Video As A Sensor Market Size, Share, Trends, & Industry Analysis Report

: By Component (Hardware, Software, and Services), By Sensor Type, By Connectivity, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5729

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

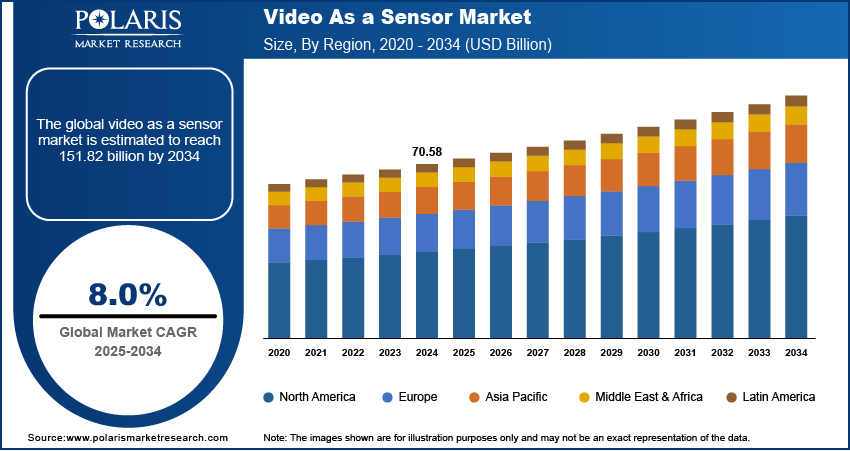

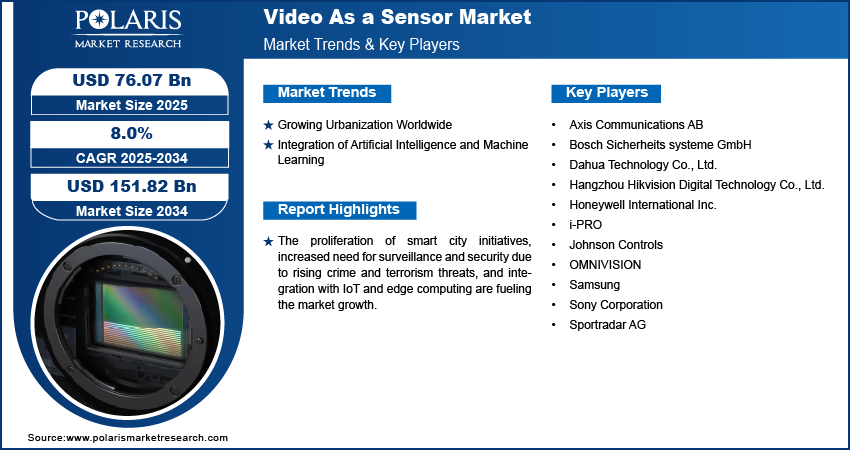

The global video as a sensor market size was valued at USD 70.58 billion in 2024, growing at a CAGR of 8.0 % during 2025–2034. The proliferation of smart city initiatives, increased need for surveillance and security due to rising crime and terrorism threats, and integration with IoT and edge computing fuel the market growth.

Video as a sensor is an advanced technology that transforms traditional video cameras into intelligent data-gathering devices by integrating them with artificial intelligence (AI) and machine learning (ML) analytics. Unlike conventional cameras that simply record footage, video sensors actively interpret scenes using algorithms capable of object detection, behavior analysis, anomaly recognition, and pattern identification. These systems typically consist of high-resolution IP cameras, storage devices, monitors, and accessories, all connected to robust analytics platforms that process and analyze the captured video streams. The integration of AI and ML allows for sophisticated functionalities such as facial recognition, traffic flow analysis, crowd monitoring, and predictive maintenance, making these solutions crucial in applications where situational awareness and rapid decision-making are critical.

The rising crimes globally are driving the video as a sensor industry. In 2022, the FBI reported a total of 1,954.4 property crimes per 100,000 people, compared with 380.7 violent crimes per 100,000 people in the US. This is propelling law enforcement agencies, municipal governments, and private sector stakeholders to increasingly rely on advanced surveillance systems, powered by video sensors, to deter criminal activities, monitor high-risk areas, and support post-incident investigations. Cities witnessing a surge in street crimes or terrorist threats are rapidly installing smart video sensors in public transportation systems, parks, intersections, and commercial zones to monitor activities continuously. These sensors record visual data and interpret the context, such as detecting unusual crowd behavior or identifying unauthorized access in restricted areas, leading to a reduction in crimes. Therefore, the demand for video as a sensors is increasing, with the rising crimes globally.

To Understand More About this Research: Request a Free Sample Report

The video as a sensor demand is driven by the rising development of smart cities across the world. Smart cities prioritize efficient urban management, improved public safety, and enhanced citizen services by leveraging advanced technologies, including IoT, AI, video as a sensor, and big data analytics. Smart city planners and administrators implement video sensor systems to monitor traffic patterns, ensure public safety, and optimize municipal services such as waste management, energy distribution, and emergency response. Transportation authorities in smart cities also use video sensors to manage traffic congestion, identify violations, and adjust signal timings dynamically. Hence, as the development of smart cities expands globally, the demand for video as a sensor also surges. For instance, under the Impact Canada Initiative, the Government of Canada committed to spending $300 million over 11 years to create the Smart Cities Challenge. Smart Cities Challenge is designed to encourage local governments and Indigenous communities to adopt smart cities approaches.

Industry Dynamics

Growing Urbanization Worldwide

Urbanization creates challenges related to traffic congestion, public safety, infrastructure management, and environmental monitoring. City officials, law enforcement agencies, and urban authorities turn to video as a sensor technology to handle these challenges in real time, as this technology allows for continuous surveillance and data analysis, which helps in preventing incidents, managing resources, and improving service delivery across increasingly crowded urban environments. Urban growth also places pressure on infrastructure and public utilities. Video as a sensor helps in reducing this pressure by managing critical infrastructure such as water pipelines, electrical grids, and waste collection by providing visual insights into operations and potential breakdowns. For instance, as per the data published by the World Bank, the urban population worldwide is expected to more than double by 2050. Thus, the expanding urbanization worldwide is fueling the adoption of video as a sensor solution.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) in video as a sensor is boosting their adoption by transforming traditional video surveillance into intelligent, real-time monitoring systems. Conventional video systems only recorded footage, requiring manual analysis and offering limited situational awareness. In contrast, AI-powered video as a sensor solution automatically detects patterns, recognizes objects or faces, and identifies anomalies without human intervention, leading to its greater adoption. Businesses and public sector organizations are also increasingly investing in AI-enabled video sensors to improve operational efficiency and enhance decision-making. Traffic management departments in developed countries are relying on AI-enabled video sensors to analyze vehicle flow, recognize license plates, and optimize signal timings.

Segmental Insights

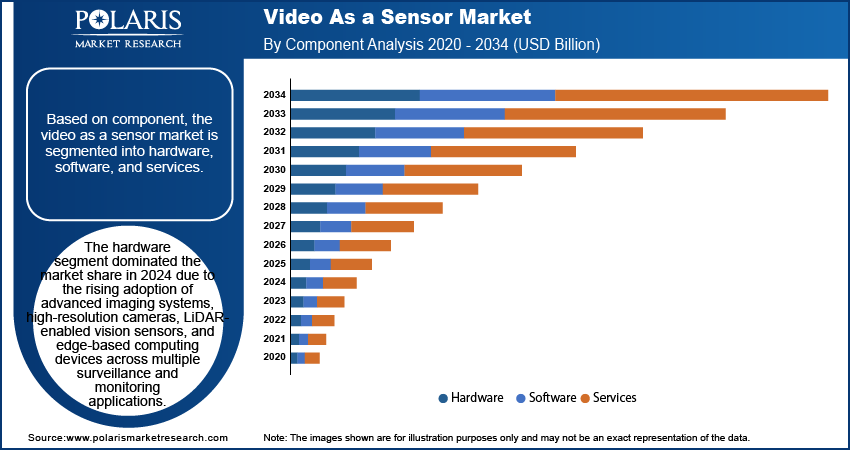

By Component Analysis

Based on component, the segmentation includes hardware, software, and services. The hardware segment dominated the market share in 2024 due to the rising adoption of advanced imaging systems, high-resolution cameras, LiDAR-enabled vision sensors, and edge-based computing devices across multiple surveillance and monitoring applications. Industries such as transportation, defense, and smart cities prioritize real-time data capture through sophisticated video hardware to enhance situational awareness, crowd monitoring, and automated threat detection. The growing demand for AI-powered vision hardware, including thermal cameras and stereo vision systems, further strengthened the hardware segment’s dominance. Integration of IoT and AI also led to a surge in the deployment of embedded vision hardware systems that deliver low-latency video analytics without centralized computing infrastructure.

By Sensor Type Analysis

Based on sensor type, the segmentation includes RGB sensors, infrared (IR) sensors, thermal sensors, depth sensors, and multispectral sensors. The RGB sensors segment accounted for major market share in 2024 due to their widespread use in conventional video surveillance, consumer electronics, and automotive applications. These sensors offer high-resolution color imaging and serve as the foundation for real-time monitoring and object detection in both public and private infrastructures. The affordability, ease of integration, and compatibility with machine vision systems make RGB sensors a preferred choice across a broad range of industries, including smart cities, retail analytics, and transportation. Additionally, improvements in CMOS imaging technology and edge processing capabilities enhanced the performance and versatility of RGB sensors, further contributing to their dominance.

By Connectivity Analysis

Based on connectivity type, the segmentation includes wired and wireless. The wired segment held a larger market share in 2024 due to its reliability, high data transmission rates, and low latency, which are critical for real-time video processing and analytics. Industries such as defense, transportation, and industrial automation continue to prefer wired systems for mission-critical applications where uninterrupted data flow and stable connections are essential. Ethernet and fiber optic connections allow high-resolution video feeds to be transmitted securely and efficiently, especially in controlled environments such as command centers, smart factories, and secured government facilities. Additionally, the efficient infrastructure for wired networks, along with lower susceptibility to signal interference or cyber intrusions, strengthened their dominance.

By Application Analysis

In terms of application, segmentation includes security & surveillance, traffic monitoring & smart mobility, industrial automation & robotics, retail analytics, healthcare & patient monitoring, environmental monitoring, agriculture & livestock monitoring, and others. The traffic monitoring & smart mobility segment is expected to grow at a robust pace in the coming years, owing to the rapid expansion of intelligent transportation systems and the push for safer, more efficient urban mobility. Cities and transportation authorities are increasingly deploying video-enabled sensor networks to monitor traffic flow, detect accidents, and manage congestion in real time. The rising adoption of autonomous and connected vehicles also necessitates a robust video analytics infrastructure capable of interpreting road conditions, pedestrian movement, and vehicular behavior. Furthermore, as urbanization accelerates and climate goals prompt a shift toward smart mobility solutions, video systems play a critical role in optimizing public transit operations, supporting adaptive traffic signal control, and reducing emissions through better traffic management. These evolving requirements are expected to propel the demand for video as a sensor in the traffic monitoring applications during the forecast period.

Regional Analysis

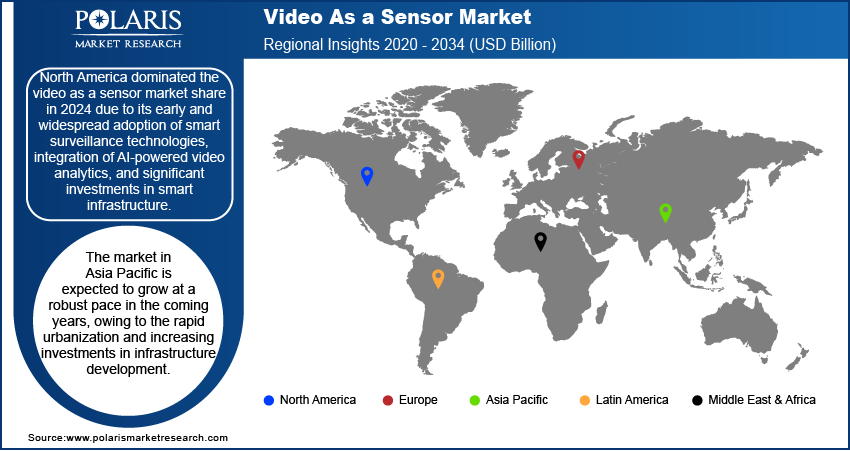

By region, the report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America video as a sensor market dominated with the largest share in 2024 due to its early and widespread adoption of smart surveillance technologies, integration of AI-powered video analytics, and significant investments in smart infrastructure. The growing emphasis on national security, coupled with large-scale deployment of smart city initiatives and advanced traffic monitoring systems, propelled demand for video as a sensor across the government and commercial sectors. Moreover, the presence of major companies and favorable regulatory support for public safety and infrastructure modernization played a crucial role in the regional dominance.

The Asia Pacific video as a sensor market is expected to grow at a robust pace in the coming years, owing to the rapid urbanization and increasing investments in infrastructure development. The proliferation of AI and edge computing technologies across sectors such as healthcare, agriculture, and transportation accelerates regional adoption. Additionally, supportive government policies and rising security concerns in densely populated cities such as New Delhi, Shanghai, Mumbai, and others are boosting the deployment of intelligent video-based sensing solutions. The China video as a sensor market is estimated to hold a major share in Asia Pacific, driven by its aggressive implementation of surveillance systems, growing investments in industrial automation, and the expansion of smart city programs across major urban centers.

The Europe video as a sensor market is projected to hold a substantial share over the forecast period, owing to the regulatory push toward digital transformation and data security, combined with funding support under programs such as Horizon Europe. Germany is emerging as a prominent country in the region due to its strong focus on industrial automation, smart manufacturing, and infrastructure modernization. The region’s commitment to sustainability and energy efficiency is accelerating the integration of intelligent video sensors across smart grid management, transportation, and environmental monitoring systems. Additionally, rising concerns over public safety and border control are prompting governments across countries such as the UK, France, and Italy to invest heavily in advanced security and surveillance technologies, such as video as a sensor.

Key Players and Competitive Analysis

The video as a sensor market is rapidly evolving, with key players leveraging portfolio expansion, strategic partnerships, and mergers and acquisitions to strengthen their positions. Major companies are broadening their offerings by integrating AI-powered analytics, edge computing, and cloud-based video processing into their solutions. Strategic partnerships are accelerating innovation and market penetration, while M&A activity is reshaping the competitive landscape, with larger firms acquiring niche innovators to consolidate expertise.

A few prominent companies in the video as a sensor market are Axis Communications AB; Bosch Sicherheitssysteme GmbH; Dahua Technology Co., Ltd.; Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International Inc.; i-PRO; Johnson Controls; OMNIVISION; Samsung; Sony Corporation; and Sportradar AG.

Key Players

- Axis Communications AB

- Bosch Sicherheits systeme GmbH

- Dahua Technology Co., Ltd.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- i-PRO

- Johnson Controls

- OMNIVISION

- Samsung

- Sony Corporation

- Sportradar AG

Industry Developments

April 2025: OMNIVISION, a global developer of semiconductor technology, including advanced digital imaging, analog, and display solutions, launched its new OV50X ultra high dynamic range 1‑inch image sensor for movie-grade video capture in flagship smartphones.

September 2024: Sony Semiconductor Solutions Corporation (SSS) released the LYT-818, a new effective-50-megapixel*1 CMOS image sensor to reduce noise in low-light conditions and deliver a high dynamic range.

February 2024: Sony India introduced the Alpha 9 III camera equipped with a full-frame global shutter image sensor.

June 2024: Samsung Electronics, a global company in advanced semiconductor technology, announced three new mobile image sensors: the ISOCELL HP9, the ISOCELL GNJ, and the ISOCELL JN5.

Video As A Sensor Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Sensor Type Outlook (Revenue, USD Billion, 2020–2034)

- RGB Sensors

- Infrared (IR) Sensors

- Thermal Sensors

- Depth Sensors

- Multispectral Sensors

By Connectivity Outlook (Revenue, USD Billion, 2020–2034)

- Wired

- Wireless

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Security & Surveillance

- Traffic Monitoring & Smart Mobility

- Industrial Automation & Robotics

- Retail Analytics

- Healthcare & Patient Monitoring

- Environmental Monitoring

- Agriculture & Livestock Monitoring

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Video As A Sensor Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 70.58 billion |

|

Market Size Value in 2025 |

USD 76.07 billion |

|

Revenue Forecast by 2034 |

USD 151.82 billion |

|

CAGR |

8.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 70.58 billion in 2024 and is projected to grow to USD 151.82 billion by 2034.

The global market is projected to register a CAGR of 8.0% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Axis Communications AB; Bosch Sicherheitssysteme GmbH; Dahua Technology Co., Ltd.; Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International Inc.; i-PRO; Johnson Controls; OMNIVISION; Samsung; Sony Corporation; and Sportradar AG.

The hardware segment dominated the market share in 2024.

The traffic monitoring & smart mobility segment is expected to witness the fastest growth during the forecast period.