Video Analytics Market Size, Share, Trends, & Industry Analysis Report

By Type (Software and Service), By Deployment Mode, By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM1416

- Base Year: 2024

- Historical Data: 2020-2023

Overview

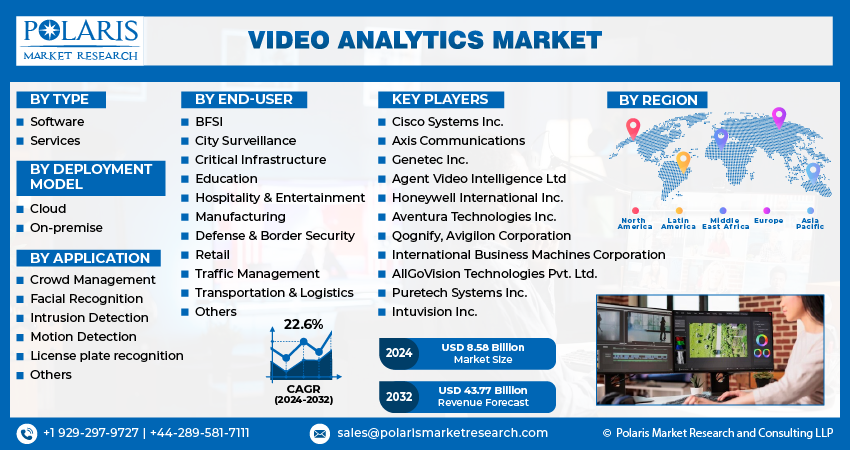

The global video analytics market size was valued at USD 12.47 billion in 2024, growing at a CAGR of 19.38% from 2025 to 2034. Key factors driving demand for video analytics include rising investment in the development of smart cities, increasing military spending, and rising need for enhanced surveillance systems.

Key Insights

- The software segment accounted for a major revenue share in 2024. This is due to organizations across industries increasingly adopted advanced software solutions for real-time monitoring.

- The intrusion detection segment dominated the revenue share in 2024 due to rising focus on strengthening security.

- North America video analytics market held 31.11% of the global video analytics market share in 2024, owing to rapid digital transformation across industries and a strong investment in smart city infrastructure.

- U.S. held a major revenue share in the North America video analytics landscape in 2024, due to rising innovation in artificial intelligence.

- The industry in Europe is projected to grow at a rapid CAGR from 2025 to 2034, owing to strict regulatory frameworks that are encouraging video analytics use in security surveillance.

Industry Dynamics

- The increasing need for enhanced surveillance systems is boosting demand for video analytics as organizations and governments are seeking smarter ways to monitor and secure public and private spaces.

- The rising military spending is fueling the need for video analytics as it enables real-time analysis of drone footage, satellite imagery, and ground-based camera feeds.

- Growing urbanization worldwide is creating a lucrative market opportunity.

- The high cost of video analytics software is projected to hamper the market demand.

Market Statistics

- 2024 Market Size: USD 12.47 Billion

- 2034 Projected Market Size: USD 73.17 Billion

- CAGR (2025-2034): 19.38%

- North America: Largest Market Share

AI Impact on Video Analytics Market

- AI revolutionizes video analytics by enabling real-time object detection, behavior analysis, and predictive insights.

- It enhances accuracy, reducing false alarms via deep learning models.

- Scalability improves as AI automates monitoring across thousands of feeds.

- AI-driven analytics now deliver actionable intelligence, not just raw data, empowering faster, data-backed responses across industries.

Video analytics refers to the use of advanced software and artificial intelligence to automatically analyze video footage and extract meaningful information from it. Instead of relying only on human operators to watch cameras, the technology uses algorithms to detect patterns, recognize objects, track movements, and even identify unusual behavior in real time. One of the most common uses is in security and surveillance, where it helps detect suspicious activity, monitor crowds, and improve public safety.

Retail companies use it to study customer behavior, optimize store layouts, and reduce theft. In transportation, it helps manage traffic flow, monitor congestion, and prevent accidents. Industrial sites apply it to ensure worker safety and improve operational efficiency. It also plays a key role in smart city development by supporting automated parking systems, law enforcement, and emergency response.

The global demand for video analytics is driven by the rising investment in the development of smart cities. As of June 2025, 94% of the total 8,067 projects under Smart Cities Mission have been completed in India, with ₹1.64 lakh crore or USD 19.4 billion invested. Smart cities rely on vast networks of surveillance cameras and IoT sensors, all of which need sophisticated video analytics to process the massive influx of visual data to manage traffic, enhance public safety, and optimize urban services. Businesses and retail centers within smart cities also adopt advanced monitoring solutions along with video analytics software to enhance customer experience and operational efficiency. Therefore, with governments and private sectors funding smart city projects, the adoption of video analytics is accelerating.

Drivers & Opportunities/Trends

Rising Need for Enhanced Surveillance Systems: The increasing need for enhanced surveillance systems is boosting demand for video analytics as organizations and governments are seeking smarter ways to monitor and secure public and private spaces. Modern security challenges, such as crime prevention, terrorism threats, and crowd management, require more than just traditional CCTV cameras; they demand intelligent systems that can analyze video feeds in real time. Video analytics empowers surveillance systems to automatically detect suspicious activities, recognize faces, track objects, and identify unusual patterns, reducing reliance on human operators and increasing response speeds. Businesses, law enforcement agencies, and critical infrastructure providers are now prioritizing advanced video analytics to gain deeper insights, improve threat detection, and enhance operational efficiency. The growing complexity of security risks and the push for proactive rather than reactive measures are further driving the adoption of AI-powered video analytics.

Increasing Military Spending: Military operations are now relying heavily on advanced technologies to monitor borders, track enemy movements, and secure critical installations. Video analytics enhances these efforts by enabling real-time analysis of drone footage, satellite imagery, and ground-based camera feeds, allowing armed forces to identify threats, classify objects, and make rapid, data-driven decisions. Therefore, as defense budgets expand, military organizations prioritize investments in surveillance and intelligence tools, driving the adoption of sophisticated video analytics solutions across land, sea, and air domains. STOCKHOLM INTERNATIONAL PEACE RESEARCH INSTITUTE, in its reports, stated that world military expenditure reached $2718 billion in 2024, an increase of 9.4 per cent in real terms from 2023.

Segmental Insights

Type Analysis

Based on type, the segmentation includes software and service. The software segment accounted for a major revenue share in 2024 due to organizations across industries increasingly adopted advanced software solutions for real-time monitoring, pattern recognition, and incident detection. Enterprises invested heavily in software that supported facial recognition, license plate identification, and behavioral analysis to strengthen security operations and optimize business intelligence. The rising integration of video management systems with AI algorithms encouraged companies to adopt scalable and flexible software that reduce manual intervention and improve accuracy. Additionally, sectors such as retail, transportation, and banking prioritized advanced video software solutions to analyze customer behavior, manage crowd flow, and detect fraudulent activities.

The services segment is projected to grow at a rapid pace in the coming years owing to the growing demand for managed and professional support to implement and maintain complex video solutions. Organizations seek expert consulting, system integration, and cloud-based service models to ensure seamless deployment and scalability while minimizing operational costs. The rising popularity of video-as-a-service (VaaS) models enables companies to access advanced tools without heavy upfront investment, making services increasingly attractive for small and medium enterprises. Moreover, the need for ongoing training, predictive maintenance, and customization fuels service adoption, as businesses focus on achieving long-term efficiency and compliance with evolving data security regulations

Deployment Mode Analysis

Based on deployment mode, the segmentation includes cloud and on-premise. The on-premise segment held the largest revenue share in 2024 due to its security, reliability, and control. Enterprises in sectors such as government, defense, and banking adopted on-premise solutions to comply with strict regulatory standards and safeguard sensitive information. Companies in these industries invested heavily in robust in-house analytics systems to ensure seamless integration with existing hardware and software. The ability to process data locally without depending on external servers further encouraged large enterprises to rely on on-premise deployment, especially in regions where data privacy concerns remain high.

Application Analysis

In terms of application, the segmentation includes crowd management, facial recognition, intrusion detection, motion detection, license plate recognition, and others. The intrusion detection segment dominated the revenue share in 2024 due to rising focus on strengthening security and preventing unauthorized access across critical facilities. Airports, government buildings, and industrial plants invested in advanced video analytics to reduce the risks of theft, vandalism, and terrorist threats. Businesses in retail and banking also relied on these solutions to safeguard assets and ensure customer safety. The ability to integrate intrusion detection with existing surveillance infrastructure and provide real-time alerts encouraged wide adoption. Increasing urbanization and the rise in smart city projects further supported the dominance of the segment. For instance, the United Nations, in its report, stated that the global urban population is projected to increase to around two-thirds of the total population in 2050.

End Use Analysis

In terms of end user, the segmentation includes BFSI, city surveillance, critical infrastructure, education, hospitality & entertainment, manufacturing, defense & border security, retail, traffic management, transportation & logistics, and others. The city surveillance segment accounted for a major revenue share in 2024 due to increasing smart city initiatives to strengthen public safety and crime prevention. Rapid urbanization created the need for advanced monitoring systems to manage traffic, detect suspicious behavior, and ensure crowd safety in densely populated areas. Law enforcement agencies deployed intelligent surveillance networks to respond quickly to incidents and improve investigation efficiency. Integration of analytics with high-resolution cameras, IoT devices, and real-time alert systems further enhanced adoption, making city surveillance the dominant end-use segment.

The retail segment is projected to grow at a rapid CAGR from 2025 to 2034. Retailers deploy these systems to prevent theft, monitor in-store activities, and optimize store layouts based on consumer behavior analysis. The growing trend of smart retail, driven by e-commerce competition, encourages physical stores to adopt advanced video analytics for customer engagement and operational efficiency. Rising demand for loss prevention, coupled with the focus on personalized shopping experiences, is projected to accelerate the adoption of video analytics in the retail segment.

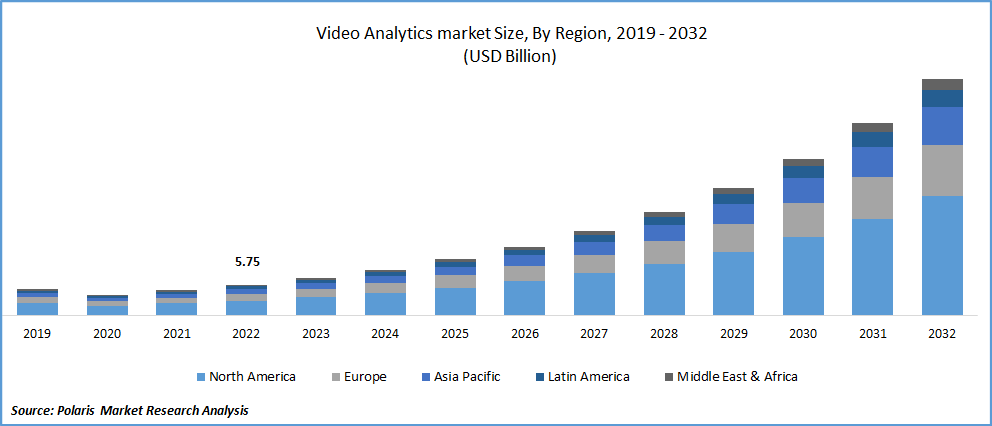

Regional Analysis

North America video analytics market held 31.11% of the global video analytics market share in 2024. This dominance is attributed to rapid digital transformation across industries, strong investments in smart city infrastructure, and high emphasis on public safety and security. Businesses in this region actively adopted AI-powered video surveillance to optimize operations, reduce costs, and enhance customer experiences. Government agencies and law enforcement also fueled growth by integrating intelligent video systems to monitor critical infrastructure and respond to threats in real time.

U.S. Video Analytics Market Insight

U.S. held a major revenue share in the North America video analytics landscape in 2024, due to rising innovation in artificial intelligence and machine learning technologies. Retailers, transportation networks, and healthcare providers in the country aggressively deployed video analytics to improve efficiency, track consumer behavior, and ensure regulatory compliance. Federal and local security initiatives, coupled with increasing cybersecurity concerns, pushed organizations to invest in advanced video intelligence platforms that deliver actionable insights.

Asia Pacific Video Analytics Market

The Asia Pacific market is projected to hold a significant revenue share in 2034, driven by expanding urbanization and smart city projects. Countries such as India, Japan, and South Korea are prioritizing intelligent traffic management, crowd control, and crime prevention through video-based AI solutions. Rapid industrial automation and the expansion of e-commerce logistics are further compelling manufacturers and warehouse operators to implement video analytics for process optimization and safety monitoring.

China Video Analytics Market Overview

The demand for video analytics in China is being driven by scaling surveillance infrastructure under national security and social governance agendas. The government and private sector in the country are collaborating to deploy facial recognition, behavior analysis, and predictive policing tools across cities and transportation hubs. Domestic tech giants are driving innovation with homegrown AI capabilities, while manufacturing and retail industries are leveraging video analytics to boost productivity, manage supply chains, and personalize customer engagement.

Europe Video Analytics Market

The industry in Europe is projected to grow at a rapid CAGR from 2025 to 2034, owing to strict regulatory frameworks that are encouraging ethical AI use in security surveillance. Countries in the region are investing in smart surveillance to manage traffic, reduce emissions, and enhance public safety without compromising privacy. Retail, banking, and transportation sectors are also adopting video analytics to streamline operations and detect fraud. Cross-border collaboration and EU-funded innovation programs are further stimulating market expansion.

Key Players & Competitive Analysis Report

The video analytics market is fiercely competitive, with global tech giants and specialized vendors vying for dominance. Companies such as IBM, Cisco, and Honeywell leverage AI, cloud infrastructure, and enterprise integration to offer scalable, intelligent surveillance. Meanwhile, niche players such as Milestone Systems, Genetec, and Axis Communications focus on open-platform analytics and edge-computing innovations. Dahua and Avigilon drive cost-efficient, high-performance solutions for mass deployment, while startups like Irisity AB and Gorilla Technology Inc. disrupt with behavioral analytics and deep learning. AllGoVision contributes regional expertise and customization.

Major companies operating in the video analytics industry include AllGoVision Technologies Pvt. Ltd; Avigilon; Axis Communications AB; Cisco Systems, Inc.; Dahua Technology; Genetec Inc.; Gorilla Technology Inc.; Honeywell International Inc.; IBM Corporation; Irisity AB; and Milestone Systems.

Key Companies

- AllGoVision Technologies Pvt. Ltd

- Avigilon

- Axis Communications AB

- Cisco Systems, Inc.

- Dahua Technology

- Genetec Inc.

- Gorilla Technology Inc.

- Honeywell International Inc.

- IBM Corporation

- Irisity AB

- Milestone Systems

Industry Developments

September 2022, Irisity AB introduced IRIS+, its next generation AI-powered video analytics solution.

February 2021, Openpath announced a new Video Management System (VMS) partnership integration with Cisco Meraki.

Video Analytics Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Software

- Services

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- Cloud

- On-premise

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Crowd Management

- Facial Recognition

- Intrusion Detection

- Motion Detection

- License Plate Recognition

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- City Surveillance

- Critical Infrastructure

- Education

- Hospitality & Entertainment

- Manufacturing

- Defense & Border Security

- Retail

- Traffic Management

- Transportation & Logistics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Video Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 12.47 Billion |

|

Market Size in 2025 |

USD 14.86 Billion |

|

Revenue Forecast by 2034 |

USD 73.17 Billion |

|

CAGR |

19.38% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 12.47 billion in 2024 and is projected to grow to USD 73.17 billion by 2034.

The global market is projected to register a CAGR of 19.38% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are AllGoVision Technologies Pvt. Ltd; Avigilon; Axis Communications AB; Cisco Systems, Inc.; Dahua Technology; Genetec Inc.; Gorilla Technology Inc.; Honeywell International Inc.; IBM Corporation; Irisity AB; and Milestone Systems.

The software segment dominated the market revenue share in 2024.

The retail segment is projected to witness the fastest growth during the forecast period.