Water Storage Systems Market Share, Size, Trends, Industry Analysis Report

By Material (Steel, Fiberglass, Concrete, Plastic, and Others); By Application; By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Apr-2023

- Pages: 114

- Format: PDF

- Report ID: PM3144

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

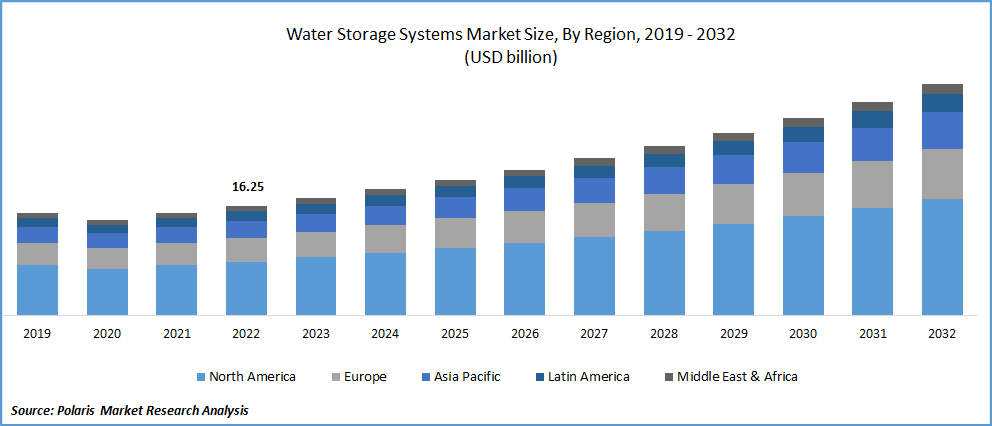

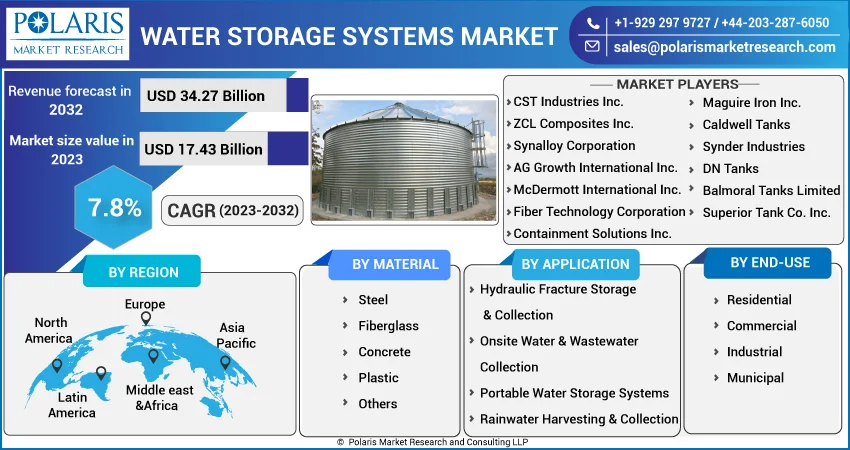

The global water storage systems market was valued at USD 16.25 billion in 2022 and is expected to grow at a CAGR of 7.8% during the forecast period. The rapidly growing concerns regarding the water shortages, increased global population, and high rate of urbanization coupled with the implementation of several types of laws for water conservation and continuously changing climatic circumstances across the globe, are the key factors propelling the global market growth.

Know more about this report: Request for sample pages

Moreover, extensive rise in the advancements in rehabilitation and construction related activities of water storage systems especially in developed countries like US, Germany, and France will further boost the market growth soon.

For instance, in May 2021, Pennslyvania American Water, announced about its plan to rehabilitate 11 of its existing water storage tanks and also construct seven new structures, which would cost a total of USD 17 million. In the last five years, the company has already invested over USD 40 million to maintain, rehabilitate, and develop its storage tanks.

Furthermore, the treated water storage systems are being highly used as a backup in many situations like water supply failure from source, critical pipeline, and sudden increase in the water demand. Thus, the need and demand for water storage systems is mainly dependent on the demand variation in that areas and the number of facilities providing to the area.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the water storage systems market. The rapid spread of the deadly coronavirus has slowed down the investment across many sectors including the water sector and has further resulted in higher cost disruptions, trade restrictions, and shortage of labors. Moreover, the change in pattern of water demand along with the several emergency measures imposed by governments from various governments to handle the pandemic, are also negatively impacted the market growth.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The sharp increase in the global population especially in APAC region countries like China, India, and Bangladesh, which fuels the need for drinking water and also water for agriculture, and is likely to augment the demand and growth of the water storage systems exponentially in the coming years. In addition, escalating water use in the industrial and commercial sectors and emerging trend of storing rainwater to cater the demand of people is also projected to drive global market growth.

Furthermore, the increasing adoption of plastic and reused & recycled plastic storage tanks across many households, as these types tanks have a very longer lie and are also cost-effective as compared to other tanks available in the market and environment-friendliness are prominent factors expected to help in the expansion of the market.

Report Segmentation

The market is primarily segmented based on material, application, end-use, and region.

|

By Material |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Fiberglass segment is expected to witness fastest growth over the projection period

Fiberglass-based structures have superior and extra mechanical strength and are resistant to the degradation, which is fueling its adoption in variety of water tanks or storage systems. Moreover, owing to its lighter weight and high durable qualities compared to other materials available in the market, and growing awareness regarding the food-grade coating inside their surface, making its high preferable for longer duration of time and is expected top fuel the segment market growth in the coming years.

The concrete segment led the market for in 2022 with a significant market share, which is mainly driven by the cost-effectiveness of the material-based water tanks & low maintenance costs. Moreover, concrete based water storage systems are highly durable, easy to maintain hygiene, and easily available in both high- and low-income-income countries, that had fueled its adoption globally.

Onsite water & wastewater collection segment is projected to hold significant share

The onsite water & wastewater collection segment is anticipated to account for healthy market share over the study period owing to the rapid increase in the prevalence for variety of water-borne diseases & increased regulations on the appropriate and safe use of onsite water treatment systems across the globe. In addition, surge in clean water supply, water pollution, & economic urban areas in the emerging nations around the world have added to the demand for innovated water storage systems and propelling the segment growth at rapid pace.

However, the hydraulic fracture storage & collection segment held the largest market share in 2022, and is likely to grow at substantial growth rate over the coming years. Rising utilization of treated and fresh water in the oil & gas refineries and rapidly growing concerns associated with water conservation because of the scarcity of water in several regions are among the key factors driving the segment growth.

Municipal segment accounted for the largest market share in 2022

The municipal segment accounted for largest market share in 2022, and is likely to retain its position throughout the forecast period, as providing proper and efficient storage of water is extremely important for every municipality. Municipal water tanks are widely used to meet the specific guidelines or codes based on the region’s municipal codes and are also used to meet peak demands, like fire flows when of water is high.

The residential segment is expected to expand at remarkable growth rate during the study period. The growth of the segment market can be highly attributed to the increased awareness regarding the depletion of groundwater levels and the extremely growing scarcity of freshwater resources across the globe, has led to the higher adoption of efficient water saving techniques in many households, thereby fueling of the growth of the segment market.

The demand in Asia Pacific is expected to witness significant growth

In the last few decades, APAC region has experienced tremendous economic growth and rapid social development and good water management and human capital enhancement is likely to be critical in the region and will propel the growth and demand for water storage systems market. Additionally, in countries like India and China, river basins are inadequate to supply the growing water demand in these highly populated countries, and resulting in high water shortages, which in turn raised the demand for water storage systems in the near future.

North America region is also projected to account for considerable growth rate over the coming years, owing to wide utilization of water in countries such as US and Canada for commercial, industrial, irrigation, and residential applications and presence of one of the world’s major gas reserves in US. In addition, the rising oil & gas activities and growth in the thermoelectric power generation sector, that uses water on a larger scale are further anticipated to contribute significantly to the market growth.

Competitive Insight

Some of the major players operating in the global market include CST Industries, ZCL Composites, McDermott International, Fiber Technology, Containment Solutions, Maguire Iron., Caldwell Tanks, Synder Industries, DN Tanks, Balmoral Tanks, American Tanks Company, Superior Tank, and Preload.

Recent Developments

- In January 2022, Prayag announced the launch of its new extra strong and durable water tanks, that combines technology and innovations and have been tested for durability and virtually unbreakable. These tanks are developed with latest Rotomoulding technology, and have strong corners and ribs have been provided also for additional strength.

- In March 2022, TRUFLO announced the starting of its new water storage tanks from the Telangana plant to fulfil the demand from southern market. Initially, the water storage solutions will be produced at capacity of 45 lakh liters per month and will expand further, as demand increases.

Water Storage Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 17.43 billion |

|

Revenue forecast in 2032 |

USD 34.27 billion |

|

CAGR |

7.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Material, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

CST Industries Inc., ZCL Composites Inc., Synalloy Corporation, AG Growth International Inc., McDermott International Inc., Fiber Technology Corporation, Containment Solutions Inc., Maguire Iron Inc., Caldwell Tanks, Synder Industries, DN Tanks, Balmoral Tanks Limited, American Tanks Company Inc., Superior Tank Co. Inc., and Preload LLC. |

FAQ's

The water storage systems market report covering key segments are material, application, end-use, and region.

Water Storage Systems Market Size Worth $34.27 Billion By 2032.

The global water storage systems market expected to grow at a CAGR of 7.8% during the forecast period.

Asia Pacific is leading the global market.

Key driving factors in the water storage systems market increasing use of water in the industrial and commercial sectors.