EMI Shielding Market Size, Share, Trends, Industry Analysis Report

: By Material (Conductive Coatings & Paints, Conductive Polymers, Metal Shielding Product, EMC/EMI Filters, and Others), By Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM3404

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

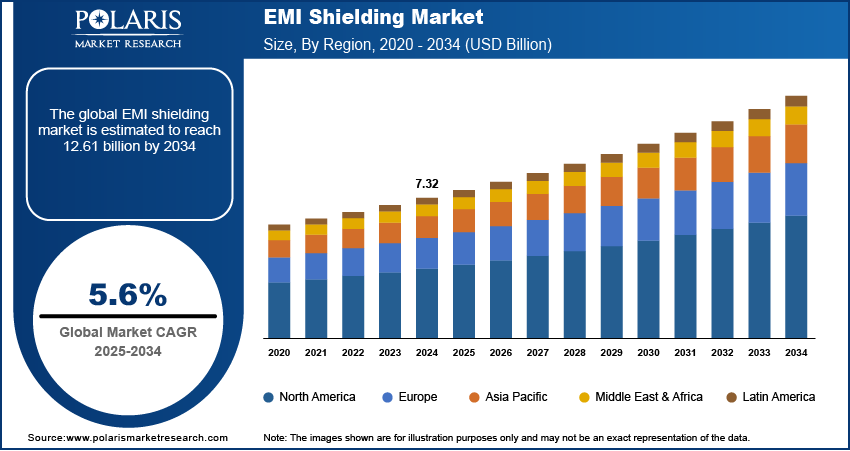

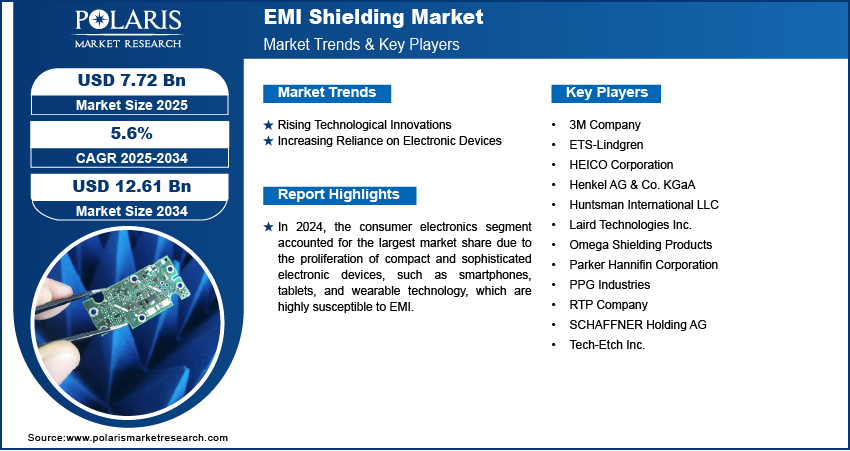

The EMI shielding market was valued at USD 7.32 billion in 2024, exhibiting a CAGR of 5.6% during 2025–2034. The growing shift towards more compact electronic devices and the rising adoption of IOT technology are the key factors driving market expansion.

Key Insights

- The conductive coatings & paints segment accounted for the largest market share in 2024, driven by their versatility and cost-effectiveness across various applications.

- The consumer electronics segment led the market in 2024, owing to the rising proliferation of compact and advanced electronic devices.

- Asia Pacific dominated the market in 2024, primarily due to the expanding electronics manufacturing sector in the region.

- North America is anticipated to register the highest CAGR during the projection period. The rising adoption of advanced technologies drives the regional market growth.

Industry Dynamics

- Rising technological innovations in EMI shielding, which are improving the effectiveness and applicability of shielding solutions, are driving market growth.

- The growing reliance on electronic devices across industries is fueling the demand for effective electromagnetic shielding solutions.

- Increased emphasis on the development of eco-friendly materials is expected to provide several market opportunities in the coming years.

- High material costs may present market challenges.

Market Statistics

2024 Market Size: USD 7.32 billion

2034 Projected Market Size: USD 12.61 billion

CAGR (2025-2034): 5.6%

Asia Pacific: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The rapid deployment of private 5G networks has significantly increased the demand for effective solutions to maintain signal integrity and network performance, which is contributing to the overall growth.

The electromagnetic interference (EMI) shielding focuses on materials and technologies designed to protect electronic devices from electromagnetic interference, ensuring optimal performance and reliability. Additionally, the emerging trend toward smaller, more compact electronic devices necessitates efficient EMI shielding protect sensitive components within limited spaces, which is the market demand.

The growing number of Internet of Things (IoT) technology requires robust to ensure reliable communication and functionality, which is influencing the dynamics. Moreover, the imposition of stringent environmental and electromagnetic compatibility (EMC) regulations across industries is driving the adoption of solutions to meet compliance requirements.

Market Dynamics

Rising Technological Innovations in EMI Shielding

Ongoing technological advancements in materials and technologies are significantly enhancing the effectiveness and applicability of shielding solutions across various industries. For instance, recent advancements leverage conductive materials such as copper, aluminum, and nickel, which provide effective and lightweight barriers against electromagnetic interference. Their high conductivity efficiently redirects electromagnetic waves, protecting sensitive electronics, while their flexibility allows for easy customization to meet specific design requirements. Moreover, innovations such as conductive coatings, paints, and nanomaterials are at the forefront of this evolution. Conductive coatings and paints have emerged as versatile solutions, offering ease of application and adaptability to complex geometries. These materials are applied to various substrates, providing effective while maintaining the integrity and functionality of the underlying components. The development of advanced conductive polymers and composite materials has further improved the performance of these coatings, enabling their use in a wider range of applications, thereby fueling the overall expansion.

Increasing Reliance on Electronic Devices

The growing dependence on electronic devices across multiple sectors, including automotive, healthcare, and consumer electronics, has led to an increase in the need for effective electromagnetic interference (EMI) shielding solutions. The growing smartphone adoption is closely tied to the progressive integration of complex electronic systems, which require comprehensive to maintain optimal operation and adhere to stringent regulatory requirements. Further, in the automotive sector, a transformative shift toward electric vehicles (EVs) and the deployment of advanced driver-assistance systems (ADAS) has resulted in a significant uptick in electronic component usage within vehicles. This escalation necessitates advanced techniques to mitigate interference and ensure system reliability, thereby fueling the demand.

Market Segment Insights

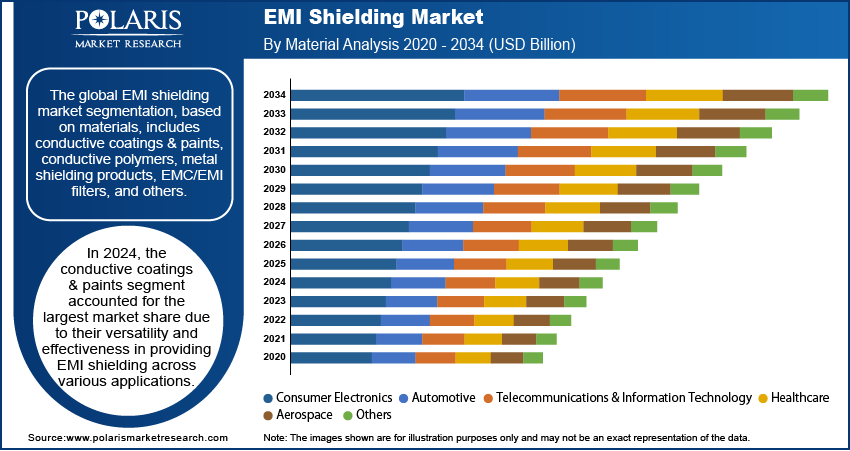

Market Assessment by Material Outlook

Based on material, it includes conductive coatings & paints, conductive polymers, metal shielding product, EMC/EMI filters, and others. In 2024, the conductive coatings & paints segment accounted for the largest share due to their versatility and effectiveness in providing across various applications. Conductive coatings and paints are formulated with conductive materials, such as metallic particles or carbon-based additives, which impart electrical conductivity to the coated surfaces. This property enables them to effectively reflect or absorb electromagnetic radiation, thereby protecting sensitive electronic components from interference. Their adaptability allows for application on complex geometries and different substrates, making them suitable for a wide range of industries, such as consumer electronics, automotive, and telecommunications. Additionally, the ease of application and cost-effectiveness of conductive coatings and paints contribute to their widespread adoption, solidifying their leading position.

Market Evaluation by Industry Outlook

The global EMI shielding market segmentation, based on industry, includes consumer electronics, automotive, telecommunications & information technology, healthcare, aerospace, and others. In 2024, the consumer electronics segment accounted for the largest share due to the proliferation of compact and sophisticated electronic devices, such as smartphones, tablets, and wearable technology, which are highly susceptible to EMI. The increasing integration of electronic devices into daily routines necessitates maintaining their optimal performance to ensure seamless functionality. Effective EMI shielding is essential to maintain device functionality and user satisfaction, thereby driving substantial demand for solutions in the consumer electronics sector.

Regional Analysis

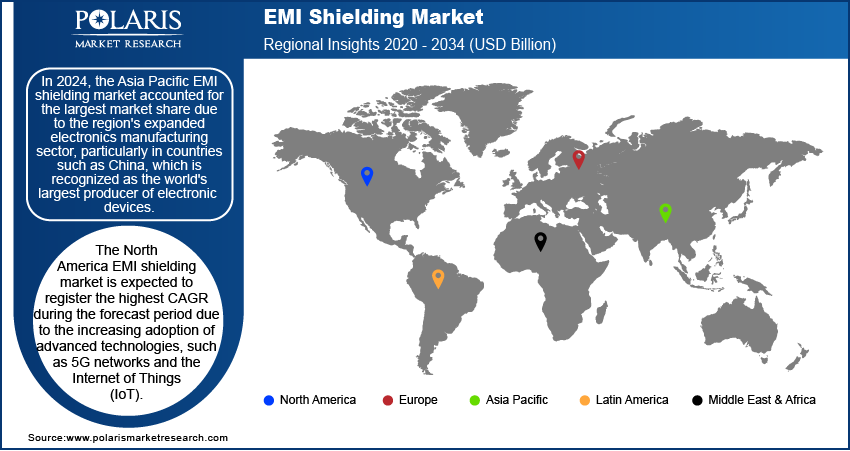

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific EMI shielding market accounted for the largest share due to the region's expanded electronics manufacturing sector, particularly in countries such as China, which is recognized as the world's largest producer of electronic devices. For instance, China's consumer electronics sector has shown growth, with leading manufacturers in computing, telecommunications, and electronic devices achieving about USD 38.39 billion in profits in the first seven months of 2023. This indicates strong demand and ongoing innovation in the industry. The surge in the production of consumer electronics, such as smartphones, laptops, and tablets, has significantly increased the demand for solutions to ensure device performance and compliance with regulatory standards. Additionally, the rapid adoption of advanced technologies, including the Internet of Things (IoT) and 5G infrastructure, across various industries in Asia Pacific has propelled the need for effective EMI shielding. These technologies require robust shielding to prevent electromagnetic interference that could compromise functionality and data integrity. Furthermore, the region's burgeoning automotive industry, with a growing focus on electric vehicles and advanced electronic systems, has contributed to the increased demand for EMI shielding solutions. The integration of sophisticated electronic components in modern vehicles necessitates effective EMI shielding to ensure operational reliability and safety.

The North America EMI shielding market is expected to register the highest CAGR during the forecast period due to the increasing adoption of advanced technologies, such as 5G networks and the Internet of Things (IoT). This necessitates effective EMI shielding solutions to ensure optimal performance and compliance with stringent regulatory standards. The region's robust automotive and aerospace industries, which extensively utilize sophisticated electronic systems, further contribute to the heightened demand. In 2023, the US aerospace and defense sector surpassed USD 955 billion in sales, marking a 7.1% increase from the previous year, driven by technological advancements and heightened defense spending. Additionally, the proliferation of consumer electronics and the emphasis on high-performance electronic devices underscore the critical need for advanced solutions in North America.

Market Players & Competitive Analysis Report

The electromagnetic interference (EMI) shielding market is characterized by a competitive landscape featuring several key players striving to enhance their presence through innovation and strategic initiatives. These leading firms are actively engaged in developing advanced EMI shielding solutions to meet the evolving demands of various industries, such as consumer electronics, automotive, telecommunications, and healthcare. Their strategies encompass product innovation, strategic partnerships, and acquisitions to strengthen their positions.

The electromagnetic interference shielding market is also witnessing contributions from numerous small- and medium-sized enterprises that offer specialized and customized products, catering to niche applications. This diversity enhances the overall competitiveness. The increasing reliance on electronic devices and the expansion of telecommunication networks are significant factors driving the demand for effective EMI shielding solutions. As a result, companies are focusing on research and development to introduce innovative materials and technologies that provide superior shielding effectiveness while meeting industry-specific requirements.

3M Company is a global technology services provider with operations spanning the US and internationally. Organized into four main segments, including transportation and electronics, safety and industrial, health care, and consumer, the company offers a diverse array of products and solutions. The transportation and electronics segment focuses on ceramic solutions, tapes, films, and products for temperature management in transportation vehicles, as well as graphic films for advertising. It also provides interconnection and packaging solutions and reflective signage for safety applications. 3M Company offers a comprehensive range of EMI shielding solutions, including high-performance electrically conductive tapes and gaskets designed to minimize electromagnetic interference and meet stringent EMC requirements.

PPG Industries Inc. (PPG), headquartered in Pennsylvania, US, is a chemical company that manufactures and distributes paints, coatings, optical products, and specialty materials. The company supplies protective and decorative coatings, sealants, and amorphous precipitated silica. It provides its products and services to customers in diverse end-use, including industrial equipment and components, packaging material, aircraft and marine equipment, automotive original equipment (OEM), automotive refinish, and industrial and consumer products. PPG Industries Inc. also serves commercial and residential new build and maintenance. Along with its subsidiaries, the company operates manufacturing operations across Asia Pacific, Europe, the Middle East & Africa (EMEA), Latin America, and North America. It has research facilities in Pennsylvania and North Carolina, US. PPG Industries Inc. provides advanced EMI/RF shielding materials, such as PPG TESLIN, a tough, flexible, and moldable solution ideal for various applications requiring effective electromagnetic interference protection.

List of Key Companies

- 3M Company

- ETS-Lindgren

- HEICO Corporation

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Laird Technologies Inc.

- Omega Shielding Products

- Parker Hannifin Corporation

- PPG Industries

- RTP Company

- SCHAFFNER Holding AG

- Tech-Etch Inc.

EMI Shielding Industry Developments

In May 2024, IIT Mandi researchers developed an eco-friendly EMI shielding composite using kenaf fiber, HDPE, and carbon nanotubes. The biodegradable material offers over 30 dB shielding efficiency and enhanced mechanical strength, addressing environmental concerns while meeting industrial performance requirements.

In August 2024, Vikas Lifecare Limited partnered with DEAL-DRDO, IIT Delhi, and CSIR-NPL to develop nanocomposites for improved electromagnetic interference (EMI) shielding. This collaboration aims to optimize formulations for effective EMI protection across various applications.

In June 2022, Graphene partnered with Delta Tecnic to advance the commercialization of EMI shielding solutions that utilize graphene-based materials.

In September 2023, Parker launched the first non-rectangular fabric-over-foam EMI shielding gaskets for high-temperature environments. This innovative solution provides enhanced electromagnetic interference protection while accommodating unique geometries, ideal for advanced applications.

EMI Shielding Market Segmentation

By Material Outlook (Revenue – USD Billion, 2020–2034)

- Conductive Coatings & Paints

- Conductive Polymers

- Metal Shielding Product

- EMC/EMI Filters

- Others

By Industry Outlook (Revenue – USD Billion, 2020–2034)

- Consumer Electronics

- Automotive

- Telecommunications & Information Technology

- Healthcare

- Aerospace

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

EMI Shielding Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.32 billion |

|

Market Size Value in 2025 |

USD 7.72 billion |

|

Revenue Forecast in 2034 |

USD 12.61 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global EMI shielding market size was valued at USD 7.32 billion in 2024 and is projected to grow to USD 12.61 billion by 2034.

The global market is projected to register a CAGR of 5.6% during the forecast period.

In 2024, Asia Pacific accounted for the largest market share due to the region's expanded electronics manufacturing sector, particularly in countries such as China, which is recognized as the world's largest producer of electronic devices.

A few of the key players in the market are 3M Company, ETS-Lindgren, HEICO Corporation, Henkel AG & Co. KGaA, Huntsman International LLC, Laird Technologies Inc., Omega Shielding Products, Parker Hannifin Corporation, PPG Industries, RTP Company, SCHAFFNER Holding AG, and Tech-Etch Inc.

In 2024, the conductive coatings & paints segment accounted for the largest market share due to their versatility and effectiveness in providing EMI shielding across various applications.

In 2024, the consumer electronics segment accounted for the largest market share due to the proliferation of compact and sophisticated electronic devices, such as smartphones, tablets, and wearable technology, which are highly susceptible to EMI.