Water Treatment Chemicals Market Size, Share, Trends, Industry Analysis Report

By Type (Flocculants, Coagulants, Corrosion Inhibitors, pH Adjusters & Softeners, and Others), By End Use, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 112

- Format: PDF

- Report ID: PM2049

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

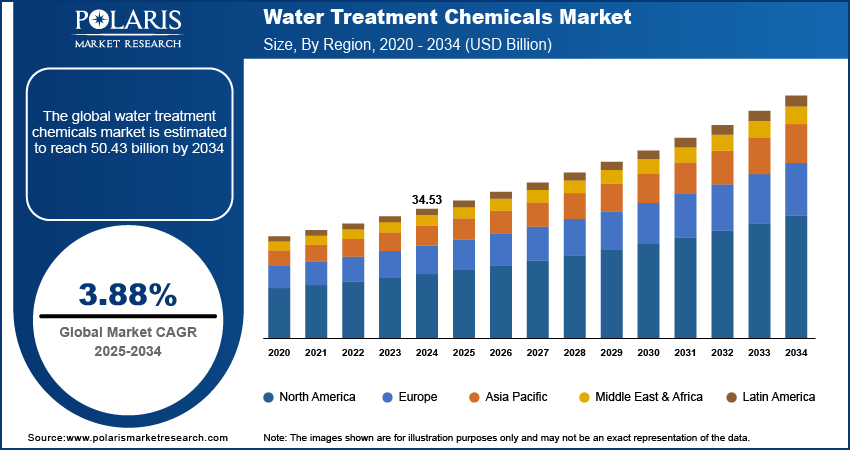

The global water treatment chemicals market size was valued at USD 34.53 billion in 2024. The market is projected to grow at a CAGR of 3.88% during 2025 to 2034. Key factors driving demand for water treatment chemicals include rapid industrialization and urbanization, increasing water scarcity, and stringent environmental regulations.

Key Insights

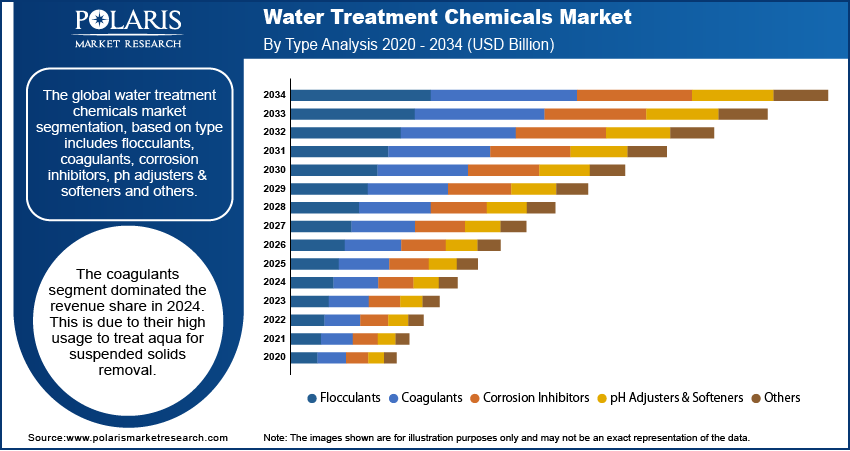

- The coagulants segment dominated the revenue share in 2024. This is due to their high usage to treat aqua for suspended solids removal.

- The industrial segment dominated the global market share in 2024 due to greater aqua treatment in industries such as chemical, food and beverages, and mining.

- Asia Pacific dominated the global water treatment chemicals market in 2024. This is attributed to the industrial growth in countries such as China, India, and Japan.

- The market in North America is projected to grow at a robust pace in the coming years, owing to stringent environmental regulations.

Industry Dynamics

- Economic growth in developing countries, rising industrialization, and declining water reserves are leading to high demand for water treatment chemicals.

- The growing urbanization across the globe is also increasing the demand for water treatment chemicals.

- Technological advancements and initiatives & regulations introduced by governments are creating a lucrative market opportunity.

- Alternative water treatment technologies may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 34.53 Billion

- 2034 Projected Market Size: USD 50.43 Billion

- CAGR (2025-2034): 3.88%

- Asia Pacific: Largest Market Share

To Understand More About this Research:Request a Free Sample Report

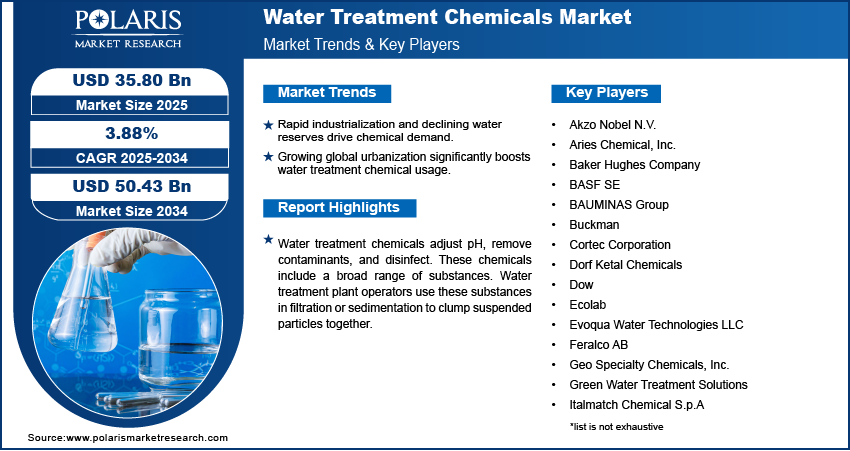

Water treatment chemicals adjust pH, remove contaminants, and disinfect. These chemicals include a broad range of substances. Water treatment plant operators use these substances in filtration or sedimentation to clump suspended particles together. These chemicals eliminate pathogens, including bacteria and viruses, to ensure safe drinking water or process water. The growing demand for safe and freshwater for residential applications has increased the requirement for water treatment chemicals. Different chemicals are used during water treatment. These chemicals include flocculants, corrosion inhibitors, coagulants, biocides & disinfectants, and deforming agents, among others.

These chemicals remove minerals, solids, algae, and other microbes during the treatment process. Growing urbanization and economic development have increased the demand for clean water treatment chemicals across the globe. Rising environmental regulations, scarcity of freshwater resources, and growth in industrial water consumption have increased the adoption of water treatment chemicals. The different kinds of corrosion inhibitors include precipitation-inducing inhibitors, passivity inhibitors, cathodic inhibitors, organic inhibitors, and volatile corrosion inhibitors.

Industry Dynamics

Growth Drivers

Economic growth in developing countries, rising industrialization, and declining water reserves have resulted in greater demand for water treatment chemicals. Industries such as oil and gas, power generation, mining, and paper and pulp, are heavily adoptiong water treatment chemicals. The growing population and increasing focus on river cleaning programs, especially in emerging nations such as India is propelling the demand for water treatment chemicals. The growing diseases due to poor water quality is also encouraging municipalities to use these chemicals. Moreover, technological advancements and initiatives & regulations introduced by governments have strengthened the water treatment chemical market.

The market is primarily segmented on the basis of type, end use, and region.

|

By Type |

By End Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Type

Based on type, the market is segmented into flocculants, coagulants, corrosion inhibitors, pH adjusters & softeners, and others. The coagulants segment held the largest revenue share in 2024, due to its ability in removing suspended solids, organic matter, and pollutants from contaminated water sourcesis. Coagulants are added to the solution to accomplish charge neutralization. Governments strict regulations and water quality standards further contributed to the segment's dominance.

Insight by End Use

The end use industry segment has been divided into municipal, industrial, and others. The industrial segment dominated the global market in 2024 due to water treatment needs in industries such as chemical, food and beverages, mining, power, and paper and pulp, among others. The increasing industrialization in developing countries and the introduction of stringent safety regulations further supported the segment's growth. High wastewater generation from industrial sectors, scarcity of clean water, and technological advancements in the development of efficient treatment processes, contributed to segment's major revenue share.

Geographic Overview

Asia Pacific dominated the global water treatment chemicals market in 2024. The industrial growth in countries such as China, India, and Japan and the growing population drove this region's growth. Increasing urbanization, expansion of international players in this region, and technological advancements are some of the other factors attributed to the region's dominance. Rising environmental concerns and stringent regulations regarding the treatment of water in developing countries of this regin offered a lucrative opportunities for the market.

The market in North America is growing at a rapid CAGR. This is attributed to the stringent environmental regulations, urbanization and population growth, and aging infrastructure. The high awarness about water-borne disease in the region is also leading to adoption of water treatment chemicals. The presence of high numbers of swimming pools and traning centers in the region are further propellin the demand for water treatment chemicals. Moreover, high government spending on people's health in the region is leading to the demand for water cure chemicals.

Competitive Landscape

The leading players in the water treatment chemicals market include Akzo Nobel N.V., Aries Chemical, Inc. Baker Hughes Company, BASF SE, BAUMINAS Group, Buckman, Cortec Corporation, Dorf Ketal Chemicals, Dow, Ecolab, Evoqua Water Technologies LLC, Feralco AB, Geo Specialty Chemicals, Inc., Green Water Treatment Solutions, Italmatch Chemical S.p.A, Kemira, Kurita Europe GmbH, LANXESS, Lonza, SNF CHINA FLOCCULANT CO., LTD., Solenis, Somicon ME FZC, and Suez S.A. These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Industry Developments

April 2024, Thermax announced the opening of its new manufacturing facility in Pune for water and wastewater treatment solutions.

Water Treatment Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 34.53 billion |

| Market size value in 2025 | USD 35.80 billion |

|

Revenue forecast in 2034 |

USD 50.43 billion |

|

CAGR |

3.88% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key Companies |

Akzo Nobel N.V., Aries Chemical, Inc. Baker Hughes Company, BASF SE, BAUMINAS Group, Buckman, Cortec Corporation, Dorf Ketal Chemicals, Dow, Ecolab, Evoqua Water Technologies LLC, Feralco AB, Geo Specialty Chemicals, Inc., Green Water Treatment Solutions, Italmatch Chemical S.p.A, Kemira, Kurita Europe GmbH, LANXESS, Lonza, SNF CHINA FLOCCULANT CO., LTD., Solenis, Somicon ME FZC, and Suez S.A. |

FAQ's

• The global market size was valued at USD 34.53 billion in 2024 and is projected to grow to USD 50.43 billion by 2034.

• The global market is projected to register a CAGR of 3.88% during the forecast period.

• Asia Pacific dominated the market in 2024

• A few of the key players in the market are Akzo Nobel N.V., Aries Chemical, Inc. Baker Hughes Company, BASF SE, BAUMINAS Group, Buckman, Cortec Corporation, Dorf Ketal Chemicals, Dow, Ecolab, Evoqua Water Technologies LLC, Feralco AB, Geo Specialty Chemicals, Inc., Green Water Treatment Solutions, Italmatch Chemical S.p.A, Kemira, Kurita Europe GmbH, LANXESS, Lonza, SNF CHINA FLOCCULANT CO., LTD., Solenis, Somicon ME FZC, and Suez S.A.

• The coagulants segment dominated the market revenue share in 2024.