Fuel Cell Market Size, Share, Trends, Industry Analysis Report

By Type (Solid Oxide Fuel Cells, Phosphoric Acid Fuel Cells, Proton Exchange Membrane Fuel Cells), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM1585

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

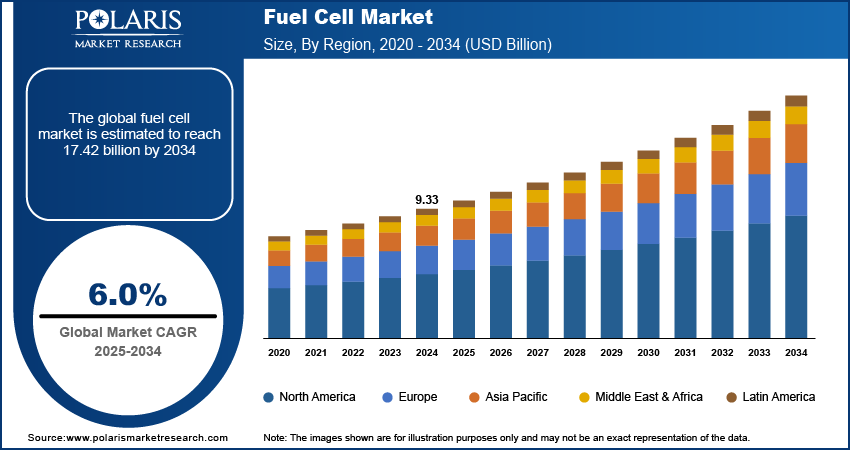

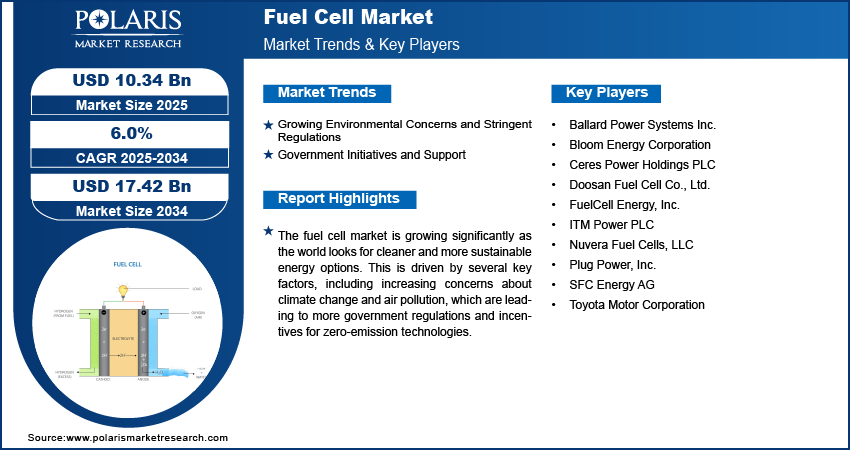

The global fuel cell market size was valued at USD 9.33 billion in 2024 and is anticipated to register a CAGR of 6.0% from 2025 to 2034. The main drivers are the global demand for clean energy and the push to lower carbon emissions. Government policies and investments are also helping to grow the sector by supporting hydrogen infrastructure and encouraging the use of fuel cells in vehicles and power generation. Advancements in fuel cell technology, such as improved efficiency and lower costs, are also boosting their appeal.

Key Insights

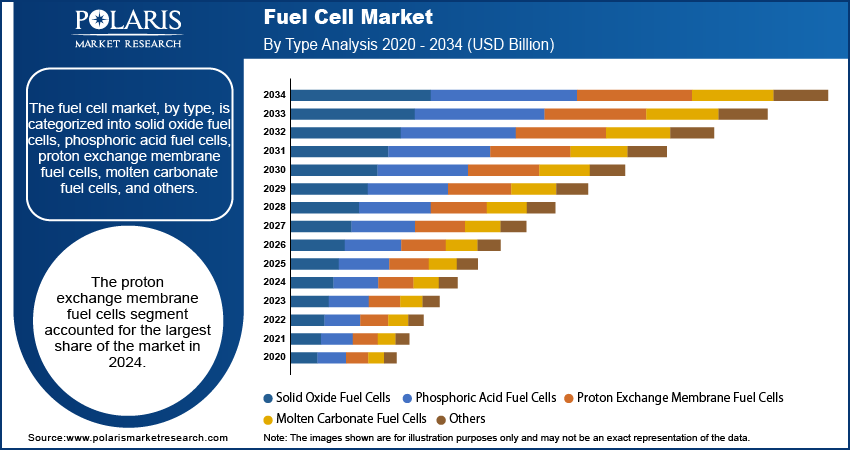

- By type, the proton exchange membrane fuel cell (PEMFC) segment held the largest share in 2024. Its quick startup time and high power density make it very useful for the transportation industry, especially in fuel cell electric vehicles.

- In terms of application, the stationary segment accounted for the largest share in 2024. It is a vital source of clean and reliable power for essential infrastructure such as data centers and hospitals, as well as for combined heat and power systems.

Industry Dynamics

- The increasing focus on reducing carbon emissions and the adoption of strict environmental regulations by governments around the world are major growth factors. As a clean energy source, fuel cells produce electricity with water and heat as the only byproducts, making them an attractive alternative to fossil fuels. The push for a cleaner environment and the need for sustainable energy solutions are significantly driving their demand across various industries.

- Governments globally are offering favorable policies, incentives, and subsidies to promote the use of zero-emission technologies. These initiatives include funding for research and development, building hydrogen refueling infrastructure, and tax credits for fuel cell electric vehicles (FCEVS). This support helps in lowering the initial costs and encourages both businesses and consumers to adopt fuel cell technology.

- Ongoing developments in technology are improving the efficiency, durability, and cost-effectiveness of fuel cells. Innovations in materials, manufacturing processes, and system design are making them more viable for commercial use. These improvements are expanding the use of fuel cells beyond traditional applications, such as in heavy-duty transportation and large-scale power generation.

Market Statistics

- 2024 Market Size: USD 9.33 billion

- 2034 Projected Market Size: USD 17.42 billion

- CAGR (2025-2034): 6.0%

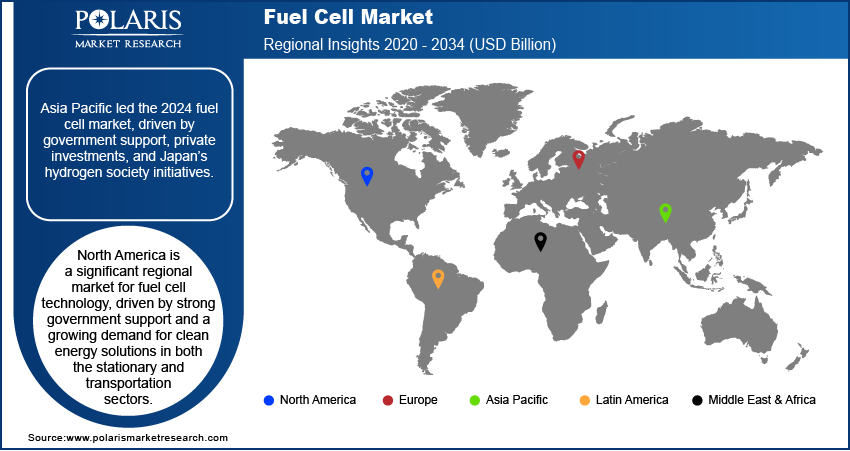

- Asia Pacific: Largest market in 2024

AI Impact on Fuel Cell Market

- Artificial Intelligence (AI) is transforming the fuel cell market across various dimensions such as design, manufacturing, performance optimization, and energy management.

- Engineers use AI tools to explore thousands of fuel cell configurations, optimizing electrode layouts and fluid dynamics for better efficiency.

- The technology integrates electrochemical, thermal, and structural models to deliver high-fidelity insights during prototyping

- AI tools redistribute power across fuel cell stacks to maintain safety and performance.

- AI enhances thermal management, hydrogen storage, and autonomous driving features in fuel cell vehicles (FCVs).

The global clean energy industry includes the production, distribution, and use of devices that convert the chemical energy of a fuel, such as hydrogen, into electricity. It is a key part of the global shift away from fossil fuels, with applications in various sectors such as transportation, stationary power, and portable electronics.

Rising demand for efficient and reliable power backup systems drives the demand for fuel cells. Fuel cells are a strong option for the backup systems as they provide continuous power without the need for frequent refueling or long recharge times. It makes them suitable for critical applications such as data centers and telecommunications. Another factor is the increased interest in off-grid power solutions, especially in remote areas or developing countries. Fuel cells offer a clean and dependable way to generate power in places without access to an electrical grid.

One driver that has seen significant developments is the push for sustainable energy sources. Fuel cells are a key part of this global effort as they produce electricity with almost no harmful emissions. This aligns with worldwide goals to fight climate change and improve air quality. For instance, the use of fuel cells in medical equipment and facilities demonstrates their potential for providing clean and reliable power in critical healthcare settings. As regulations become stricter and the cost of renewable energy becomes lower, the demand for this technology is expected to keep growing.

Drivers and Trends

Growing Environmental Concerns and Stringent Regulations: The increasing focus on reducing carbon emissions and the worldwide push for cleaner energy sources are a primary growth factor. Fuel cells are a clean technology that uses hydrogen to produce electricity, with water as the only byproduct, making them a zero-emission solution at the point of use. This environmental advantage is a key reason for their growing adoption in various sectors, from transportation to stationary power generation. As global climate goals become more urgent, governments and industries are looking for effective ways to cut their carbon footprint, and fuel cells offer a direct path to achieving that.

The International Energy Agency (IEA) highlights that over 85% of global car sales are subject to fuel economy and CO2 standards. The European Union's CO2 emissions standards have played a major role in promoting the sales of electric cars. Moreover, the US Department of Energy (DOE) emphasizes that a 10% reduction in vehicle weight can improve fuel efficiency by 6% to 8%. The rising demand for sustainable and eco-friendly solutions is thus driving the forward.

Government Initiatives and Support: Government policies and financial support are another key driver. Many countries are now creating strategies to develop a hydrogen economy, which includes building the necessary infrastructure for producing, storing, and distributing hydrogen. These policies often come with significant funding for research and development, as well as incentives for businesses and consumers to adopt fuel cell technology. This support helps to reduce the high initial costs and encourages wider use, making fuel cells more competitive with traditional power sources.

India's National Green Hydrogen Mission, launched with a significant budget, aims to support pilot projects for using green hydrogen in the transport sector, including fuel cell-based buses and trucks. The Inflation Reduction Act of U.S. also includes tax incentives to stimulate investment in hydrogen production and distribution. Such government-led initiatives are vital for building a robust and ensuring the long-term success of the technology. This government backing is creating a strong foundation for the industry, which is driving overall growth.

Segmental Insights

Type Analysis

Based on type, the segmentation includes solid oxide fuel cells, phosphoric acid fuel cells, proton exchange membrane fuel cells, molten carbonate fuel cells, and others. The proton exchange membrane fuel cells segment held the largest share in 2024. These cells operate at a lower temperature, which allows them to start up quickly and makes them a great fit for a wide range of applications. Their high power density and compact size make them particularly well-suited for the transportation industry, including fuel cell electric vehicles like cars, buses, and heavy-duty trucks. Additionally, the growing push for zero-emission transportation and investments from major automakers in hydrogen vehicles have boosted the adoption of PEMFCs. Their technological maturity, combined with ongoing efforts to reduce costs and improve performance, positions them as the leading segment.

The solid oxide fuel cells (SOFCs) segment is anticipated to register the highest growth rate during the forecast period. The growth is largely attributed to their high efficiency and ability to use different types of fuels, such as synthetic natural gas and biogas, in addition to hydrogen. Their high operating temperature also makes them suitable for combined heat and power systems, where the heat they produce can be used for other purposes, increasing their overall efficiency. This makes SOFCs an attractive option for stationary power generation in industrial and commercial settings. As the demand for highly efficient and flexible power solutions for decentralized energy systems continues to rise, the growth of this segment is expected to be strong.

Application Analysis

Based on application, the segmentation includes stationary, transportation, and portable. The stationary segment held the largest share in 2024. These systems are used as backup power for critical infrastructure such as data centers, hospitals, and telecommunications networks, where an uninterrupted power supply is essential. They also serve as a source for primary power in combined heat and power systems, which are highly efficient and used in commercial and industrial settings. The ability of stationary fuel cells to operate quietly, with zero emissions, makes them an attractive alternative to traditional diesel generators, particularly in urban areas with strict environmental regulations.

The transportation segment is anticipated to register the highest growth rate during the forecast period. This is because of the global move toward zero-emission vehicles and increasing government support for hydrogen infrastructure. Fuel cells are gaining traction in heavy-duty vehicles, including buses, trucks, trains, and even marine vessels, as they offer advantages such as fast refueling and long-range capabilities, which are often not possible with battery electric vehicles. As hydrogen production becomes more cost-effective and the network of hydrogen refueling stations expands, the use of fuel cells in transportation is set to increase significantly. The development of advanced fuel cell technology and rising investments from major automotive fuel cell companies are also driving this segment's rapid expansion.

Regional Analysis

The Asia Pacific fuel cell market accounted for the largest share in 2024, with strong government support and significant private sector investments driving innovation and adoption. The region’s focus on energy security and addressing air pollution has led to the widespread development of hydrogen infrastructure and the commercialization of fuel cell technologies in various applications. The major players in the region are heavily investing in both the stationary and transportation sectors, with a particular emphasis on making fuel cell vehicles more accessible to the public.

Japan Fuel Cell Market Overview

In Asia Pacific, Japan is a key country in the advancement of fuel cell technology. The country has been a pioneer in commercializing fuel cell vehicles and has a well-established network of hydrogen refueling stations. Japan's government has a long-term strategy to build a hydrogen-based society, which includes promoting residential fuel cells and supporting the use of fuel cells in a variety of sectors. This has made Japan a central hub for research, development, and commercial deployment of fuel cell systems in the region.

North America Fuel Cell Market Trends

The market in North America is driven by strong government support and a growing demand for clean energy solutions in both the stationary and transportation sectors. The region has seen considerable investment in hydrogen infrastructure and research and development, particularly in the U.S. and Canada. Companies are also actively working on partnerships to push fuel cell systems into commercial and industrial applications. This combination of government backing and private sector investment is helping to accelerate the adoption of this technology.

U.S. Fuel Cell Market Insights

The U.S. plays a central role in North America, with a strong focus on both the development and deployment of fuel cell technology. Government initiatives and funding programs are key to advancing hydrogen and fuel cell technologies. There is also a major push for fuel cells in the transportation sector, especially for heavy-duty vehicles and buses, as states work to meet zero-emission vehicle mandates. The country's strong industrial base and focus on reducing carbon emissions continue to support the expansion of fuel cell applications across different industries.

Europe Fuel Cell Market Outlook

The European market is experiencing notable growth, fueled by the region's strong commitment to decarbonization and a robust hydrogen strategy. Policies and funding from the European Union and national governments are helping to build a comprehensive hydrogen ecosystem, which includes production, storage, and refueling infrastructure. This supportive environment is particularly beneficial for the use of fuel cells in transportation, where they are being deployed in buses, trucks, and trains as part of efforts to reduce emissions in the logistics and public transit sectors.

The Germany fuel cell market is a major country in Europe, known for its ambitious goals and strong government support for hydrogen and fuel cells. The country has invested heavily in developing a nationwide hydrogen infrastructure, with a growing number of refueling stations and pilot projects for heavy-duty fuel cell vehicles. Germany's industrial and manufacturing capabilities, combined with its focus on renewable energy, make it a leader in the development and adoption of fuel cell systems for both stationary power generation and transportation.

Key Players and Competitive Insights

The market's competitive landscape is shaped by a mix of established players and emerging companies. Key players such as Plug Power, Inc.; Ballard Power Systems, Inc.; FuelCell Energy, Inc.; Bloom Energy; and Doosan Fuel Cell, Co., Ltd. are working on new technologies to gain a competitive edge. They are focused on improving the efficiency and durability of fuel cells while also trying to lower production costs. Companies are also forming partnerships and collaborations to develop a complete hydrogen ecosystem, which includes building infrastructure and providing end-to-end solutions for customers. The race to create more powerful and cost-effective fuel cell systems for applications like transportation and stationary power is driving significant innovation.

A few prominent companies include Plug Power, Inc.; Ballard Power Systems, Inc.; FuelCell Energy, Inc.; Doosan Fuel Cell, Co., Ltd.; Bloom Energy; Ceres Power Holdings PLC; ITM Power PLC; SFC Energy AG; Nuvera Fuel Cells, LLC; and Toyota Motor Corporation.

Key Players

- Ballard Power Systems Inc.

- Bloom Energy Corporation

- Ceres Power Holdings PLC

- Doosan Fuel Cell Co., Ltd.

- FuelCell Energy, Inc.

- ITM Power PLC

- Nuvera Fuel Cells, LLC

- Plug Power, Inc.

- SFC Energy AG

- Toyota Motor Corporation

Fuel Cell Industry Developments

September 2025: Ballard introduced the FCmove-SC fuel cell at Busworld 2025. Ballard stated that the fuel cell is designed for city transit buses. It offers improved performance and can be easily integrated into vehicles.

July 2025: Doosan Fuel Cell, a major provider of fuel cell solutions, announced that it has started mass production of fuel cell stacks using Ceres Power's solid oxide technology.

July 2025: Plug Power announced a new multi-year strategic supply agreement with a major industrial gas company. This deal extends their current partnership through 2030.

Fuel Cell Market Segmentation

By Type Outlook (Revenue – USD Billion; Volume, Units; 2020–2034)

- Solid Oxide Fuel Cells

- Phosphoric Acid Fuel Cells

- Proton Exchange Membrane Fuel Cells

- Molten Carbonate Fuel Cells

- Others

By Application Outlook (Revenue – USD Billion; Volume, Units; 2020–2034)

- Stationary

- Transportation

- Portable

By Regional Outlook (Revenue – USD Billion; Volume, Units; 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fuel Cell Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.33 billion |

|

Market Size in 2025 |

USD 10.34 billion |

|

Revenue Forecast by 2034 |

USD 17.42 billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

USD Billion; Volume, Units; and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.33 billion in 2024 and is projected to grow to USD 17.42 billion by 2034.

The global market is projected to register a CAGR of 6.0% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include Plug Power, Inc.; Ballard Power Systems, Inc.; FuelCell Energy, Inc.; Doosan Fuel Cell, Co., Ltd.; Bloom Energy; Ceres Power Holdings PLC; ITM Power PLC; SFC Energy AG; Nuvera Fuel Cells, LLC; and Toyota Motor Corporation.

The proton exchange membrane fuel cells segment accounted for the largest share of the market in 2024.