Water-Based Barrier Coatings Market Share, Size, Trends, Industry Analysis Report

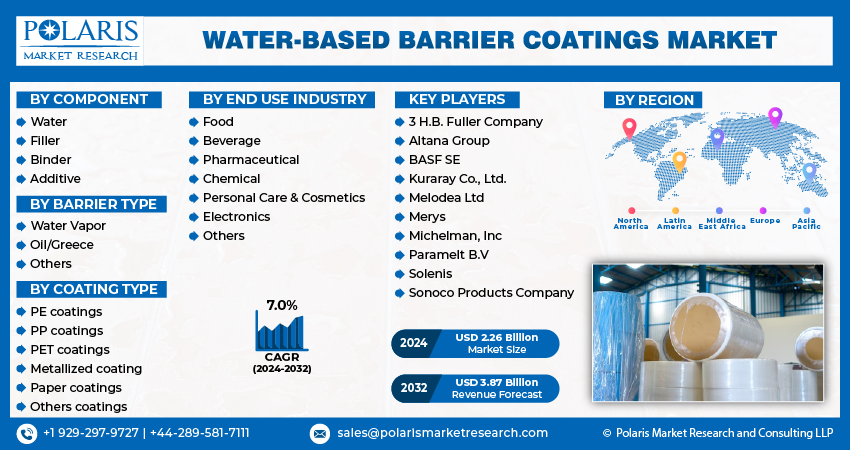

By Component (Water, Filler, Binder, Additive); By Barrier Type; By Coating Type; By End-Use Industry; By Region.; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4524

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

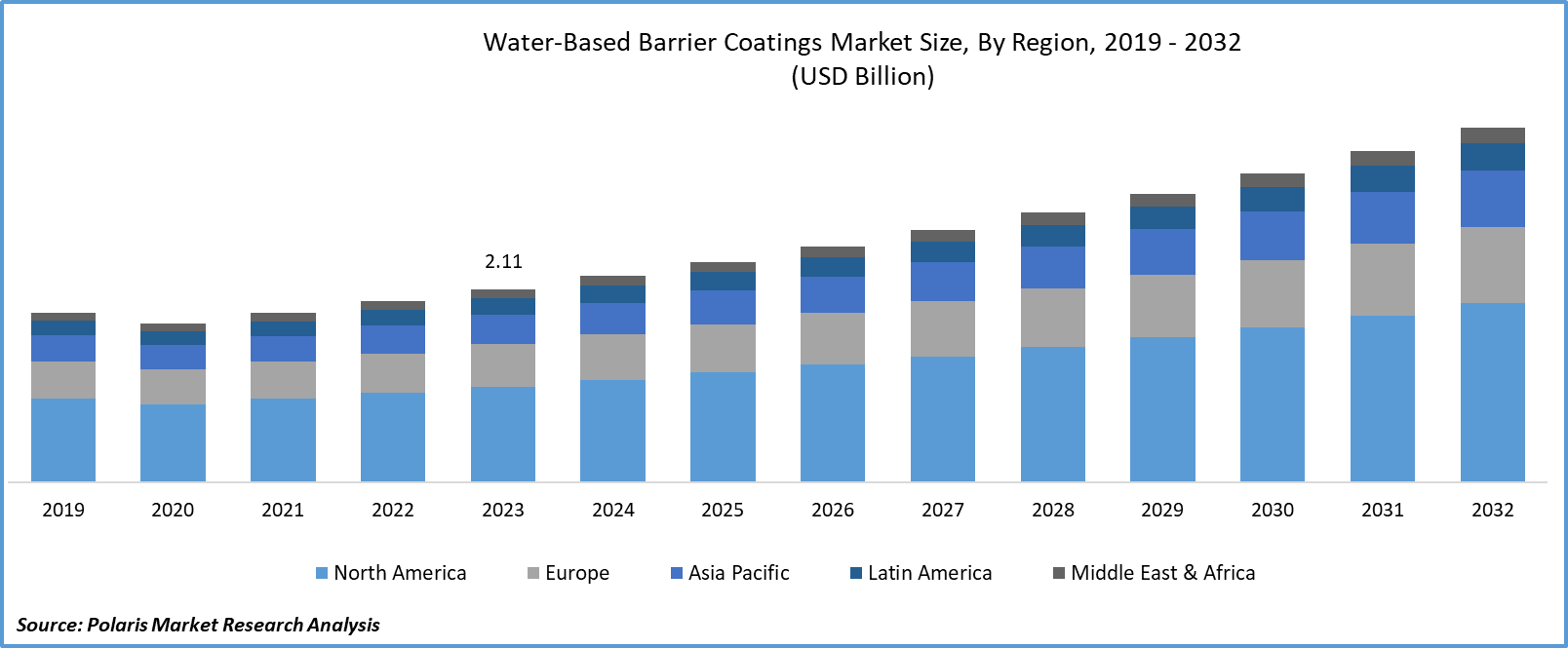

The water-based barrier coatings market size was valued at USD 2.11 billion in 2023. The market is anticipated to grow from USD 2.26 billion in 2024 to USD 3.87 billion by 2032, exhibiting the CAGR of 7.0% during the forecast period.

Industry Trends

Water-based barrier coatings refer to a type of coating or sealant that is primarily composed of water as a solvent or carrier. These coatings are designed to provide a protective barrier on various surfaces, offering resistance against moisture, chemicals, or other environmental factors. The water-based nature of these coatings means that they have lower levels of volatile organic compounds (VOCs) compared to solvent-based alternatives, making them more environmentally friendly.

These coatings are applied to paper, cardboard, or other packaging materials to enhance their resistance to moisture, grease, and other contaminants. This helps maintain the integrity of the packaging and protects the contents. Water-based barrier coatings are used on surfaces such as concrete, wood, or masonry to create a protective layer against water penetration, preventing damage from moisture and contributing to the durability of structures.

The company has recently injected substantial capital into a groundbreaking investment initiative, leveraging cutting-edge technology to revolutionize its operations. This forward-thinking approach aims not only to enhance existing products and services but also to pioneer innovative solutions that will set new industry standards. This comprehensive approach is geared towards enlarging the market footprint, attracting new demographics, and ensuring sustainable growth in an ever-evolving business landscape. Through this synergy of investment, technology, innovation, and strategic planning, the company is poised to remain competitive and emerge as a leader in its industry.

To Understand More About this Research: Request a Free Sample Report

For instance, In April 2023, the Sherwin-Williams Company entered into a purchase agreement with Akzo Nobel N.V., a global coatings company, for the divestment of its architectural paint business in China. The plant is slated to become operational by the conclusion of 2023 and is strategically positioned to address the increasing market demand for water-based coatings in the region.

Moreover, these coatings may be used in medical devices or packaging to create a barrier against liquids, bacteria, or other contaminants. This helps ensure the sterility and safety of medical products. Water-based barrier coatings can be applied to automotive components to protect against corrosion and environmental damage, contributing to the longevity and appearance of the vehicles contribute to grow the water-based barrier coatings market during the forecast period.

Key Takeaway

- Asia Pacific accounted for the largest market and contributed to more than 37% of share in 2023.

- North America region is projected to grow at the fastest CAGR during the forecast period.

- By Coating Type category, PE coating segment accounted for the largest market share in 2023.

- By End-use industry category, the pharmaceutical segment is expected to witness fastest growing CAGR during the forecast period.

What are the Market Drivers Driving the Demand for the Water-Based Barrier Coatings Market?

Rising Demand in Food Packaging

The surge in demand for water-based barrier coatings within the food and beverage industry can be attributed to their instrumental role in addressing critical challenges associated with packaging perishable products. These coatings serve as a protective barrier, offering a multi-faceted shield against external elements, primarily moisture, and gases, that can adversely affect the quality and shelf life of food and beverage items.

One of the primary functions of water-based barrier coatings is to prevent moisture ingress. Moisture is a common adversary in the food industry, as it can lead to issues such as product degradation, spoilage, and the growth of mold or bacteria. Water-based coatings create a robust barrier that inhibits the penetration of water vapor, thus safeguarding the integrity of the packaged food and maintaining its freshness over an extended period.

Moreover, these coatings act as a barrier against gases such as oxygen and carbon dioxide. Oxygen can accelerate the oxidation of food products, due to flavor changes, nutrient degradation, and the development of off-flavors. On the other hand, controlling the permeability to carbon dioxide is crucial for products that require modified atmosphere packaging to slow down the ripening process and preserve freshness. Water-based barrier coatings can be applied to a wide range of substrates, including paper, cardboard, and flexible packaging materials. This versatility makes them suitable for diverse applications, from food packaging to pharmaceuticals and beyond, result in driving the water-based barrier coatings market demand.

Which Factor Is Restraining the Demand for Water-Based Barrier Coatings?

Perceived Shorter Shelf Life

There is a perception, whether accurate or not, that water-based coatings may have a shorter shelf life compared to some solvent-based alternatives, impacting confidence in the longevity and durability of the coatings. Resistance to change within established industries can impede the widespread adoption of water-based coatings. Companies may be hesitant to depart from proven methods and materials, especially if they have longstanding practices with solvent-based coatings. Additionally, water-based coatings may have slightly different application requirements and drying times compared to solvent-based coatings. Manufacturers may need to invest in training employees to adapt to these changes in application techniques and processes, due to a temporary slowdown in production efficiency during the transition period.

Report Segmentation

The market is primarily segmented based on component, barrier type, coating type, end-use industry, and region.

|

By Component |

By Barrier Type |

By Coating Type |

By End Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Coating Type Insights

Based on Coating type analysis, the market is segmented on the basis of PE coatings, PP coatings, PET coatings, metallized coating, paper coatings, and other coatings. PE coating accounted for the largest market share in 2023. Polyethylene (PE) coating has emerged as the dominant player in the Water-Based Barrier coatings market, securing the largest market share. This prominence is attributed to several factors that make PE coating highly desirable in various applications. PE coatings provide an effective barrier against water, moisture, and other environmental factors, enhancing the overall protection of the underlying substrate. The versatility of PE coatings allows them to be applied to diverse materials, including paper and cardboard, making them suitable for a wide range of packaging solutions.

Additionally, PE coatings demonstrate excellent sealing properties, contributing to improved product freshness and shelf life. The ease of application and cost-effectiveness further enhance the appeal of PE coatings for manufacturers seeking efficient barrier solutions.

By End Use Industry Insights

Based on End-use industry analysis, the market has been segmented on the basis of food, beverages, pharmaceuticals, chemicals, personal care and cosmetics, electronics, and others. The pharmaceutical segment is expected to witness the fastest-growing CAGR during the forecast period. The pharmaceutical industry places a premium on product integrity, safety, and compliance with stringent regulatory requirements. Water-based barrier Coatings offer an ideal solution for pharmaceutical packaging, providing an effective barrier against moisture, gases, and external contaminants that could compromise the quality and efficacy of pharmaceutical products.

Water-based coatings, being environmentally friendly and devoid of volatile organic compounds (VOCs), align with the increasing demand for sustainable and eco-friendly packaging solutions within the pharmaceutical sector. The global emphasis on reducing carbon footprints and adopting green practices has heightened the appeal of water-based coatings in pharmaceutical packaging.

Moreover, the pharmaceutical industry is witnessing a surge in the demand for water-based barrier coatings market due to their compatibility with various substrates, including paper and cardboard, commonly used in pharmaceutical packaging. The versatility of these coatings ensures that they can be applied to different packaging formats, such as blister packs, folding cartons, and labels, meeting the diverse needs of pharmaceutical manufacturers.

Regional Insights

Asia Pacific

In 2023, Asia Pacific accounted for the largest market share. The rapid economic growth and industrialization witnessed in several Asia Pacific countries have fueled the demand for packaging solutions across various industries. As the manufacturing sector expanded, the need for effective and sustainable packaging, met by water-based barrier coatings, became increasingly apparent. The densely populated and rapidly urbanizing regions in the Asia Pacific have contributed to an upsurge in demand for packaged goods, ranging from food and beverages to personal care products. This surge has driven the need for advanced packaging solutions like water-based barrier coatings to ensure product safety and shelf life. Growing environmental awareness among consumers has led to a preference for eco-friendly and sustainable packaging options.

North America

North America region is projected to grow at the fastest CAGR during the forecast period. North America has been at the forefront of implementing strict environmental regulations and standards, driving industries to adopt sustainable and eco-friendly practices. Water-based barrier coatings, being low in volatile organic compounds (VOCs) and more environmentally friendly than solvent-based alternatives, align with these regulations, making them a preferred choice. The region has witnessed a growing consumer preference for sustainable and green packaging solutions. Water-based coatings, with their eco-friendly profile, meet this demand and are increasingly chosen by manufacturers looking to align with consumer expectations and market trends. North American companies have been actively investing in research and development to innovate and improve the performance of water-based barrier coatings. Technological advancements have resulted in formulations with enhanced barrier properties, adhesion, and versatility, making these coatings more appealing to a wide range of industries.

Competitive Landscape

The water-based barrier coatings market is characterized by fragmentation, with competition arising from the involvement of numerous players. Leading service providers in this market consistently upgrade their technologies to uphold a competitive advantage, giving priority to efficiency, integrity, and safety. In their pursuit of a significant market share, these participants underscore the importance of strategic partnerships, continuous product upgrades, and collaborative initiatives to outperform their counterparts in the industry.

Some of the major players operating in the global market include:

- 3 H.B. Fuller Company

- Altana Group

- BASF SE

- Kuraray Co., Ltd.

- Melodea Ltd

- Merys

- Michelman, Inc

- Paramelt B.V

- Solenis

- Sonoco Products Company

Recent Developments

- In August 2022, BASF and Nippon Paint China, prominent coatings manufacturers, have collaboratively introduced eco-friendly industrial packaging adopted by Nippon Paint's dry-mixed mortar series. Utilizing BASF's Joncryl, High-Performance Barrier (HPB), a water-based acrylic dispersion, the new packaging represents a milestone as the first use of BASF's water-based barrier coatings in Chinese industrial packaging.

Report Coverage

The water-based barrier coatings market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, barrier type, coating type, end-use industry, and their futuristic growth opportunities.

Water-Based Barrier Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.26 Billion |

|

Revenue forecast in 2032 |

USD 3.87 billion |

|

CAGR |

7.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Barrier Type, By Coating Type, By End Use Industry, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Delve into the intricacies of Water-Based Barrier Coatings in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Mushroom Cosmetics Market Size, Share 2024 Research Report

Rye Market Size, Share 2024 Research Report

Packaged Salad Market Size, Share 2024 Research Report

Coworking Spaces Market Size, Share 2024 Research Report

Pessary Market Size, Share 2024 Research Report

FAQ's

The Water-Based Barrier Coatings Market report covering key segments are component, barrier type, coating type, end-use industry, and region.

Water-Based Barrier Coatings Market Catalyst Market Size Worth $3.87 Billion By 2032

The water-based barrier coatings market exhibiting the CAGR of 7.0% during the forecast period.

North America is leading the global market

key driving factors in Water-Based Barrier Coatings Market are rising Demand in Food Packaging