Aerogel Market Size, Share, Trends, Industry Analysis Report

: By Technology, By Product (Silica, Polymer, Carbon, and Others), By Form, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 180

- Format: PDF

- Report ID: PM1172

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

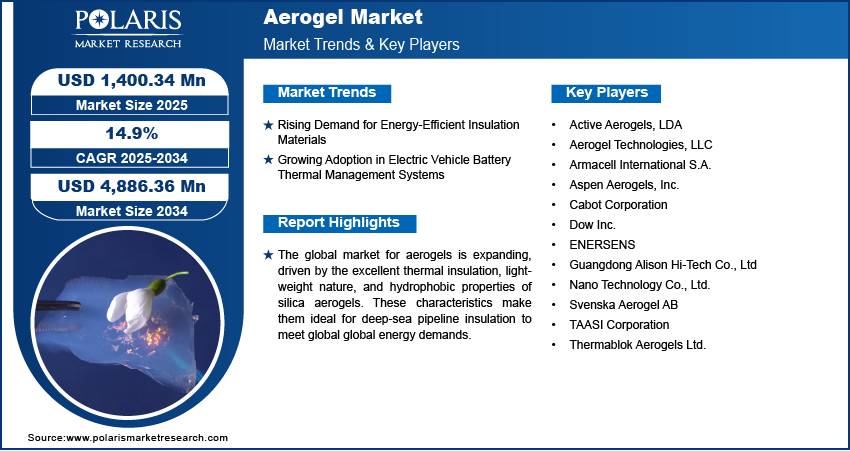

The global aerogel market size was valued at USD 1,228.15 million in 2024. The market is expected to grow from USD 1,400.34 million in 2025 and 4,886.36 million by 2034, exhibiting a CAGR of 14.9% during 2025–2034.

The aerogel market is growing due to its key advantages, including excellent thermal insulation properties, lightweight nature, and increasing industrial applicability across varied sectors. Among the different product types, silica aerogels are witnessing significant demand, particularly in the oil & gas sector, due to their thermal insulation properties. These aerogels are being utilized extensively for deep-sea pipe insulation, owing to their low thermal conductivity and hydrophobic properties. In addition, a major factor propelling aerogel demand is the rising global renewable energy consumption, especially in the oil & gas sector. As a result, companies in the sector have raised the frequency of exploration and operations to meet global energy needs, thereby fuelling the demand for aerogels.

A key factor driving aerogel market growth is the increasing adoption of aerogel blankets in the building & construction industry, driven by stringent regulations for energy conservation in residential and commercial buildings. Aerogel blankets deliver superior thermal insulation and maintain structural flexibility, making them a preferred choice for retrofit applications in older infrastructure. Additionally, government support for sustainable building practices to curb global warming is expected to boost growth in the coming years. Moreover, advancements in supercritical drying technology have enhanced the porosity and insulation properties of aerogels, improving performance and driving their use in cold climates and high-altitude projects.

To Understand More About this Research: Request a Free Sample Report

Aerogels possess valuable properties such as non-combustibility, a lightweight structure, and low density, which make them well-suited for industrial applications like automotive and aerospace manufacturing. The integration of aerogels in automotive battery thermal management systems and aerospace panels has emerged as a key trend, supporting green mobility and enhancing flight efficiency. Thus, the increasing use of aerogels for thermal efficiency is creating new opportunities, especially in the clean energy and electric mobility sectors, thereby expanding the share of innovative aerogel solutions.

Market Dynamics

Rising Demand for Energy-Efficient Insulation Materials

The rising demand for energy-efficient insulation materials in the construction and oil & gas sectors is a key driver propelling market expansion. Stricter energy codes and sustainability targets, such as the EU’s 2020 Renovation Wave initiative, are creating opportunities for the development and adoption of high-performance and efficient aerogel. For instance, in 2025, Armacell launched ArmaGel XGC, targeting industrial applications and improving operational safety and efficiency. These developments are significantly driving market growth, enhancing product visibility, and generating robust growth opportunities.

Growing Adoption in Electric Vehicle Battery Thermal Management Systems

As global EV demand continues to surge, with over 14 million units sold in 2023, manufacturers are incorporating advanced materials to enhance battery safety and efficiency. Aerogels offer superior thermal insulation and lightweight properties, making them well-suited for managing battery heat and preventing thermal runaway. The growing adoption of aerogels in electric vehicle (EV) batteries for thermal management applications is a pivotal factor driving the growth of the aerogel market.

Segment Insights

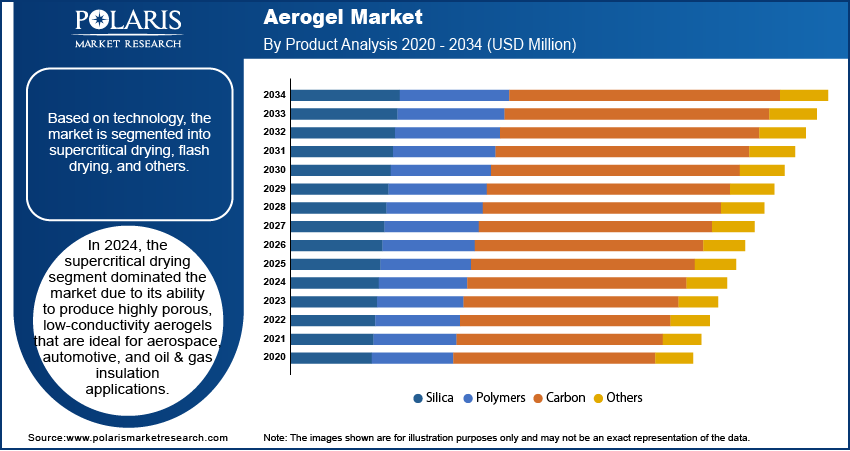

Market Assessment – By Technology

The market segmentation, based on technology, includes supercritical drying, flash drying, and others. In 2024, the supercritical drying segment held the largest share due to its ability to produce aerogels with superior structural integrity and low thermal conductivity. Aerogels produced using this method are ideal for high-performance insulation applications in industries such as aerospace, automotive, and oil & gas. Supercritical drying offers the highest porosity and superior insulation properties, driving its widespread adoption in these sectors. The technology's scalability and improved manufacturing techniques are helping reduce production costs, further enhancing its appeal. As demand for advanced materials continues to rise, the supercritical drying segment is expected to maintain its dominant position.

Market Evaluation – By Product

The global market, based on product, is divided into silica, polymer, carbon, and others. In 2024, the silica segment held a significant aerogel market share due to its widespread applications in industries such as oil & gas, construction, and automotive. Silica aerogels are particularly valued for their exceptional thermal insulation properties, lightweight nature, and versatility, making them ideal for use in extreme conditions. Additionally, these aerogels are cost-effective and offer superior performance in applications requiring high efficiency, such as insulation in high-temperature environments. As the demand for energy-efficient solutions continues to rise, the silica aerogels segment is expected to maintain its dominance, supported by ongoing advancements in production methods and expanding adoption in energy-intensive sectors.

Market Outlook – By End Use

The global market, based on end use, is segregated into oil & gas, building & construction, automotive, aerospace, industrial coating, and others. The automotive segment is expected to witness the highest growth rate during the forecast period due to the increasing demand for energy-efficient and lightweight materials in electric and hybrid vehicles. Aerogels offer excellent thermal insulation, low density, and non-combustibility, making them ideal for applications such as battery thermal management, under-the-hood insulation, and cabin soundproofing. As global EV production continues to surge, automakers are actively integrating advanced materials like aerogels to improve safety, extend battery life, and enhance vehicle efficiency. This trend is significantly fueling market expansion and creating lucrative opportunities within the automotive segment.

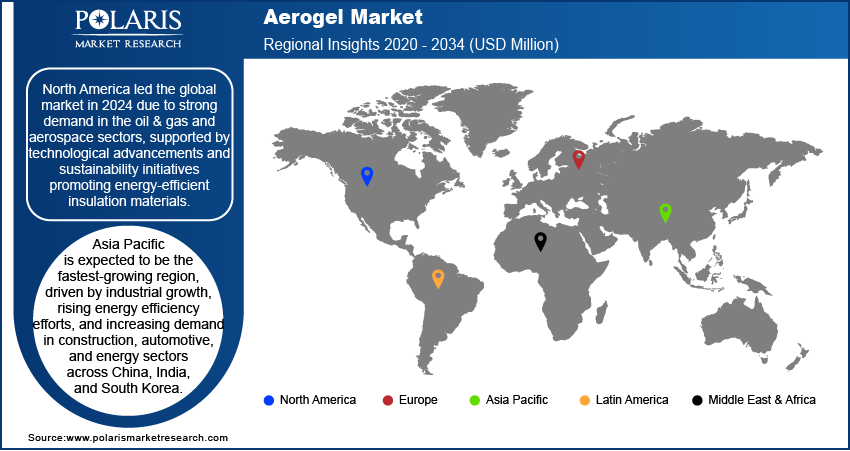

Regional Analysis

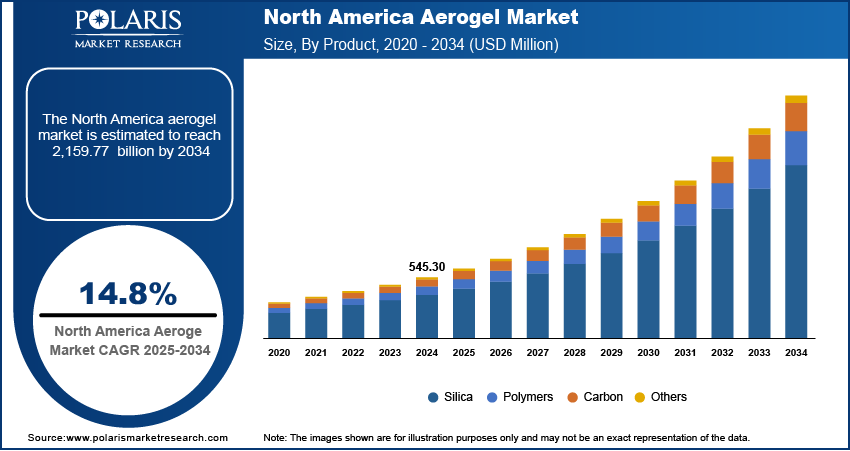

The global aerogel market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America led the global market in 2024. The regional dominance is driven by strong demand across key sectors such as oil & gas, automotive, aerospace, and building & construction, where aerogels are employed due to their thermal insulation and lightweight properties. In the US, the market benefits from a well-established manufacturing infrastructure and significant investments in research and development. Companies such as Aspen Aerogels and Cabot Corporation are at the forefront, contributing to technological advancements and expanding production capacities. Additionally, the region's emphasis on energy efficiency and sustainable construction practices is accelerating the adoption of aerogels in the building & construction sector for insulation. Key properties such as high thermal resistance and low thermal conductivity, which help reduce energy consumption in residential and commercial buildings, are driving growth in the region.

In the US, the market for aerogels is growing rapidly due to growing EV production in the country and the growing integration of aerogel in EV battery systems. In addition, the rising demand for energy-efficient vehicles is also contributing to market growth. For instance, Aspen Aerogels’ collaboration with General Motors has boosted the application of PyroThin thermal barriers in EVs. Additionally, the US Department of Energy’s initiatives to promote net-zero buildings are supporting the adoption of aerogel-based insulation solutions.

In Canada, aerogels are gaining momentum due to the rising demand for energy-efficient construction materials and government initiatives promoting green building standards. Aerogels are increasingly used in building retrofits due to their superior insulation capabilities. Moreover, projects, including the Canadian Green Building Council, are expected to support the use of advanced materials such as aerogels in LEED-certified projects. Additionally, Canada’s oil & gas sector is adopting aerogel blankets for pipeline insulation in extreme climates, supporting safer operations while reducing energy loss across facilities.

Europe held the second-largest position in the global market, driven by stringent energy efficiency regulations, growing demand for sustainable building materials, and the region’s commitment to carbon neutrality. The regional growth is driven by the EU’s Green Deal and Renovation Wave strategy, which encourages the adoption of advanced insulation solutions in buildings. Additionally, increasing investments in the aerospace and automotive sectors are accelerating aerogel adoption. Companies such as Armacell and Dow Inc. are expanding their product portfolios across Europe to meet the rising demand for lightweight, high-performance insulation materials.

Asia Pacific is expected to emerge as the fastest-growing region during the forecast period due to rapid industrialization, increasing infrastructure development, and rising energy efficiency initiatives. Countries including China, India, and South Korea are investing in advanced insulation technologies, especially in the construction, automotive, and energy sectors, to reduce carbon emissions and enhance performance.

Aerogel Market – Key Players and Competitive Insights

The aerogel market is characterized by a dynamic and competitive landscape, comprising both established and emerging players competing to expand their presence. Major companies are actively engaged in activities such as investments in research and development, product innovation, and strategic collaborations to enhance the performance and versatility of aerogel materials across various end-use industries. Additionally, other factors like the growing demand for aerogel from sectors such as automotive, oil & gas, and building & construction are prompting companies to focus on developing cost-effective and high-performance solutions to gain revenue shares.

Dow Inc. is a global chemical manufacturer that operates across three primary business segments, including industrial intermediates & infrastructure, packaging & specialty plastics, and performance materials & coatings. Through the performance materials & coatings division, Dow offers DOWSIL VM-2270 Aerogel Fine Particles, a hydrophobic silica silylate aerogel designed for personal care applications. This product serves as a thickening and texturing agent, providing benefits such as superior oil and sebum absorption, fragrance retention, and a soft-focus effect in formulations for skincare, haircare, and antiperspirants.

Cabot Corporation is a global company engaged in the manufacturing of specialty chemicals and performance materials. It offers a comprehensive range of aerogel products tailored for diverse applications, including EV batteries, coating, and more. Their ENTERA aerogel particles are specifically designed for thermal barriers in EV batteries, providing superior thermal insulation to enhance safety and efficiency. ENOVA aerogels serve as high-performance additives used in coatings and personal care products, offering benefits such as ultra-low thermal conductivity and enhanced light diffusion.

List of Key Companies

- Active Aerogels, LDA

- Aerogel Technologies, LLC

- Armacell International S.A.

- Aspen Aerogels, Inc.

- Cabot Corporation

- Dow Inc.

- ENERSENS

- Guangdong Alison Hi-Tech Co., Ltd

- Nano Technology Co., Ltd.

- Svenska Aerogel AB

- TAASI Corporation

- Thermablok Aerogels Ltd.

Aerogel Industry Developments

September 2024: Armacell launched its next-generation aerogel product line, ArmaGel XGH, which is fully compliant with ASTM C1728 and offers best-in-class thermal performance.

September 2024: Armacell acquired Armacell JIOS Aerogels Limited (AJA) by purchasing all shares from its joint venture partner, JIOS Aerogel. This acquisition allows Armacell to fully integrate AJA's operations, enhancing its capabilities in producing silica aerogel products, particularly the ArmaGel line known for high-temperature and cryogenic insulation.

November 2024: Svenska Aerogel and Matrix Brands entered into an agreement to supply specially developed aerogel material for use in personal care applications.

Aerogel Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Supercritical Drying

- Flash Drying

- Others

By Product Outlook (Revenue, USD Million, 2020–2034)

- Silica

- Polymer

- Carbon

- Others

By Form Outlook (Revenue, USD Million, 2020–2034)

- Blanket

- Particle

- Panel

- Monolith

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Oil & Gas

- Building & Construction

- Automotive

- Aerospace

- Industrial Coating

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Aerogel Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,228.15 million |

|

Market Size Value in 2025 |

USD 1,400.34 million |

|

Revenue Forecast by 2034 |

USD 4,886.36 million |

|

CAGR |

14.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market was valued at USD 1,228.15 million in 2024 and is projected to grow to USD 4,886.36 million by 2034

The global market is projected to register a CAGR of 14.9% during the forecast period.

In 2024, North America accounted for the largest share, driven by increased demand for aerogel in industries such as oil and gas, construction, automotive, and aerospace.

A few of the key players in the market are Active Aerogels, LDA; Aerogel Technologies, LLC; Armacell International S.A.; Aspen Aerogels, Inc.; Cabot Corporation; Dow Inc.; ENERSENS; Guangdong Alison Hi-Tech Co., Ltd; Nano Technology Co., Ltd.; Svenska Aerogel AB; TAASI Corporation; and Thermablok Aerogels Ltd.

In 2024, the supercritical drying segment accounted for the largest share due to the method's ability to preserve the three-dimensional pore structures of aerogels, resulting in materials with high porosity, low density, and large surface area.

The silica segment held a significant market share in 2024 due to its thermal insulation properties, lightweight nature, and high porosity, which is ideal for applications across various industries.