanced molecular and biochemical tests, genetic screening, and imaging tests such as MRI and CT scans, which allow for the early and accurate identification of neurological disorders that are usually difficult to diagnose based on clinical symptoms. Veterinary neurodegenerative disease diagnostics are primarily used in veterinary hospitals, clinics, and diagnostic laboratories, where they support comprehensive care and facilitate rapid decision-making for treatment plans.

The rising global pet ownership is driving the market growth. According to the American Veterinary Medical Association, the number of pet dog-owning households in the US increased from 31.3 million in 1996 to 59.8 million in 2024. This increasing pet ownership is leading to a higher incidence of age-related and genetic neurodegenerative conditions, such as cognitive dysfunction syndrome (CDS). This is fueling demand for veterinary neurodegenerative disease diagnostics to detect and manage these conditions early, and improve the overall health of pets.

The veterinary neurodegenerative disease diagnostics demand is driven by the rising population of dogs and cats worldwide. According to the American Veterinary Medical Association, from 1996 to 2024, the dog population in the US increased from 52.9 million to a new peak of 89.7 million, whereas the cat population increased from 59.8 million to 73.8 million. This increasing population is fueling the incidence of health issues, including neurodegenerative diseases such as cognitive dysfunction syndrome, cerebellar abiotrophy, and spongiform encephalopathies. This increasing incidence of neurodegenerative diseases propels the demand for advanced veterinary diagnostic tools for early detection and management.

Industry Dynamics

Increasing Disposable Income Worldwide

Increasing disposable income is encouraging pet owners to prioritize their pets' health and seek early detection and specialized treatments for conditions such as cognitive dysfunction syndrome (CDS) in dogs and dementia in cats. Growing disposable income is also fueling the growth of premium veterinary services, including neurology specialties, as wealthier pet owners increasingly seek out clinics with advanced diagnostic tools, pushing veterinarians to adopt advanced technologies. Additionally, increased spending power strengthens the pet insurance industry, making costly neurodegenerative diagnostics more accessible. Therefore, as the disposable income of people across the globe increases, the demand for veterinary neurodegenerative disease diagnostics also rises.

Technological Advancements in Veterinary Neurology

Technological advancements in veterinary neurology are increasing the demand for neurodegenerative disease diagnostics by making detection faster, more accurate, and less invasive. Advanced imaging tools such as high-resolution MRI and CT scanners are now allowing veterinarians to identify brain abnormalities with clarity, encouraging more pet owners to pursue diagnostic testing. The development of portable and affordable diagnostic devices is further expanding access to neurological testing beyond specialty hospitals. General veterinary clinics can now use handheld EEGs or rapid blood tests that screen for neurodegenerative markers, making diagnostics available to a wider range of pets, leading to market expansion.

Segmental Insights

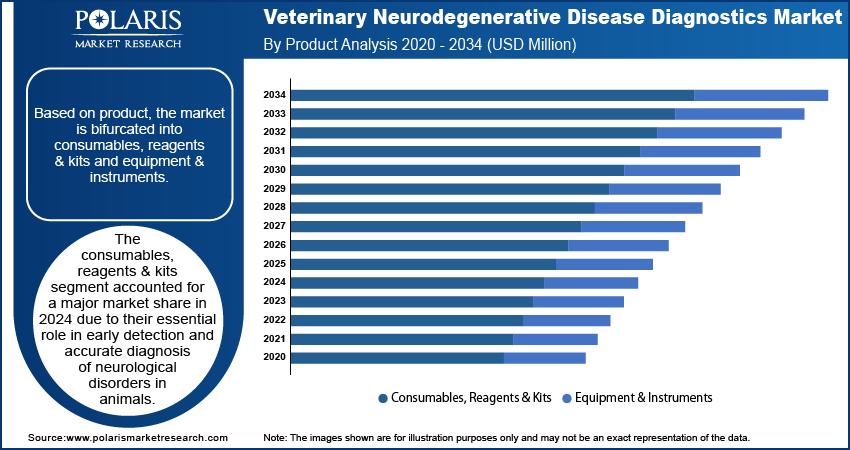

By Product Analysis

The consumables, reagents & kits segment accounted for a major share in 2024 due to their essential role in early detection and accurate diagnosis of neurological disorders in animals. Veterinarians and diagnostic laboratories increasingly rely on advanced biomarker-based kits to identify conditions such as canine cognitive dysfunction and equine neuroaxonal dystrophy. The growing awareness among pet owners regarding the importance of timely neurological tests, combined with the affordability and ease of use of diagnostic kits, drove the growth of the segment. Additionally, the expansion of point-of-care testing capabilities in veterinary clinics supported widespread adoption of consumables, reagents & kits, particularly in urban areas where pet healthcare spending is rising.

By Test Analysis

The imaging segment dominated the market share in 2024, due to its critical role in identifying abnormalities in the brain and spinal cord of animals. Diagnostic imaging techniques such as magnetic resonance imaging (MRI) and micro computed tomography scans allowed veterinarians to detect lesions, atrophy, and inflammation associated with neurodegenerative conditions. The increasing availability of advanced imaging equipment in veterinary hospitals and specialty clinics, coupled with rising pet insurance coverage, also contributed to the growth of the segment.

The biomarker diagnostic tests segment is projected to grow at a robust pace in the coming years, owing to the growing emphasis on early and molecular-level diagnosis. Research advancements in veterinary neuroscience are leading to the identification of specific veterinary biomarkers in blood, cerebrospinal fluid, and other biological samples, enabling accurate and predictive assessments. Furthermore, the increasing prevalence of age-related neurological disorders in pets and the rising interest in preventive veterinary care are fueling the demand for biomarker testing. The convenience, cost-effectiveness, and potential for integration into routine health screenings further make these tests a preferred option for both clinicians and pet owners.

By Animal Type Analysis

The companion segment held the largest share in 2024, due to the rising prevalence of neurological disorders in aging pets, particularly dogs and cats. Pet owners are increasingly prioritizing preventive healthcare and early disease detection, leading to higher diagnostic testing rates for conditions such as canine cognitive dysfunction syndrome and feline dementia. The emotional value placed on pets in households, especially across North America and Europe, is also driving investments in advanced veterinary diagnostics. Furthermore, the growth of urbanization and nuclear families is strengthening the human-animal bond, encouraging more frequent veterinary visits and early neurological assessments.

By Indication Analysis

The cognitive dysfunction accounted for a major share in 2024, due to its high prevalence among aging companion animals, particularly dogs. Pet owners and veterinarians are showing a growing interest in the early detection of behavioral and cognitive changes such as disorientation, memory loss, and altered sleep cycles, fueling segment growth. The rise in awareness campaigns, educational resources, and training programs for veterinarians is further improving diagnostic accuracy for cognitive dysfunction.

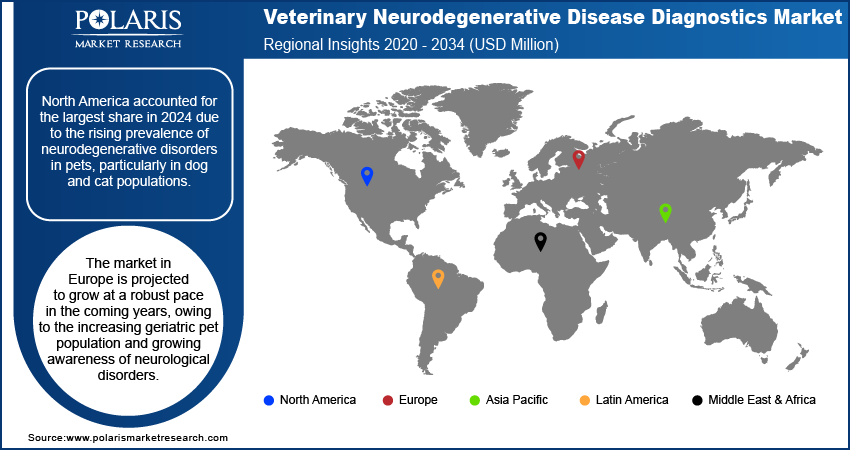

Regional Analysis

The North America veterinary neurodegenerative disease diagnostics market accounted for the largest share in 2024 due to the rising prevalence of neurodegenerative disorders in pets, particularly in dog and cat populations. Increased pet ownership and spending on advanced veterinary care have led to greater awareness and early diagnosis of conditions such as cognitive dysfunction syndrome (CDS) and degenerative myelopathy. Additionally, advancements in diagnostic technologies, such as MRI and genetic testing, along with strong R&D investments by veterinary diagnostic companies, propelled market expansion in the region. Pet insurance adoption and the availability of specialized veterinary neurology services further contributed to market dominance in North America.

US Veterinary Neurodegenerative Disease Diagnostics Market Insight

The US held 63.32% of the regional share in 2024, due to a high pet ownership rate and a growing emphasis on pet health. According to HealthforAnimals, a global animal health association, 70% of households in the US owned a pet as of 2021. Improved veterinary neurology practices in the country further increased the neurodegenerative diseases diagnostic rates in dogs and cats, leading to market growth. The presence of major veterinary diagnostic firms and research innovation in biomarker-based and imaging diagnostics contributed to the dominance of the US in North America. Additionally, increased disposable income in the country supported its dominance in the veterinary neurodegenerative disease diagnostics industry, as it allows pet owners to opt for advanced diagnostic tests. For instance, according to data published by the Bureau of Economic Analysis, the disposable personal income in the US increased by +0.7% in April 2025 from March 2025.

Europe Veterinary Neurodegenerative Disease Diagnostics

The veterinary neurodegenerative disease diagnostics market in Europe is projected to grow at a robust pace in the coming years, owing to the increasing geriatric pet population and growing awareness of neurological disorders. Countries such as Germany, France, and Italy are supporting the adoption of advanced veterinary diagnostics with the presence of established veterinary healthcare systems. The growing trend of pet humanization and willingness to spend on premium pet care is also contributing to market growth. Furthermore, collaborations between veterinary research institutes and diagnostic companies are enhancing the development of novel testing methods, including cerebrospinal fluid (CSF) analysis and genetic screening for inherited neurodegenerative conditions, leading to industry expansion.

UK Veterinary Neurodegenerative Disease Diagnostics Market Overview

The veterinary neurodegenerative disease diagnostics market in the UK is influenced by a strong culture of pet ownership and high expenditure on veterinary services. The increasing lifespan of pets in the country is leading to a higher incidence of age-related neurodegenerative diseases, prompting demand for early diagnostic solutions. The presence of specialized veterinary neurology clinics and academic research centers, such as the Royal Veterinary College, is also supporting innovation in the industry. Additionally, high pet insurance penetration in the country is fueling the market revenue as it enables owners to afford expensive diagnostic procedures.

Asia Pacific Veterinary Neurodegenerative Disease Diagnostics Market

The veterinary neurodegenerative disease diagnostics market in Asia Pacific is projected to hold a substantial share in 2034 due to rising pet adoption, increasing disposable income, and improving veterinary healthcare infrastructure. Countries such as Japan, Australia, and South Korea are leading in veterinary advanced diagnostics due to high pet care standards, while emerging countries such as India are witnessing rapid growth due to urbanization and increasing awareness of pet neurological disorders. For instance, according to the Economic Survey 2023-24, conducted by NITI Aayog, more than 40% of India's population will live in urban areas by 2030. Moreover, growing investments by global diagnostic firms and partnerships with local veterinary hospitals are expected to support the Asia Pacific market demand.

Key Players & Competitive Analysis Report

The veterinary neurodegenerative disease diagnostics industry is highly competitive, with key players leveraging product portfolio expansion, strategic partnerships, and mergers & acquisitions (M&A) to strengthen their positions. Companies such as Zoetis, IDEXX Laboratories, and Heska are investing in advanced diagnostic technologies, including biomarker-based assays, genetic testing, and AI-driven imaging tools, to enhance early detection of conditions such as canine cognitive dysfunction (CCD) and equine neuroaxonal dystrophy. Strategic partnerships are also critical in the industry, as diagnostic firms are collaborating with academic institutions, biotech startups, and veterinary hospitals to fuel R&D and improve test accuracy. M&A activity is further propelling competition, with larger players acquiring specialized diagnostic labs and innovative startups to consolidate expertise.

A few major companies operating in the veterinary neurodegenerative disease diagnostics market include ACUVET BIOTECH; Antech Diagnostics, Inc.; Avacta Animal Health Limited; Heska Corporation; IDEXX Laboratories, Inc.; Life Diagnostics; Merck & Co., Inc.; Mercodia AB; MI:RNA Diagnostics Ltd.; Virbac; and Zoetis.

Key Players

- ACUVET BIOTECH

- Antech Diagnostics, Inc.

- Avacta Animal Health Limited

- IDEXX Laboratories, Inc.

- Life Diagnostics

- Merck & Co., Inc.

- Mercodia AB

- MI: RNA Diagnostics Ltd.

- Virbac

- Zoetis

Industry Developments

March 2024: CVS Group Plc started its mobile CT service visit in Animed Veterinary Hospital and Nine Mile Veterinary, once every four weeks, to enhance Veterinary care.

January 2024: IDEXX Laboratories, Inc., a global company in pet healthcare innovation, announced the launch of the IDEXX inVue Dx Cellular Analyzer to detect the common cytologic changes found in ear and blood samples.

November 2023: Antech, a subsidiary of Mars Petcare, announced the opening of a new UK veterinary diagnostics laboratory in Warwick. This expands Antech's UK lab network, which includes Dick White Referrals Diagnostic Laboratory and Southfields Veterinary Specialists Diagnostic Laboratory.

Veterinary Neurodegenerative Disease Diagnostics Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Consumables, Reagents & Kits

- Equipment & Instruments

By Test Outlook (Revenue, USD Million, 2020–2034)

- Imaging

- MRI (Magnetic Resonance Imaging)

- CT (Computed Tomography)

- Others

- Biomarker Diagnostic Tests

- CSF (Cerebrospinal Fluid) biomarkers

- Blood-based biomarkers

- Others

- Others

By Animal Type Outlook (Revenue, USD Million, 2020–2034)

- Livestock

- Sheep

- Cattle

- Others

- Companion

- Canine

- Feline

- Equine

- Others

By Indication Outlook (Revenue, USD Million, 2020–2034)

- Cognitive Dysfunction

- Cerebellar Abiotrophy

- Spongiform Encephalopathies

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034

- Veterinary Hospitals and Clinics

- Veterinary Diagnostic Laboratories

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Veterinary Neurodegenerative Disease Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 357.21 Million |

|

Market Size in 2025 |

USD 387.00 Million |

|

Revenue Forecast by 2034 |

USD 805.79 Million |

|

CAGR |

8.49% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 357.21 million in 2024 and is projected to grow to USD 805.79 million by 2034.

The global market is projected to register a CAGR of 8.49% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are ACUVET BIOTECH; Antech Diagnostics, Inc.; Avacta Animal Health Limited; Heska Corporation; IDEXX Laboratories, Inc.; Life Diagnostics; Merck & Co., Inc.; Mercodia AB; MI:RNA Diagnostics Ltd.; Virbac; and Zoetis.

The consumables, reagents & kits segment dominated the market share in 2024.

The biomarker diagnostic tests segment is expected to witness the fastest growth during the forecast period.