Wastewater Reverse Osmosis Membrane Market Share, Size, Trends, Industry Analysis Report

By Type (Thin Film Composite, Cellulose Acetate, Others); By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4368

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

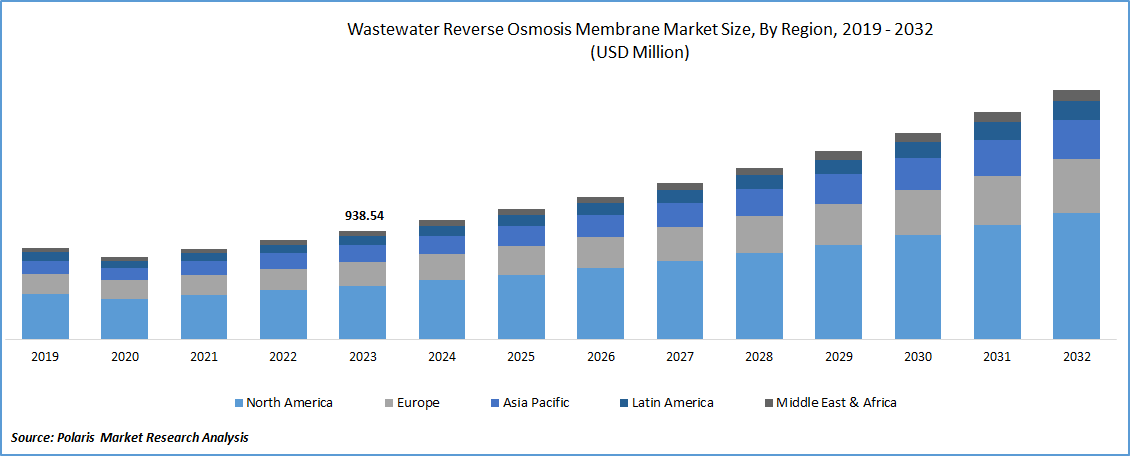

The global wastewater reverse osmosis membrane market was valued at USD 938.54 million in 2023 and is expected to grow at a CAGR of 9.7% during the forecast period.

The escalating pace of industrial activities worldwide results in a substantial increase in industrial wastewater generation. RO membrane technology is crucial for industries, including manufacturing, chemicals, and pharmaceuticals, seeking efficient solutions to treat and manage wastewater in compliance with environmental standards. Rapid urbanization and population growth contribute to the surge in municipal wastewater. Municipalities globally are investing in advanced wastewater treatment systems, prominently featuring RO membranes. These membranes are integral to the development of sustainable and effective solutions for managing the escalating urban wastewater challenges.

Developments in RO membrane technology propel the market growth. The goal of research and development is to improve the permeability, durability, and fouling resistance of membranes. RO membranes are at the forefront of effective and affordable wastewater treatment owing to technological progress. To meet the increasing demands of consumers, industry participants are launching new products.

To Understand More About this Research: Request a Free Sample Report

For instance, in April 2022, Veolia Water Technologies introduced the Barrel, an integrated plug-and-play reverse osmosis (RO) technology, in the Asia Pacific region. This innovative system is designed for applications such as wastewater reuse and low-pressure RO processes.

Regions grappling with water stress due to climate change and increased demand turn to advanced water treatment technologies. RO membranes address the challenge by providing effective solutions for converting wastewater into valuable and usable water resources. The increasing recognition of the environmental impact of industrial effluents underscores the importance of effective wastewater treatment. RO membranes are deployed in industrial settings to treat effluents, ensuring compliance with discharge standards and fostering responsible water management practices.

A growing awareness of the health risks associated with untreated wastewater highlights the importance of robust treatment processes. RO membranes contribute to public health by effectively removing contaminants, producing water that meets safety standards and aligns with the broader goal of ensuring clean and safe water sources. Governments and private entities are actively investing in water infrastructure projects. These investments encompass the expansion and modernization of wastewater treatment plants, providing opportunities for the deployment of advanced RO membrane technologies to enhance overall treatment efficiency.

The development of membrane technologies now focuses on energy efficiency. By addressing issues with operational costs and sustainability, continuous attempts to minimize energy usage in RO membrane processes help to lessen the environmental impact of water treatment operations. Campaigns for public awareness and educational programs are essential in influencing public opinion on water conservation and wastewater treatment. The increased consciousness impacts the municipal and industrial domains, cultivating an enhanced significance of allocating resources towards sophisticated RO membrane technology for sustainable water governance.

Industry Dynamics

Growth Drivers

Stringent Environmental Regulations and Water Scarcity Concerns

Industries are adopting modern wastewater treatment technologies due to the global tightening of environmental restrictions, particularly with regard to water quality standards. Because of their demonstrated effectiveness in eliminating impurities, wastewater RO membranes are essential for businesses trying to adhere to ever-stricter regulatory standards.

A greater emphasis on water conservation is brought about by growing worries about water scarcity, which are made worse by climate change. Reclamation and reuse of treated wastewater, in line with sustainability objectives and tackling the problems caused by depleting freshwater supplies, are made possible by RO membranes.

Reusing and recycling water is becoming popular around the world. RO membranes play a key role in safely reusing wastewater across a variety of industries by treating it to fulfill strict quality standards. This emphasis on water reuse lessens dependency on traditional water supplies and is consistent with sustainable practices.

Report Segmentation

The market is primarily segmented based on type, end use, and region.

|

By Type |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Thin Film Composite Segment Accounted for a Significant Market Share in 2023

In 2023, the thin film composite segment accounted for a significant market share. These membranes offer selectivity and permeability. While rejecting dissolved salts, minerals, and other pollutants in wastewater, the thin layer of polyamide acts as an effective barrier to contaminants, letting water molecules flow. These membranes exhibit a certain level of resistance to fouling, which lengthens the membrane's operational life and lowers the need for cleaning and maintenance. The overall sustainability of wastewater treatment operations is enhanced by the energy-efficient design of these membranes. To maximize energy efficiency and preserve excellent separation performance, cutting-edge materials and technical methods are utilized.

By End Use Analysis

The Industrial Wastewater Treatment Segment Accounted for the Largest Market Share in 2023

The industrial wastewater treatment segment accounted for the largest market share in 2023. Heavy metals, dissolved salts, and organic compounds are some contaminants that are frequently found in wastewater from industrial activities. By efficiently removing these impurities, reverse osmosis membranes provide treated water that satisfies quality requirements. Industrial wastewater can be effectively treated with RO membranes to a quality that is acceptable for reuse in subsequent industrial processes. Decreasing the need for freshwater resources and lowering the environmental effect of wastewater discharge promotes sustainable water management techniques. Industrial facilities must follow regulations governing the release of wastewater into the environment. By offering a dependable and effective way to treat wastewater to appropriate levels, wastewater RO membranes enable the industry to achieve these regulations.

Regional Analysis

Asia-Pacific is Expected to Experience Significant Growth During the Forecast Period

Asia-Pacific is expected to experience significant growth during the forecast period. Owing to rising industrialization, population expansion, and the demand for environmentally friendly water treatment technologies, the wastewater reverse osmosis membrane market in Asia-Pacific has been expanding significantly. Reverse osmosis membrane technology has been used in the region for wastewater treatment, especially in countries that are struggling with pollution and water constraints. A significant problem with water scarcity affects several Asian nations, especially those in some regions of South Asia. With reverse osmosis membranes emerging as a vital technology to handle the growing demand for freshwater resources, adopting modern water treatment solutions is gaining significant traction.

Wastewater from industrial sources has significantly increased as a result of the strong industrialization in the Asia-Pacific region, especially in China and India. Reverse osmosis membrane use has surged as industries realize how important it is to deploy advanced water treatment procedures in order to assure environmental standards compliance and promote sustainable water practices.

In North America, there is a growing emphasis on water reuse and recycling with the adoption of sustainable water management practices. In order to promote water conservation efforts, the RO membrane sector is essential in offering solutions for purifying wastewater to high standards. Continuous improvements in RO membrane technology are a major industry driver. Developments in fouling resistance, energy efficiency, and membrane materials have led to the creation of RO membranes that are more robust and effective in wastewater treatment applications.

Key Market Players & Competitive Insight

The market faces fierce rivalry, with companies leveraging cutting-edge technology, top-notch product offerings, and a robust brand reputation to propel revenue expansion. Key players employ diverse tactics, including dedicated research and development, strategic mergers and acquisitions, and continuous technological advancements. These strategic maneuvers are aimed at broadening their product ranges and sustaining a competitive advantage. The market dynamic is shaped by constant innovation and a commitment to delivering high-quality solutions, underscoring the importance of strategic initiatives in ensuring sustained competitiveness.

Some of the major players operating in the global market include:

- Alfa Laval

- Applied Membranes, Inc.

- AXEON Water Technologies

- DuPont

- GEA Group

- Hydramem

- Hydranautics

- Koch Membrane Systems, Inc.

- LG Chem Ltd.

- MANN+HUMMEL Gruppe

- Membranium

- Pall Corporation

- Toray Industries, Inc.

- Toyobo Co., Ltd.

- Veolia

Recent Developments

- In November 2023, ZwitterCo unveiled the initiation of its Early Access Program for the latest brackish water reverse osmosis (BWRO) membranes. Notable high-fouling applications for these BWRO membranes encompass secondary effluent from wastewater treatment systems and the polishing of effluent.

Wastewater Reverse Osmosis Membrane Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,027.79 million |

|

Revenue forecast in 2032 |

USD 2,153.98 million |

|

CAGR |

9.7% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global wastewater reverse osmosis membrane market size is expected to reach USD 2,153.98 million by 2032

., DuPont, Hydranautics, LG Chem Ltd., MANN+HUMMEL Gruppe, Toray Industries, Inc., Toyobo Co., Ltd are the top market players in the market.

Asia-Pacific region contribute notably towards the global Wastewater Reverse Osmosis Membrane Market.

The global wastewater reverse osmosis membrane market is expected to grow at a CAGR of 10.3% during the forecast period.

The Wastewater Reverse Osmosis Membrane Market report covering key segments are type, end use, and region.