Veterinary Biomarkers Market Share, Size, Trends, Industry Analysis Report

By Animal Type (Companion Animals, Production Animals); By Product Type; By Application; By Disease Type; By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Aug-2023

- Pages: 118

- Format: PDF

- Report ID: PM3726

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

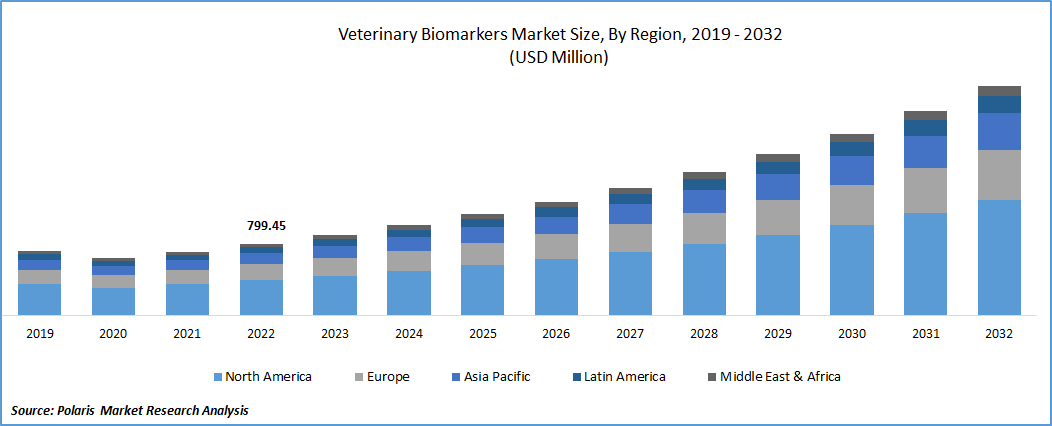

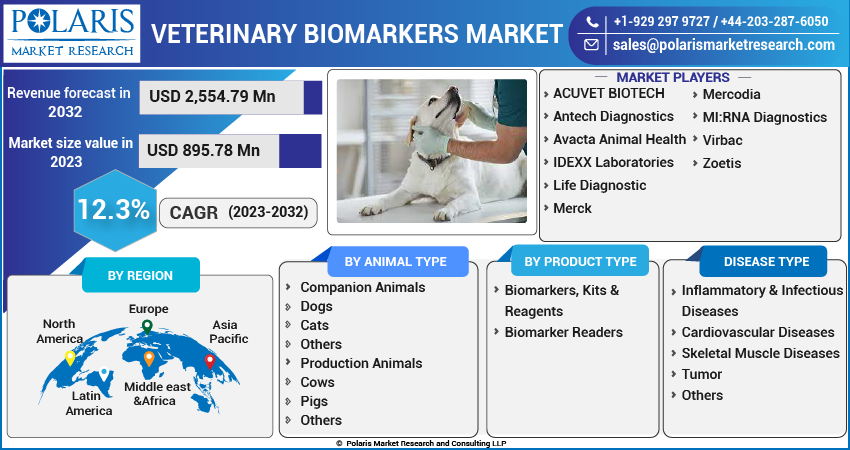

The global veterinary biomarkers market was valued at USD 799.45 million in 2022 and is expected to grow at a CAGR of 12.3% during the forecast period.

Key factors favoring the market growth include increasing focus on research and development by key companies, expansion of product portfolios, higher expenditure on animal healthcare, and the anticipated return to normalcy post-pandemic.

To Understand More About this Research: Request a Free Sample Report

- For instance, the American Pet Products Association's 2023 report indicates that pet industry expenditure in the United States has been consistently rising, from USD 90.5 billion in 2018 to USD 136.8 billion in 2022, with a projected increase to USD 143.6 billion by the end of 2023. Similarly, according to FEDIAF, in Europe, approximately 21.8 billion was spent on pet food products and 21.2 billion was spent on pet-related services and products in 2020. These positive factors are expected to drive market growth during the forecast period.

The uncertainties surrounding distribution channels posed challenges for key market players in supplying veterinary products during the pandemic. However, prominent players and government agencies have implemented several measures to ensure the continuity of animal healthcare businesses. One such example is Merck, which took comprehensive steps to overcome the challenges posed by the pandemic and successfully maintained its animal health business. The company reported a significant increase in worldwide sales, with USD 12.5 Bn in the final quarter of 2020, representing a 5% growth compared to the previous year.

Market experienced a downturn in 2020 as a result of the COVID-19 pandemic. The implementation of lockdown measures in different countries and the subsequent restrictions on access to veterinary services played a significant role in this decline. The pandemic also posed challenges for animal owners as they faced limitations and cancellations of veterinary appointments, making it difficult for them to access proper veterinary care. Even though veterinary practices are considered essential healthcare businesses in the United States, the American Veterinary Medical Association reported that veterinarians faced challenges in providing veterinary services during the pandemic.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Rising incidence of chronic conditions like cancer and cardiovascular diseases among animals is a significant driver for the demand of biomarker-based assay diagnostic kits.

These kits are utilized in veterinary applications to detect diseases in their early stages. The market growth is further propelled by the research and development efforts undertaken by leading companies to improve their biomarker portfolios. Additionally, the increasing population of companion animals and the growing rate of pet adoption are also contributing factors in the veterinary biomarkers market expansion.

In November 2021, the American Veterinary Medical Association reported a substantial increase in the population of companion animals from 2016 to 2020. Furthermore, according to the APPA National Pet Owners Survey (2023-2024), there are approximately 86.9 million households in the United States that own a pet, accounting for over 66% of all households. These statistics are expected to have a positive impact on the growth of the market.

Report Segmentation

The market is primarily segmented based on animal type, product type, disease type, application, and region.

|

By Animal Type |

By Product Type |

Disease Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Animal Type Analysis

Companion animals segment accounted for the largest market share

Companion animals held the largest share. This is primarily attributed to the increasing adoption rates of dogs and the prevalence of diseases among them. The American Kennel Club (AKC) reported a rise in the number of U.S. households owning a dog, from 50% in 2018 to 54% in 2021. Similarly, according to the 2022 FEDIAF European Pet Food Industry report, approximately 90 million households in Europe, accounting for 46% of total households, owned a pet, with an estimated dog population of 92.9 million in 2021. Furthermore, the COVID-19 pandemic prompted many individuals worldwide to adopt dogs for emotional support and companionship.

Production segment is likely to grow at fastest growth rate. This growth can be attributed to the expanding population of production animals, including cattle and other livestock, particularly in developing countries like China, India, & Japan. For instance, data from the national dairy development board indicates that the cattle population in India increased from 185 million in 2003 to 193 million in 2019, while the total bovine population grew from 283 million in 2003 to 302 million in 2019. Additionally, the rising prevalence of serious infectious diseases, such as tuberculosis, among production animals has become a major concern, leading to an increased demand for various diagnostic approaches.

By Product Type Analysis

Kits & reagents segment held the significant revenue share

Kits & reagents segment held the majority market share. Veterinarians increasingly prefer utilizing sensitive and accurate disease diagnostic approaches that utilize biomarker test kits. These kits enable a deeper understanding of disease progression and facilitate precise treatments targeting the specific biological indicators of the disease. Furthermore, the growing awareness of the applications of biomarkers in the veterinary field, particularly in developing countries, has significantly contributed to the market's growth in recent years.

Biomarker readers segment is likely to exhibit fastest growth rate. Unlike human biomarker readers, which are not accurate or calibrated for animal readings, key market players have introduced specialized veterinary biomarker readers. For example, Virbac has developed an intuitive and compact laser-based fluorescent reader called the 'speed reader' that precisely measures biomarker concentrations in animal serum or plasma samples. This development has significantly contributed to the growth of the biomarker readers segment in the market.

By Disease Type Analysis

Inflammatory & infectious diseases segment held the substantial share

Inflammatory & infectious diseases segment held the majority market share. This dominance can be attributed to the increasing incidence of various infectious diseases among both companion and production animals. Governments worldwide have expressed concern about preventing the transmission of zoonotic diseases from animals to humans, leading to the implementation of various diagnostic strategies. As a result, the adoption of biomarker-based diagnostic kits in these initiatives has been on the rise, thereby expanding the market's scope for such products.

Cardiovascular diseases exhibited the steady growth rate. Cardiovascular diseases and cancer are prevalent conditions among animals and require increased focus on proper diagnosis. These diseases often go unnoticed as they are typically asymptomatic and are often overlooked until they reach advanced stages. For instance, research conducted by the University of Kentucky has revealed that a significant number of cattle infected with cancer show no signs of the disease, resulting in delayed treatment and contributing to sudden death cases ranging from 5% to 20%. Consequently, there is a growing demand for accurate diagnostic tests that can detect and predict the progression of diseases and identify risk factors at an early stage.

Regional Insights

North America region dominated the global market in 2022

The North America region dominated the global market. Region’s growth is primarily due to implementation of effective strategies to expand their market reach, increased research and development activities, higher diagnostic rates, and a growing expenditure on veterinary care and animal population. Furthermore, the region has witnessed a significant rise in the number of veterinary clinics staffed with licensed and trained veterinarians. According to the American Veterinary Medical Association (AVMA), the United States alone had approximately 118,624 licensed veterinarians in 2020, with a primary focus on providing healthcare services to companion animals.

APAC expected to grow at the fastest rate. This is primarily due to increased expenditure on animal healthcare and rising disposable income in key markets within the region. Additionally, there is a growing awareness of the significance of biomarkers in veterinary practices, driving the demand for accurate and timely disease diagnosis. The market growth is further fueled by the rising demand for pet humanization and the need for advanced diagnostic tools in developing countries such as India.

Key Market Players & Competitive Insight

Key players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- ACUVET BIOTECH

- Antech Diagnostics

- Avacta Animal Health

- IDEXX Laboratories

- Life Diagnostic

- Merck

- Mercodia

- MI:RNA Diagnostics,

- Virbac

- Zoetis

Recent Developments

- In October 2021, A new manufacturing facility was established by Zoetis in Ireland, aimed at expanding their production capabilities for monoclonal antibodies. This strategic move has enabled Zoetis to enhance their manufacturing capacity in this field. Additionally, other market players are also introducing innovative biomarker-based products, thereby solidifying their leading position in the market.

Veterinary Biomarkers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 895.78 million |

|

Revenue forecast in 2032 |

USD 2,554.79 million |

|

CAGR |

12.3% from 2022 – 2030 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Animal Type, Product Type, Application, Disease Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The veterinary biomarkers market report covering key segments are animal type, product type, disease type, application, and region.

Veterinary Biomarkers Market Size Worth $2,554.79 Million By 2032.

The global veterinary biomarkers market is expected to grow at a CAGR of 12.3% during the forecast period.

North America is leading the global market.

key driving factors in veterinary biomarkers market are Rising incidence of chronic conditions like cancer and cardiovascular diseases.