Aerospace Insulation Market Size, Share, Trends, & Industry Analysis Report

By Material (Ceramic Materials, Mineral Wool, Foamed Plastics, Fiberglass, Others), By Product, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6085

- Base Year: 2024

- Historical Data: 2020-2023

Overview

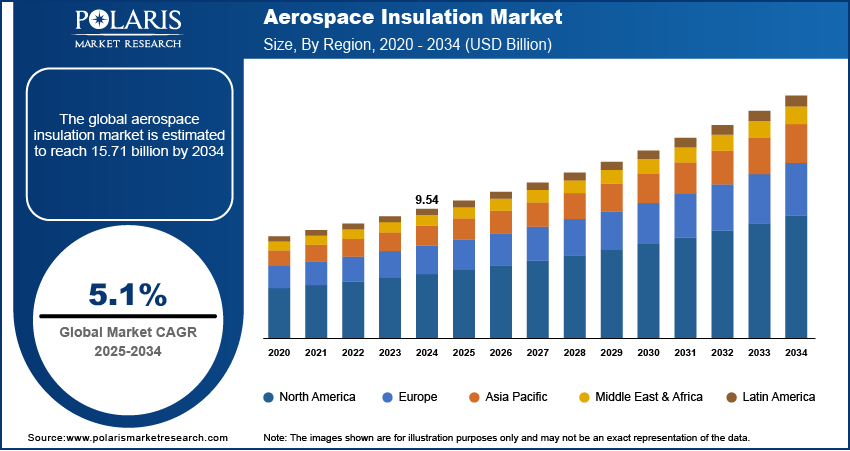

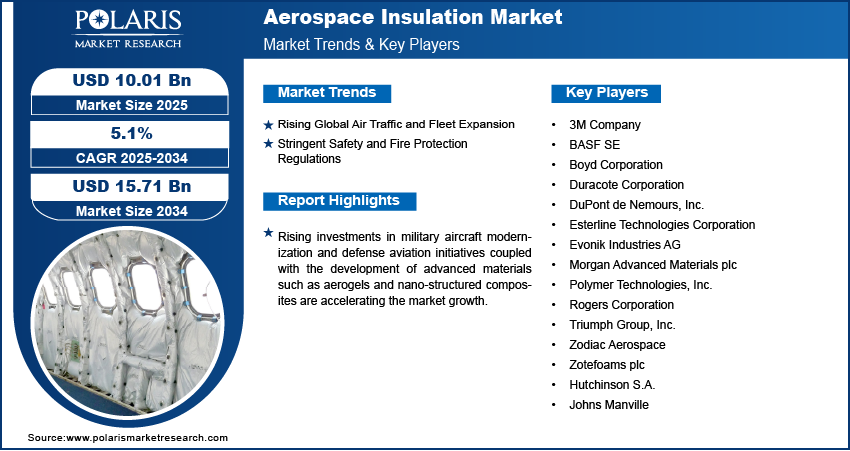

The global aerospace insulation market size was valued at USD 9.54 billion in 2024, growing at a CAGR of 5.1% from 2025–2034. Rising global air traffic and fleet expansion coupled with stringent safety and fire protection regulations are driving the growth of the market.

Key Insights

- The foamed plastics segment dominated the market share in 2024.

- The ceramic materials segment is projected to grow at the fastest rate over the forecast period, driven by increasing adoption in high-temperature zones such as engine bays and propulsion systems.

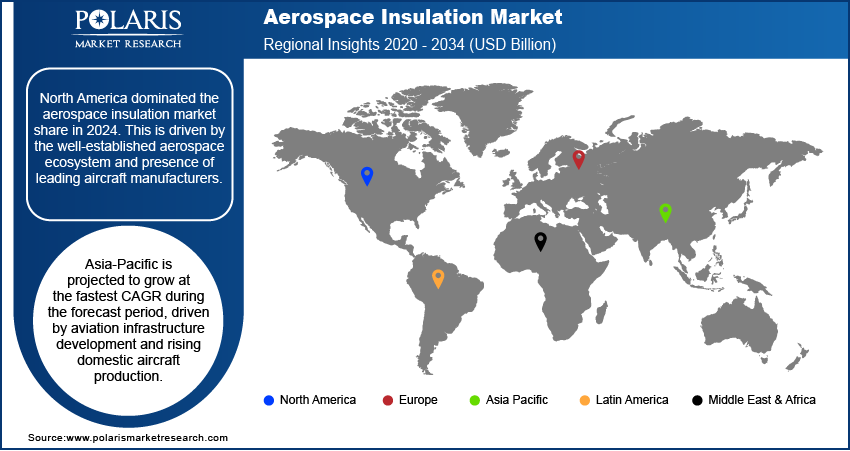

- The North America aerospace insulation market dominated the global market share in 2024.

- The US aerospace insulation market held the largest regional share of the North America market in 2024, attributed to substantial defense investments and high manufacturing output in commercial and military aviation sectors.

- The market in Asia Pacific is projected to grow at fastest CAGR during the forecast period, driven by aviation infrastructure development and rising domestic aircraft production.

- The market in India is expanding due to the rapid growth of the commercial aviation sector.

Industry Dynamics

- Rising global air traffic and the expansion of commercial and military aircraft fleets are driving the demand for advanced insulation systems to ensure thermal regulation, acoustic dampening, and cabin safety across varied flight environments.

- Stringent safety, fire resistance, and smoke toxicity regulations enforced by aviation authorities are compelling manufacturers to develop insulation materials that comply with global airworthiness standards for cabin interiors and engine compartments.

- High production costs associated with advanced insulation materials such as aerogels, composites, and multi-layer laminates remain a key challenge for smaller players targeting commercial scalability and regulatory compliance.

- Growing adoption of 3D printing and additive manufacturing is creating opportunities to produce customized insulation components with complex geometries, enabling reduced material waste, faster prototyping, and enhanced structural integration in next-generation aircraft platforms.

Market Statistics

- 2024 Market Size: USD 9.54 billion

- 2034 Projected Market Size: USD 15.71 billion

- CAGR (2025-2034): 5.1%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Aerospace insulation comprises engineered materials designed to manage temperature, reduce cabin noise, and enhance fire resistance across various aircraft structures. These insulation systems are built to perform under extreme conditions such as high-altitude temperature shifts, pressure changes, and mechanical vibrations. The increasing focus on fuel efficiency and emission reduction is supporting the adoption of lightweight, high-performance insulation materials that contribute to aircraft weight optimization.

Ongoing investments in military aircraft modernization and defense aviation initiatives are supporting consistent demand for high-performance insulation materials. Defense aircraft, including fighters, transporters, and surveillance systems, require insulation components that provide thermal stability, vibration control, and electromagnetic shielding in extreme operating conditions. According to the Stockholm International Peace Research Institute, global military expenditure reached USD 2,718 billion in 2024, marking a decade of continuous growth with a 37% increase since 2015. This sustained rise in defense spending is supporting increased investment in military aircraft programs, including new fleet procurement and modernization of existing platforms. The growing allocation of defense budgets toward air capabilities is driving the demand for advanced insulation materials that support thermal protection, noise reduction, and system reliability in harsh operational environments.

The development of advanced materials such as aerogel and nano-structured composites is enhancing the performance of aerospace insulation systems, thus fueling the market growth. These innovations offer improved thermal resistance, reduced weight, and enhanced sound attenuation compared to conventional materials. Aerogels are gaining attention for their ultra-low thermal conductivity and flexibility, making it suitable for critical aircraft components exposed to high heat. Nano-structured composites are engineered to combine lightweight properties with structural strength and acoustic damping. These material advancements are enabling manufacturers to meet evolving performance requirements while adhering to fuel efficiency and safety standards, thereby driving adoption across commercial and military aircraft platforms.

Drivers & Opportunities

Rising Global Air Traffic and Fleet Expansion

The growth in global air travel is contributing significantly to the expansion of the aerospace insulation market. Emerging economies across Asia Pacific, the Middle East, and Latin America are witnessing a steady increase in passenger volumes, leading to rising demand for new commercial aircraft. According to the International Energy Agency, total commercial air passenger traffic recovered to nearly 95% of pre-pandemic levels in 2023. Domestic air travel increased by 30% year-on-year, while international passenger activity grew by over 40% during the same period. Aircraft manufacturers are ramping up production schedules to fulfill large backlogs of orders, which is generating consistent demand for high-performance insulation systems. These systems are integrated into aircraft cabins, fuselage sections, and engine bays to ensure thermal efficiency, noise reduction, and passenger comfort. The need for improved onboard experience, alongside compliance with environmental and efficiency standards, is accelerating the integration of specialized insulation solutions in modern fleet programs.

Stringent Safety and Fire Protection Regulations

Compliance with global aviation safety regulations is influencing the adoption of advanced insulation materials across the aerospace sector. Regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) implemented strict standards for fire resistance, toxicity, and smoke emission levels in aircraft interiors. These regulations mandate the use of certified fire-retardant insulation materials to minimize onboard hazards and improve passenger safety. Thus, aircraft manufacturers and component suppliers are focusing on integrating materials that meet these stringent criteria while maintaining mechanical and thermal stability.

Segmental Insights

Material Analysis

Based on material, the segmentation includes ceramic materials, mineral wool, foamed plastics, fiberglass, and others. The foamed plastics segment dominated the market in 2024, due to its superior combination of lightweight structure, durability, and thermal performance. These materials are widely adopted in commercial and military aircraft owing to the ease of installation and excellent insulation properties. The widespread application across cabin interiors, fuselage panels, and cargo areas supports enhanced thermal efficiency and fuel economy.

The ceramic materials segment is projected to grow at the fastest CAGR from 2025 to 2034, driven by increasing adoption in high-temperature zones such as engine bays and propulsion systems. These materials offer outstanding thermal resistance and structural stability under extreme operating conditions, making it suitable for insulation in advanced military jets and commercial engine modules. The ability of this material to withstand heat and mechanical stress is contributing to the rising preference in retrofit and next-generation aircraft platforms.

Product Analysis

By product, the segmentation includes thermal insulation, acoustic insulation, and electric insulation. The thermal insulation segment dominated the market in 2024, due to its crucial role in maintaining optimal cabin temperatures and protecting vital systems from external temperature fluctuations. It is extensively integrated into aircraft structures to enhance thermal control, minimize energy consumption, and improve passenger comfort. The increasing focus on reducing operational costs and enhancing aircraft efficiency is accelerating the use of thermal insulation materials across a range of aircraft types.

The acoustic insulation segment is expected to grow at the highest CAGR over the forecast period. Demand for advanced soundproofing materials is rising as aircraft manufacturers aim to reduce cabin noise levels and meet evolving passenger expectations for quieter travel. Improvements in material science is leading to the development of lightweight acoustic insulation solutions that offer high sound absorption while maintaining compliance with aviation safety and weight standards.

Application Analysis

Based on application, the segmentation includes aerostructure, engine and propulsion systems, cabin interiors, and others. The cabin interiors segment accounted for the highest market share in 2024. This is due to the rising need to enhance thermal comfort and acoustic performance for passengers. Airlines are investing in insulation upgrades within seating areas, overhead bins, and sidewalls to offer a superior flying experience while improving fuel efficiency through thermal containment. These upgrades also help meet regulatory noise and thermal standards in new aircraft and refurbishment projects.

The engine and propulsion systems segment is anticipated to grow at the fastest CAGR during the forecast period, owing to the increasing complexity of aircraft engines and the need to manage extreme heat generated during flight operations. Manufacturers are deploying high-performance insulation materials to shield sensitive components from thermal damage and to enhance the longevity and efficiency of propulsion systems. These solutions are crucial in military and high-speed aircraft where thermal loads are significantly higher.

Regional Analysis

North America aerospace insulation market dominated the global market in 2024. This is attributed to the well-established aerospace ecosystem and presence of leading aircraft manufacturers. Companies such as Boeing and Lockheed Martin continue to generate consistent demand for high-performance insulation materials used across commercial, military, and space platforms. The region benefits from mature production facilities, robust supply chains, and engineering capabilities that enable integration of advanced thermal, acoustic, and electrical insulation technologies. Additionally, regulatory requirements set by the Federal Aviation Administration (FAA) regarding insulation performance and fire protection is increasing the adoption of compliant materials in aircraft manufacturing and maintenance programs.

The US Aerospace Insulation Market Insight

The US held a dominating market share in the North America Aerospace Insulation landscape in 2024, attributed to substantial defense investments and high manufacturing output in commercial and military aviation sectors. According to the Stockholm International Peace Research Institute, US military expenditure increased by 5.7% in 2024, reaching USD 997 billion. This accounted for 66% of total NATO defense spending and 37% of global military expenditure during the year. The country’s focus on stealth aircraft, next-generation fighter jets, and unmanned aerial vehicles is boosting the demand for specialized insulation materials that offer thermal resistance, noise suppression, and EMI shielding. Additionally, research and procurement programs initiated by the US Department of Defense continue is further accelerating innovation and deployment of high-performance insulation solutions.

Asia Pacific Aerospace Insulation Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period, driven by aviation infrastructure development and rising domestic aircraft production. Government-led initiatives across countries such as China, India, and Indonesia are focusing on expanding regional connectivity and developing indigenous aircraft manufacturing capabilities. These efforts are propelling the demand for modern aircraft equipped with reliable thermal and acoustic insulation systems. In addition, the growing middle-class population and rising disposable incomes further contributing to a surge in air passenger traffic, pusing airlines to prioritize cabin upgrades that improve in-flight comfort and reduce noise levels.

India Aerospace Insulation Market Overview

The market in India is expanding due to the rapid growth of the commercial aviation sector. Increasing air passenger volume and government initiatives supporting regional connectivity are fueling the procurement of new aircraft, which, in turn, is driving demand for effective insulation systems. According to data from the Press Information Bureau, the Government of India, the country ranked as the third-largest domestic aviation market. In FY24, Indian airports handled 376 million passengers, marking a 15% year-on-year growth in total air passenger traffic. Airlines in the country are investing in modern fleets with enhanced cabin thermal control and noise reduction features to meet evolving customer expectations. Domestic aerospace manufacturing programs and partnerships with global OEMs are further contributing to the adoption of advanced insulation technologies in the country.

Europe Aerospace Insulation Market

The aerospace insulation landscape in Europe is projected to hold a substantial share in 2034. This is owing to the stringent regulatory frameworks and growing focus on sustainable aviation practices. The European Union Aviation Safety Agency (EASA) implemented rigorous standards related to fire resistance and acoustic insulation in aircraft interiors, compelling manufacturers to integrate certified materials that meet these safety benchmarks. Additionally, environmental regulations in the region are pushing the development and use of lightweight, recyclable insulation solutions to reduce aircraft emissions and support long-term sustainability goals. Aircraft producers and suppliers across Europe are aligning their production strategies with these evolving requirements, resulting in increasing demand for high-performance aerospace insulation systems.

Key Players & Competitive Analysis Report

The aerospace insulation market is moderately competitive, with major players focusing on the development of high-performance, lightweight, and flame-retardant insulation materials tailored for stringent aerospace applications. Companies are actively investing in research and engineering to deliver thermal, acoustic, and vibration insulation solutions that enhance passenger comfort and operational safety while adhering to evolving aviation safety and environmental standards. Strategic priorities include expanding production capabilities, integrating sustainable and recyclable materials, and forming partnerships with aircraft OEMs and MRO (maintenance, repair, and overhaul) service providers to support global aerospace demand. Additionally, firms are working to meet increasing demand from commercial and defense aviation sectors by offering insulation systems compatible with electric and hybrid propulsion technologies.

Major companies operating in the aerospace insulation industry include 3M Company, BASF SE, Boyd Corporation, Duracote Corporation, DuPont de Nemours, Inc., Esterline Technologies Corporation, Evonik Industries AG, Morgan Advanced Materials plc, Polymer Technologies, Inc., Rogers Corporation, Triumph Group, Inc., Zodiac Aerospace, Zotefoams plc, Hutchinson S.A., and Johns Manville.

Key Players

- 3M Company

- BASF SE

- Boyd Corporation

- Duracote Corporation

- DuPont de Nemours, Inc.

- Esterline Technologies Corporation

- Evonik Industries AG

- Morgan Advanced Materials plc

- Polymer Technologies, Inc.

- Rogers Corporation

- Triumph Group, Inc.

- Zodiac Aerospace

- Zotefoams plc

- Hutchinson S.A.

- Johns Manville

Industry Developments

- in April 2024, Airbus Ventures invested in OROS Labs, creators of Solarcore insulation, as part of a USD 22 million Series B funding round. This investment aimed to accelerate the commercialization of advanced thermal insulation solutions designed for aerospace and defense applications.

- August 2023: Ethiopian Airlines committed to a USD 15 million expansion at Kilinto Industrial Park to produce aircraft interior components including thermo-acoustic insulation blankets, wire harnesses, and more in partnership with Boeing and supported by national investment agencies. This venture is expected to create over 300 skilled jobs and position Ethiopia as a future hub for aircraft insulation and component exports.

Aerospace Insulation Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Ceramic Materials

- Mineral Wool

- Foamed Plastics

- Fiberglass

- Others

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Thermal Insulation

- Acoustic Insulation

- Electric Insulation

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Aerostructure

- Engine and Propulsion Systems

- Cabin Interiors

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aerospace Insulation Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.54 Billion |

|

Market Size in 2025 |

USD 10.01 Billion |

|

Revenue Forecast by 2034 |

USD 15.71 Billion |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.54 billion in 2024 and is projected to grow to USD 15.71 billion by 2034.

The global market is projected to register a CAGR of 5.1% during the forecast period.

North America dominated the market in 2024, driven by the well-established aerospace ecosystem and presence of leading aircraft manufacturers.

A few of the key players in the market are 3M Company, BASF SE, Boyd Corporation, Duracote Corporation, DuPont de Nemours, Inc., Esterline Technologies Corporation, Evonik Industries AG, Morgan Advanced Materials plc, Polymer Technologies, Inc., Rogers Corporation, Triumph Group, Inc., Zodiac Aerospace, Zotefoams plc, Hutchinson S.A., and Johns Manville.

The foamed plastics segment dominated the market in 2024, due to its superior combination of lightweight structure, durability, and thermal performance.

The ceramic materials segment is expected to witness the fastest growth during the forecast period, driven by increasing adoption in high-temperature zones such as engine bays and propulsion systems.