Virtual Event Platform Market Share, Size, Trends, Industry Analysis Report

By Component (Software and Services); By Organization Size (Large Enterprises, Medium-Size Enterprises, Small Enterprises); By End Use, By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2196

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

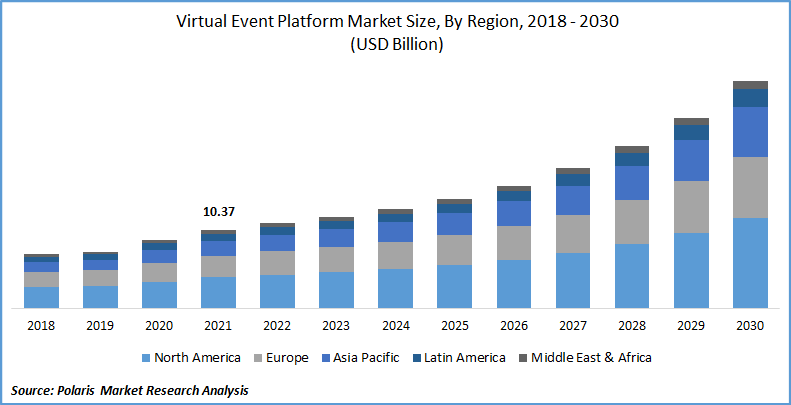

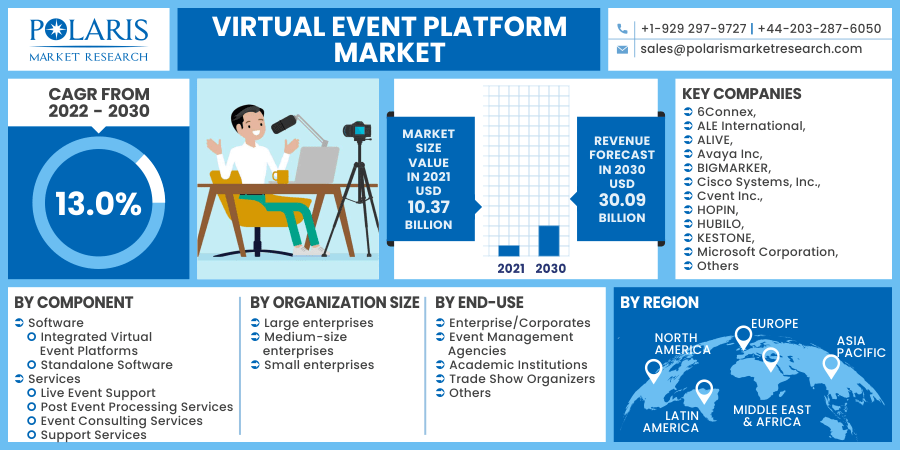

The global virtual event platform market was valued at USD 10.37 billion in 2021 and is expected to grow at a CAGR of 13.0% during the forecast period. The surging adoption of digital media marketing platforms to expand the audience base, the shift of businesses from on the role to remote working approaches, the rise in popularity of online streaming to replace in-person presentations are expected to drive the industry growth. Further, cloud services are gaining traction in SMEs and surging demand for accurate customer information, thereby enhancing the virtual event platform market growth.

Know more about this report: request for sample pages

These platforms are used to build new business relationships. It's easy to host and attend virtual events. They provide a higher return on investment (ROI) as they demand less money. Clients and organizations regard events or functions to be an important and useful means of communication. Companies, colleges, governments, public/private organizations, agencies, and the hospitality industry all have occasions on a regular basis, which can help the virtual event platform market grow faster.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Businesses have implemented virtual software solutions for online marketing because of the rise in smartphone use and internet penetration. Furthermore, the COVID-19 epidemic prompted a spike in virtual marketing meetings to avoid real gatherings and expand the client base. Aside from that, the changing lifestyles of consumers prompted businesses to seek out new ways to create theme-based functions that could be attended from anywhere.

The firm is looking for a shift in its IT investment due to the extraordinary speed of digital transformation in 2021 to meet the problems posed by the emergence of COVID-19. Throughout the function, the audience is kept engaged and linked through the digital media platform. Marketers are focusing on online marketing methods such as new product launches, email marketing, brand promotion, advertising campaigns, and product demos as the popularity of social media grows. As a result, digital marketing efforts are on the rise.

Furthermore, technological advancements such as online conferences and software-as-a-service-based virtual events have emerged as easy, fast, and cost-effective alternatives. Through podcasting, instant messaging, and a virtual product experience, the cloud-based technology allows end-users to give an engaging experience while increasing the overall sales experience. Furthermore, live streaming is another method that has a favorable impact on the growth of the industry. More people can access information resources and better align with context thanks to living streaming events. As a result, the growing adoption of the industry by over 80% of event organizers is driving considerable growth in the global virtual event platform market.

Report Segmentation

The market is primarily segmented based on the basis of component, organization size, end-use, and region.

|

By Component |

By Organization Size |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Component

The software segment holds the majority of the industry share during 2021. The software enables virtual communication from faraway locations by developing technologies such as augmented reality and 3D simulation to recreate in-person experiences. Thousands of people can share information in real-time because of the software's interactive capabilities, including a live chat box, live polls, and one-to-one video and audio chats.

Insight by Organization Size

The large enterprises' segment obtained the greatest revenue share in 2021owing to the increased demand for the deployment of digital platforms in large corporations. The growing tendency of large corporations adopting "local" strategies, with clients, employees, and other business stakeholders spread across multiple geographic regions, has increased demand for the industry in this sector. Large-scale organizations need virtual communication and collaborative platforms since it is critical to maintaining a smooth workflow across multiple locations. Following the Covid-19 pandemic, this software has allowed businesses to continue working efficiently despite any physical obstacles.

Small businesses are focusing on acquiring industry share through various growth methods and adapting to customer requests, resulting in widespread adoption of cloud services. In comparison to major organizations, these businesses confront greater obstacles in terms of restricted budgets for marketing and sales operations. They demand better approaches to resolve complications to improve the cost optimization of their business processes. However, during the projected period, the small businesses segment is expected to increase at a faster CAGR. Small businesses benefit from these platforms because they lower the overall cost of hosting a real seminar, conference, or meeting. Virtual functions are also simple to organize, affordable, and link relevant people to meetings regardless of their geographical location. Small businesses are projected to use these platforms at a quick rate as a result of these considerations.

Geographic Overview

In 2021, North America had the highest revenue share, and it is likely to continue to dominate the virtual event platform market over the forecast period. This can be attributed to the U.S and Canada's technical breakthroughs, stable economies, and advanced digital infrastructure. North America is seen as a business hub, with a higher rate of adoption of new and advanced technology.

Over the projected period, the rising usage of digitally simulated platforms, particularly in the healthcare business, is expected to move Canada's economy forward significantly. For several decades, companies like Apple, Microsoft, and Cisco Systems Inc. have been at the forefront of the North American market. These companies provide complex and cutting-edge virtual platforms with high bandwidth and stability.

Asia Pacific is predicted to be the fastest-growing industry, with a CAGR of over 14.7%. The growing awareness of this industry, increasing demand to adhere to stringent laws, the growing presence of virtual event platform suppliers, increasing government initiative and support, and improving return on investments contribute to the industry expansion. The public and private sectors are investing heavily in asset management, increasing demand for such advanced solutions and services.

Competitive Insight

6Connex, ALE International, ALIVE, Avaya Inc, BIGMARKER, Cisco Systems, Inc., Cvent Inc., HOPIN, HUBILO, KESTONE, Microsoft Corporation, On24, REMO, vFairs, ZOOM are some of the prominent participants in the global industry.

Virtual Event Platform Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 10.37 billion |

|

Revenue forecast in 2030 |

USD 30.09 billion |

|

CAGR |

13.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Organization Size, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

6Connex, ALE International, ALIVE, Avaya Inc, BIGMARKER, Cisco Systems, Inc., Cvent Inc., HOPIN, HUBILO, KESTONE, Microsoft Corporation, On24, REMO, vFairs, ZOOM |