Aerospace Coatings Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Top-coat, Primer, and Others), Resin Type, Technology, End User, Application, Aviation Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Feb-2025

- Pages: 127

- Format: PDF

- Report ID: PM1179

- Base Year: 2024

- Historical Data: 2020-2023

Aerospace Coatings Market Overview

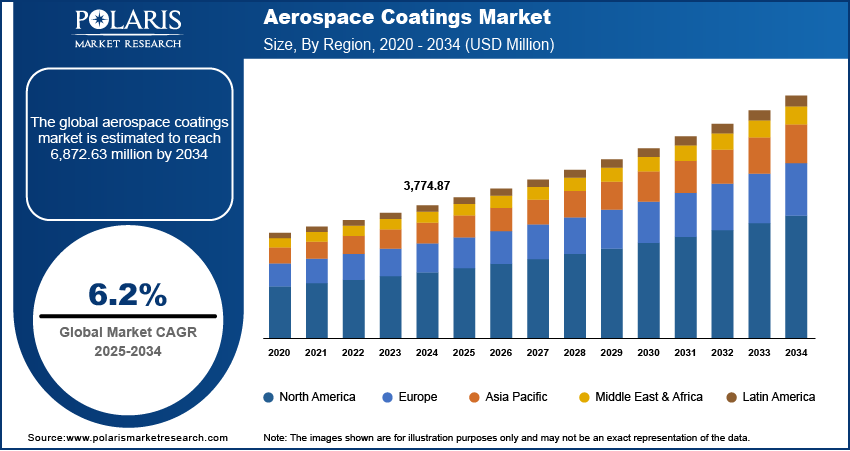

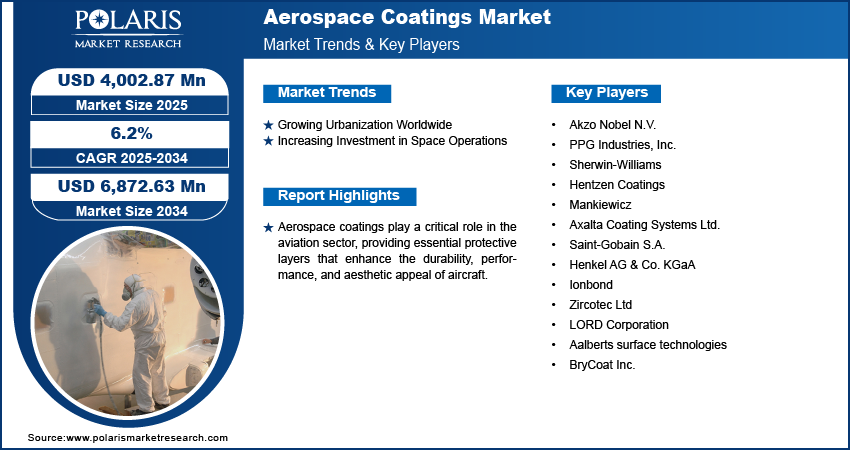

Aerospace coatings market size was valued at USD 3,774.87 million in 2024. The market is projected to grow from USD 4,002.87 million in 2025 to USD 6,872.63 million by 2034, exhibiting a CAGR of 6.2% during the forecast period.

Aerospace coatings play a critical role in the aviation sector, providing essential protective layers that enhance the durability, performance, and aesthetic appeal of aircraft. These coatings are specifically formulated to withstand extreme flight conditions, including rapid altitude changes, temperature fluctuations, and exposure to harsh environmental elements such as UV radiation and corrosive substances.

The increasing tourism worldwide is driving the global aerospace coatings market. According to the UN Tourism World Tourism Barometer, an estimated 1.1 million international tourist arrivals (overnight visitors) were recorded in January-September 2024, about 11% more than in the same period of 2023. Airlines expand their fleets to accommodate the rising number of passengers and increase the frequency of flights as tourism increases. This leads to greater wear and tear on aircraft, necessitating regular maintenance, painting and coating applications to ensure performance, safety, and visual appeal, thereby boosting demand for aerospace coatings. Additionally, airlines often refresh branding and livery to appeal to their expanding customer base, further driving the need for high-performance coatings.

To Understand More About this Research: Request a Free Sample Report

The aerospace coatings market demand is driven by growing investment by governments in modernizing and upgrading existing aircraft. Modernization initiatives often involve refurbishing older aircraft to meet updated safety standards, improve fuel efficiency, and incorporate advanced technologies. These processes require specialized aerospace coatings to protect aircraft surfaces, enhance aerodynamics, and ensure resistance to environmental stressors such as corrosion and temperature fluctuations. This surge in government-backed modernization drives the demand for aerospace coatings in defense sectors.

Aerospace Coatings Market Dynamics

Growing Urbanization Worldwide

The growing urbanization worldwide is projected to propel the global aerospace coatings market growth. As per data published by the United Nations Population Fund, more than half of the world's population, which is about 4 million, lives in cities and towns and is expected to increase to about 5 million by 2030. There is a greater need for efficient transportation networks, including air travel, to connect cities and support economic activity as urbanization spurs. This rise in urban connectivity leads to an increase in airline operations, necessitating frequent maintenance and the use of aerospace coatings to protect and enhance aircraft surfaces. Urbanization also drives the construction of new airports and the expansion of existing ones, which often requires updated aircraft coated with durable, weather-resistant finishes. Additionally, urbanization propels economic growth and disposable income, encouraging more people to travel, further fueling demand for aerospace coatings in commercial aviation.

Increasing Investment in Space Operations

The increasing investment in space operations is estimated to fuel the global aerospace coatings market. The production and maintenance of spacecraft escalate as government agencies and private companies invest in ambitious space missions, including satellite launches, space exploration, and space tourism, necessitating the use of advanced coatings, including aerospace coatings. These coatings enhance durability, ensure thermal regulation, and improve the performance of spacecraft and satellite launch vehicles in the harsh vacuum of space. Additionally, the growing focus on reusable spacecraft and extended mission durations further amplifies the demand for innovative aerospace coatings.

Aerospace Coatings Market Segment Analysis

Aerospace Coatings Market Assessment by Product Type

Based on product type, the aerospace coatings market is categorized into top-coats, primers, and others. The top-coats segment held the major market share in 2024 due to its critical role in providing both aesthetic and functional benefits for aircraft surfaces. Airlines and manufacturers rely on top coats to enhance the visual appeal of aircraft while ensuring durability, UV resistance, and protection against harsh environmental conditions such as corrosion, extreme temperatures, and abrasion. The growing emphasis on branding and customization of aircraft further fueled the demand for these coatings. Additionally, advancements in technology have led to the development of high-performance, lightweight material top coats that improve fuel efficiency and reduce emissions, thereby boosting demand.

The primers segment is also expected to grow rapidly during the forecast period, owing to their foundational importance in the coating process. Primers enhance adhesion, protect the underlying material from corrosion, and provide a uniform surface for subsequent layers. The increased adoption of advanced composite materials in aircraft manufacturing has driven the demand for specialized primers designed to bond effectively with these materials. Moreover, governments and private entities are heavily investing in modernizing aging fleets, which involves extensive surface preparation and reapplication of protective coatings, including primers.

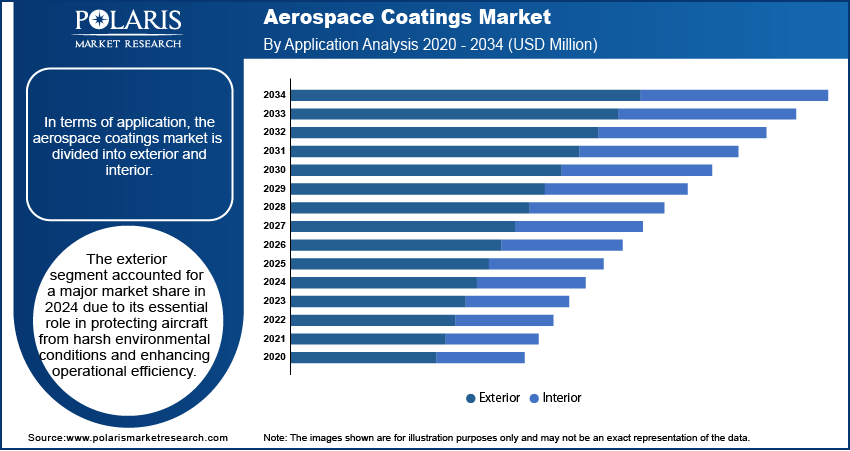

Aerospace Coatings Market Evaluation by Application

In terms of application, the aerospace coatings market is divided into exterior and interior. The exterior segment accounted for a major market share in 2024 due to its essential role in protecting aircraft from harsh environmental conditions and enhancing operational efficiency. Exterior coatings shield aircraft surfaces from extreme temperatures, UV radiation, and moisture, reducing the risk of corrosion and structural degradation. Airlines and manufacturers increasingly prioritize exterior coatings to improve aerodynamics, which contributes to fuel efficiency and lowers carbon emissions. The growing need for repainting and maintenance of aging fleets, coupled with the rising demand for advanced coatings that offer durability and lightweight properties, further drove the dominance of the segment.

Aerospace Coatings Market Regional Insights

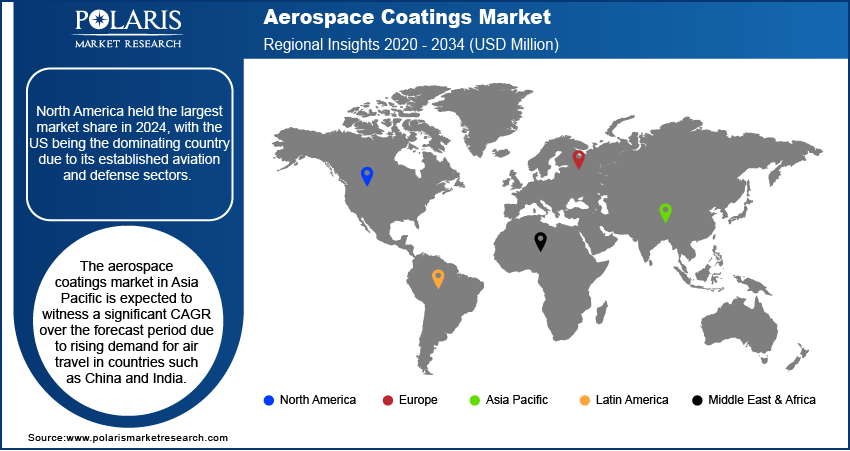

By region, the study provides the aerospace coatings market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024, with the US being the dominating country due to its established aviation and defense sectors. The country’s wide commercial aviation industry, with major airlines and aircraft manufacturers such as Boeing, fueled consistent demand for advanced coatings to enhance fleet performance and durability. Additionally, significant defense budgets allocated to modernizing military aircraft further boosted the market. The increasing focus on sustainability and efficiency also spurred the adoption of innovative coatings that reduce weight and improve fuel efficiency. The region’s extensive maintenance, repair, and overhaul (MRO) operations supported consistent demand, ensuring North America’s dominance in the market.

The aerospace coatings market in Asia Pacific is expected to witness a significant CAGR over the forecast period due to rising demand for air travel in countries such as China and India. China, in particular, is emerging as a key country in the region due to its growing domestic aviation market and investments in aircraft manufacturing, such as the development of indigenous commercial planes such as the COMAC C919. Increasing government support for aerospace infrastructure and the expansion of low-cost carriers further amplify the region’s growth potential.

Aerospace Coatings Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the aerospace coatings industry grow even more. Market participants are also undertaking various strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The aerospace coatings market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Akzo Nobel N.V.; PPG Industries, Inc.; Sherwin-Williams; Hentzen Coatings; Mankiewicz; Axalta Coating Systems Ltd.; Saint-Gobain S.A.; Henkel AG & Co. KGaA; Ionbond; Zircotec Ltd; LORD Corporation; Aalberts surface technologies; and BryCoat Inc.

Akzo Nobel N.V., commonly known as AkzoNobel, is a prominent Netherland-based multinational company specializing in the production of paints and performance coatings. Headquartered in Amsterdam, AkzoNobel operates in over 150 countries and employs approximately 35,000 people. The company has a rich history dating back to 1792 and has grown to become the world's third-largest paint manufacturer by revenue, following Sherwin-Williams and PPG Industries. The company's extensive portfolio includes well-known brands such as Dulux, Sikkens, International, and Interpon, which cater to various markets, including decorative paints, industrial coatings, and specialty chemicals.

PPG Industries, Inc., headquartered in Pittsburgh, Pennsylvania, is a major global supplier of paints, coatings, and specialty materials. Founded in 1883 as the Pittsburgh Plate Glass Company, PPG has evolved into a Fortune 500 company recognized for its innovative products and extensive market reach. With operations in over 70 countries and more than 150 manufacturing facilities worldwide, PPG serves a diverse range of industries, including automotive, aerospace, construction, and consumer products. The aerospace coatings division of PPG is particularly notable for its advanced technology and commitment to quality. PPG Aerospace provides a comprehensive range of coatings specifically designed for the aviation industry, which includes both commercial and military aircraft. The product line includes primers, topcoats, and specialty coatings that protect aircraft surfaces from environmental factors such as UV radiation, extreme temperatures, and chemical exposure.

Key Companies in Aerospace Coatings Market

- Akzo Nobel N.V.

- PPG Industries, Inc.

- Sherwin-Williams

- Hentzen Coatings

- Mankiewicz

- Axalta Coating Systems Ltd.

- Saint-Gobain S.A.

- Henkel AG & Co. KGaA

- Ionbond

- Zircotec Ltd

- LORD Corporation

- Aalberts surface technologies

- BryCoat Inc.

Aerospace Coatings Market Developments

September 2023: Sherwin-Williams, a global player in paints & coatings, announced the launch of new aerospace conductive coating (CM0485115), enabling aircraft owners to impart conductivity onto aluminum and composite substrates. The coating offers high conductivity to non-conductive substrates by producing an anti-static conductive film on their surfaces with a resistivity of 0.1 to 100,000 ohms per square meter.

July 2022: PPG Industries, Inc., a major global supplier of paints, coatings, and specialty materials, announced that it will partner with Aerobrand, a U.K. airline brand and design consultancy, to provide airline customers with a unique service that combines paint supply with livery design. The partnership will enable customers to work closely with designers to create custom paint colors and give direct input on the design of their livery at PPG LIVERY LAB aircraft coatings and design facilities in Burbank, California, and Shildon, U.K.

July 2022: Akzo Nobel N.V., a prominent Netherland-based multinational company specializing in the production of paints and performance coatings, announced a EUR 20 million investment to increase and improve production at two of its sites in France. A total of EUR 15 million will be spent on the company’s aerospace coatings facility in Pamiers, and another EUR 5 million will be spent on improving production flexibility at the decorative paints site in Montataire

Aerospace Coatings Market Segmentation

By Product Type Outlook (Volume, Tons; Revenue, USD Million, 2020 - 2034)

- Top-coat

- Primer

- Others

By Resin Type Outlook (Volume, Tons; Revenue, USD Million, 2020 - 2034)

- Polyurethanes

- Epoxy

- Others

By Technology Outlook (Volume, Tons; Revenue, USD Million, 2020 - 2034)

- Liquid Coating

- Powder Coating

- Others

By End User Outlook (Volume, Tons; Revenue, USD Million, 2020 - 2034)

- MRO

- OEM

By Application Outlook (Volume, Tons; Revenue, USD Million, 2020 - 2034)

- Exterior

- Interior

By Aviation Type Outlook (Volume, Tons; Revenue, USD Million, 2020 - 2034)

- Commercial Aviation

- Military Aviation

- General Aviation

- Others

By Regional Outlook (Volume, Tons; Revenue, USD Million, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- AsiaPacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aerospace Coatings Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,774.87 million |

|

Market Size Value in 2025 |

USD 4,002.87 million |

|

Revenue Forecast in 2034 |

USD 6,872.63 million |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Volume in Tons, Revenue in USD Million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global aerospace coatings market size was valued at USD 3,774.87 million in 2024 and is projected to grow to USD 6,872.63 million by 2034.

• The global market is projected to register a CAGR of 6.2% during the forecast period.

• North America had the largest share of the global market in 2024.

• Some of the key players in the market are Akzo Nobel N.V.; PPG Industries, Inc.; Sherwin-Williams; Hentzen Coatings; Mankiewicz; Axalta Coating Systems Ltd.; Saint-Gobain S.A.; Henkel AG & Co. KGaA; Ionbond; Zircotec Ltd; LORD Corporation; Aalberts surface technologies; and BryCoat Inc.

• The primer segment is projected for significant growth in the global market.

• The exterior segment dominated the aerospace coatings market in 2024.