Washed Silica Sand Market by Fe Content (>0.01%, <0.01%), By Application (Glass, Foundry, Oil Well Cement, Ceramic & Refractories, Abrasive, Metallurgy, Filtration & Others), By Region and Segment Forecast – 2023 to 2032

- Published Date:May-2023

- Pages: 114

- Format: PDF

- Report ID: PM3262

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

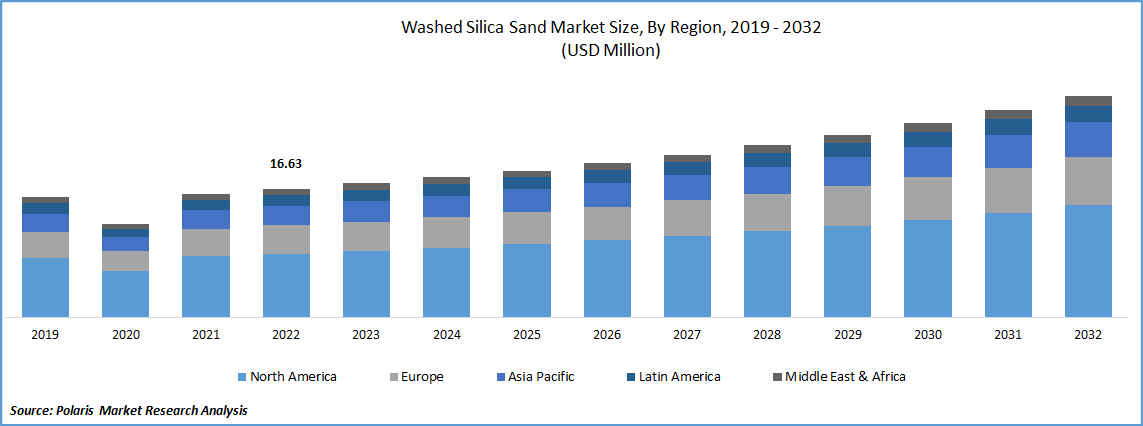

The global washed silica sand market was valued at USD 16.63 million in 2022 and is expected to grow at a CAGR of 5.62% during the forecast period. The demand for washed silica sand in the construction, container glass, specialty glass, fiberglass, foundry, oil well cementing, and cosmetics sectors is anticipated to rise significantly over the next few years.

To Understand More About this Research: Request a Free Sample Report

The silica is a hazardous material, it is governed by Occupational Health and Safety Regulations on Hazardous Substances. This means that an employer has a legal obligation to recognise risks, get rid of them or control any risks, give employees knowledge and training, watch the atmosphere, keep records, and, in the case of crystalline silica, monitor employee health. The exposure guidelines for the three types of crystalline silica, quartz, cristobalite, and tridymite, have been updated by the National Occupational Health and Safety Commission (NOHSC; now SafeWork Australia). These rules and requirements have forced manufacturers to use innovative methods to keep a secure workplace.

During the forecast period, an increase in building and infrastructure-related activities is anticipated to fuel demand for washed silica sand all over the world. In the process of making glass, silica sand makes up between 65% and 70% of the basic materials. Consistently rising demand for building glass and flat glass

The world population is anticipated to hit 9.5 billion people by 2050, according to projections from World Population and the UN Department of Economic and Social Affairs/Population Division. The demand for washed silica sand is being supported by the country's constantly growing population, as well as the manufacturing boom that has followed the economic downturn of 2020.

One of the most prevalent and dangerous occupational hazards to employees' health is crystalline silica. The negative health impacts on workers limit the market for washed silica sand. According to the National Health Portal of India, prolonged exposure to crystalline silica-containing dust is linked to lung diseases like pneumoconiosis, progressive massive fibrosis of the lung (PMF), lung cancer, pulmonary tuberculosis, and other lung and airway diseases. However, since silica is odorless, non-irritating, and does not cause any immediate health effects, exposure to large amounts of free silica may not be noticed. Therefore, the negative impacts of silica flour on human health pose a significant threat to the market's expansion.

The implementation of emergency procedures and the closure of numerous activities and facilities have been noted in 2020 due to the increase in COVID-19 cases. Since the majority of multinational corporations have their offices in these nations, the COVID-19 outbreak that started in Wuhan, China, has spread to the major APAC, European, and North American nations. This has an impact on the market for washed silica sand. The COVID-19 effect had disrupted the supply chain, which had delayed market expansion due to a shortage of raw materials and a labour shortage.

For Specific Research Requirements, Request For Customized Report

Industry Dynamics

Growth Drivers

One of the main uses for washed silica sand is the production of glass, and the washed silica sand market for this material has expanded because of the expansion of the glass industry and rising demand for flat and container glassware. The main ingredient in all kinds of standard and specialty glass production is silica sand because it provides the necessary Silicon Dioxide (SiO2) needed for glass formulation. Silica makes up more than 70% of the end weight of glass, despite the fact that the production of glass requires a wide range of different materials. The main factor affecting the color, clarity, and strength of the glass created is its chemical purity.

One of the main producers of washed silica sand, VRX Silica, predicted that the demand for washed silica sand would rise as soon as the glass production in APAC is anticipated to rise by 7%-8%. Additionally, it is expected that the global pharmaceutical industry will experience a surge in demand for glass vials, which will result in a significant increase in the demand for washed silica sand for use in glass manufacturing.

Report Segmentation

The market is primarily segmented based on Fe content, particle size and region.

|

By Fe Content |

By Application |

By Region |

|

|

|

For Specific Research Requirements: Request for Customized Report

The >0.01% segment has dominated the market, accounting for the largest market share in 2022

Based on Fe content, the biggest washed silica sand market segment for washed silica sand is anticipated to be silica sand with iron content >0.01%. Sand with a significant silicon dioxide (SiO2) content is referred to as silica sand, quartz sand, white sand, industrial sand, and silica sand. It is a silica and oxygen-based material that is hard and crystalline.

The demand in Asia Pacific is expected to witness significant growth during projected timeframe

In terms of value, APAC held the biggest market share. One of the main drivers of industry growth in this area is the rising population and rapid urbanization. The demand for washed silica sand in the region is being fueled by the expanding glass, cement, foundry, oil well, and other sectors in several APAC nations. One of the biggest producers of silica sand, VRX Silica, claims that flat glass, specialty glass, and solar glass are consistently increasing at rates of 6%, 10%, and 30%.

Competitive Insight

Unimin Corporation, Fairmount Minerals, U.S. Silica, Emerge Energy Services LP, Badger Mining Corp, Hi-Crush Partners, Preferred Sands, Premier Silica, Pattison Sand, Sibelco, Minerali Industriali, Quarzwerke Group, Aggregate Industries & WOLFF & MÜLLER are a few of the major producers of washed silica sand.

Recent Developments

- In 25th June 2023, the High-purity silica sand in southern Jordan is estimated to be worth billions of dollars, providing a strong incentive for both international and domestic investors.

- Research shows that there is a high return on investment for silica (quartz sand). It is estimated that there are 12 billion tons of high purity silica deposits in the southern Ma’an Governorate, with 22,000 tons used by the local market each year.

Washed Silica Sand Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 17.33 million |

|

Revenue forecast in 2032 |

USD 28.34 million |

|

CAGR |

5.62% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019- 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Fe Content, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Unimin Corporation, Fairmount Minerals, U.S. Silica, Emerge Energy Services LP, Badger Mining Corp, Hi-Crush Partners, Preferred Sands, Premier Silica, Pattison Sand, Sibelco, Minerali Industriali, Quarzwerke Group, Aggregate Industries & WOLFF & MÜLLER |

FAQ's

Key companies in washed silica sand market are Unimin Corporation, Fairmount Minerals, U.S. Silica, Emerge Energy Services LP, Badger Mining Corp, Hi-Crush Partners, Preferred Sands.

The global washed silica sand market expected to grow at a CAGR of 5.62% during the forecast period.

The washed silica sand market report covering key segments are fe content, application and region.

key driving factors in washed silica sand market are rising demand for flat and container glassware.

The global washed silica sand market size is expected to reach USD 28.34 Million by 2032.