AI-Based Climate Modelling Market Size, Share, Trends, & Industry Analysis Report

By Component (Hardware, Software, Services), By Technology, By Deployment, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5997

- Base Year: 2024

- Historical Data: 2020-2023

Overview

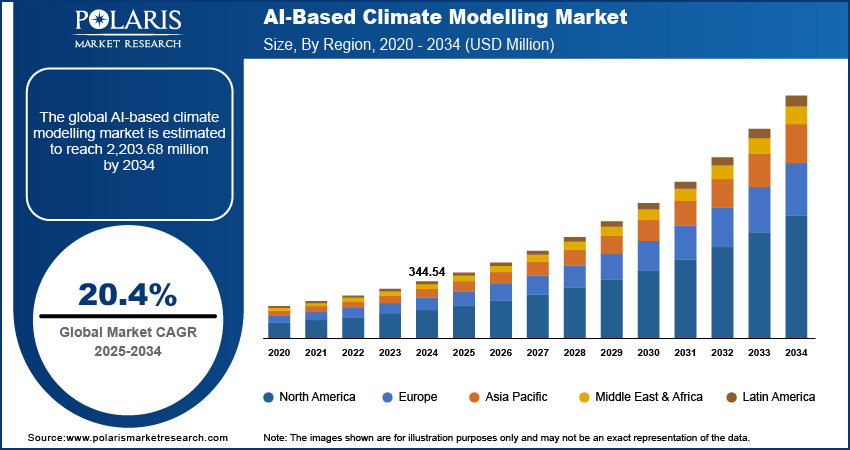

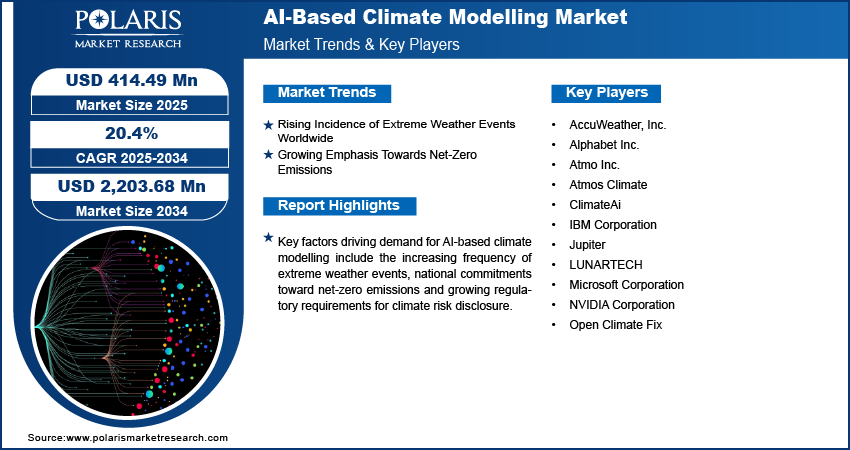

The global AI-based climate modelling market size was valued at USD 344.54 million in 2024, growing at a CAGR of 20.4% from 2025–2034. Rising extreme weather events and growing net-zero targets are accelerating the adoption of AI-based climate models for precision forecasting and carbon sink monitoring.

Key Insights

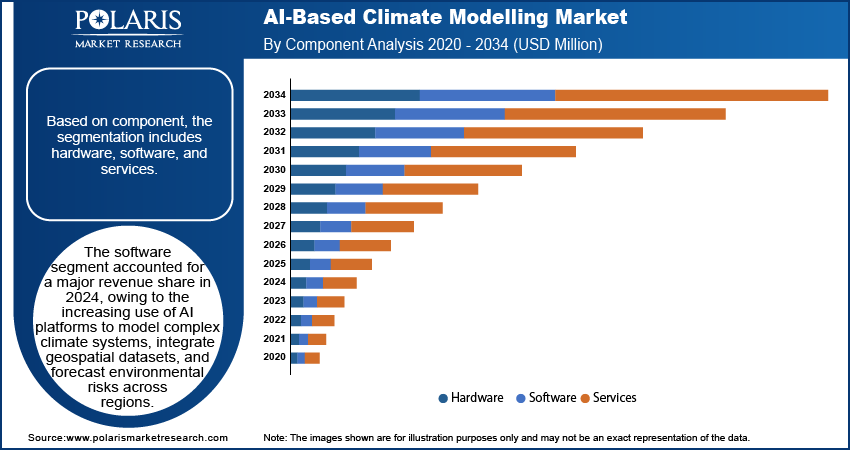

- The software segment accounted for 70.7% market share in 2024.

- The services segment is projected to grow at the fastest rate over the forecast period, driven by rising demand for implementation, training, and technical support for AI model deployment across climate research and policy planning.

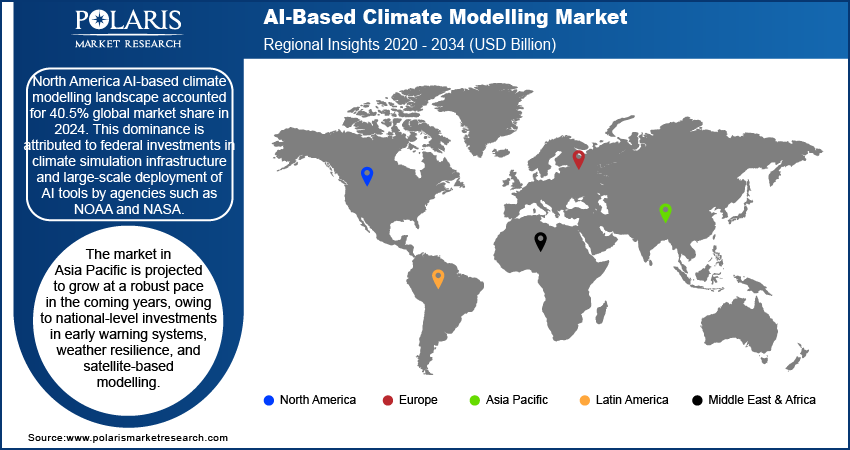

- The North America AI-based climate modelling market accounted for 40.5% of the global market share in 2024, due to federal investment in climate R&D and widespread use of AI tools across public agencies.

- The US AI-based climate modelling market held largest regional share of the North America market in 2024, driven by robust cloud infrastructure, centralized climate data ecosystems, and consistent federal funding for AI-integrated national climate initiatives.

- The market in Asia Pacific is projected to grow with a fastest CAGR from 2025-2034, owing to increasing government investment in early warning systems, AI-driven weather forecasting, and resilience planning.

- The market in China is expanding steadily, fueled by large-scale government investments in AI-powered meteorological infrastructure and national climate resilience programs.

AI-based climate modelling integrates machine learning algorithms with atmospheric, oceanic, and geospatial data to enhance predictive accuracy and simulation speed. These models are used to analyze historical climate patterns, project future climate risks and support real-time environmental monitoring. Companies in the field of research institutes, space agencies, and climate-focused organizations are deploying AI-enabled platforms to optimize model resolution, reduce computational cost, and improve scenario analysis.

Increasing frequency of extreme weather events and regulatory focus on climate resilience are accelerating the use of AI tools for forecasting, disaster preparedness, and mitigation planning. The rising volume of climate data from satellites, remote sensors, and earth observation networks is fueling demand for AI models that help to process large datasets with high temporal and spatial granularity. Some of the key users are seeking platforms with automated anomaly detection, real-time alerting, and integrated visualization capabilities to support decision-making.

Global investments in carbon-neutral infrastructure, renewable energy forecasting, and climate risk insurance are driving the adoption of AI-powered modelling tools. According to the International Energy Agency (IEA), global annual clean energy investments are expected to rise to approximately USD 4 trillion by 2030. This is expected to accelerate the adoption of AI-based climate modelling tools to optimize renewable energy deployment, assess climate risks, and support data-driven policy planning. Furthermore, international research initiatives and climate agreements are further driving the integration of AI models into environmental impact assessments and national adaptation strategies.

Industry Dynamics

- Rising incidence of extreme weather events is increasing the demand for AI-based climate modelling for high-precision forecasting tools.

- Growing targets for net-zero emissions are fostering the use of AI-based models to monitor industrial and natural carbon sinks.

- Rising adoption of AI in sustainable agriculture and water resource management creates an opportunity for the market to forecast crop yields, optimize irrigation, and manage drought risk.

- High initial costs for AI deployment and customization are limiting scalability in developing and underdeveloped regions.

Rising Incidence of Extreme Weather Events Worldwide: The increasing frequency and severity of extreme weather events, including floods, droughts, hurricanes, and heat waves, are fueling demand for advanced climate prediction systems. According to the World Meteorological Organization, over 600 extreme weather events were recorded in 2024, including 148 deemed “unprecedented,” resulting in 1,700 deaths and displacing 824,000 people. Governments and climate agencies are adopting AI-based models to improve the accuracy and timeliness of forecasts, enabling better disaster preparedness and risk mitigation. These systems help to analyze vast datasets from satellites and ground sensors to detect early climate anomalies and simulate future scenarios with higher spatial and temporal resolution. The adoption of AI-enabled climate modelling is growing due to national resilience and early warning system frameworks in various economies and infrastructure.

Growing Emphasis Towards Net-Zero Emissions: A Growing focus on achieving net-zero emission targets is driving the adoption of advanced AI-based climate modelling tools for emission monitoring and regulatory compliance. It supports real-time location tracking of carbon emissions, detection of industrial pollution sources, and evaluation of mitigation strategies. These platforms assist in identifying emission hotspots, assessing carbon capture potential, and optimizing renewable energy deployment. Moreover, the increasing focus on decarbonization and adherence to ESG benchmarks is driving companies and governments to adopt AI-based climate modelling tools. The push for decarbonization across sectors, coupled with growing investment in sustainability analytics, is boosting the integration of AI-driven modelling in national climate action plans and transition roadmaps.

Segmental Insights

Component Analysis

Based on the component, the segmentation includes hardware, software, and services. The software segment accounted for 70.7% revenue share in 2024, due to the rising deployment of AI-based platforms for dynamic simulation, data visualization, and climate forecasting. Research institutions and government agencies are adopting software tools to support model customization, integration of heterogeneous climate datasets, and advanced climate risk simulations. Growing interoperability with remote sensing systems and policy modelling tools is boosting software demand. Cloud-enabled features, automated updates, and flexible design are making the software more scalable while driving its dominance in overall market revenue.

The services segment is projected to grow at the fastest pace during the forecast period, owing to the increasing need for implementation, training, and managed services. Companies rely on external service providers to configure AI modelling systems to ensure data compliance and provide analytical insights. The complexity of climate data processing and the demand for post-deployment optimization are boosting the uptake of consulting and managed services. Additionally, public-private collaborations and multilateral climate initiatives are expanding the availability of funded service programs across emerging economies with limited internal technical infrastructure.

Technology Analysis

By technology, the market includes machine learning, deep learning, computer vision, and other technologies. The machine learning segment held the largest revenue share in 2024, owing to its broad applicability in climate trend analysis, anomaly detection, and predictive modelling. These algorithms enable real-time data ingestion, adaptive learning, and scenario-based forecasting across meteorology, agriculture, and environmental planning. Public agencies and academic institutions are deploying machine learning-based frameworks to simulate multi-factorial interactions within climate systems. The segment continues to benefit from advances in model interpretability, training efficiency, and compatibility with diverse climate data sources.

The deep learning segment is anticipated to grow at the fastest rate, due to its ability to process high-resolution geospatial and temporal datasets for detailed climate mapping. Convolutional and recurrent neural networks are deployed for cyclone tracking, glacier melt prediction, and ocean current simulation. These architectures support multi-dimensional feature extraction, allowing improved model precision and extended forecasts. The expansion of remote sensing infrastructure and satellite imagery archives is driving the rapid adoption of deep learning tools in climate applications.

Deployment Analysis

Based on deployment, the segmentation includes cloud-based and on-premise. The cloud-based segment accounted for significant revenue share in 2024, driven by the demand for scalable, real-time modelling capabilities across government, academic, and commercial entities. Cloud platforms offer integrated access to climate databases, remote collaboration tools, and GPU-based processing power, enabling efficient handling of complex simulations. Strategic partnerships between climate tech providers and major cloud vendors are accelerating platform adoption. Furthermore, the ability to support multi-location research and compliance with international data governance frameworks is leading to wider cloud deployment adoption.

The on-premise segment is projected to grow at the fastest pace during the forecast period, particularly across institutions handling sensitive environmental data and classified national models. These deployments offer secure data management, low-latency processing, and operational autonomy, making it suitable for critical infrastructure planning and national climate programs. High-performance computing clusters installed on-site enable institutions to run intensive simulations without reliance on external connectivity. Rising concerns over data sovereignty and cyber risks are prompting a renewed focus on secure, local deployment models.

Application Analysis

Based on the application, the segmentation includes weather forecasting, carbon emissions monitoring, disaster risk assessment, and climate risk assessment. The weather forecasting segment accounted for substantial share in 2024, due to its widespread use in public safety, agriculture, transportation, and aviation sectors. AI-based platforms are used to enhance short- and medium-term forecasts by integrating live sensor data with historical climate patterns. Enhanced model resolution, increased forecast reliability, and predictive automation are driving adoption. Governments and meteorological agencies continue to invest in AI-enhanced systems to improve early warning capabilities and resource allocation during extreme weather events.

The carbon emissions monitoring segment is projected to grow at the fastest pace during the forecast period, driven by increasing regulatory enforcement, ESG disclosure mandates, and net-zero policy targets. AI-based platforms support continuous monitoring of industrial emissions, carbon fluxes, and sequestration activities. These tools enable real-time tracking and verification, aiding compliance with international frameworks such as the Paris Agreement. The rising integration of AI-based climate modelling with satellite monitoring and IoT networks is boosting demand across power generation, manufacturing, and urban planning applications. The need for granular, location-specific emissions data is further accelerating market growth in this segment.

End User Analysis

By end user, the market includes the government and public sector, energy and utilities, agriculture, insurance, and transportation. The government and public sector segment held the largest revenue share in 2024, driven by large-scale climate research programs, policy formulation initiatives, and national resilience planning. Government agencies deploy AI-based modelling tools for climate risk evaluation, emissions inventory, and international reporting compliance. Public investments in climate monitoring infrastructure and growing collaboration with research institutions are boosting the segment’s market share. For instance, in January 2025, India launched Mission Mausam to upgrade its weather forecasting systems using AI, cloud chambers, and advanced sensors. The initiative aims to improve prediction accuracy for extreme weather events and strengthen climate preparedness across the country.

The energy and utilities segment is anticipated to grow at the fastest rate, owing to the rising need to optimize renewable energy output, manage climate-related risks to infrastructure, and forecast resource demand. AI-based climate models are adopted to predict solar irradiance, wind patterns, and hydrological variability. These insights support efficient grid management and infrastructure planning. The growing focus on regulatory pressure to decarbonize operations and the integration of weather-sensitive renewable assets are accelerating the adoption of climate AI platforms within utility networks and energy producers.

Regional Analysis

North America AI-based climate modelling market accounted for 40.5% of global market share in 2024. This dominance is primarily driven by the government's extensive funding toward AI-driven climate science and its established network of public climate agencies. Also, the growing partnership among the public-private firms in deploying AI for high-resolution modelling of extreme weather patterns, coastal erosion, and emissions tracking is fueling the market growth. In March 2024, NASA and Microsoft launched the Earth CoPilot to make complex Earth science data more accessible through AI. The tool uses Microsoft’s AI capabilities to support researchers and policymakers in analyzing climate patterns, disaster risks, and environmental changes more efficiently.

US AI-Based Climate Modelling Market Insight

The US held largest regional share in North America AI-based climate modelling landscape in 2024, driven by the high federal investment in climate R&D and expanding integration of AI into national resilience programs. The presence of prominent agencies such as the National Oceanic and Atmospheric Administration (NOAA) and the Department of Energy (DoE) is applying machine learning for forecasting wildfires, sea-level rise, and urban heat risks. In April 2024, the US Department of Energy is investing USD 13 million to develop AI tools that address the climate crisis. The funding will support advanced computing projects focused on improving climate modeling, clean energy research, and environmental risk assessment.

Asia Pacific AI-Based Climate Modelling Market

The market in Asia Pacific is projected to grow with a fastest CAGR from 2025-2034, driven by rising climate vulnerability and major investments in AI-based forecasting infrastructure in China, Japan, South Korea, and India. As an example, China’s National Climate Center is deploying deep learning models for improved El Niño and monsoon forecasting, enabling better disaster response. Moreover, in February 2025, India’s Ministry of Earth Sciences (MoES) is integrating AI tools into district-level hydrological planning and seasonal forecasting. These initiatives enhance broader regional goals to strengthen early warning systems and adapt infrastructure planning in response to increasing climate extremes in the Asia Pacific.

China AI-Based Climate Modelling Market Overview

The market in China is expanding due to the state-backed AI innovation and national initiatives to improve climate prediction and disaster response. The China Meteorological Administration is expanding deep learning models to enhance accuracy in rainfall, typhoon, and monsoon forecasting. For instance, in March 2025, China announced that the country aims to launch three Fengyun meteorological satellites, including FY-3F, FY-3G, and FY-4C between 2025 and 2026 to enhance regional weather forecasting and climate surveillance. These satellites feature AI-powered meteorological models by improving real-time data acquisition for disaster warning, environmental monitoring, and climate modeling across the Asia-Pacific and Belt and Road regions. Additionally, climate modelling is growing in China due to the adoption of initiatives such as decarbonization in monitoring industrial emissions and tracking carbon sink performance. Centralized data governance and substantial R&D funding are further driving the rapid deployment of AI climate platforms across energy, agriculture, and urban planning sectors.

Europe AI-Based Climate Modelling Market

The AI-based climate modelling landscape in Europe is projected to hold a substantial share in 2034, driven by strict regulatory compliance under the European Green Deal and R&D investments through Horizon Europe. The contribution by countries such as Germany and France to widespread AI deployment for emissions tracking and regional climate risk modelling to meet EU taxonomy rules. Moreover, the integration of AI by the Copernicus Climate Change Service to enhance satellite-based monitoring, coupled with EU-wide climate disclosure mandates and innovation grants, is driving the adoption of AI-based climate modelling across public and academic sectors in Europe.

Key Players & Competitive Analysis Report

The AI-based climate modelling market is moderately fragmented, with competition centered around algorithm accuracy, data integration capabilities, and platform scalability. Key players are investing in advanced machine learning and deep learning architectures that enable real-time simulation, high-resolution climate projections and multi-source data assimilation. The industry strategic focus areas include partnerships with government agencies, integration with Earth observation satellites, and expansion of cloud-based deployment models. In addition, companies are enhancing their platforms with features such as automated anomaly detection, emissions tracking modules, and open APIs for research institutions.

Major companies operating in the AI-based climate modelling industry include IBM Corporation, Microsoft Corporation, Alphabet Inc., NVIDIA Corporation, ClimateAi, Jupiter, AccuWeather, Inc., Atmos Climate, Open Climate Fix, Atmo Inc., and LUNARTECH.

Key Players

- AccuWeather, Inc.

- Alphabet Inc.

- Atmo Inc.

- Atmos Climate

- ClimateAi

- IBM Corporation

- Jupiter

- LUNARTECH

- Microsoft Corporation

- NVIDIA Corporation

- Open Climate Fix

Industry Developments

- June 2025: The Allen Institute for AI introduced new applications of its ACE 2.0 model to improve climate science, energy forecasting, and biodiversity research. These tools enable researchers to generate high-quality scientific insights more efficiently using advanced language modeling.

- June 2025: NVIDIA introduced an advanced AI model to create a digital twin of Earth for more accurate climate forecasting. The model enables high-resolution simulations to support long-term climate risk assessment and early warning systems.

- September 2024: IBM partnered with NASA to release an open-source AI model on Hugging Face to support weather and climate applications. The model enables broader access to satellite data and helps researchers improve forecasting, climate analysis, and disaster response using AI.

AI-Based Climate Modelling Market Segmentation

By Component Outlook (Revenue, USD Million, 2020–2034)

- Hardware

- Software

- Services

- Consulting

- Managed Services

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Machine Learning

- Deep Learning

- Computer Vision

- Other Technology

By Deployment Outlook (Revenue, USD Million, 2020–2034)

- Cloud-Based

- On-Premise

By Application Outlook (Revenue, USD Million, 2020–2034)

- Weather Forecasting

- Carbon Emissions Monitoring

- Disaster Risk Assessment

- Climate Risk Assessment

By End User Outlook (Revenue, USD Million, 2020–2034)

- Government and Public Sector

- Energy and Utilities

- Agriculture

- Insurance

- Transportation

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AI-Based Climate Modelling Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 344.54 Million |

|

Market Size in 2025 |

USD 414.49 Million |

|

Revenue Forecast by 2034 |

USD 2,203.68 Million |

|

CAGR |

20.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 344.54 million in 2024 and is projected to grow to USD 2,203.68 million by 2034.

The global market is projected to register a CAGR of 20.4% during the forecast period.

North America dominated the market in 2024, holding 40.5% share.

A few of the key players in the market are IBM Corporation, Microsoft Corporation, Alphabet Inc., NVIDIA Corporation, ClimateAi, Jupiter, AccuWeather, Inc., Atmos Climate, Open Climate Fix, Atmo Inc., and LUNARTECH.

The software segment dominated the market in 2024, holding 70.7% share. This is due to its broad deployment across government agencies, research institutes, and environmental monitoring systems for simulation, forecasting and geospatial data integration.

The energy and utilities segment is expected to witness the fastest growth during the forecast period, owing to increasing need for AI-based forecasting tools to optimize renewable energy output, manage climate risks to infrastructure and support decarbonization initiatives.