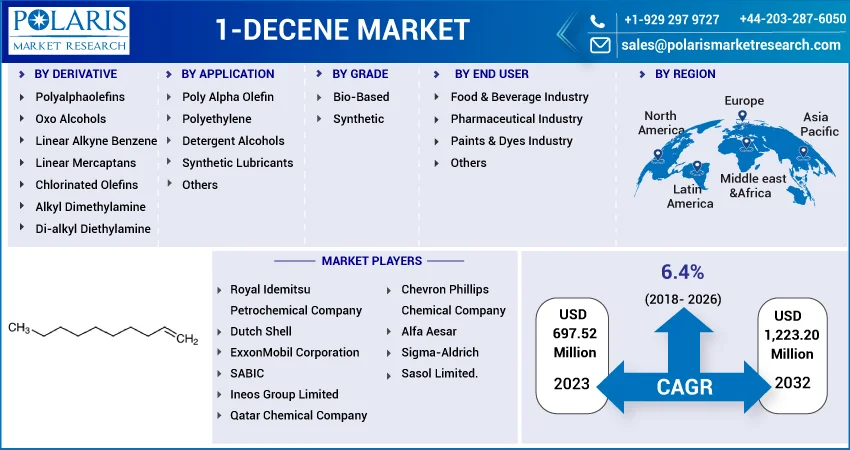

1-Decene Market [By Derivative (Polyalphaolefins, Oxo Alcohols (Plasticizer and Detergent Alcohols), Linear Alkyl Benzene, Linear Mercaptans, Chlorinated Alpha Olefins, Alkyl Dimethylamine & di-Alkyl Dimethylamine); By Application; By Grade; By End-Use; By Region]: Market size & Forecasts, 2023-2032

- Published Date:Feb-2023

- Pages: 112

- Format: PDF

- Report ID: PM1152

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

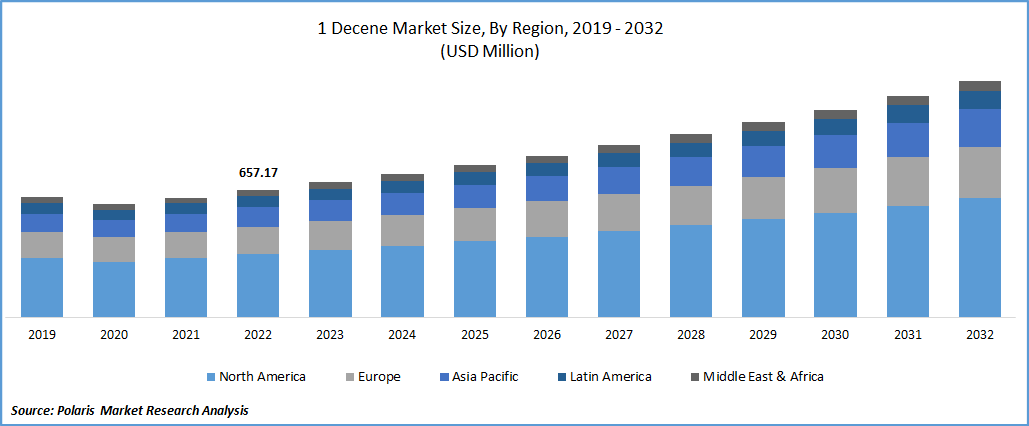

The global 1-decene market was valued at USD 657.17 million in 2022 and is expected to grow at a CAGR of 6.4% during the forecast period.

The need for synthetic lubricants, rising environmental pollution concerns, especially from the automotive industry, and rising demand for synthetic lubricants like Poly Alpha Olefins (PAO) are the main drivers anticipated to propel the growth of the global 1-decene market.

Know more about this report: Request for sample pages

Synthetic lubricant producers are forced to look for other raw materials for oil production due to a lack of PAO in the market. Thus, ester-based synthetic oils are becoming more popular and are projected to have an impact on the growth of the 1-decene market over the forecast period.

Global demand for synthetic lubricants and poly alpha olefin manufacture has grown as a result of increased environmental concerns in the automobile industry, cosmetic industry, and demand for food additives from developing nations. The usage of 1-decene has significantly increased as a result of this. The synthesis of detergents and their derivatives, which are used to make commercial surfactants, uses 1-decene as a chemical intermediary.

The supply and demand situation, as well as the state of the economy, have always had a significant impact on the global industry. The cost-plus pricing method, in which raw material costs play a significant role, is typically the basis for determining the 1-decene market price. The price of ethylene has fluctuated in the past, and the same pattern can be seen for the pricing of alpha olefins.

Demand for poly alpha olefins has recently increased due to the rising use of synthetic lubricants, which offer superior lubrication and result in reduced engine wear and tear. The most popular alpha-olefin for PAO manufacturing is C-10, which is created when linear alpha olefins are oligomerized. The primary reason driving the 1-decene sector is anticipated to be rising PAO demand for generating engine/gear oils, greases, and other lubricants.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

One of the preferred industrial-essential isomers, 1-decene is utilized as a copolymer monomer, a step in the synthesis of epoxides, amines, oxo alcohols, and synthetic lubricants. Increased product demand as a result of this factor is anticipated to propel market expansion. Demand for 1-decene is anticipated to rise in response to the growing demand for high-density polyethylene (HDPE), a material used to make appliances for homes and packaging. Another factor promoting market expansion is the growing use of Low-density polyethylene (LDPE) in the production of kitchen equipment.

The market for 1-decene is anticipated to develop as a result of rising demand for 1-decene used to make lubricants such as gear oil, compressor oil, transmission oil, and lube oil. The global market is expanding as a result of rising POA demand from automotive OEMs for improving engine efficiency and reducing VOC emissions by automobiles.

In the synthesis of detergents and their derivatives, such as industrial surfactants, 1-decene is employed as a chemical intermediary. The global 1-decene market is anticipated to expand as a result of rising demand for surfactants from various end-use industries and the simple availability of raw materials.

Report Segmentation

The market is primarily segmented based on derivative, application, grade, end use, and region.

|

By Derivative |

By application |

By Grade |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The Polyalphaolefins Segment is Expected to Witness the Fastest Growth over the Forecast Period

The poly-alpha olefins segment is expected to witness the fastest growth during the forecast period. The manufacturing and automotive industries are the two main users of polyalphaolefins. They are also utilized as gear oil, lube oil additives, compressor oil, and transmission oil. These practical applications raise demand.

The Synthetic Lubricant Segment for the Largest Market Share in 2022

The synthetic lubricant category dominated the market in 2022. The variables that might be linked to rising environmental laws in the automobile industry, as well as the requirements for increasing demand in the cosmetic and food and beverage industries, are driving up demand for this market.

The Demand in North America is Expected to Witness Significant Growth over the Forecast Period

Because of the region's expanding shale gas development and rising Polyalphaolefin production, North America currently holds a sizable portion of the global 1-Decene industry (PAO). One of the biggest chemical firms in the world, for instance, is ExxonMobil Chemical. Over the past few years, it has seen the highest increase in polyalphaolefin production capacity anywhere in the globe, and it is anticipated to drive 1-Decene market expansion in North America.

The market expansion of 1-Decene in the North American region is projected to be driven by the rising demand from the automotive industry as well as the growing awareness of environmentally friendly products. In the meantime, the Asia Pacific region is anticipated to be a sizable market during the forecast period. Due to the fact that detergent alcohols and their dependents are important raw materials utilised as surfactants in clothes and dishwashing applications, the dishwashing and detergents business is growing.

Due to rising PAO and synthetic lubricant production in the region, the region Asia Pacific is expected to see the fastest growth throughout the projection period. The simple accessibility of raw materials contributes to regional growth as well. It is anticipated that increasing demand for polyethylene in developing nations like China and India would boost product demand even more.

Competitive Insight

The major key players include Royal Idemitsu Petrochemical Company, Dutch Shell, ExxonMobil Corporation, SABIC, Ineos Group Limited, Qatar Chemical Company, Chevron Phillips Chemical Company, Alfa Aesar and Sigma-Aldrich, Sasol Limited.

Recent Developments

- In January 2019, the fourth alpha olefins (AO) unit of Royal Dutch Shell (Netherlands) has begun production at the company's chemical manufacturing facility in Geismar, Louisiana, in the United States.

- In May 2019, Exxon Mobil intended to invest USD 2 billion in the expansion of its Baytown, Texas, US chemical facility.

- In June 2019, INEO Group Ltd., announced signing an agreement of Understanding together with Saudi Aramco, France, and Total, for the construction of three new plants as part of the Jubail 2 complex in the region of Saudi Arabia.

1-Decene Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 697.52 million |

|

Revenue forecast in 2032 |

USD 1,223.20 million |

|

CAGR |

6.4% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

Derivative, Application, Grade, End Use and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Royal Idemitsu Petrochemical Company, Dutch Shell, ExxonMobil Corporation, SABIC, Ineos Group Limited, Qatar Chemical Company, Chevron Phillips Chemical Company, Alfa Aesar and Sigma-Aldrich, Sasol Limited. |

FAQ's

The 1-decene market report covering key segments are Derivative, Application, Grade, End Use and region.

1-Decene market Size Worth $1,223.20 Million By 2032.

The global 1-decene market expected to grow at a CAGR of 6.4% during the forecast period.

North America is leading the global market.

key driving factors in 1-decene market are Growing Poly alfa olefin (PAO) Demand.