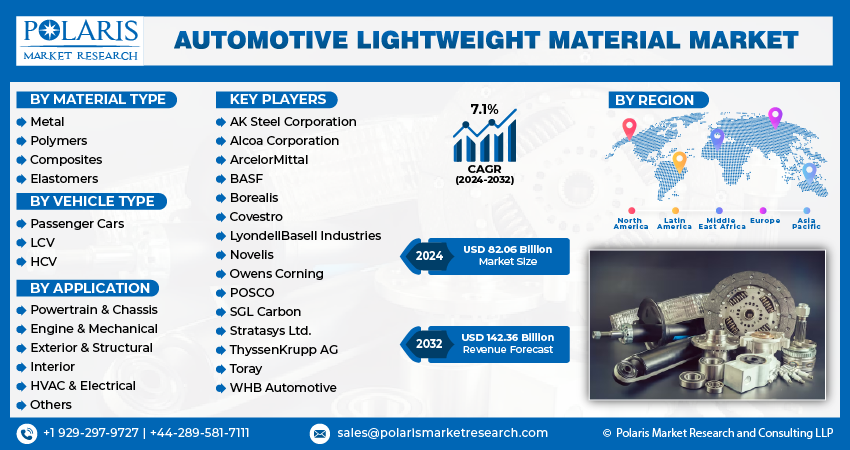

Automotive Lightweight Material Market Size, Share, Trends, & Industry Analysis Report

: By Material Type (Metal, Polymers, Composites, and Elastomers), By Vehicle Type, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1757

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The automotive lightweight material market size was valued at USD 93.22 billion in 2024, growing at a CAGR of 2.1% during 2025–2034. The market is driven by the rising adoption of electric vehicles, stringent emission standards, advancements in material science, and growing sustainability goals.

Key Insights

- The composites segment dominated the market in 2024, due to its superior strength-to-weight ratio and corrosion resistance, particularly in electric and premium vehicles.

- The passenger cars segment held the largest market share in 2024, driven by high production volumes and the need for fuel-efficient models to meet regulatory requirements.

- In 2024, Europe led the market, driven by stringent CO₂ emission standards and strong investments in lightweighting technologies, particularly in electric vehicle production and luxury cars.

- The Asia Pacific market is expected to grow significantly due to industrialization, rising electric vehicle production, and a shift toward lightweight materials for fuel efficiency and regulatory compliance.

Industry Dynamics

- The growing adoption of electric vehicles is driving demand for lightweight materials to improve battery efficiency and energy consumption.

- Sustainability goals are pushing automakers to adopt recyclable and eco-friendly materials, aligning with circular economy principles.

- Innovations in material science, such as advanced composites and alloys, are promoting market growth by providing strength with reduced weight.

- High production costs and the complexity of sourcing advanced materials may hinder the widespread adoption of lightweight materials.

Market Statistics

2024 Market Size: USD 93.22 billion

2034 Projected Market Size: USD 114.81 billion

CAGR (2025–2034): 2.1%

Europe: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Automotive lightweight materials refer to substances and composites specifically chosen and engineered to reduce the overall weight of vehicles while maintaining or enhancing their structural strength and performance. The automotive industry is increasingly focused on incorporating lightweight materials to address challenges such as fuel efficiency, emissions reduction, and improved overall vehicle dynamics. A few common lightweight materials include metal, polymers, composites, and elastomers. The escalating demand for electric and hybrid vehicles has increased the significance of lightweight materials, as lower vehicle weight directly results in extended battery range and improved overall performance. Advancements in material science and manufacturing technologies have also propelled the industry growth. Engineers and researchers are continually developing new composite materials, alloys, and manufacturing processes that offer the ideal combination of strength, durability, and reduced weight. This innovation is driving the adoption of materials such as carbon fiber-reinforced polymers, aluminum, and high-strength steel in automotive design.

Stringent global emission standards are compelling OEMs to reduce vehicle weight to enhance fuel efficiency and lower carbon dioxide emissions. Lightweight materials such as high-strength steel, aluminum, magnesium alloys, and carbon fiber composites play a critical role in achieving compliance without compromising safety or performance. Advanced lightweight materials offer high strength-to-weight ratios, allowing automakers to design safer vehicles that absorb impact energy efficiently while maintaining a lower overall mass, aligning with global safety protocols.

Market Dynamics

Rising Adoption of Electric Vehicles

The growing penetration of electric vehicles is significantly contributing to the demand for automotive lightweight materials. For instance, according to the International Energy Agency, in 2023, the global registration of new electric vehicles reached nearly 14 million units, contributing to a cumulative total of approximately 40 million electric cars operating on roads worldwide. Reducing vehicle weight remains one of the most effective strategies to enhance electric vehicle efficiency, particularly in extending battery range and minimizing energy consumption per kilometer. Heavier battery packs and complex power electronics require structural compensation to preserve vehicle performance, safety, and regulatory compliance. This is driving increased integration of high-strength aluminum alloys, advanced polymers, and carbon fiber-reinforced composites into vehicle chassis, body panels, and interiors. The transition to electrification is accelerating material innovation and supporting market expansion through heightened demand for energy-optimized vehicle architectures that prioritize lightweight design without compromising durability or passenger safety.

Sustainability and Circular Economy Goals

A growing emphasis on environmental sustainability and adherence to circular economy principles is driving substantial shifts in material sourcing and utilization strategies among automakers, which will boost the automotive lightweight material market opportunities. The European Union (EU) is aiming to establish a fully circular economy by 2050. The automotive industry is increasingly adopting lightweight materials that are recyclable, resource-efficient, and aligned with corporate ESG frameworks. This transformation is reshaping R&D pipelines and manufacturing ecosystems toward closed-loop systems, reducing lifecycle emissions and raw material dependency. Biocomposites, recycled aluminum, and thermoplastics engineered for reuse are gaining traction, contributing to market expansion while enhancing environmental compliance. These initiatives are reinforcing the role of sustainable lightweighting as a cornerstone in future-ready automotive design and long-term competitiveness.

Segment Insights

Market Assessment by Material Type

The global market segmentation, based on material type, includes metal, polymers, composites, and elastomers. In 2024, the composites segment dominated the automotive lightweight material market share due to their superior strength-to-weight ratio and excellent resistance to fatigue, corrosion, and thermal stress. High-performance composites, including carbon fiber-reinforced plastics and glass fiber composites, are increasingly preferred in structural and semi-structural vehicle components. Their integration supports both weight reduction and enhanced crash performance, particularly in premium and electric vehicles where performance and efficiency are critical. Extensive use of automated manufacturing processes and advancements in thermoset and thermoplastic composites are reinforcing their commercial viability, contributing to overall market dominance and supporting automakers in achieving ambitious fuel economy and emissions targets.

The polymers segment is expected to witness the highest CAGR during the forecast period, driven by expanding adoption in interior components, under-the-hood applications, and electric vehicle insulation systems. Advanced engineering plastics such as polyamide, polycarbonate, and polypropylene offer a balance of lightweight properties, thermal stability, and design flexibility. Innovation in bio-based polymers and recyclable formulations is accelerating uptake in both ICE and electric vehicle architectures. OEMs are leveraging polymers to optimize component integration, reduce assembly complexity, and lower manufacturing costs, thus contributing to market expansion and material diversification strategies across the global automotive landscape.

Market Evaluation by Vehicle Type

The global market segmentation, based on vehicle type, includes passenger cars, LCV, and HCV. The passenger cars segment accounted for the largest market share in 2024 due to heightened production volumes, shifting consumer demand toward fuel-efficient models, and regulatory pressure on fleet emissions. OEMs are intensifying lightweighting initiatives in this segment to balance performance, comfort, and sustainability expectations. Structural aluminum components, lightweight steel grades, and polymer-composite hybrids are being widely implemented across body-in-white, closures, and interior modules. Continuous advancements in forming techniques and bonding technologies are enabling broader deployment of lightweight solutions at scale, enhancing both mass reduction and cost-efficiency.

The LCV segment is expected to register the highest CAGR during the forecast period due to the rising demand for efficient urban delivery fleets and electrified utility vehicles. Weight optimization in LCVs directly improves payload capacity, driving range, and operational economy key performance metrics for fleet operators. Manufacturers are increasingly integrating lightweight aluminum chassis, composite cargo enclosures, and polymer-intensive interior structures to achieve substantial mass savings. Coupled with growing investments in electric and hybrid LCV platforms, this is reinforcing light weighting as a strategic priority and contributing to robust market expansion in the segment.

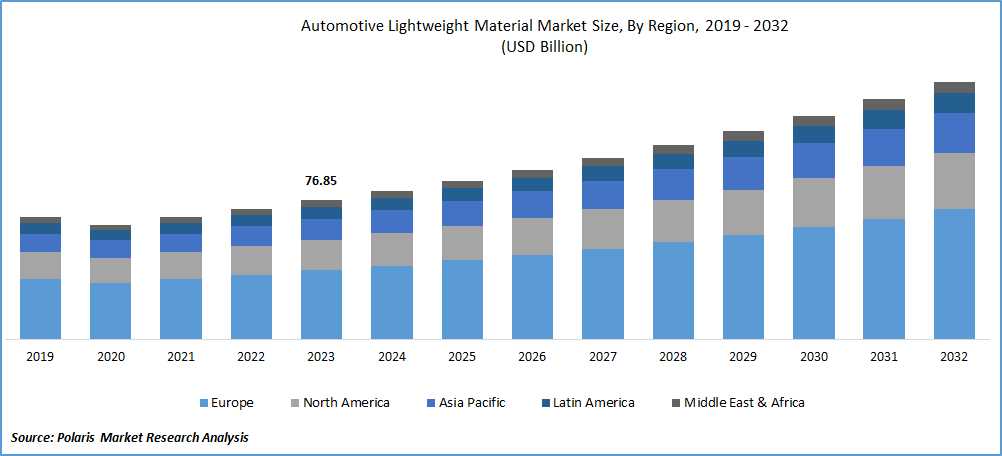

Regional Analysis

By region, the study provides automotive lightweight material market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Europe accounted for the largest share due to the region's stringent vehicle emission standards, such as the EU CO₂ targets, which continue to drive demand for advanced lightweighting technologies. For instance, in April 2023, the European Parliament and Council updated EU regulations to tighten CO₂ emission standards for new cars and vans, supporting the bloc's 2050 climate neutrality goal. The revised rules impose stricter 2030 targets and mandate a 100% emissions cut for all new vehicles by 2035. Automakers operating in the region are heavily investing in structural optimization and the substitution of traditional steel with high-performance materials such as aluminum alloys, carbon fiber composites, and advanced polymers. Strong presence of luxury and performance vehicle manufacturers, along with a well-established electric vehicle production ecosystem, is further amplifying the use of weight-reduction solutions. Robust government support for clean mobility and an advanced R&D infrastructure are contributing significantly to market dominance, positioning Europe as a leader in sustainable automotive engineering and lightweight material innovation.

The Asia Pacific automotive lightweight material market is projected to experience the significant growth during the forecast period driven by rapid industrialization, increasing vehicle production, and growing demand for electric and hybrid vehicles across major economies such as China, Japan, and South Korea. According to the India Brand Equity Foundation, the Indian electric vehicle (EV) market is projected to experience substantial growth, escalating from an estimated value of USD 3.21 billion in 2022 to a remarkable USD 113.99 billion by 2029. Rising focus on energy efficiency, fuel economy, and regulatory compliance is pushing OEMs to adopt lightweight materials across mid-range and compact vehicle categories. Expansion of domestic manufacturing capabilities, alongside investments in composite fabrication and metal forming technologies, is enabling cost-effective integration of advanced materials. Strengthening supply chains, government-led sustainability initiatives, and a growing EV market are collectively contributing to accelerated market expansion across the region.

Key Market Players and Competitive Analysis

The competitive landscape of the automotive lightweight material market is characterized by a high degree of innovation and strategic alignment aimed at reducing vehicle weight without compromising performance or safety. Industry analysis reveals that market players are increasingly pursuing market expansion strategies through joint ventures and strategic alliances, particularly to enhance access to advanced material technologies and region-specific manufacturing capabilities. Mergers and acquisitions are reshaping competitive dynamics, enabling participants to streamline supply chains and achieve scale in composite and high-performance polymer production. New product launches featuring high-strength aluminum alloys, magnesium composites, and thermoplastic polymers are setting benchmarks in lightweight performance.

Post-merger integration efforts are focused on consolidating R&D and accelerating time-to-market for next-generation materials tailored for electric and hybrid vehicles. Technology advancements in nanocomposites, multi-material joining techniques, and additive manufacturing are further intensifying competition. The shift toward circular economy practices is also prompting strategic moves to develop recyclable and sustainable lightweight solutions. Collaborative efforts between material science firms and automotive OEMs underscore the importance of synergistic development in response to regulatory pressures and evolving design philosophies. This dynamic competitive environment continues to fuel innovation and sustain long-term growth in the global automotive lightweight material industry.

BASF is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the Materials section. BASF is engaged in the development and supply of advanced lightweight materials for the automotive industry, focusing on polymer matrix composites such as epoxy resin, polyurethane, and polyamide, as well as innovative plastic and foam solutions. These materials are engineered to replace traditional metals in automotive components, enabling significant weight reduction without compromising mechanical strength, impact resistance, or thermal stability, and are used in parts such as body panels, engine covers, bumpers, and structural inserts.

Toray Industries, Inc. is engaged in producing advanced materials and products for various industries. The company specializes in polymer chemistry and offers a wide range of products such as polyester films for imaging and electronics, carbon fiber composites for aerospace and automotive sectors, and textiles for industrial use. Toray provides services in research and development to innovate sustainable solutions. Headquartered in Tokyo, Japan, Toray has a significant presence across Asia Pacific, Europe, North America, and other regions through its subsidiaries and production facilities. Toray Industries, Inc. is engaged in producing high-performance composite materials for automotive light weighting, including carbon-fiber-reinforced plastics (CFRP) and both thermoset and thermoplastic prepregs. Its materials offer substantial weight savings up to 70% lighter than steel and are designed for structural and body panel applications, providing high strength, impact resistance, and thermal stability, with rapid molding technologies supporting efficient production for next-generation and electric vehicles.

List of Key Companies

- Alcoa Corporation

- ArcelorMittal

- BASF

- LyondellBasell

- Novelis Inc.

- Owens Corning

- POSCO

- Stratasys Ltd.

- Tata Steel

- Toray Industries, Inc.

Automotive Lightweight Material Industry Developments

In March 2025, Toray Industries, Inc. launched a 50-micrometer-thick version of its PICASUS IR film for windows, offering high transparency and heat shielding through nano-multilayer technology.

In June 2024, Stratasys Ltd. launched its innovative SAF Polypropylene (PP) material for the Stratasys H350 3D printer, enhancing performance and broadening additive manufacturing applications.

In April 2024, Hyundai-Kia and BASF collaborated for the third time on the Kia EV3 Study Car, an experimental concept vehicle. The car incorporated BASF’s sustainable materials in plastics, textiles, tires, and steel to improve performance, design, and environmental impact.

Automotive Lightweight Material Market Segmentation

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Metal

- Polymers

- Composites

- Elastomers

By Vehicle Type Outlook (Revenue, USD Billion, 2020–2034)

- Passenger Cars

- LCV

- HCV

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Powertrain & Chassis

- Engine & Mechanical

- Exterior & Structural

- Interior

- HVAC & Electrical

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Lightweight Material Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 93.22 billion |

|

Market Size Value in 2025 |

USD 95.14 billion |

|

Revenue Forecast by 2034 |

USD 114.81 billion |

|

CAGR |

2.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue, USD Billion; and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 93.22 billion in 2024 and is projected to grow to USD 114.81 billion by 2034.

The global market is projected to register a CAGR of 2.1% during the forecast period.

In 2024, Europe accounted for the largest share due to the region's stringent vehicle emission standards, such as the EU CO? targets, which continue to drive demand for advanced lightweighting technologies

A few of the key players in the market are Alcoa Corporation; ArcelorMittal; BASF; LyondellBasell; Novelis Inc.; Owens Corning; POSCO; Stratasys Ltd.; Tata Steel; and Toray Industries, Inc.

In 2024, the composites segment held the largest market share due to their superior strength-to-weight ratio and excellent resistance to fatigue, corrosion, and thermal stress.

The passenger cars segment accounted for the largest market share in 2024 due to heightened production volumes, shifting consumer demand toward fuel-efficient models, and regulatory pressure on fleet emissions.