Adiponitrile Market Share, Size, Trends, Industry Analysis Report

By Application (Electrolyte Solution, Nylon Synthesis, Hexamethylene Diisocyanate); By Production Method; By End Use; By Regions; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 132

- Format: PDF

- Report ID: PM1811

- Base Year: 2024

- Historical Data: 2020 - 2023

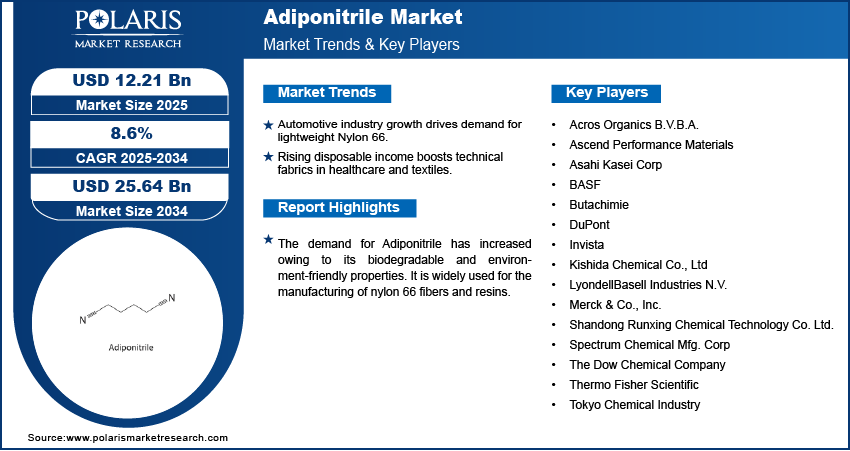

The global adiponitrile market size was valued at USD 11.27 billion in 2024 and is expected to grow at a CAGR of 8.1% during the forecast period. Key factors driving the demand includes increasing demand in the end-use industries, increasing application in the automotive industry, and due to its dimensional stability, superior melting point, and compact molecular structure.

Key Insights

- In 2024, the nylon synthesis segment accounted for the largest global adiponitrile market. This is due to its application in diverse industries such as textiles and automotive.

- The automotive market segment dominated the global adiponitrile market in 2024, driven by the rise in use of adiponitrile for manufacturing interior and exterior automotive components.

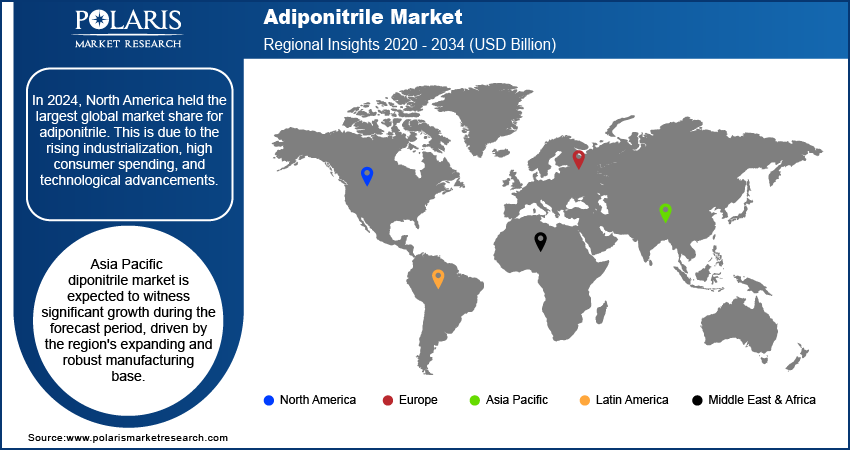

- In 2024, North America held the largest global market share for adiponitrile. This is due to the rising industrialization, high consumer spending, and technological advancements.

- Asia Pacific adiponitrile market is expected to witness significant growth during the forecast period, driven by the region's expanding and robust manufacturing base.

Industry Dynamics

- The growth of the automotive industry for lightweight nylon 66 is the driving demand for performance traits, and to improve economy regulations, particularly for hybrid and electric motor vehicles.

- Improvements in textiles, healthcare, and personal care applications also innovated technical fabrics, with the rise of disposable income.

- The fluctuations in raw material prices, especially butadiene and ammonia, impact the profit margins and the production cost which adversely affect the growth of the market.

- The increase in demand for lightweight material in the electric vehicle (EV) and aerospace sector creates the potential for growth in the adiponitrile market.

Market Statistics

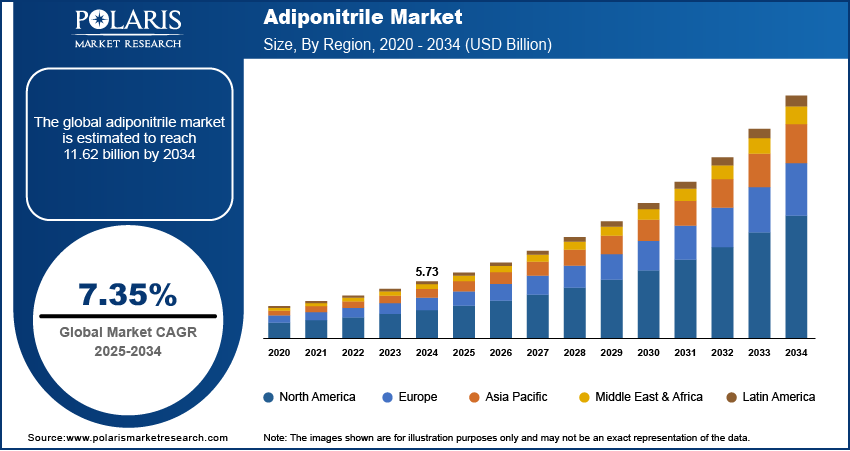

- 2024 Market Size: USD 5.73 billion

- 2034 Projected Market Size: USD 11.62 billion

- CAGR (2025-2034): 7.35%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Adiponitrile is increasingly being used in textile, plastic, and fiber industries as an intermediate for the chemical synthesis of hexamethylenediamine. Hexamethylenediamine is used for the production of Nylon 66. Adiponitrile is also widely used for the production of adipoguanamine to make amino resins. The demand for Adiponitrile has increased owing to its biodegradable and environment-friendly properties. It is widely used for the manufacturing of nylon 66 fibers and resins. The demand for nylon 66 has increased significantly owing to its dimensional stability, superior melting point, and compact molecular structure. Nylon 66 offers greater tensile strength, excellent abrasion resistance, high machinability, and a high melting point. Nylon 66 is used in a wide range of applications such as textile, automotive, furniture, and packaging among others. The automotive sector uses nylon 66 for the manufacturing of heavy-duty tires and reinforced belts capable of withstanding high temperatures and fast curing cycles. The use of nylon 66 in tire cords of aircraft and off-road vehicle tires offers higher durability, longer life, and high fatigue resistance. Some other applications of nylon 66 include sleeve and slide bearings, wear pads, support and guide wheels, gear wheels, seal rings, and track plates among others.

Industry Dynamics

Growth Factors

Rising industrialization, growing urbanization, and increasing demand from the automotive sector drive the growth of the market for adiponitrile. Modernization of vehicles to improve performance and efficiency coupled with increased adoption of electric and hybrid vehicles owing to rising environmental concerns have fueled the growth of the market for adiponitrile across the globe. The growth is further supported by the regulatory mandates for improved fuel economy, which boost the use of lightweight nylon 66 compound that is derived from adiponitrile. Furthermore, the infrastructure development across the globe has boosted the demand for engineering plastics that are used in electronics and construction to create growth avenues.

Increasing application in the textile and healthcare industry further fuels the demand for adiponitrile. Rising use in the development of personal care products, growing disposable income, and increasing shift towards beauty and wellness trends have increased the demand for adiponitrile, especially in the emerging economies. The healthcare sector's depencency on streilizable and high-strength materials for advanced medical devices creates stable demand. Moreover, technological innovation in protective appareal and smart fabrics textiles has created new segments for market expansion beyond traditional use.

Adiponitrile Market Report Scope

The market is primarily segmented on the basis of application, production method, end-use, and region.

|

By Application |

By Production Method |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Segmental Insights

Application Analysis

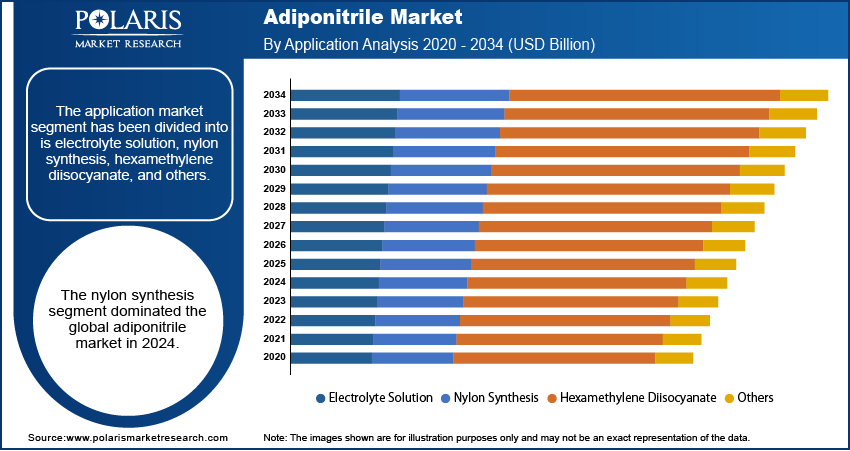

The application market segment has been divided into is electrolyte solution, nylon synthesis, hexamethylene diisocyanate, and others. The nylon synthesis segment dominated the global adiponitrile market in 2024. Nylon synthesis finds application in diverse industries such as textile and automotive. Increasing demand for nylon for the manufacturing of apparel, furniture, packaging solutions, and vehicles coupled with growth in industrialization and automation across the globe drives the market growth.

End Use Analysis

On the basis of end use, the market is segmented into automotive, chemical, textile, healthcare, electronics, personal care, and others. The automotive market segment dominated the global adiponitrile market in 2024. The automotive industry makes use of adiponitrile for the manufacturing of different interior and exterior automotive components, resulting in reduced weight and higher fuel efficiency. It is also used for the production of truck parts, passenger & commercial vehicle parts, cars, heavy & light duty vehicle parts, and others. The growing adoption of electric vehicles and the rising use of adiponitrile in lithium-ion batteries is expected to further boost the market growth of this segment.

Regional Analysis

North America Adiponitrile Market Assessment

North America dominated the global market for adiponitrile in 2024. Rising industrialization, high consumer spending, the presence of leading players, and technological advancements are some factors attributed to the market growth of this region. The rising automotive penetration, increasing modernization of vehicles, and initiatives to promote the use of electric vehicles support the market growth in the region. Increasing application in textile, construction, chemical, and personal care sectors further drive the market growth in this region.

Asia Pacific Adiponitrile Market Insights

Asia Pacific adiponitrile market is expected to witness significant growth during the forecast period. This is due to the region's expanding and robust manufacturing base, particularly in the automotive and electronics sector. Nylon 66 is essential for the production of high-performance engineering plastics and fibers. Its demand is directly linked with the ongoing industrial activity. Furthermore, the demand for adiponitrile is boosted by the rapid industrialization, rise in disposable income, and infrastructure development across countries such as India, China, and Japan. These factors have driven the demand for end-use products that include nylon 66 especially in the automotive and electronics to construction and textile materials.

Key Players & Competitive Analysis Report

The adiponitrile landscape is highly associated with high barriers to entry, with a small number of global players commanding a dominant revenue share. The main tactics of key vendors involve strategies to establish qualitative sustainable value chains through backward integration into essential raw materials such as butadiene and forward integration through nylon 66 production. Factors shaping future development strategies are driven primarily by economic and geopolitical upheaval and regional supply chain disruption, which necessitates a focus on the optimization of regional footprint, specifically in the high-growth Asia Pacific region. Competitive intelligence and relative competition have revealed new growth opportunities linked to latent demand and opportunities in emerging applications in automotive and electronics markets. A critical method of differentiation is technological advancement as it relates to production process to assess increased efficiency, quality, and environmental impact. Moreover, the industry outlook remains dynamic, where competitive positioning circles around factors pertaining to production, cost leadership, and the ability to drive strategic alliances, collaborate, and capture value.

A few key players in the market for adiponitrile include Asahi Kasei Corp, Thermo Fisher Scientific, Butachimie, Acros Organics B.V.B.A., Tokyo Chemical Industry, Merck & Co., Inc., BASF, Ascend Performance Materials, The Dow Chemical Company, LyondellBasell Industries N.V., Kishida Chemical Co., Ltd, Spectrum Chemical Mfg. Corp, DuPont, Invista, and Shandong Runxing Chemical Technology Co. Ltd.

Industry Developments

November 2024: Invista and its joint venture partner launched a new adiponitrile technology in France. The new technology increases output, reduces energy consumption, decreases greenhouse gas emissions, and improves process stability and capital efficiency. The new technology increases output, reduces energy consumption, decreases greenhouse gas emissions, and improves process stability and capital efficiency.

November 2023: BASF and SINOPEC launched the expanded downstream chemical plants. TBA is a monofunctional monomer that offers outstanding chemical resistance, weatherability, and hydrophobicity. These properties make it widely used in industries such as paper, coatings, adhesives, and inks.

Adiponitrile Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 11.27 Billion |

|

Market Size in 2025 |

USD 12.21 Billion |

|

Revenue Forecast by 2034 |

USD 25.64 Billion |

|

CAGR |

8.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market size was valued at USD 11.27 billion in 2024 and is projected to grow to USD 25.64 billion by 2034.

• The global market is projected to register a CAGR of 8.6% during the forecast period.

• North America dominated the market share in 2024.

• A few key players are Asahi Kasei Corp, Thermo Fisher Scientific, Butachimie, Acros Organics B.V.B.A., Tokyo Chemical Industry, Merck & Co., Inc., BASF, Ascend Performance Materials, The Dow Chemical Company, LyondellBasell Industries N.V., Kishida Chemical Co., Ltd, Spectrum Chemical Mfg. Corp, DuPont, Invista, and Shandong Runxing Chemical Technology Co. Ltd.

• In 2024, the nylon synthesis segment accounted for the largest global adiponitrile market.

• The automotive market segment dominated the global adiponitrile market in 2024.