3D Secure Payment Authentication Market Size, Share, Trend & Industry Analysis Report

: By Component (Access Control Server, Merchant Plug-in, and Others), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM2998

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

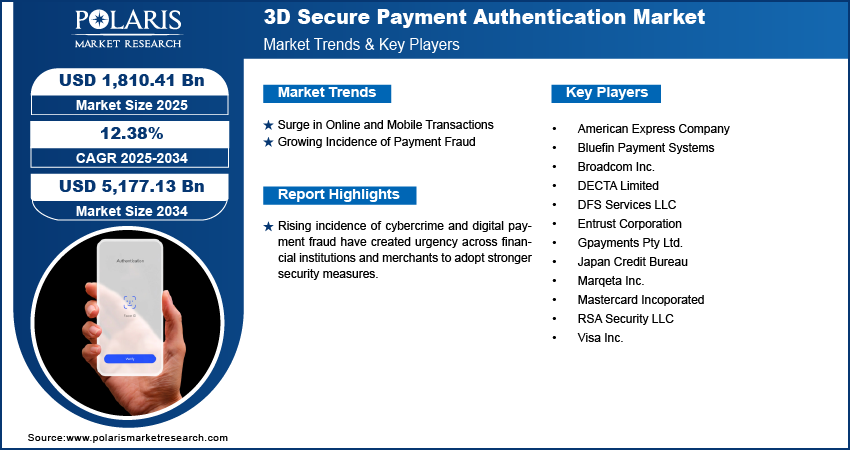

The global 3D secure payment authentication market size was valued at USD 1623.83 million in 2024 and is projected to grow at a CAGR of 12.38% during 2025–2034. Rising incidence of cybercrime and digital payment fraud have created urgency across financial institutions and merchants to adopt stronger security measures. 3D Secure provides a reliable layer of protection by authenticating users before transaction approval, thereby reducing fraudulent chargebacks.

The market refers to a segment of the digital payments ecosystem focused on enhancing online transaction security through an additional layer of user authentication. This protocol commonly recognized in versions like 3D secure 2.0 enables real-time verification during ecommerce payments, reducing the risk of unauthorized use while complying with evolving regulatory standards. It is used by banks, merchants, and payment gateways to ensure that the person initiating a card-not-present transaction is the legitimate cardholder. The market is gaining traction due to the rising need for fraud prevention, better customer experience, and increased digital payment adoption across industries. Regulatory frameworks such as the revised payment services directive (PSD2) in the EU and similar mandates across Asia-Pacific and Latin America are compelling financial service providers to adopt strong customer authentication (SCA).

To Understand More About this Research: Request a Free Sample Report

The evolution of artificial intelligence, machine learning, and biometric system is enhancing the effectiveness of 3D Secure systems. These advancements enable adaptive authentication methods that assess transaction risk in real time, improving fraud prevention accuracy. Integration with mobile devices, IoT platforms, and API-based environments also allows 3D Secure solutions to stay relevant and future-proof, fueling ongoing investment and innovation in the market.

Market Dynamics

Surge in Online and Mobile Transactions

The rapid growth of e-commerce, mobile banking, and mobile wallets is driving strong demand for advanced payment authentication solutions. For instance, according to the US Census Bureau, US retail e-commerce sales in the first quarter of 2025 were USD 300.2 billion, up 6.1% compared to the same period in 2024. E-commerce made up 16.2% of total retail sales in Q1 2025. Total retail sales rose to USD 1,858.5 billion, an increase of 4.5% from Q1 2024. Consumers are increasingly shopping online across sectors such as retail, travel, and food delivery, creating a vast volume of card-not-present transactions. Merchants and payment processors are under pressure to offer seamless and secure experiences to retain customer trust. 3D Secure authentication helps prevent fraud while minimizing checkout friction through biometric and token-based verifications. Businesses are adopting this solution to ensure compliance with industry standards like PSD2 while safeguarding sensitive user data. The growth in digital payment activity directly supports the expansion of the 3D Secure payment ecosystem.

Growing Incidence of Payment Fraud

Rising cases of identity theft, phishing, and unauthorized card use are creating an urgent need for enhanced transaction security. For instance, according to the data released by the Federal Trade Commission indicated that in 2023, consumers reported losses exceeding USD 10 billion due to fraud. This represents a 14% increase compared to the reported losses in 2022, highlighting a concerning upward trend in consumer fraud. Fraudulent activities in card-not-present environments have become more sophisticated, targeting both consumers and merchants. Financial institutions and payment gateways are implementing 3D Secure protocols to prevent unauthorized access and reduce chargeback losses. This authentication layer strengthens trust among users by verifying transactions through real-time risk analysis, behavioral insights, and step-up authentication when needed. The ability to adapt to new fraud patterns while maintaining a smooth user experience makes 3D Secure an essential tool in modern fraud prevention strategies.

Segment Insights

Market Assessment by Component

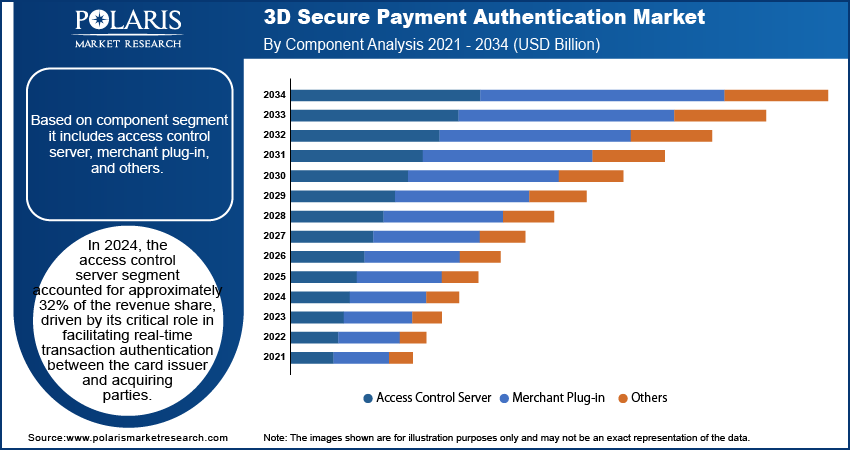

Based on component segment it includes access control server, merchant plug-in, and others. In 2024, the access control server segment accounted for approximately 32% of the revenue share, driven by its critical role in facilitating real-time transaction authentication between the card issuer and acquiring parties. Financial institutions rely on access control servers to validate the legitimacy of online payments using risk-based decisioning, behavioral data, and multi-factor authentication. The server acts as the backbone of the 3D Secure protocol, enabling secure communication channels and supporting the seamless flow of data during verification. High demand from issuing banks and regulatory compliance requirements such as PSD2 have led to increased deployment of robust and scalable access control server infrastructure across various digital payment environments.

The merchant plug-in segment is projected to register the fastest CAGR of 12.3% over the forecast period due to its growing integration into e-commerce platforms and digital checkout systems. Online merchants are adopting 3D Secure plug-ins to authenticate cardholders and reduce chargebacks without compromising user experience. The plug-in enables secure payment between the merchant’s payment gateway and the cardholder’s bank, adding a necessary security layer in real-time. Rising concerns over fraudulent online transactions and pressure to provide frictionless checkouts are encouraging retailers and service providers to implement merchant plug-ins that balance speed, convenience, and security in high-volume digital environments.

Market Assessment by Application

Based on application segment it includes banks, merchants & payment gateway, and others. In 2024, the merchants and payment gateway segment was valued at USD 769.97 million, driven by the surge in digital commerce and demand for secure payment processing. Online retailers, subscription services, and fintech platforms are prioritizing 3D Secure adoption to safeguard against fraudulent transactions and improve customer trust. Payment gateways, serving as intermediaries, are embedding advanced authentication protocols into their systems to offer compliant and scalable solutions to their merchant clients. Increased smartphone penetration, global e-commerce growth, and real-time payments are pushing service providers to upgrade their authentication capabilities, making this segment a key contributor to the overall market value.

The banks segment is projected to register the fastest CAGR of 12.18% over the forecast period due to rising adoption of customer-centric authentication frameworks and increased pressure to comply with global regulatory standards. Issuers are integrating enhanced 3D Secure technologies to verify cardholder identity while reducing false declines and improving transaction approval rates. Banks are also leveraging analytics and machine learning within access control servers to enable dynamic, risk-based verification. Growing demand for secure digital banking channels and mobile-first financial services has placed added emphasis on implementing robust, user-friendly authentication mechanisms, which is driving consistent investment in this segment’s growth trajectory.

Regional Analysis

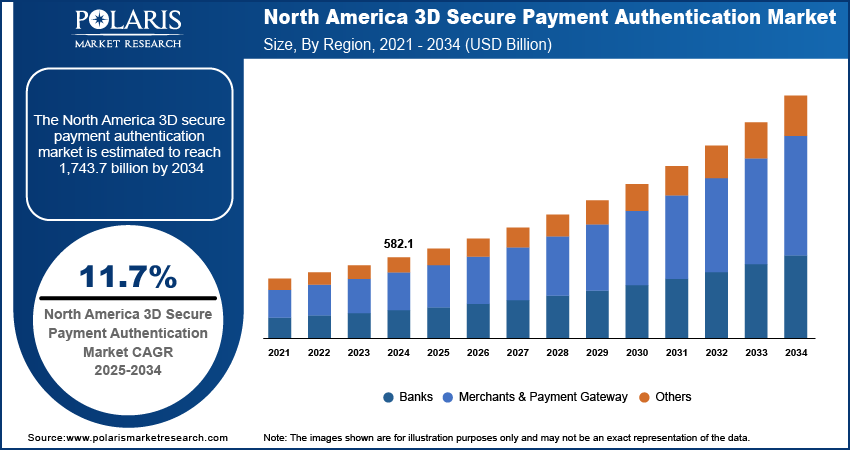

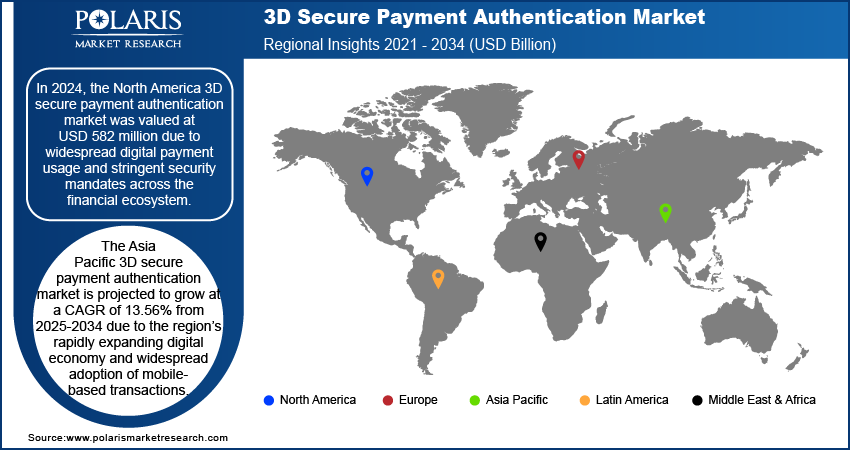

In 2024, the North America 3D secure payment authentication market was valued at USD 582 million due to widespread digital payment usage and stringent security mandates across the financial ecosystem. Financial institutions and online merchants are proactively deploying 3D Secure protocols to mitigate fraud risks and protect customer data in real-time. The region’s mature e-commerce infrastructure, paired with high consumer trust in digital transactions, supports the rapid scaling of advanced authentication solutions. Regulatory emphasis on data protection and the rise in sophisticated cyber threats are further pushing organizations to implement multi-layered authentication frameworks, solidifying North America’s position in the global market. For instance, according to the Federal Bureau of Investigation, in US, the top cybercrimes by victim complaints were phishing/spoofing, extortion, and personal data breaches. Investment fraud, particularly in cryptocurrency, resulted in over USD 6.5 billion in losses, in 2024. Most complaints came from California, Texas, and Florida, with individuals over 60 suffering nearly USD 5 billion in losses and filing the most complaints.

US 3D Secure Payment Authentication Market

The US 3D secure payment authentication market accounted for approximately 67% of the share in North America, supported by a dense network of online merchants, fintech firms, and card issuers actively investing in fraud prevention tools. Consumer expectations for seamless and secure checkout experiences are compelling stakeholders to enhance their payment infrastructure using 3D Secure 2.0. Real-time decision-making, biometric authentication, and mobile-first strategies are being implemented to strike a balance between convenience and protection. A strong regulatory focus on identity protection, coupled with rising online payment volumes across industries such as retail, healthcare, and travel, is fueling demand for scalable authentication technologies.

Asia Pacific 3D Secure Payment Authentication Market

The Asia Pacific 3D secure payment authentication market is projected to grow at a CAGR of 13.56% from 2025-2034 due to the region’s rapidly expanding digital economy and widespread adoption of mobile-based transactions. Growing e-commerce penetration, coupled with rising consumer demand for secure payment experiences, is encouraging financial institutions and merchants to implement robust authentication systems. For instance, according to the India Brand Equity Foundation, India's e-commerce sector, was valued at USD 125 billion in FY24 and is anticipated to grow at USD 345 billion by FY30, reflecting a robust growth trajectory driven by increased digital penetration, shifting consumer behaviors, and advancements in logistics and payment systems. Many countries in the region are strengthening regulatory frameworks to combat online payment fraud, prompting faster adoption of 3D Secure 2.0 solutions. The increased participation of fintechs, mobile wallets, and super apps in cross-border commerce is also driving the need for scalable and adaptive authentication protocols. Rapid digitalization in rural and semi-urban markets is creating new opportunities for service providers to deliver secure, real-time transaction infrastructure tailored for local needs.

China 3D Secure Payment Authentication Market

China’s 3D secure payment authentication market was valued at approximately USD 100 million in 2024, fueled by strong digital payment infrastructure and rising focus on transaction security. Leading domestic platforms are upgrading security protocols to align with global fraud prevention standards. The popularity of QR-based and mobile-first payment ecosystems has created a need for low-friction and secure authentication processes. Increased regulatory pressure to curb financial cybercrime is accelerating deployment of 3D Secure frameworks across banking and online retail.

Japan 3D Secure Payment Authentication Market

The Japan 3D secure payment authentication market is projected to grow at a CAGR of 13.86% from 2025–2034 due to rising online transaction volumes and a national push for digital transformation in financial services. Local banks and card issuers are investing in advanced authentication tools to reduce fraud and enhance customer trust. Strong demand from eCommerce, digital banking, and contactless payments is driving market momentum. Government-led cashless initiatives and emphasis on cybersecurity standards are further reinforcing the adoption of 3D Secure technologies across key sectors.

Europe 3D Secure Payment Authentication Market

The Europe 3D secure payment authentication market is accounted for the second largest share globally, holding 25% of the total revenue in 2024, driven by strict enforcement of payment security regulations such as PSD2 and SCA. Financial institutions and merchants are mandated to use strong customer authentication (SCA) measures, making 3D Secure a vital component of compliance. The region’s mature digital infrastructure and high card usage rates in online transactions are encouraging the use of frictionless and secure protocols. Enterprises are implementing 3D Secure 2.0 to enhance user experience through biometric and contextual authentication while reducing transaction abandonment. Continuous innovations in real-time risk scoring and seamless integration with mobile apps are further boosting adoption.

UK 3D Secure Payment Authentication Market

The UK 3D secure payment authentication market accounted for 21% of the revenue share in 2024 and is projected to grow at the fastest CAGR of 13.2% from 2025–2034 due to rapid expansion in online retail, digital banking, and fintech services. Rising consumer concerns over online fraud and identity theft are prompting businesses to implement stronger verification mechanisms. The UK’s early and strict implementation of PSD2 regulations has positioned it as a leader in secure payment practices. Fintech innovation, especially in mobile-first payment platforms, is encouraging the use of adaptive authentication tools that offer high security with minimal disruption to the user journey.

Key Players & Competitive Analysis Report

The competitive landscape of the 3D secure payment authentication market is shaped by rapid innovation, evolving regulatory mandates, and increased pressure to provide frictionless yet secure transaction experiences. Industry analysis reveals that market participants are focusing on expansion strategies such as strategic alliances and joint ventures to strengthen their presence across high-growth regions and meet the growing demands of mobile and e-commerce platforms. Mergers and acquisitions are being actively pursued to enhance technological capabilities and integrate advanced fraud detection, behavioral biometrics, and machine learning into authentication workflows. Post-merger integration efforts are concentrated on streamlining cloud infrastructure, optimizing customer onboarding, and improving response times in real-time verification systems. Companies are investing in next-generation solutions that support EMV 3D Secure protocols and token-based authentication, aligning with PSD2, SCA, and other global compliance frameworks. Strategic focus on embedded security across payment gateways, digital wallets, and banking apps is reshaping the competitive field. Demand for low-latency, API-driven, and mobile-first authentication experiences has pushed vendors to innovate across access control servers and merchant plug-ins. As fraud tactics grow more sophisticated, the market is witnessing a pivot toward adaptive authentication models, driven by contextual data and AI. These dynamics continue to redefine competition in this fast-evolving sector.

List of Key Companies

- American Express Company

- Bluefin Payment Systems

- Broadcom Inc.

- DECTA Limited

- DFS Services LLC

- Entrust Corporation

- Gpayments Pty Ltd.

- Japan Credit Bureau

- Marqeta Inc.

- Mastercard Incoporated

- RSA Security LLC

- Visa Inc.

3D Secure Payment Authentication Industry Developments

In June 2025, Worldpay enhanced its collaboration with Visa to optimize the 3D Secure (3DS) solution, helping US merchants reduce fraud, minimize consumer friction, and increase authorization rates. 3DS Flex merchants transmit authentication data to the issuer, improving payment security and the shopping experience.

In March 2024, Visa expanded its global value-added services business by introducing three new AI-powered risk and fraud protection products. The new tools, which are part of Visa Protect's end-to-end suite, are intended to prevent fraud in instant account-to-account and card-not-present (CNP) payments, as well as transactions on and off Visa's network.

3D Secure Payment Authentication Market Segmentation

By Component Outlook (Revenue USD Million, 2020–2034)

- Access Control Server

- Merchant Plug-in

- Others

By Application Outlook (Revenue USD Million, 2020–2034)

- Banks

- Merchants & Payment Gateway

- Others

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

3D Secure Payment Authentication Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,623.83 million |

|

Market Size Value in 2025 |

USD 1,810.41 million |

|

Revenue Forecast by 2034 |

USD 5,177.13 million |

|

CAGR |

12.38% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,623.83 million in 2024 and is projected to grow to USD 5,177.13 million by 2034.

The global market is projected to register a CAGR of 12.38% during the forecast period.

In 2024, the North America 3D secure payment authentication market was valued at USD 582 million due to widespread digital payment usage and stringent security mandates across the financial ecosystem.

A few of the key players includes are American Express Company; Bluefin Payment Systems; Broadcom Inc.; DECTA Limited; DFS Services LLC; Entrust Corporation; Gpayments Pty Ltd.; Japan Credit Bureau; Marqeta Inc.; Mastercard Incoporated; RSA Security LLC; Visa Inc.

In 2024, the access control server segment accounted for approximately 32% of the revenue share, driven by its critical role in facilitating real-time transaction authentication between the card issuer and acquiring parties.

In 2024, the merchants and payment gateway segment was valued at USD 769.97 million, driven by the surge in digital commerce and demand for secure payment processing.