5G Chipset Market Share, Size, Trends & Industry Analysis Report

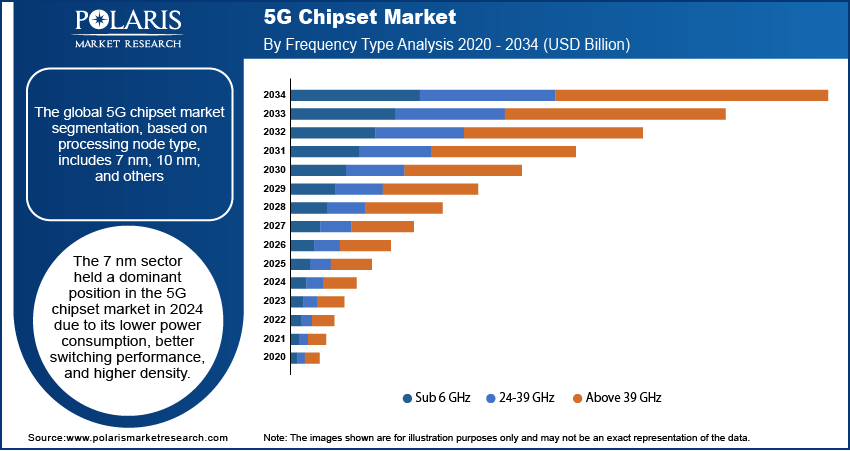

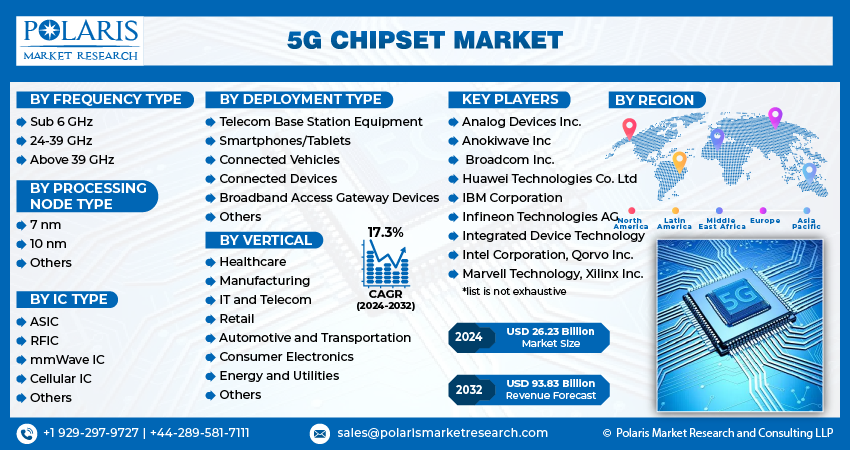

By Frequency type (Sub 6 GHz, 24-39 GHz, Above 39 GHz); By Processing Node type; By IC type; By Deployment type; By Vertical; By Region type; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM1711

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

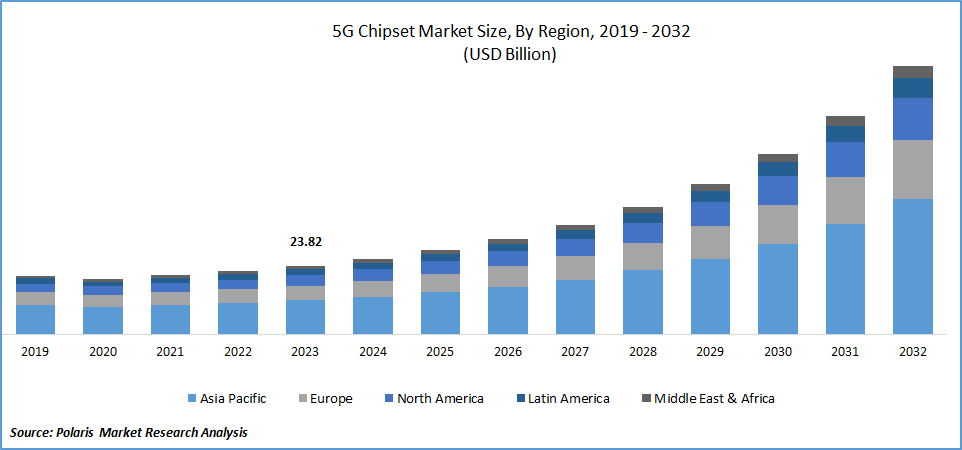

The global 5G chipset market was valued at USD 29.7 billion in 2024 and is anticipated to grow at a CAGR of 23.40% from 2025 to 2034. The market is expanding rapidly due to the global rollout of 5G infrastructure and connected devices.

Key Insights

- The sub-6 GHz frequency segment accounts for the majority share of the market, driven by its superior coverage, better indoor penetration, and earlier global adoption compared to mmWave frequencies.

- The 7 nm sector held a dominant position in the market, as it offers an optimal balance of performance and power efficiency essential for advanced mobile and connected devices.

- The RFIC segment accounts for the highest growth rate of the market, fueled by increasing demand for compact, integrated radio frequency components in 5G-enabled communication hardware.

- The connected devices segment accounted for the largest revenue share of the market, driven by rapid growth in 5G-enabled smartphones, wearables, IoT devices, and consumer electronics.

- Asia-Pacific holds the largest revenue share of the market for 5G chipsets worldwide, owing to early 5G deployment, high consumer demand, and strong manufacturing ecosystems in countries like China and South Korea.

Industry Dynamics

- The rapid growth in connected devices is accelerating demand for 5G chipsets, as manufacturers require high-speed, low-latency solutions to support smartphones, IoT devices, and smart appliances.

- Increasing investments in 5G infrastructure by governments and telecom operators are driving the adoption of 5G chipsets to enable next-generation connectivity across urban and rural areas.

- The rising adoption of autonomous vehicles and smart manufacturing is boosting demand for 5G chipsets due to their ability to support ultra-reliable, low-latency communication.

- The high cost of developing advanced 5G chipsets is expected to restrain market growth, particularly for small and mid-sized manufacturers with limited R&D budgets.

- Security and interoperability concerns across diverse 5G ecosystems may hinder adoption, as chipset providers must ensure seamless integration with global standards and device architectures.

Market Statistics

- 2024 Market Size: USD 29.7 Billion

- 2034 Projected Market Size: USD 249.8 Billion

- CAGR (2025-2034): 23.40%

- Asia Pacific: Largest Market Share

AI Impact on 5G Chipsets Market

- AI is transforming 5G chipset design by optimizing signal processing, power efficiency, and network performance through intelligent resource allocation and adaptive algorithms.

- It accelerates testing and development by simulating network conditions and predicting chipset behavior using machine learning models.

- AI enhances edge computing capabilities by enabling real-time decision-making directly on 5G-enabled devices, reducing latency and bandwidth usage.

- AI-powered chipsets support dynamic spectrum management and network slicing, allowing telecom providers to deliver more efficient, customized connectivity solutions.

To Understand More About this Research:Request a Free Sample Report

The 5G chipset market is expected to grow significantly over the coming years. It is all set to expand the mobile ecosystem with high speeds, superior reliability, and negligible latency. This will impact every industry, making safer transportation, digitized logistics, precision agriculture, remote Healthcare, and more a reality. This is expected to create employment opportunities. For instance, in January 2024, Qualcomm expanded its business to Chennai, India, investing Rs 177.27 crore to build a new design center and creating 1,600 job opportunities.

5G holds a significant transformative potential across a number of industries. It will eventually increase into healthcare- remotely monitor patient health, supply dependable connectivity with real-time results, transmit HD photos and videos such as X-rays and mammograms swiftly and securely, Supply chain- shelf, cashier-less checkouts, and HD cameras and drones to replace security guards, Fixed wireless networks, Smart cities, Edge computing and AI. This is primarily because of its ability to move large amounts of data quickly and securely between connected devices at speeds that have never been achieved before.

The quantity of data produced by networks and mobile devices has grown exponentially since the inception of mobile broadband. It has gradually extended into every aspect of work and home life. Presently, some technologies, such as Artificial Intelligence and Machine Learning, require enormous amounts of data to operate at high speeds. The 5G network is ideal for providing quick and secure access to extensive data amounts with its high-band frequencies and rapid speeds.

Market Dynamics

Market Drivers

Surge in High-Speed Internet and Mobile Data Traffic

5G mobile network is increased due to rising requirements for high-speed data transport, mobile internet services, and information and data processing. The need for mobile data services is primarily being driven by the rising use of services and applications in consumer electronics and B2B communication networks, which are currently using data-intensive apps such as 3D, AR, and VR, and ultra-HD video content.

High use of M2M Connection Technology

M2M technologies are adopted for better connectivity, smooth communication, and low power requirements, which are driving the growth of 5G chipsets in the Industry. The reliability and speed of 5G are expected to have a massive influence on machine-to-machine (M2M) and IoT. M2M communication technology can be widely used in heavy manufacturing and processing industries to increase the efficiency of different processes and reduce human and machine interaction. This will lead to massive interconnection between devices, promising quick results.

Market Restraints

Rise in Cost of 5G Chipset for Mobile Devices

The cost of 5G chips is resulting in increased expenses for mobile device producers and manufacturers .This cost is incurred during the integration of 5G capabilities into tablets, smartphones, and other mobile devices. Hence, Smartphone chipsets supporting 5G are expected to be pricier than current 4G ones. Various companies have planned to significantly expand the 5G line-up by offering 5G to the company’s new series line-ups.

Report Segmentation

The market is primarily segmented based on frequency type, processing node type, IC type, deployment type, vertical, and region.

|

By Frequency Type |

By Processing Node Type |

By IC Type |

By Deployment Type |

By Vertical |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Segmental Analysis

By Frequency Type Analysis

- The sub-6 GHz frequency segment accounts for the majority share of the market. These chipsets typically include a range of advanced features and technologies to optimize network performance and improve user experience. A key feature of 5G chipsets for Sub-6 GHz is the support for Massive MIMO antenna systems, which enable the use of multiple antennas to improve network capacity and performance.

- The range of 24-39 GHz frequency segment accounts for the fastest growing segment. This segment provides ultra-high-speed 5G connections, which is critical for applications such as high-definition video streaming, augmented reality, and virtual reality.

By Processing Node Type Analysis

- The 7 nm sector held a dominant position in the market in 2023 due to its lower power consumption, better switching performance, and higher density. A 7nm process node outperforms larger process nodes in terms of performance, which is critical for fulfilling the rigorous specifications of 5G networks.

- The 10 nm category is expected to grow at the highest CAGR throughout the forecast period. Because the 10 nm process can incorporate more transistors onto a single chip, enabling the development of more potent and energy-efficient processes.

By IC Type Analysis

- The RFIC segment accounts for the highest growth rate of the market, owing to its quicker data rates and higher bandwidth, which meets the demand for increasing mobile data traffic. The expansion of the market is driven by smartphones' growing complexity, which necessitates the use of additional RF transceiver integrated circuits (ICs) to support numerous antennas for features like Wi-Fi, Bluetooth, GPS, and NFC.

By Deployment Type Analysis

- The connected devices segment accounted for the largest revenue share of the market. This growth is driven by the increasing need for more dependable and faster connectivity across the Internet of Things. Connected devices, such as industrial machinery, security systems, and smart home appliances, need high-speed, low-latency connectivity to perform at their best.

These devices use 5G chipsets, which allow quick and more dependable data transfer, resulting in more effective and efficient equipment usage. 5G networks can substantially accommodate more connected devices than previous generations of wireless networks, which makes them well-suited for IoT applications that involve a large number of devices.

By Vertical Analysis

- IT & Telecom segment will see the fastest growth due to the rising need for Faster and more dependable networks to manage data-intensive applications such as video streaming and cloud services. By utilizing 5G chipsets, Machine-to-machine communication can be made faster and more effective in the production process. New use cases and applications in the manufacturing industry, such as smart factories and industrial Internet of Things applications that need real-time data transfer and analytics, are also being driven by this trend.

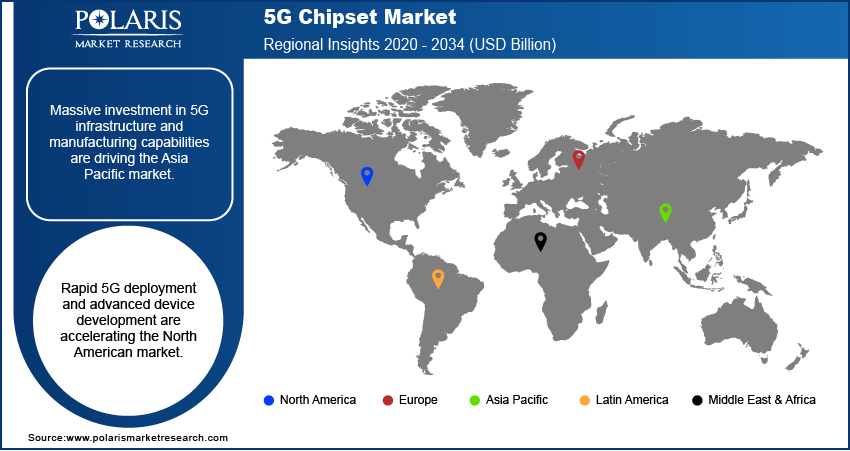

Regional Analysis

- Asia-Pacific holds the largest revenue share of the market for 5G chipsets worldwide, is anticipated to expand over the projected period due to global workflow automation owing to the fastest-growing countries like China, Japan, and India. Many leading companies are also aiming to expand their network technology.

- North American region is the fastest expanding market over the forecast period of 2024-2032 due to the influence of smart cities, smart homes, smart industries, high-definition online gaming, self-driving cars, and intelligent transportation infrastructure.

Competitive Landscape

The market is going to witness growth in the forthcoming years. Major industry players are planning on launching premium yet affordable 5G smartphones. Prominent companies are exploring various avenues, such as developing novel products and forming strategic alliances in order to enhance their market share. The primary objectives of market participants are to generate innovative items, broaden their range of products, and secure a significant portion of the market. For instance, Qualcomm and MediaTek have powered a new offering, the Snapdragon 4G Gen 2 chipset, which Poco has already adopted, and Realme 12 mobile brand companies.

Some of the major players operating in the global market include:

- Analog Devices Inc.

- Anokiwave Inc

- Broadcom Inc.

- Huawei Technologies Co. Ltd

- IBM Corporation

- Infineon Technologies AG

- Integrated Device Technology

- Intel Corporation

- Marvell Technology

- MediaTek Inc.

- Nokia Corporation

- NXP Semiconductors NV

- Qorvo Inc.

- Qualcomm Incorporated

- Renesas Electronics Corporation

- Samsung Electronics Co. Ltd

- Texas Instruments Inc.

- Unisoc Communications, Inc.

- Xilinx Inc.

Recent Development

- In Febraury 2025, Qualcomm launched the Snapdragon 6 Gen 4 5G chipset for premium mid-range smartphones, featuring GenAI support, enhanced gaming, 4K displays, and improved performance and efficiency. Realme, Oppo, and Honor prepared upcoming devices with this chipset

- In April 2024, Qualcomm and MediaTek launched their advanced 5 G chipsets in the mobile phone market. The phones are set to be launched in August 2024 within the affordable range of 10,000-11,000.

- In March 2024, MediaTek announced its working with every Android phone brand with over 15 designs at the Mobile World Congress 2024.

- In July 2023, Ericsson entered into a strategic collaboration with Intel to create a system-on-chip (SoC) designed specifically for the vendor’s 5G offering, a move the duo claim will create highly differentiated products for future infrastructure.

Report Coverage

The 5G chipset market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, frequency type, processing node type , IC type, deployment type, vertical and their futuristic growth opportunities.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 36.68 billion |

|

Revenue forecast in 2034 |

USD 249.8 billion |

|

CAGR |

23.40% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Frequency Type, By Processing Node Type, By IC Type, By Deployment Type, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

5G Chipset Market Size Worth $249.8 Billion By 2034

The top market players in 5G Chipset Market are Texas Instruments Inc, Marvell Technology, Anokiwave Inc, Samsung Electronics Co

Asia-Pacific is contribute notably towards the 5G Chipset Market

5G Chipset Market exhibiting the CAGR of 23.40% during the forecast period.

5G Chipset Jewelry Market report covering key segments are frequency type, processing node type, IC type, deployment type, vertical, and region.