Warm Air Furnaces Market Share, Size, Trends, Industry Analysis Report

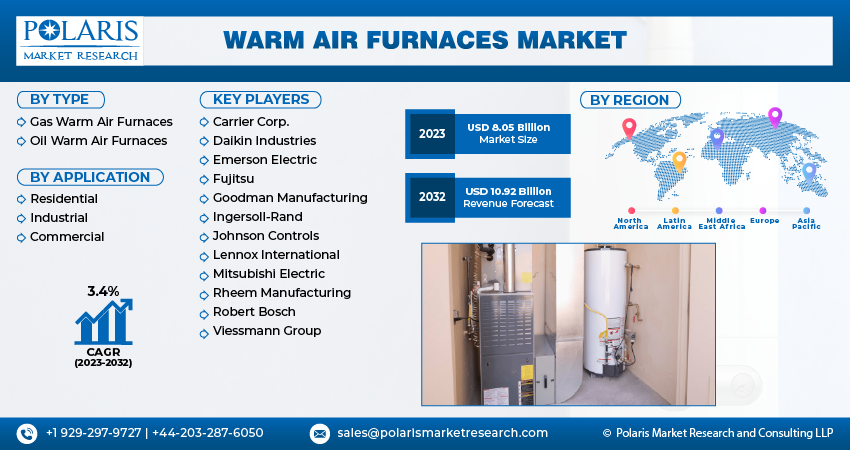

By Type (Gas Warm Air Furnaces, Oil Warm Air Furnaces), By Application, By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Nov-2023

- Pages: 114

- Format: PDF

- Report ID: PM4049

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

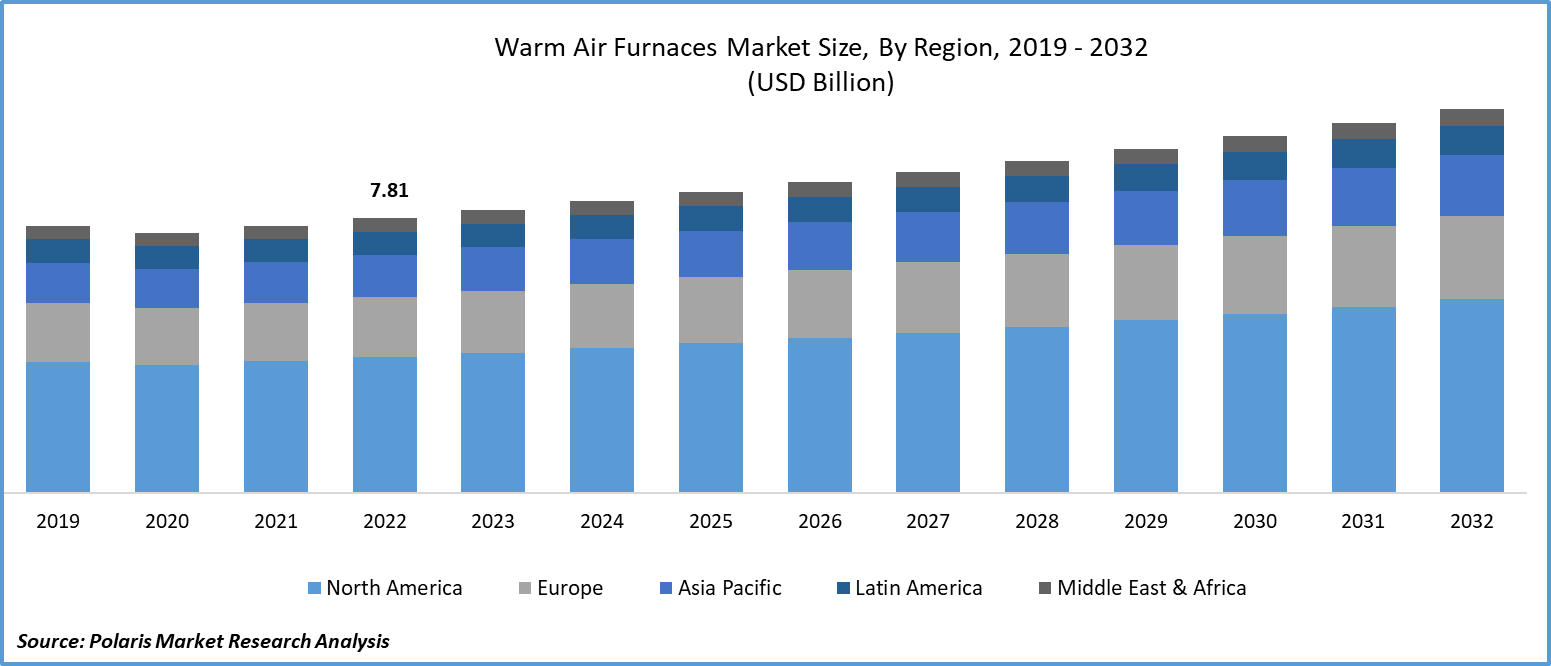

The global warm air furnaces market was valued at USD 7.81 billion in 2022 and is expected to grow at a CAGR of 3.4% during the forecast period.

The consistent growth in both home construction & renovation endeavors has amplified the need for warm-air furnaces, which are a favored selection for a substantial portion of these projects. As per data from the U.S. Census Bureau, expenditure on commercial construction escalated from USD 120.10 billion in September 2022 to USD 125.87 billion in October 2022. Additionally, investments in lodging and hotel construction in the U.S. rose to USD 21.85 billion and USD 89.97 billion in September 2022 and October 2022, respectively. Hence, the burgeoning expansion in commercial construction is expected to propel the demand for the product in the forthcoming years.

To Understand More About this Research: Request a Free Sample Report

In the United States, the demand for warm air furnaces is influenced by a variety of elements, including weather conditions, economic circumstances, energy costs, and trends in the housing market. Warm air furnaces, also recognized as warm air heating systems, are a favored choice for both residential and commercial properties due to their efficiency, relatively lower installation expenses, and capacity to distribute heat evenly throughout a space.

Moreover, the momentum is enhanced by federal and state regulations that offer tax credits, rebates, and other incentives to promote the adoption of energy-efficient systems and stimulate the utilization of renewable energy resources. These factors mentioned above are predicted to generate heightened demand in the warm air furnaces market throughout the forecast years. The expansion is further set to receive a boost from increasing investments in building projects and a rise in maintenance and replacement activities. The U.S. construction sector places a strong emphasis on the creation of ecologically sustainable and energy-efficient structures.

For Specific Research Requirements: Request for Customized Report

Growth Drivers

- Efficient warm air furnaces with effective air conditioning

The anticipated expansion is set to be propelled by the effective air conditioning provided by these furnaces in contrast to alternative heating systems. Additionally, most warm-air furnaces incorporate humidification as a built-in feature. This aids in the removal of indoor air pollutants and addresses problems related to excessive humidity, which can lead to harm to properties and health issues. Warm air furnaces are characterized by their exceptional efficiency, boasting Annual Fuel Utilization Efficiency ratings that can reach as high as 99%.

Moreover, hydronic and electric heating systems require more time to heat a space. In contrast, warm air furnaces provide quicker start times, delivering comfort to the entire space within a few minutes. Furthermore, warm air furnaces are renowned for their durability and reliability, boasting an average lifespan of 15 to 30 years, surpassing the longevity of heat pumps & boilers.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The oil-warm furnaces segment is projected to have the fastest growth over the projected period.

The oil-warm furnaces segment is expected to have faster growth in the market. It excels in efficiently distributing warm air throughout a structure. The inclusion of a thermostat enables precise regulation of temperatures. When adequately maintained, the warm air generated by oil-warm air furnaces is less dry compared to that produced by electric or wood-burning systems, and it lacks any noticeable odor.

Gas-warm furnaces held the largest share. It exhibits higher efficiency compared to electric furnaces. They can convert a larger proportion of the consumed fuel into usable heat, resulting in diminished environmental impact and decreased energy expenses. These furnaces are adept at rapidly heating spaces, delivering nearly immediate warmth. This attribute is particularly vital in colder regions where a swift response is essential for maintaining comfort. Additionally, considering that natural gas is frequently more affordable than electricity, gas furnaces present a cost-effective heating solution, especially in areas abundant in natural gas resources.

For instance, Lennox International is a company that provides the SLP99V variable-capacity gas furnace. This furnace stands out as the most efficient option, boasting an impressive efficiency rate of up to 99%. Furthermore, it comes with the choice of either a 20-year or a lifetime limited warranty, ensuring extended coverage. Additionally, the Daikin warm gas furnace offers both efficient and cost-effective heating capabilities. Moreover, gas air furnaces are renowned for their reliability & longevity. When subjected to proper maintenance, they can deliver consistent and trustworthy heating for numerous years.

By Application Analysis

- The commercial segment dominated the market in 2022.

The commercial segment held the largest share. Warm air furnaces find extensive utilization in commercial contexts, catering to the heating needs of various types of commercial establishments and areas. Their adaptability, efficiency, and comparatively affordable installation and upkeep costs position them as a favored option for numerous commercial applications. For example, warm air furnaces frequently find applications in office buildings to deliver centralized heating solutions. Their capability to effectively warm expansive open spaces, individual offices, and conference rooms is noteworthy. Moreover, many retail stores opt for warm air furnaces to ensure a warm and inviting environment for customers throughout colder months.

Warm air furnaces present the benefit of rapid heating and the potential to seamlessly integrate with ventilation and air conditioning systems, thereby offering combined heating and cooling functionalities within a single HVAC system. These furnaces can be powered by a range of fuels, such as natural gas, oil, electricity, or propane, granting businesses the flexibility to select the most fitting option according to their geographic location and energy resources.

The residential segment is expected to have faster growth in the market. Warm air furnaces hold a prevalent position as a favored heating choice for residential purposes. They find widespread usage in residential settings to furnish centralized heating solutions. For example, warm air furnaces are meticulously engineered to deliver warmth to the entire household via an intricate network of ducts and vents. This adept distribution system efficiently channels warm air to various rooms, ensuring a uniform and pleasant temperature experience throughout the residence.

Regional Insight

- North America registered the largest revenue share in the forecast time frame.

North America garnered the largest revenue share for the market. This dominance can be attributed to significant investments made by diverse governments to advance public infrastructure and bolster residential construction. Additionally, there is a growing consciousness within the region about energy conservation, which is foreseen to contribute to an even greater surge in market demand.

Asia Pacific is expected to grow at a rapid pace. Various factors contribute to the favorability of specific heating systems over others in this region. These factors encompass climatic conditions, architectural styles in building construction, regulations pertaining to energy efficiency, and cultural inclinations. Notably, several nations within the region place heightened emphasis on energy-efficient and sustainable heating solutions, which in turn has propelled the prominence of warm air furnaces.

Within Europe, alternative heating systems hold greater prominence owing to variations in climate, energy cost dynamics, and building construction norms. Consequently, the requirement for continuous and high-intensity heating tends to be comparatively lower. Moreover, residential structures in Europe often adopt distinct construction methodologies, placing increased emphasis on insulation and energy efficiency. These practices geared toward optimizing energy usage, coupled with the adoption of radiant heating systems, collectively mitigate the demand for warm-air furnaces.

Competitive Insight

The warm air furnaces market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Carrier Corp.

- Daikin Industries

- Emerson Electric

- Fujitsu

- Goodman Manufacturing

- Ingersoll-Rand

- Johnson Controls

- Lennox International

- Mitsubishi Electric

- Rheem Manufacturing

- Robert Bosch

- Viessmann Group

Recent Developments

- In March 2023, Rheem unveiled a comprehensive line-up named Endeavor Line, encompassing an array of offerings, including gas furnaces, split & packaged air conditioners, split & packaged heat pumps, air handlers, & packaged gas electric units.

Warm Air Furnaces Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 8.05 billion |

|

Revenue Forecast in 2032 |

USD 10.92 billion |

|

CAGR |

3.4% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation |